NFP

-

The Insurance Insider US news team runs you through this week’s key agency M&A.

-

The move comes over a year after Aon completed its $13bn purchase of NFP.

-

The executives are based in Seattle and New York.

-

The Insurance Insider US news team runs you through this week’s key agency M&A.

-

The Insurance Insider US news team runs you through this week’s key agency M&A.

-

The Insurance Insider US news team runs you through this week’s key agency M&A.

-

Case added that recently acquired broker NFP has “exceeded” expectations.

-

This publication revealed last year that Brownyard was considering a sale.

-

The news team runs you through this week’s key M&A deals.

-

Walsh is currently co-president of the northeast region.

-

A quick round-up of today’s need-to-know news, including Ryan Specialty and Skyward Specialty.

-

A roundup of today’s need-to-know news, including Commissioner Lara’s FAIR plan reforms.

-

The executive has over 20 years of experience in construction risk management.

-

Avoiding an antitrust fight aids execution, but creates uncomfortable optics around the multiple paid.

-

Aon will provide further updates on NFP and deal financials, on its earnings call tomorrow.

-

The deal cleared a major antitrust hurdle two months ago.

-

NFP claims it has so far lost five clients to Alliant, resulting in damages of $2mn.

-

The deal value represents roughly 4x last year’s insurance broking income.

-

Deanna Brewer will work with NFP’s construction clients.

-

The end of the waiting period effectively clears the path to close in the US.

-

The exec was speaking alongside Doug Hammond after Aon agreed to buy NFP.

-

Amanda Ruback will focus on driving commercial P&C business growth, including supporting new business and client acquisition/retention and managing the region's commercial P&C account teams.

-

NFP will need to be brought close enough to realize the benefits, but not so close its talent feels smothered.

-

The CEO also disclosed that the break fee on the takeover is $250mn.

-

She will work with Atlantic Region, industry group, and risk practice leaders to grow NFP’s commercial P&C business.

-

As part of the initiative, recently appointed MD John Hyland will join David Bowcott and Adrian Pellen as co-leaders of the C&I group.

-

The question of how to finance the private brokers no longer begins and ends with a PE flip.

-

Based in Birmingham, Alabama, the executive will report to NFP management, cyber and professional liability managing director Matthew Schott.

-

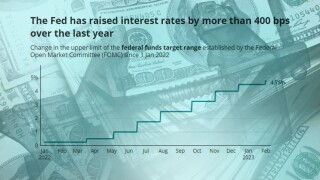

Increased cost of capital is cooling tuck-in M&A, encouraging a pivot to organic growth and forcing greater creativity around financing.

-

The proposed change could disrupt M&A at brokers, shift the calculus in favor of team lifts and dial up C-suite focus on becoming an employer of choice.

-

The broker appointed Marc Tauber to lead FIG’s broking and advisory team, Patrick O’Neill to head large accounts and Justin Corey to oversee business development.

-

The group will provide clients with construction and surety services designed for complex national and cross-border projects.

-

The moves are expected to enable NFP to form and administer Alberta-domiciled captive insurance companies for their clients.

-

Debenport joins the energy practice within NFP's specialty business.

-

Based in Toronto, the executive will report to Guy Jolicoeur, NFP Canada technical risk construction surety natural resources managing director.

-

A tougher environment for debt financing and a potential recession will reverse some of the remarkable tailwinds of recent years.

-

The industry veteran, who joins the broker from Markel Canada, will focus on the firm’s mid-market business.

-

Based in Chicago, the executive will report to NFP’s cyber senior vice president Rick Cavaliere.

-

The executive joined the company last September after the acquisition of Thompson Flanagan, where he was a partner for over 17 years.

-

The realignment reflects the increased scale of the firm’s wealth management and retirement businesses, which have around $445bn in combined assets under management.

-

The deal comes after NFP bought KGJ in the UK and Thompson Flanagan in the US last year.

-

The executive will serve clients in the global oil and gas, power, mining and marine industries.

-

The company is on the look-out for M&A opportunities in Western Europe and Latin America.

-

The P&C division grew overall revenue to $633mn in 2021, expanded adjusted Ebitda to $178mn and adjusted Ebitda margins by 210bps to 31.5%.

-

The partnership will add NFP branding to the Austin FC website and the Q2 Stadium in Texas.

-

Courtney Maugé and Rick Cavaliere will report to Matthew Schott, managing director and head of NFP’s management and professional liability practice.

-

The executives succeed existing Northeast head Bill Austin, who is transitioning to a managing director role focused on scaling NFP’s business in South Florida.

-

NFP will be the anchor limited partner of a Distributed Ventures fund that focuses on start-ups and early-stage companies.