Metromile

-

“Tomorrow will be a better day.” “Next year will be a better year.” “The coming decade will be when this industry realizes its true potential.” We hear the same for most public enterprises.

-

The InsurTechs’ results show the path to profitability remains unclear, even as Lemonade said it expects to be self-funding from here.

-

The all-cash deal was completed following the closure of Metromile’s $500mn acquisition by Lemonade last week.

-

Last November, Lemonade struck a deal to buy the Californian InsurTech in an all-stock transaction, implying a diluted equity value of $500mn, or $200mn net of cash.

-

Metromile’s Preston and Lemonade co-CEOs Wininger and Schreiber all joined industry stalwarts in this year’s top 10.

-

The executive discussed InsurTech challenges, his priorities for Branch, fundraising, and his concerns about the capital markets.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

Embedded insurance can help sidestep some of the challenges faced by InsurTech 1.0.

-

Inside P&C’s news team runs you through the key developments from the past week.

-

Following the announcement of the delay, Metromile shares rose over 9% earlier this morning to just under $0.90 per stock.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

The companies have received approval from the Department of Justice under the Hart-Scott-Rodino Act and are awaiting other required regulatory approvals.

-

Companies that had easily lured investors with major premium growth are now scrambling to prove their fundamentals work, and are sitting out fundraising to avoid a down round.

-

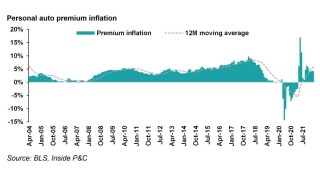

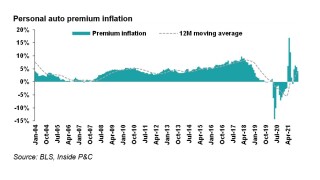

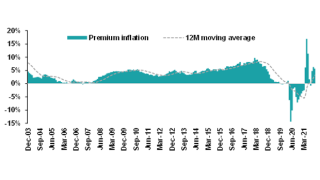

March’s CPI report shows elevated inflation levels, including vehicle CPI of 10.5% and average used car price increase of 24.7%.

-

Following the acquisitions of Trov and Insureon, what InsurTech M&A deals are next?

-

The auto InsurTech’s accident period loss ratio grew to 78.1% during the quarter, up from 56.9% at the same point last year.

-

The merger proposal was supported by at least 95.9% of the votes cast at during a special meeting of stockholders on Tuesday.

-

The next generation must stay private longer, employ a partnership approach to capital and take the complexities of insurance more seriously.

-

Stock prices fluctuated, and InsurTech short-sellers took some profits.

-

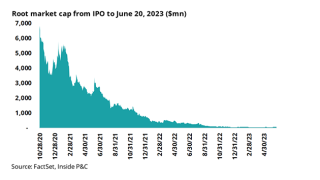

The InsurTech’s stock traded at $28.25 by midday Tuesday, down from its $163.93 peak in February 2021.

-

The latest report shows even higher inflation pushing up severity, forcing carriers to take rate.

-

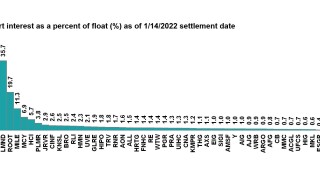

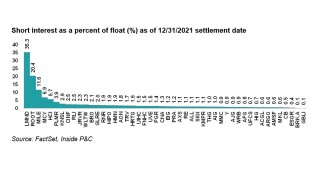

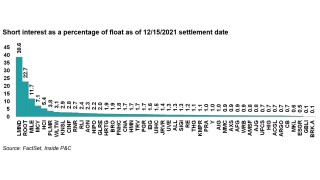

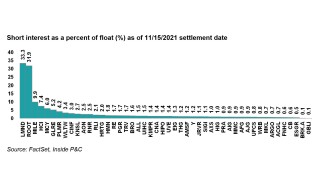

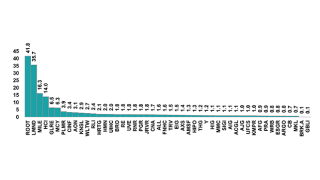

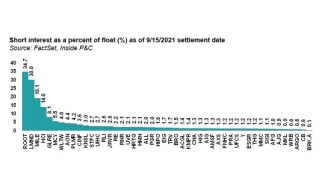

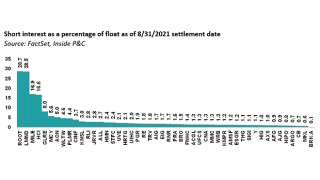

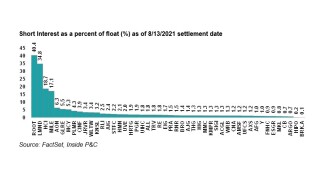

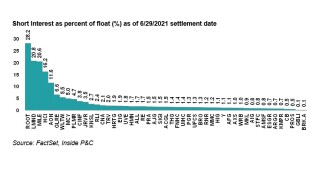

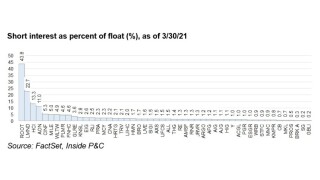

InsurTechs, including Lemonade, Root, Hippo, and Metromile, shed some short interest but remain the target of choice for short-sellers.

-

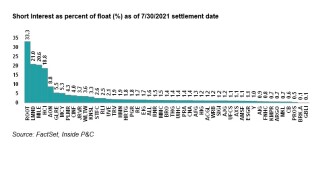

Lemonade, Root, and Metromile remain the focus of short sellers, as most firms see little short interest change.

-

Inside P&C dissects the biggest deals of the year across broking, commercial lines and InsurTech.

-

Carriers are planning for inflationary threats and have been responding to major catastrophes, while the InsurTech and broking markets have driven M&A drama.

-

The monthly CPI report shows that inflation continues to push severity higher as carriers take rate in response.

-

Lemonade and Root remain the focal points of short sellers, while Metromile’s stock loan fee rate increases (pending acquisition).

-

Short interest fell in InsurTechs, but not enough to ease the pressure on the sector.

-

Metromile reported a contribution loss of $2.1mn in the third quarter compared with a contribution profit of $4.7mn in the prior-year period, as the loss ratio at the auto carrier continued to swell.

-

The deal derisks its early auto build-out, likely delays its next capital raise and still stands a good chance of delivering InsurTech alchemy.

-

Lemonade expects that Metromile will be a key to run faster through a competitive auto insurance market while assuming fewer risks on the road.

-

InsurTech shares trade mixed in response to Lemonade-Metromile combination.

-

Lemonade CEO Daniel Schreiber told analysts that the Metromile acquisition will put the InsurTech “at the vanguard of car insurance”.

-

Lemonade’s acquisition of Metromile helps both firms redirect focus from ongoing challenges.

-

Root and Lemonade remain the highest-shorted stocks covered, as short interest in most firms remains flat in anticipation of earnings.

-

The move is part of the InsurTech’s efforts to expand its independent agents program.

-

The private equity-backed retail brokers have lessons to teach the sector’s tech start-ups.

-

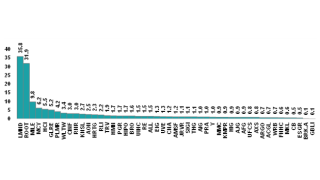

Without any major catalysts, the short interest for the industry was muted, with movement centering around InsurTechs once again.

-

Pressure on Root cools following stock price dips, but persistent short interest in InsurTechs suggests that prices haven’t bottomed out yet.

-

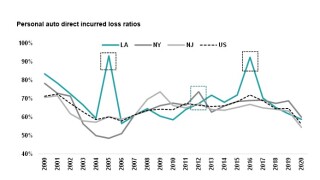

Ida soaks the tri-state – and has the potential to affect personal auto carriers more than comparable storms of the past.

-

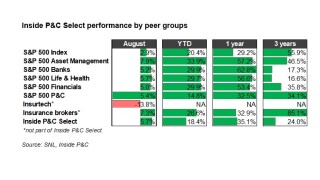

The Inside P&C Select Index outperformed the S&P 500 (5.7% to 2.9%) in August, despite Hurricane Ida making landfall.

-

Pressure on the InsurTechs – specifically Root and Lemonade – is intensifying.

-

InsurTech short interest dwarfs legacy insurers as they come under pressure to produce profits.

-

Analysts downgrade Metromile stock after disappointing Q2 results, weakened forecast.

-

Claims inflation, elevated cancelation rates and consumer behavioral changes weighed on the InsurTech’s Q2 performance.

-

The InsurTech said it now expects to hit the 2021 target forecast of between $143mn to $176mn by the third quarter of 2022.

-

Financial executive Sandra Clarke is also joining the board, as famed Spac investor Betsy Cohen, who joined the group in February, steps down.

-

Changes in short interest were muted despite large stock moves, including big rises at HCI and Lemonade.

-

The Inside P&C Research team looks at what subsectors the new class of InsurTechs is targeting.

-

Short interest data shows an incremental uptick in short interest for InsurTechs, with slight declines for the brokers.

-

The SPACs merging with Hippo, Doma and Qomplx are all trading below the redemption price.

-

Continued capital depletion could result in additional pressure on management teams with regard to executing their original business plans.

-

The accounting change will delay the release of Metromile’s Q1 results, with the company’s finance team instead focusing on rewriting its 2020 results.

-

Both InsurTech carriers have opted to go public through a merger with a blank check company this year.

-

Dye spent more than two decades at Capital One across operational and marketing roles.

-

Metromile will buy $10mn in bitcoin later this quarter, in a move the InsurTech said would help promote the financial resilience of policyholders.

-

Although this period’s short-interest shift was muted, the next update will likely show greater movement as Q1 is digested.

-

In the absence of macro and micro catalysts the short interest changes in the broader industry were muted.

-

Taking Metromile public cost the firm an estimated 22% of gross proceeds, followed by Hippo at 11%.

-

On a forward basis, frequency estimates could look high with base figures in 2020 being significantly impacted by initial lockdown measures.

-

Short interest as a percent of float is a great indicator of current market sentiment.

-

The InsurTech’s loss ratio drops 18.3 points to 57.4% amid a pandemic-related drop in driving.

-

The report parses some of the more interesting aspects of going public through de-SPACing.

-

Surprisingly, beyond the InsurTech names, changes in short interest were somewhat muted for the broader P&C sector.

-

The company becomes the latest listed Insurtech to suffer from a steep one-day drop following Lemonade’s 14% plunge last week.

-

Reduced accident development led to a prior underestimate in the December frequency benefit.

-

Former Uber executive Ryan Graves will invest $50mn in Metromile and join the company’s board.

-

California and Delaware insurance regulators are among those to approve the merger.

-

Listing capital will be enough to turn InsurTech "cash-flow positive" said the CEO.

-

The governance practices at Lemonade, Root and Metromile are distinctly “management-friendly” and bear some resemblance to tech disruptors outside the industry.

-

The InsurTech also discloses an increased fourth quarter marketing spend.

-

Metromile: In part two of our series on Metromile, our research team presents a deep dive into the company’s growth model – outlining what’s gone wrong, what the company is doing to fix it, and what the consequences of these actions are likely to be – both intended and unintended.