Munich Re

-

In casualty, the executive is seeing an acceleration of flight to quality both from cedants and reinsurers.

-

HSB CEO Greg Barats and American Modern CEO Andreas Kleiner will retire at the end of Q1 2026.

-

The carrier combined its E&S primary and excess casualty units into a single group.

-

The executive noted that an influx of new entrants in the E&S market is increasing competition.

-

The carrier is consolidating its venture capital activity into asset manager MEAG.

-

Economic volatility, including from tariffs and rising interest rates, is reshaping risk profiles for specialty insurers.

-

The insurer has been under review with positive implications since March.

-

As the fires spread, the priority shifted from saving structures to saving lives.

-

Insured losses produced the second highest first-half tally since records began in 1980.

-

The executive has been with the company for roughly one year.

-

The executive was previously president of insurance programs.

-

It is understood that Marsh brokered the tower, which is exposed to claims from a 2024 breach.

-

There is a long waiting list of carriers looking to pull the IPO trigger, but market conditions remain tough.

-

It makes sense for Next to secure a sale as an exit strategy in an increasingly challenging funding environment.

-

The executive has managed both casualty and personal lines reinsurance books.

-

Ahead of the deal, Ergo owned a 29% stake in Next, which generated top line of $548mn last year.

-

Delegated underwriters are seeing an opportunity to write in the PVT market as an add-on to property coverage.

-

The carrier will look to expand business outside North America.

-

Hurricane Milton resulted in the largest insured loss of the year at $25bn.

-

Maria Long joins the cyber insurer from Munich Re as the company's deputy CUO.

-

The carrier attributed the intensification of storms this season to climate change.

-

The executive joins Munich Re from Amwins Global Risks.

-

Over 75% of insured losses attributable to severe thunderstorms, flooding and forest fires.

-

Munich Re’s capacity is backing insurance programs for municipalities, fire and emergency services as well as water facilities.

-

The executive was formerly AIG’s head of casualty claims.

-

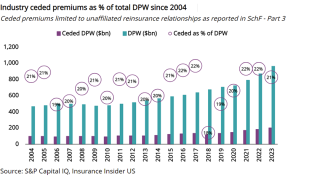

Analysis of 2023 statutory data shows that Californian insurers are leaning more heavily on reinsurers but at a nationwide level, premium cessions were more stable.

-

He replaces Joe Bonanno following a realignment of the E&S property leadership.

-

Current CEO John Mulvihill is retiring after 34 years with the specialty insurer.

-

Munich Re Specialty Insurance (MRSI) has promoted Jeffrey Marks to COO, effective immediately.

-

The uptake on war exclusions, which was followed by other reinsurers, could signal the end of "endless" discussions on the topic.

-

In addition to price, E&S insurers need to pay close attention to terms and conditions, as well as quality of risk.

-

Hohman succeeds Elizabeth Kramer following her recent appointment as president of E&S Lines. He will also become a member of the MRSI executive leadership team.

-

AM Best said market hardening was likely to continue through 2024, given global market conditions.

-

Liz King Kramer will be responsible for executing the sector’s business plan and driving growth.

-

A memo from the reinsurer raises concerns for cyber insurers over whether they could face a coverage gap after renewals.

-

Analysis of 2022 statutory data shows top US-exposed reinsurers grew assumed premiums 13% year-on-year in 2022.