-

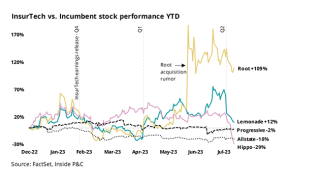

Shifting economic winds make growth plays more attractive, causing insurer stock performance to lag though short interest remains flat.

-

The two subsidiaries, which together command less than 1% of the homeowners' market share in the Golden State, are the latest to flee amid persistent inflation, high cat losses and a strict regulatory environment.

-

For insurers, the Golden State is one of the last places they want to face disputes or lawsuits with consumers.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

The estimate is based on the impact to approximately 200 structures where RLI provided primarily homeowners’ insurance.

-

Swyfft is one of Clear Blue’s largest partners, writing nearly $135mn of premium of its $519mn portfolio in 2022, according to its NAIC annual statement.

-

The start-up was previously targeting a $75mn raise. Investor meetings started last week and will continue into next week.

-

With Maui wildfire investigations beginning to point the finger at Hawaii Electric, it’s possible the insurance industry will see things play out as they did with PG&E in California, but the smaller scale of local utilities suggests lower potential recovery for insurers.

-

On the surface, InsurTech results were better than the noise from incumbents, but caution is needed to ascertain the quality of new business coming in during a time when even industry leaders stumble.

-

Inside P&C’s news team runs you through the key highlights of the week.