-

A district court judge had dismissed the case in September, with prejudice.

-

Attorneys and doctors targeted by the case claim Uber has no standing to bring a Rico suit.

-

The carrier combined its E&S primary and excess casualty units into a single group.

-

The company announced four internal promotions this week.

-

The move comes over a year after Aon completed its $13bn purchase of NFP.

-

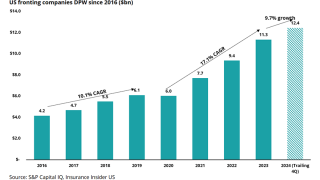

Highly concentrated, overly leveraged fronts could repeat the Unicover-Reliance story.

-

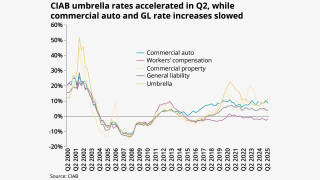

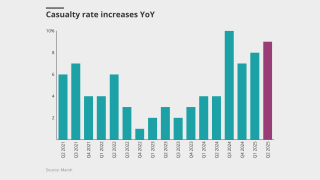

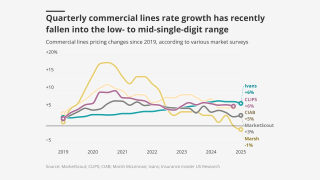

Only GL and workers’ comp had renewal rate increases compared to Q2.

-

The insurer says defendants billed “exorbitant” fees for non-existent services.

-

The company has been growing rapidly since the summer, with at least 300 currently employed.

-

A favorable nine months for the industry does not solve its underlying problems.

-

The executive was most recently head of US casualty at Aon.

-

The executives are based in Seattle and New York.

-

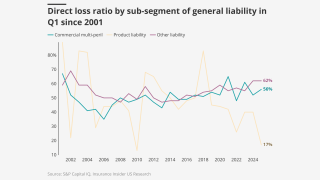

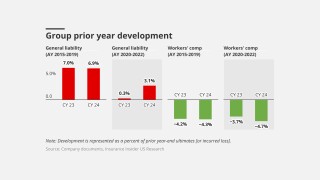

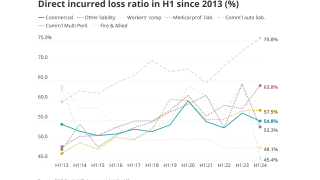

Loss ratios in troubled casualty lines ticked down year-over-year despite worsening loss costs.

-

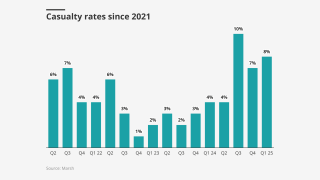

Casualty rate increases largely stabilized in Q2 and Q3 at 5%-10% for general liability.

-

The executive joins from RenaissanceRe.

-

The Caymans-based reinsurer’s Q3 CoR was 86.6%, down 9.3 points YoY.

-

The mayor-elect has promised to build 200,000 new units in New York City.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

Workers’ compensation was the only line that saw a YoY decrease.

-

The fashion brand says the insurer failed to defend it in multiple lawsuits.

-

The newly installed US vice chair explains why inefficiency drove her from legacy firms.

-

The defendant held a $1mn general liability policy with Kinsale.

-

The executive noted that an influx of new entrants in the E&S market is increasing competition.

-

The executive said inflation isn’t completely gone but is now “more understood”.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

The executive said the firm has grown its casualty business by 80% from 2022.

-

The chief executive said he doesn’t expect to see a price drop anytime soon.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

Interim CUO Nick Pritchard turned in his notice in August of this year.

-

Tompkins Insurance is a subsidiary of Tompkins Financial Corporation.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

Gray specializes in contract bonds for mid-sized and emerging contractors.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

The CEO noted that 45% of Everest’s US casualty book did not renew this quarter.

-

The company’s stock fell nearly 9% as the market digested news of an ADC, renewal rights deal and reserve charge.

-

The global insurer will need to convince investors on the quality of the book.

-

The global insurer will pick up a $650mn portfolio of US casualty business.

-

AIG will fold the portfolio into its existing business, leaving the liabilities and legal entities with Everest.

-

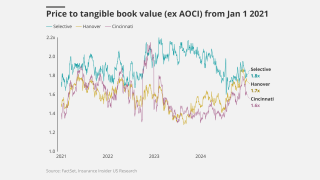

Normalized growth and peak multiples confirm we are headed towards a Darwinian race.

-

Workers’ comp rates dropped again, but the decline slowed from last quarter.

-

The appointments are aimed at offering a clearer team structure.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

Property insurance rates declined by 9%, the same as in the prior quarter.

-

Old Republic said the acquisition is expected to close in 2026.

-

Property pricing fell by 8%, while casualty rate increases tapered to 3%.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

MultiStrat, the founder of casualty ILS, is focusing on committed capital to grow, said Bob Forness, CEO, MultiStrat.

-

The CEO also said that the “bloom is off the rose” in the E&S property market.

-

The protection covers the US insurance book for the 2024 and prior accident years.

-

Property, cyber and workers’ comp rates were all down mid-single digits, offsetting casualty hardening.

-

An average of 81% of property accounts renewed flat or down.

-

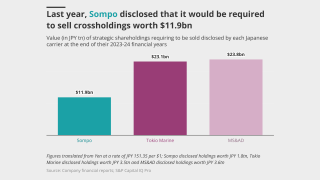

As the Great Japanese M&A Contest develops, the executive said inorganic expansion is “a top priority”.

-

The decision impacts 5% of the reinsurer’s North America P&C facultative premiums.

-

Brian Church has spent 20 years at Chubb.

-

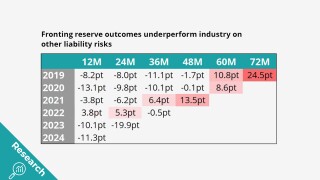

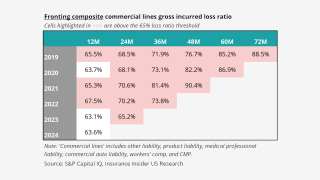

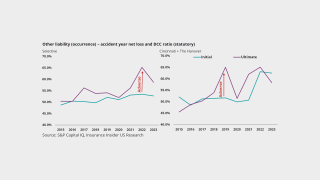

Fronting doesn’t look any better when it’s broken down by segment.

-

The mood in Orlando was sunny among cedants and reinsurers alike, but there are clouds on the horizon.

-

E&S is most exposed to growth normalization, private credit is hunting P&C and fronting is deadlocked on exits.

-

Insurers are pleased, brokers are looking for trade-offs, and everyone’s talking about Howden.

-

The unit’s co-heads, Braithwaite and Apostolides, left the firm in the summer.

-

It is understood around $1bn of premiums could be ceded to the proposed vehicle.

-

The broker will now have access to an M&A war chest for inorganic growth.

-

The Insurance Insider US news team runs you through this week’s key agency M&A.

-

Trailing three month premiums were up 7.2% versus 13.1% in August.

-

The move is the latest in a series of casualty leadership shake-ups at the insurer.

-

She previously served as Hub’s North American casualty practice leader.

-

Sexual abuse and molestation exclusions are starting to hold in higher layers of hospital towers this year.

-

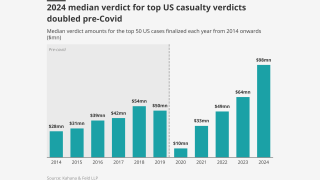

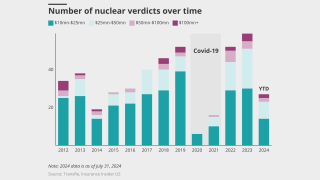

Juries don’t significantly differentiate in cases involving severe injury.

-

He will drive the growth of Chubb's claims-made excess casualty facility.

-

He will spearhead the division’s launch slated for 2026, which will be the first product launch for ICW Group’s specialty unit.

-

Whether in property or casualty, areas of the market will be profitable even with new entrants, the executive said.

-

The executive met with UK colleagues to discuss plans for the US business.

-

The WCB has denied the allegations, claiming its decisions were based on “reasonable investigations”.

-

The deal values the Onex-backed P&C broker at over $7bn.

-

Following the Golden Age of Specialty, franchise quality will play a bigger role in determining success.

-

The case is now headed to appellate court.

-

The Chicago-based executive was previously Everest’s CUO of excess casualty.

-

The MGU is entering the often-difficult habitational GL space with an initial E&S offering.

-

The executive’s skepticism is informed by the industry’s typical approach to cyclicality.

-

A process has not been launched and a firm timeline for a liquidity event has not been agreed.

-

There will also be a renewed focus on organic growth, both in P&C and across US and international operations.

-

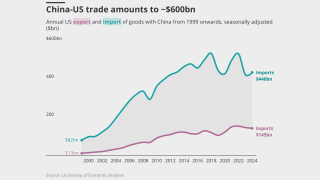

While the Fed is more concerned with jobs, other macroeconomic concerns trouble the industry.

-

Her predecessor will become head of US excess casualty and operations.

-

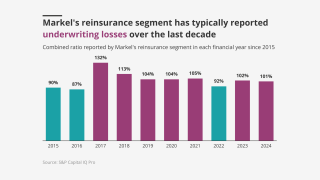

Reinsurers will not back business indefinitely where loss ratios continue to exceed the industry by a wide margin.

-

The Berkshire subsidiary is seeking coverage for a $22mn antitrust loss.

-

The affirmations reflect Everest’s strong underwriting diversification.

-

He was appointed CUO of casualty, Americas, in July last year.

-

Tricia Loney brings 20 years of industry experience to the role.

-

The platform aims to “bend the loss curve”.

-

He joins the company after 22 years in casualty leadership roles at Chubb.

-

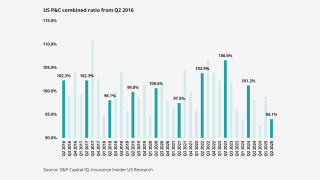

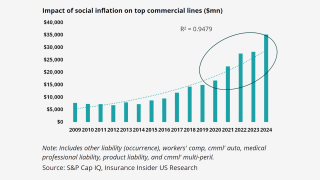

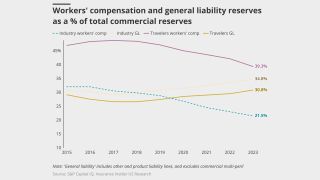

Persistent social inflation challenges evident across key long-tail lines at half-year mark.

-

All rates were up on a year-over-year basis, except for workers’ compensation.

-

Both executives will be based in New York City.

-

The ratings outlook has also been revised to stable from negative.

-

Clients in the segments that AIG trades in may not be as receptive to the idea as the insurer would like.

-

The executive will oversee the direction and management of the firm’s liability portfolio across the US and Canada.

-

The executive most recently served as head of North American treaty reinsurance.

-

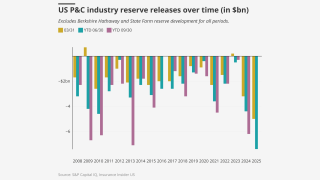

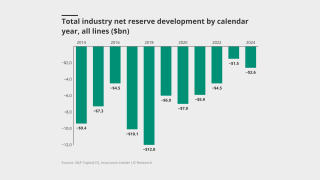

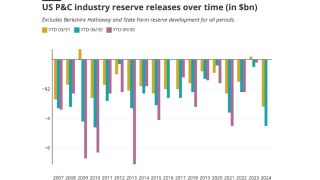

High H1 reserve releases of $7.4bn were driven by the largest of carriers.

-

California, Florida and Texas all saw decreases in monthly premium growth.

-

The ratings agency cited enhanced scale and diversification through organic growth.

-

After spending 20 years at Aon, Goodman will start a senior executive position with Guy Carpenter.

-

Cavello Bay Re will provide paper for the MGA’s business written out of Bermuda.

-

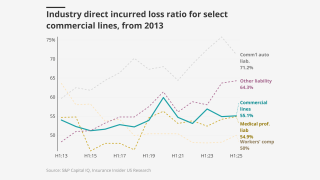

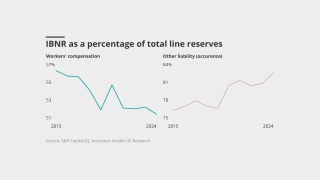

The other liability loss ratio continued to rise as workers’ comp and commercial auto reversed course.

-

Capacity has gone up slightly, with new entrants and incumbents feeling better about their books.

-

The insurer has chosen a “take two” deal after buying Endurance, betting again on Bermuda.

-

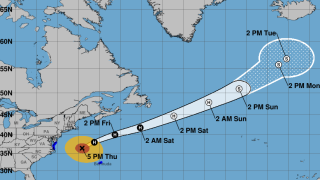

Storm surge of two to four feet could affect the North Carolina coast.

-

The Delaware high court’s reasoning could find application in other cases.

-

GL and workers’ comp, however, may benefit from a more competitive environment.

-

The promotions will enhance underwriting capability across key segments.

-

The state’s Supreme Court upheld two lower court decisions finding no liability.

-

The executive was previously Navigators’ head of excess casualty.

-

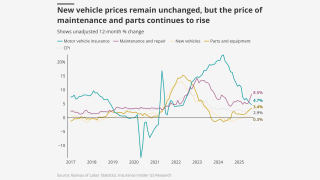

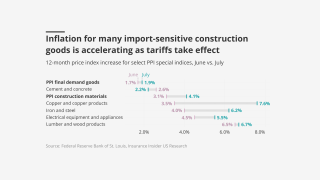

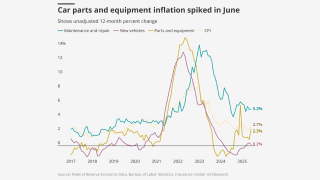

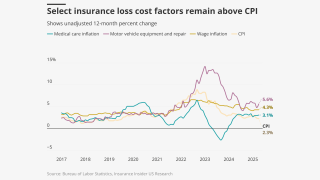

Despite mild headline CPI, some insurance-related items are heading in a worrying direction.

-

Commercial auto saw the largest rate change, which was down about a half point by the end of July to 7.96%.

-

July’s medical care increase was up from June’s o.6%.

-

Casualty premiums grew 56.7% year on year in Q2 2025.

-

Appointments include leadership in transportation, energy, marine and others.

-

It is targeting low-risk specialty lines where it has a competitive edge.

-

The tech could quickly open the door to disruptors, and firms with poor data management will lose out.

-

Q2 cat losses at AIG declined to $170mn from $330mn in the prior year quarter.

-

Social inflation is driving non-renewals, while CoRs are up for P&C and casualty.

-

Commercial liability and commercial property coverage continued to dominate the E&S market.

-

The professional lines market remains ‘challenging’ overall, however.

-

The risk of cyber incidents that cause physical damage is also rising.

-

The newly created role consolidates leadership across UK entities.

-

California posted a 47% jump YoY, from a 28.4% rise in June.

-

The Canadian insurer saw property rates dip across its global divisions, but it had strong rate on liability.

-

The executive was previously head of excess casualty, North America.

-

Specialty casualty now accounts for around 22.2% of its insurance business mix.

-

The pace of increases ticked down in the second quarter compared to Q1.

-

The broker has noted that double-digit reductions are increasingly available in property.

-

The broker posted a 6.5% drop in organic growth YoY.

-

The legacy player is working to secure its first deal, and could look to expand to US E&S.

-

The regional insurer has increased its weighting to OLO and commercial auto, versus comp.

-

The executive has been with the company for roughly one year.

-

Loss trend concerns persist, but insurers are vouching on the opportunity to push for more rate increases.

-

The executive will continue to lead CRC Insurisk in the expanded role.

-

Wind season remains an important variable, but also might not change current dynamics significantly.

-

The carrier has been steadily increasing loss trend estimates.

-

Casualty rates increased 4% globally but shot up 9% in the US.

-

Court documents show Travelers subsidiary Northfield Insurance is the insurer.

-

The move consolidates the company’s leadership of primary and excess construction casualty lines.

-

The company also encouraged insurers and brokers to support the initiative.

-

Rising inflation could raise claims severity but also increase investment income.

-

Laure Forgeron has worked at the Swiss carrier since 2009 in numerous senior positions.

-

All lines except workers’ comp are up year over year, however.

-

Rate gains are easing across many commercial and personal lines.

-

Peter Cordell will join Syndicate 1729 in January.

-

June’s increase was up from May’s 0.2%.

-

Last year, the firm obtained a Class 4 license in Bermuda.

-

Finsness joined the carrier in 2014 and was head of casualty claims in Bermuda from 2017 to 2023.

-

When it comes to sympathetic juries, high net worth individuals are under the same pressure as corporations.

-

The executive previously held roles at Capgemini, The Hartford and AIG.

-

The executive joined The Hartford when it acquired Navigators in 2019.

-

The investigation follows several civil racketeering cases filed by Tradesman based on similar facts.

-

The LA wildfires accounted for 59% of loss activity over Q1.

-

Premium rose across the top 15 P&C risks in 2024.

-

The exec said the feds have been given data to potentially pursue criminal charges.

-

The MGA and parent company Roosevelt Road Re have until July 21 to file a second amended complaint.

-

The rules would require paid rest breaks, among other measures.

-

The unit will operate via VerTerra Insurance, the company’s E&S insurer.

-

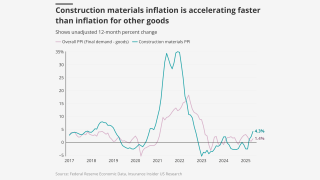

Tariffs could drive up property loss costs, but the impact on other items has been muted.

-

A deep-dive analysis shows LitFin is not the boogeyman this industry paints it out to be.

-

Major insurance industry groups and companies have recently pressed lawmakers to include the provision.

-

The pair joined MMA after the $7.75bn purchase of McGriff in November.

-

The ongoing demonstrations could have law enforcement liability implications.

-

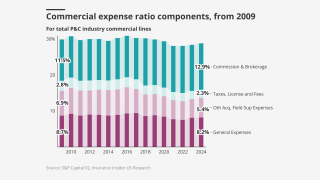

Expense ratios started to move higher in 2024 as the cycle reverses, with this trend likely to persist.

-

Marsh McLennan CEO Doyle dubbed legal system abuse a "tax” on US economy.

-

The executive brings nearly 30 years of liability experience to the role.

-

The suit, filed in Florida federal court, is Uber’s second Rico case.

-

The former Hub executive has over 30 years of experience in transportation.

-

The medical care index numbers were below April’s 0.5% rise.

-

High general liability losses are cause for concern despite modest improvements in other lines.

-

Catastrophe losses in Q1 exceeded $50bn, the second highest on record.

-

The executive will be responsible for leading E&S primary and excess casualty.

-

The legislature did pass Twia reforms, however.

-

The executive said he left the company in September.

-

The executive replaces Mike Warwicker, who left the firm earlier this year.

-

Sam Wylie has been appointed portfolio manager.

-

This will allow Ark to write business on surplus line paper and Lloyd’s business.

-

Rates and limits have done the heavy lifting to date – but there are other options.

-

The team is led by ex-Liberty Mutual executive David Perez who was hired for the launch in October.

-

The executive has been with the firm since 2011.

-

The industry veteran has also held roles at Marsh, Willis and CNA.

-

Inflation indices fell in April, but some items related to P&C are still elevated.

-

Previous complaints alleged their involvement, but this is the first time a complaint has identified the alleged funders.

-

Large account and E&S property have gotten competitive faster than expected.

-

This in turn gives carriers on a tower a little more liberty and less risk to optimize claim outcomes.

-

Strong underwriting performance and aggressive repricing of risks in most lines has aided stability.

-

He was most recently middle market casualty leader and EVP at Chubb.

-

The CEO spoke after Chubb chief executive Evan Greenberg’s call to action at RIMS.

-

The medical CPI is up 3.1% for the last 12 months.

-

Writing credit wraps for LitFin firms and steering third-party assets to them should stop.

-

“Models aren't going to tell you what the emergent risks today are,” Dolan said.

-

The take-up rate will depend on the price discount and market segment.

-

The conference came at a particularly tumultuous time for the US insurance industry and the economy at large.

-

The MGA market now makes up 10% of the overall P&C market.

-

The carrier said it is prepared to drop asset managers, lawyers, banks and brokers.

-

Jack Kuhn, President of Westfield Specialty, discusses the shifting market cycles and changing landscape at RISKWORLD 2025.

-

In casualty, getting significant blocks of capacity remains a major challenge.

-

Richard Schmitzer will retire as E&S president and CEO, and Todd Sutherland will succeed him.

-

The facility is a nudge towards a structural change, not a full-out assault.

-

Both Chubb and Zurich will underwrite the risks, with Nico as the sleeping partner.

-

He takes over from Amanda Lyons, who was promoted to global product leader last year.

-

As the industry gathers in Chicago, Insurance Insider US reviews key discussion points.

-

The facility provides up to $100mn in claims-made excess casualty coverage.

-

The remediation process is on track for completion in the fourth quarter.

-

New roles include CUO for primary and excess casualty and practice leader for complex specialty.

-

The executive will begin serving as Hiscox USA’s CUO as of May 5.

-

The program will offer liability coverage up to $5mn per occurrence.

-

Everest’s US wholesale business is seeking to expand its market presence.

-

However, the firm will take a “conservative approach” until the improvements are shown in data.

-

In a post on LinkedIn, Steve Arora said investor appetite “just wasn’t there”.

-

Rates for umbrella accelerated to 9.26%, from 8.76% in Q4 2024.

-

The specialty insurance platform has now exceeded $3.1bn in premiums.

-

The Kelso and Arch-backed run-off player has retained Evercore to advise.

-

The program will provide excess casualty coverage across a broad range of industries.

-

ISA is part of Ryan Specialty National Programs, which launched last month.

-

Live since May 2023, the reinsurer has over 40 trading relationships currently.

-

Business hates uncertainty and geopolitical tensions are off the charts.

-

The appointments cover US casualty, the US Central region and construction.

-

London-based US excess casualty writers are increasingly looking to attach lower in the tower.

-

The larger awards over the past two years could serve as an anchor for future verdicts.

-

He will oversee Ascot’s US and Bermuda insurance and reinsurance companies.

-

Despite wildfires, reinsurers are “well positioned to maintain strong profitability in 2025”.

-

The 12 insurers together have $418mn in policyholder surplus.

-

What past trends can tell us about the future of commercial reserving.

-

The amount of change over the past year falls short versus the discourse.

-

The vehicle will take a quota share of all of the risks underwritten by Ryan Specialty’s MGA arm.

-

The MGA will likely expand its D&O book as well, but excess casualty will grow faster.

-

Construction defects, GL and risk-managed professional liability lines saw the greatest headwinds.

-

The executive will continue as head of BHSI’s E&P lines business.

-

The Georgia verdict is one of many legal battles over Monsanto’s herbicide.

-

Inflation, tariffs and climate change are all making for an uncertain 2025.

-

Instead, the reinsurer plans to write more casualty business through its innovations book.

-

Surplus lines are still strong, but not the standout they used to be.

-

The partnership will launch a new umbrella excess insurance product.

-

Its full-year combined ratio for 2024 ballooned to 334.6%, from 124.7% in 2023.

-

Newly released annual stat filings on reserve data show some troubling trends.

-

A quick roundup of our best journalism for the week.

-

The company is seeking to promote growth in its US excess casualty book.

-

Excess/umbrella liability and commercial auto broke the trend with high price increases, however.

-

Executives see earnings benefits from workers’ comp beginning to diminish.

-

The executive joined the Bancolombia-owned insurer as CEO in early 2020.

-

The industry needs to find a way to rebalance power dynamics.

-

The executive is returning to Tysers after nearly four years at Price Forbes.

-

Workers' comp continued to offset GL adverse development, but the bucket is running dry.

-

Approximately 12% to 13% of Skyward’s premium was in commercial auto in Q4.

-

In the absence of interim action, the segment could face an “availability crisis”.

-

Big tort reform packages are on the table, but California steals the show, for now.

-

Frequency has rebounded, while severity has spiked beyond the pre-Covid-19 years.

-

The executive joined the firm in early 2023 after 10+ years at Aon.

-

Regionals and smaller carriers need to exercise vigilance when expanding commercial casualty lines.

-

The group should also tilt capital allocation away from M&A and deepen its disclosure.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

Insurers could absorb as much as 90% of this year’s already elevated losses given shifts in attachment points.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

Admitted carriers are dropping middle-market business due to large verdicts.

-

The underwriter has worked at Axis for a decade.

-

The Pacific region led the quarter’s price decline at -8%.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

The event now includes a casualty portion and has officially been re-branded as the Property and Casualty Symposium.

-

The executive succeeds Lou Capparelli, who becomes global casualty chairman.

-

The MGA and 49% owner SiriusPoint could bring in a new investor.

-

The carrier strengthened its GL reserves by $130mn in Q4.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

Claims related to California wildfires are "fairly insubstantial" to date, executives said.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

The impact of the devastating California wildfires is too early to ascertain, executives said during earnings calls.

-

The AIG subsidiary says it has no obligation to “defend or indemnify” McKinsey.

-

CEO Jim Williamson said social inflation was a “growing barrier” to a vibrant economy.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

The (re)insurer recorded a reserve charge of nearly $1.3bn within its casualty insurance book.

-

The insurer’s strong Q4 results might not read across to the rest of its peer group.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

Insurers are increasingly trying to push attachment points for excess layers up to $10mn.

-

Robin Hamilton has been appointed head of energy and marine liability.

-

The carrier tapped the run-off market in Q4 for a US casualty insurance-focused portfolio.

-

Rate increases are less severe and renewals are flat in some segments.

-

Supply generally exceeded demand and trading relationships were strong, CEO Tom Wakefield said.

-

A look back at the stories that defined the year in P&C for 2024.

-

The P&C industry had a rude awakening as fresh claims data came rolling in post-pandemic.

-

Concern over rate adequacy remains, but reinsurers are delving deeper into data rather than walking away.

-

Fronting growth fell by half in 2024 due to uncertain loss climate and high cost of capital.

-

By contrast, capacity remains tight at the lead level.

-

There’s a question mark around the tails of AY 2021-2023, the president said.

-

The MGA secured backing from buyout heavyweight KKR in March 2021.

-

Ceding commissions remain elevated but primary rates are improving reinsurer margins.

-

The broker said the casualty segment is approaching an “inflexion point”.

-

Andrade flagged expected 5% to 10% increases in the US and Europe.

-

Overall, insurance rates fell by 1%, led by competition in property.

-

Previously, Thomas Long was an AVP for construction at Arch.

-

Plaintiff Ionian has alleged a “fraudulent scheme” under the Rico laws.

-

He will oversee the launch of Tokio Marine’s new excess casualty line.

-

The magnitude of the hurricane may impact reinsurers’ capacity deployment.

-

Reinsurance capacity is largely stable but that doesn’t mean discussions will be a smooth ride.

-

Praedicat CEO Bob Reville outlined the firm’s approach to "casualty cat" as liability risk modeling continues to mature.

-

Third-party litigation funding has been linked to rising casualty insurance prices.

-

Attendees concurred that they don’t expect the “Golden Age of E&S” to end anytime soon.

-

Idaho and Minnesota far outpaced other reporting states in premium growth, stamping office data shows.

-

Reinsurers will likely push for double-digit US premium rate increases.

-

US liability was a hot topic at the European conference.

-

Increasing loss picks in difficult lines suggest top writers are accepting shifting loss trends.

-

The lawsuit names additional attorneys, doctors and medical practices.

-

The company is currently “underweight” in that line of business, he added.

-

The reinsurer constructed a “social inflation index” for a new study.

-

The broker reported that global reinsurer capital reached a record of $695bn as of June 30.

-

The transaction complements its previous acquisition of RMS in 2021.

-

Rate increases on primary liability placements range from 10% to 20%.

-

Umbrella was the exception, ticking up slightly on the month.

-

The highest releases in nearly 15 years challenge conventional wisdom on reserving.

-

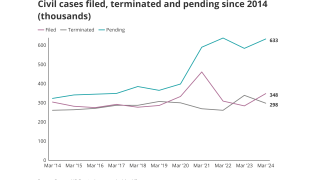

Civil case, nuclear verdict and claims count data show worrying trends.

-

The lawsuit demands coverage from insurers following opioid and product liability-related settlements.

-

While the alleged fraud is shocking, could it suggest the industry is under-investing in claims?

-

This is in large part due to the current legal environment and inflation continuing to push medical pricing up.

-

The top four lines posted low-single digit to high-single digit policy count growth.

-

-

The executive joined Chubb in 2013 as assistant VP and regional manager.

-

The executive brings more than 30 years of industry experience to the role.

-

The complaints are the first effort to crack down on existing suspicions.

-

Britt Sellers joins as head of brokerage casualty and Tyler Turk as director, primary casualty.

-

Reserve analysis shows that OL reserving may be insufficient for recent AYs.

-

The property market remains “one of the most favorable ... I've seen in my career,” the executive said.

-

Loss cost inflation remains an unknown and is sustaining price discipline.

-

Executives flagged elevated packaged auto loss activity in Q2.