Nationwide

-

Activists from the left and the right are focusing on insurance, often on the same issues.

-

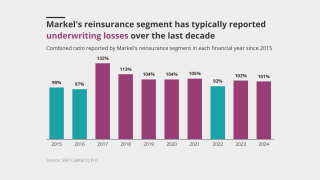

The company was right to drop its reinsurance unit and refocus on its specialty roots.

-

The president expects to see benefits from the deal in H2 2026.

-

Lion's share of Markel Re staff have been offered roles at Ryan, with others to work on run-off.

-

Nationwide will delegate management of the policies to Ryan Specialty.

-

Industry veteran Tonya Courtney will lead the company’s newest E&S business.

-

The Nationwide subsidiary is a $750mn-premium wholesale brokerage that serves about 10,000 local agents.

-

The move will expand Nationwide’s stop loss insurance sales to SMEs.

-

-

The executive previously worked at Guy Carpenter and AIG.

-

Non-renewals for certain policies will start on September 1, 2024.

-

The non-renewals will continue through June 15, 2025.

-

The executive joins from Chubb where she was EVP, digital business officer.

-

The ratings agency also downgraded carrier’s Long-Term Issuer Credit Ratings (Long-Term ICR).

-

The move reflects years of weak profitability caused by high cost inflation and cat losses.

-

The executive will lead a new specialty business line focused on global credit and political risk.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

The changes will take place “over the next few years” and will also include migrating all personal lines business into a single operating model and platform.

-

The business reductions will affect policies up for renewal from December 2023 to July 2024.

-

Inside P&C’s news team runs you through the key highlights of the week.

-

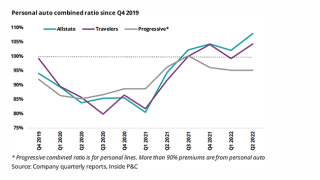

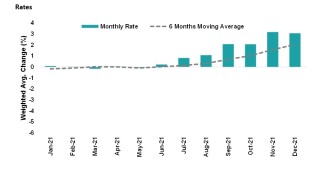

CPI figures show loss costs are cooling, and if rate levels cannot reach adequacy we are likely to see more pausing from the industry beyond State Farm, Allstate and Nationwide.

-

The carrier said the purpose of the changes is to mitigate risk and manage its personal and commercial lines portfolios.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

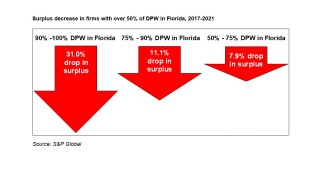

The pullback mirrors what the state went through last year before and after June 1.

-

The executive will start in his new role on April 10.

-

The MGU will help the carrier build its stop loss medical insurance portfolio.

-

Claims analysis shows slow reactions to negative trends can affect several quarters, but carriers who emerge strong will be able to pursue growth faster than the competitors who are always playing catchup on loss cost trends.

-

Excessive litigation costs and continued losses threaten the Sunshine state’s market.

-

Nationwide will provide paper via traditional risk transfer through Ryan Specialty’s managing general underwriters or through the formation of a captive.

-

Data from Apple and Google show that Omicron has slowed the return to driving in some of the largest states by premiums.

-

The two appointments follow a senior management revamp that Nationwide has executed at its E&S business in recent months.

-

Commercial lines loss ratios may move slightly higher, while personal auto carriers see the light at the end of the loss-cost tunnel.

-

The mutual has written about $50mn in premium in a little over two months, while working with four distribution partners in targeting risks with around $10mn in TIV.

-

Kinetic Insurance offers a patented safety device with a tech-driven approach to reducing injuries.