Munich Re

-

The carrier is consolidating its venture capital activity into asset manager MEAG.

-

Economic volatility, including from tariffs and rising interest rates, is reshaping risk profiles for specialty insurers.

-

The insurer has been under review with positive implications since March.

-

As the fires spread, the priority shifted from saving structures to saving lives.

-

Insured losses produced the second highest first-half tally since records began in 1980.

-

The executive has been with the company for roughly one year.

-

The executive was previously president of insurance programs.

-

It is understood that Marsh brokered the tower, which is exposed to claims from a 2024 breach.

-

There is a long waiting list of carriers looking to pull the IPO trigger, but market conditions remain tough.

-

It makes sense for Next to secure a sale as an exit strategy in an increasingly challenging funding environment.

-

The executive has managed both casualty and personal lines reinsurance books.

-

Ahead of the deal, Ergo owned a 29% stake in Next, which generated top line of $548mn last year.

-

Delegated underwriters are seeing an opportunity to write in the PVT market as an add-on to property coverage.

-

The carrier will look to expand business outside North America.

-

Hurricane Milton resulted in the largest insured loss of the year at $25bn.

-

Maria Long joins the cyber insurer from Munich Re as the company's deputy CUO.

-

The carrier attributed the intensification of storms this season to climate change.

-

The executive joins Munich Re from Amwins Global Risks.

-

Over 75% of insured losses attributable to severe thunderstorms, flooding and forest fires.

-

Munich Re’s capacity is backing insurance programs for municipalities, fire and emergency services as well as water facilities.

-

The executive was formerly AIG’s head of casualty claims.

-

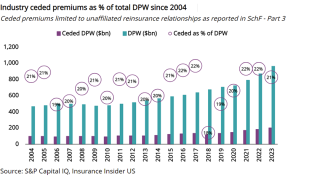

Analysis of 2023 statutory data shows that Californian insurers are leaning more heavily on reinsurers but at a nationwide level, premium cessions were more stable.

-

He replaces Joe Bonanno following a realignment of the E&S property leadership.

-

Current CEO John Mulvihill is retiring after 34 years with the specialty insurer.

-

Munich Re Specialty Insurance (MRSI) has promoted Jeffrey Marks to COO, effective immediately.

-

The uptake on war exclusions, which was followed by other reinsurers, could signal the end of "endless" discussions on the topic.

-

In addition to price, E&S insurers need to pay close attention to terms and conditions, as well as quality of risk.

-

Hohman succeeds Elizabeth Kramer following her recent appointment as president of E&S Lines. He will also become a member of the MRSI executive leadership team.

-

AM Best said market hardening was likely to continue through 2024, given global market conditions.

-

Liz King Kramer will be responsible for executing the sector’s business plan and driving growth.

-

A memo from the reinsurer raises concerns for cyber insurers over whether they could face a coverage gap after renewals.

-

Analysis of 2022 statutory data shows top US-exposed reinsurers grew assumed premiums 13% year-on-year in 2022.

-

Beneva has signed up to net-zero targets as a member of the NZIA, following a period of turbulence in which Munich Re, Zurich and Hannover Re have left the alliance.

-

She has served as interim CEO since January, after former CEO Michael Kerner was appointed as a board member.

-

Capitola operates as a digital market that connects brokers with carriers using AI for risk-appetite matching.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

Industry climate alliances have received allegations from conservative politicians and regulators in the US that such commitments are illegal group activities that violate antitrust laws.

-

The collapse of Silicon Valley Bank is creating investor fear across the global financial services sector.

-

Highlander has $300mn of insurance coverage, placed by Ed Broking and led by Munich Re Syndicate.

-

No successor will be named and some of Kuczinski’s responsibilities will be transferred to a new board division called GSI.

-

Michael Kerner, who joined Munich Re in 2018, has been appointed to lead the operation.

-

The year 2005, which featured the devastating Hurricane Katrina, remains the most expensive storm season.

-

The reinsurer said it will be “significantly more challenging” to hit EUR3.3bn 2022 profit target.

-

The carrier will no longer invest or insure contracts and projects directly relating to new oil and gas fields, new midstream oil infrastructure and new oil-fired power plants.

-

US severe thunderstorms caused insured losses of $17bn during the first half.

-

The loss comes hard on the heels of a large BI claim stemming from the Freeport LNG refinery.

-

With more than 25 years of industry experience, Karen Rzeszutko will lead the inland and ocean marine underwriting teams.

-

Dual’s crisis management team joined from Swiss Re in July 2021.

-

Scor has appointed Vanessa Contreras, its deputy team leader for professional lines, to Haynes’ old role overseeing all of US casualty.

-

The new coverage marks the first time that sovereign debt repayments have been protected by a parametric catastrophe clause.

-

Everest Insurance head of specialty casualty will transition to the reinsurance division, reporting to Beggs.

-

Munich Re’s venture capital arm Munich Re Ventures has closed a $500mn Munich Re Fund II to invest in early-stage companies.

-

The ransomware surge is likely to lead to changes in the product, a shake-up in market share and challenges for MGAs.

-

Binding insurers include Chubb and AIG, with reinsurance from Munich Re.

-

HDVI is planning to launch in Illinois, Indiana, Ohio, and Minnesota, on top of its existing presence in Tennessee and Alabama.

-

The new unit will place cover for clients trading between the US and Canada.

-

The reinsurer says it is in discussion with clients and industry trade bodies on the issue.

-

Bob Parisi says the tie-up is a first step towards more accurate pricing and coverage for clients.

-

The reinsurer has around a 20% line on the broadcaster’s policy, with Willis Towers Watson acting as the broker.

-

Amazon also joined the investment round through its Alexa Fund.

-

Celerity will write public and private D&O business for the wholesale insurance market.

-

Bruno takes leading role in the MGA’s general aviation team.

-

The outgoing chief will stand down in April after 23 years with the carrier.

-

In five years’ time, the risk solutions unit will account for 30% of Munich Re’s P&C reinsurance portfolio.

-

The portfolio of InsurTech partnerships will now be overseen by the company’s specialty businesses in the US and UK.

-

Hudzik is a thirty-year plus veteran of the (re)insurance market having also worked at Endurance, Zurich and AIG.

-

Global clients and Bermuda are also in the CUO’s purview as he replaces Peter Röder on the reinsurer’s management board.

-

The start-up has appointed Kristi Matus, a former USAA CFO, as CFO and COO.

-

Spruce partners with lenders and real estate companies to offer title insurance to homebuyers.

-

The US tech giant has participated in three rounds at the Indian start-up, which is valued at around $500mn.

-

To what extent reinsurers will pick up a share of BI exposures is a thorny question.

-

The deal follows an earlier fronting agreement supported by Markel, Nephila and RenaissanceRe.

-

Axis Capital and Argo Group shares jumped nearly 5%, while shares in Arch, Travelers and Alleghany were all up more than 3%.

-

Move comes amid double-digit rate hardening in the US commercial auto market.

-

The airline has said that it does not expect a total loss to the $200mn policy with the aircraft repairable.

-

Munich Re has also temporarily stopped underwriting Jetty policies.

-

Swiss Re and Munich Re are both on risk for the $800mn Tokyo Olympics contingency policy.

-

Marsh is now seeking new carriers to cover pandemics as demand for its PathogenRX product rises.

-

Munich Re's move to pull back capacity to Hippo comes as reinsurers are looking more cautiously at InsurTechs.

-

Large losses push the group fourth-quarter result below expectations.

-

The insured loss total is more than one third down on the 2018 tally of $80bn.

-

The MGA will initially write mid-market cyber and professional liability business.

-

The executive will work alongside Diane Link, who joined Munich Re Specialty Insurance in April.

-

Suramericana is facing at least $150mn in claims from civil unrest in Chile over the last six weeks, the company has confirmed.