Re/insurers

-

Ackman will need leaders like Ajit Jain behind him and make the right bets at the right price at the right time.

-

The executive’s 30-year career includes stints at Neon, Chubb and Arch.

-

The Japanese P&C carrier agreed a deal to buy 15% of WR Berkley shares in March.

-

Admitted carriers on the other hand are still exercising caution as regulatory reforms take hold.

-

Light cat losses at year-end portend capital deployment and return decisions in 2026.

-

The peril has been historically difficult to model compared to others.

-

Sizable reserve releases offsetting casualty reserve charges cannot last forever.

-

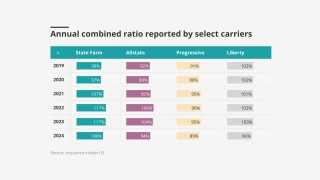

Insurers with SCS exposure reaped fewer benefits but still improved over Q3 2024.

-

The deal to reopen the government also extended the NFIP.

-

Aspen's GWP increased 0.9% to $1.13bn, as it focuses on “robust cycle management”.

-

The UK-based insurer’s Florida Re secured state regulatory approval in June.

-

The executive noted that an influx of new entrants in the E&S market is increasing competition.

-

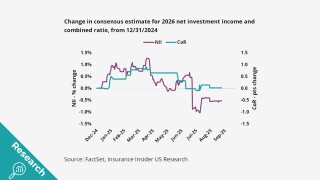

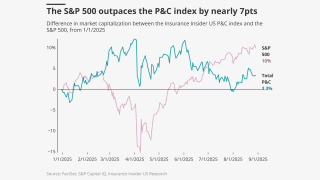

Fears of the oncoming soft market are causing a sector rotation away from P&C.

-

The global insurer is buying access to distribution and underwriting at a carrier with a 27% GWP CAGR.

-

Both the primary and reinsurance segments benefitted from a light cat year.

-

While attritional losses were up for the quarter, those in the carrier’s core business declined.

-

CFO Vogt added that the vehicle’s impact from earned premiums should ramp up from 2026 through 2029.

-

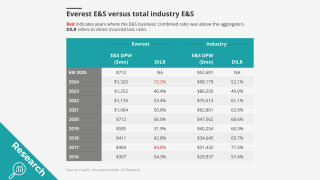

A re-focus on reinsurance nearly brings Everest back where it started.

-

The revised outlooks reflect the difficult moment as Everest moves away from retail.

-

Sources said that the businesses in Canada and LatAm were part of Everest’s original plans to sell its retail book.

-

AIG has agreed to pay Everest $10mn per month for nine months for transition services.

-

The company’s stock fell nearly 9% as the market digested news of an ADC, renewal rights deal and reserve charge.

-

The global insurer will need to convince investors on the quality of the book.

-

AIG will fold the portfolio into its existing business, leaving the liabilities and legal entities with Everest.

-

The appointments are aimed at offering a clearer team structure.

-

Cat losses in Q3 were light as peak hurricane season passes without incident.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

The protection covers the US insurance book for the 2024 and prior accident years.

-

Brian Church has spent 20 years at Chubb.

-

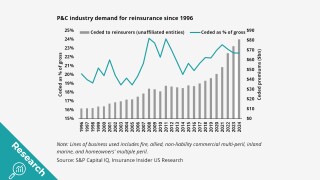

E&S is most exposed to growth normalization, private credit is hunting P&C and fronting is deadlocked on exits.

-

Insurers are pleased, brokers are looking for trade-offs, and everyone’s talking about Howden.

-

When owners are not paying attention, discipline and governance are not top priorities.

-

Expansion into adjacent markets, capital return and M&A among top means of capital deployment.

-

The executive was most recently serving as CRO – insurance.

-

Industry stocks were firmly behind the S&P 500 in Q3.

-

Superintendent Harris is stepping down this month after four years of service.

-

Winds have strengthened to 80 mph, and the hurricane is expected to intensify further over the next 48 hours.

-

The NHC also warned that a hurricane watch could be required in Bermuda as early as Monday afternoon.

-

The New York City gala paid tribute to the industry’s top talent.

-

Lower rates mean lower investment incomes and higher book values for insurers.

-

The tropical cyclone is expected to be named Imelda.

-

Juries don’t significantly differentiate in cases involving severe injury.

-

Despite the formation of Gabrielle, there is "a very high probability" of a below-average season.

-

Markel’s Bryan Sanders is receiving the Lifetime Achievement Award for his service to the industry.

-

Cat losses in August were below historical trends, but we are not in the clear just yet.

-

Vantage Group Holdings received a BBB- long-term issuer credit rating.

-

The affirmations reflect Everest’s strong underwriting diversification.

-

Models anticipate a busier second half, particularly in the next few weeks.

-

The platform aims to “bend the loss curve”.

-

Supply for property outstrips demand, but the casualty market is “bifurcated”.

-

The bipartisan legislation would make Fema a cabinet-level agency.

-

P&C stocks recovered faster than the S&P 500 following a late July dip, but a gap remains.

-

The executive most recently served as head of North American treaty reinsurance.

-

The executive said claims can be a differentiator in a softening market.

-

The action follows Sompo’s $3.5bn all-cash acquisition of Aspen Insurance.

-

Ratings agency said the Sompo deal could have positive financial and operational benefits for the Bermudian.

-

Sources see Aspen as the right fit for Sompo, with Apollo getting a full cash exit.

-

After the LA wildfires in Q1, carriers got some relief in Q2 ahead of wind season.

-

The Japanese company announced the $3.5bn deal today, three months after the Bermudian completed its IPO.

-

The all-cash deal values the Bermudian’s stock at a 36% premium.