Lemonade

-

Full-stack carriers fail to outclass incumbents with no clear platform differentiation.

-

The gross loss ratio for the homeowners InsurTech fell by 12 points last quarter.

-

The company reduced its proportional quota share program from 55% to 20% cession.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

The company said the reduction was due to years of steady improvements.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

The insurer has been focused on growing products with lower cat exposure such as pet and renter’s insurance.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

The carrier is looking to grow products with lower cat exposure such as renters and pet insurance.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

The program is led by the same carriers as the expiring treaty.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

Fourth-quarter results saw larger profits, but 2024 guidance was subdued.

-

The company reported 24% top line growth in Q4 2023.

-

The agreement has been extended an additional year through December 2025, and an incremental $140mn will be made available to Lemonade.

-

The decision is based on the belief that the clarity provided under the old structure outweighs the benefits of the co-CEO structure that was put in place two years ago.

-

Following its earnings report on Wednesday, Lemonade’s stock hit $14.80 per share on Thursday morning, nearly 35% higher than the previous close and the highest since mid-August.

-

The Inside P&C news team runs you through the earnings results for the day.

-

On the surface, InsurTech results were better than the noise from incumbents, but caution is needed to ascertain the quality of new business coming in during a time when even industry leaders stumble.

-

The InsurTech formed a new Cayman Island-domiciled risk bearing entity Lemonade Re, where it plans to hold some of the retained risk.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

The Inside P&C news team runs you through the earnings results for the day.

-

“Tomorrow will be a better day.” “Next year will be a better year.” “The coming decade will be when this industry realizes its true potential.” We hear the same for most public enterprises.

-

The programme was "oversubscribed on all dimensions”, the company said.

-

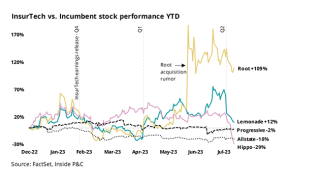

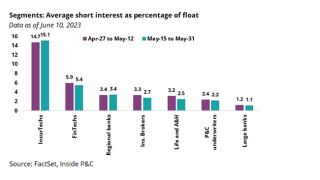

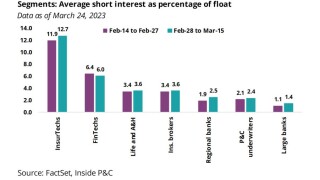

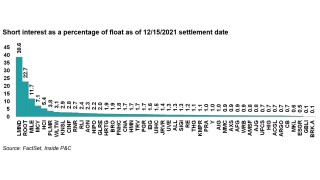

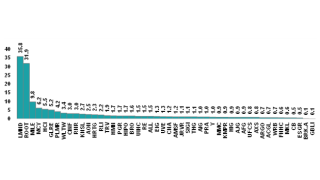

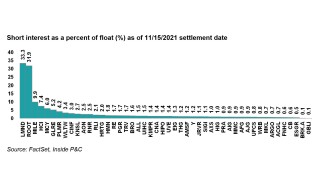

InsurTechs are still the most heavily shorted among P&C names, though they likely have been beneficiaries of a short squeeze for most of 2023.

-

InsurTech carriers pivot to profitability vs growth.

-

The company’s reinsurance structure is “almost entirely renewing at 1 July”, Bixby said.

-

The InsurTech slimmed its net loss to $65.8mn during the quarter, compared to $74.8mn in Q1 2022, as it grew both GWP and premium per customer.

-

Recent data shows an increase in InsurTech short interest and a slight uptick for brokers and P&C insurers as a result of economic uncertainty following the banking crisis.

-

The company added that it currently has less than $7,000 in cash at SVB.

-

The InsurTech filed its 2022 annual report with the SEC one day after it said it needed additional time to address the accounting in its Metromile takeover.

-

The New York-based InsurTech expects to complete the necessary work to file its annual report within the extension period provided by SEC rules.

-

Lemonade and Root both reported strong Q4 results, but will need to execute plans to near-perfection to turn things around.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

Inside P&C’s news team runs you through the key highlights of the week.

-

Lemonade will lean more into growing its renter's book in 2023 than it has in the past while it waits to see the rate impacts in other books.

-

The firm’s net loss ratio improved one point to 97% as the personal lines sector is affected by rising inflation and higher frequency and severity in auto.

-

2022 marked a reversal from last year’s unprecedented levels of global investment in InsurTech as the macroeconomic scenario flipped and investors put lossmaking companies under a magnifying glass.

-

The state is the second largest in the US for the number of licensed drivers, according to the InsurTech.

-

InsurTechs’ mounting losses and continuing cash burn combined with reinsurance market hardening could spell trouble for the sector.

-

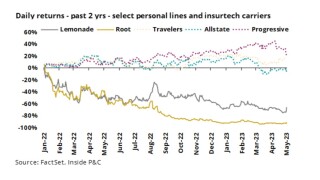

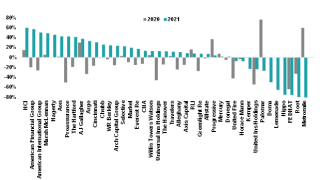

Our Trump/Biden note from yesterday discussed the rotation from growth stocks to value stocks playing out over 2022. Unfortunately, insurance technology stocks have had it the worst, with Lemonade stock down 49%, but still doing relatively better than Root (down 86%) and Hippo (down 80%).

-

The InsurTech reported that its Q3 net loss jumped 37.7% YoY to $91.4mnm, as its net loss ratio jumped 24 points to 105%.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

Acquisition costs for auto InsurTech Metromile and losses from Hurricane Ian expanded net loss by 37.7% YoY to $91.4mn.

-

The InsurTech has launched in the UK after previously setting up shop in France, Germany and the Netherlands.

-

As ITC Vegas begins, the Inside P&C Research team explores the discussions needed among InsurTechs to address questions around capital, partnerships, and profitability prospects.

-

-

Odyssey Group’s cyber chief Robert O’Connell is looking to raise up to $1bn of capital for a monoline cyber reinsurer.

-

The InsurTechs’ results show the path to profitability remains unclear, even as Lemonade said it expects to be self-funding from here.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

The executive named cat events and persistent levels of high inflation as two other factors that could “put an unforeseen dent to our loss ratios for the next few quarters”.

-

Lemonade said “ballooning costs will remain a topic of concern as long as they persist” while inflation accelerates.

-

The all-cash deal was completed following the closure of Metromile’s $500mn acquisition by Lemonade last week.

-

Last November, Lemonade struck a deal to buy the Californian InsurTech in an all-stock transaction, implying a diluted equity value of $500mn, or $200mn net of cash.

-

Metromile’s Preston and Lemonade co-CEOs Wininger and Schreiber all joined industry stalwarts in this year’s top 10.

-

The executive discussed InsurTech challenges, his priorities for Branch, fundraising, and his concerns about the capital markets.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

The sector was hit by a rough first half of 2022, with more to come in the second half of the year.

-

Embedded insurance can help sidestep some of the challenges faced by InsurTech 1.0.

-

Inside P&C’s news team runs you through the key developments from the past week.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

Following the announcement of the delay, Metromile shares rose over 9% earlier this morning to just under $0.90 per stock.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

The companies have received approval from the Department of Justice under the Hart-Scott-Rodino Act and are awaiting other required regulatory approvals.

-

The firm’s emphasis on charitable giving has enabled a differentiated narrative, but the $4mn given is dwarfed by $345mn of insider selling.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

Companies that had easily lured investors with major premium growth are now scrambling to prove their fundamentals work, and are sitting out fundraising to avoid a down round.

-

The personal auto writer’s partnership with the digital dealership should serve as a warning for other InsurTechs.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

The deal could see payouts to over 110,500 customers nationwide, with 75% of the settlement earmarked to 5,011 in Illinois.

-

Inside P&C’s News team runs you through the key highlights of the week

-

Co-CEO Wininger said Q1 loss ratios were “significantly impacted” by inflation, as while claims are quickly adjusted for inflation, rates can take months to adjust.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

The InsurTech increased premiums per customer by 21.8% from a year ago, and its customer count was up by 37.2% year-on-year to 1.5 million.

-

Following the acquisitions of Trov and Insureon, what InsurTech M&A deals are next?

-

Inside P&C’s news team runs you through the key developments from the past week.

-

The InsurTech’s net loss doubled to $70.3mn during the fourth quarter of 2021 from a $33.9mn loss in Q4 2020 as its loss ratio jumped 22 points to 98%.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

The company said the unfavorable prior period development was due to “a handful of older large losses for which we under-reserved”.

-

The merger proposal was supported by at least 95.9% of the votes cast at during a special meeting of stockholders on Tuesday.

-

The next generation must stay private longer, employ a partnership approach to capital and take the complexities of insurance more seriously.

-

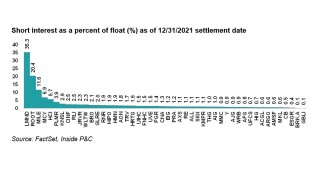

Stock prices fluctuated, and InsurTech short-sellers took some profits.

-

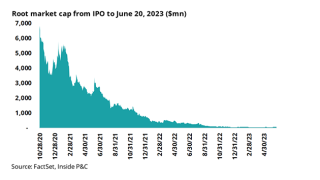

The InsurTech’s stock traded at $28.25 by midday Tuesday, down from its $163.93 peak in February 2021.

-

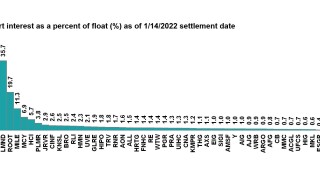

InsurTechs, including Lemonade, Root, Hippo, and Metromile, shed some short interest but remain the target of choice for short-sellers.

-

The Inside P&C research team looks forward to the big issues of the new year.

-

Lemonade, Root, and Metromile remain the focus of short sellers, as most firms see little short interest change.

-

Inside P&C dissects the biggest deals of the year across broking, commercial lines and InsurTech.

-

Carriers are planning for inflationary threats and have been responding to major catastrophes, while the InsurTech and broking markets have driven M&A drama.

-

Lemonade and Root remain the focal points of short sellers, while Metromile’s stock loan fee rate increases (pending acquisition).

-

Short interest fell in InsurTechs, but not enough to ease the pressure on the sector.

-

The deal derisks its early auto build-out, likely delays its next capital raise and still stands a good chance of delivering InsurTech alchemy.

-

Lemonade expects that Metromile will be a key to run faster through a competitive auto insurance market while assuming fewer risks on the road.

-

InsurTech shares trade mixed in response to Lemonade-Metromile combination.

-

Lemonade CEO Daniel Schreiber told analysts that the Metromile acquisition will put the InsurTech “at the vanguard of car insurance”.

-

Lemonade’s acquisition of Metromile helps both firms redirect focus from ongoing challenges.