RenaissanceRe

-

Fontana 2.0 will encompass a more flexible investment strategy than the 2022 vehicle.

-

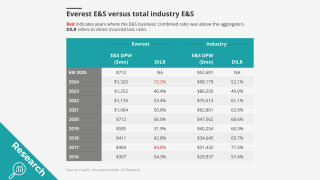

A re-focus on reinsurance nearly brings Everest back where it started.

-

Rates pulling back will rein in some of the excess margin obtained over the past three years, he said.

-

The property segment reported a combined ratio of 15.5% for the quarter, versus 60.3% a year ago.

-

The Insurance Insider US news team runs you through this week’s key agency M&A.

-

Reinsurers are mostly aligned on cat reinsurance, but goals are otherwise diverse.

-

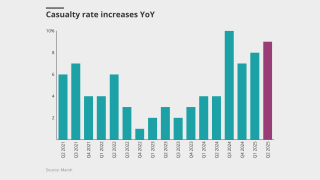

Loss trend concerns persist, but insurers are vouching on the opportunity to push for more rate increases.

-

Wind season remains an important variable, but also might not change current dynamics significantly.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

The reinsurer has also appointed Mehdi Benleulmi as global head of credit.

-

With fee income less understood, a primary acquisition or merger could reset the narrative.

-

The company will continue to deploy additional limit in property cat through mid-year, the firm’s CUO added.

-

However, the firm will take a “conservative approach” until the improvements are shown in data.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

He will oversee Ascot’s US and Bermuda insurance and reinsurance companies.

-

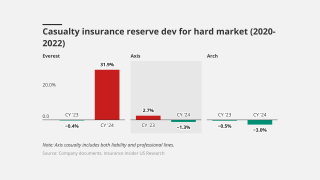

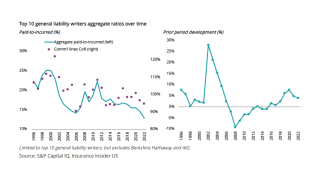

GAAP reserve triangles reveal the struggles of some hybrid franchises.

-

The reinsurer is ready to deploy additional capacity following the event, but only if prices are commensurate with risk.

-

Hurricane Milton brought the firm net losses of $270mn in Q4, while it forecast up to a $750mn wildfire hit for Q1.

-

New CEO Williamson will likely continue walking the hybrid path, with an emphasis on fixing US casualty.

-

There’s a question mark around the tails of AY 2021-2023, the president said.

-

A signal around Q4 adverse development has brought the carrier into the spotlight.

-

In other property, Helene and Milton will assure rates remain attractive, he added.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

The property market remains “one of the most favorable ... I've seen in my career,” the executive said.

-

A quick roundup of today’s need-to-know news, including the DoJ/NatGen lawsuit and RenRe's earnings call.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

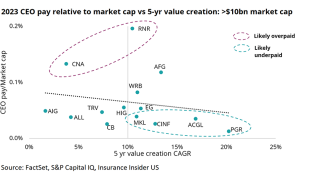

Analysis shows several CEOs with pay diverging from the trendline.

-

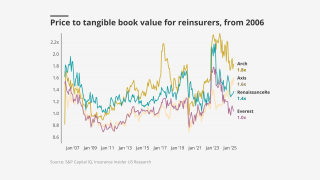

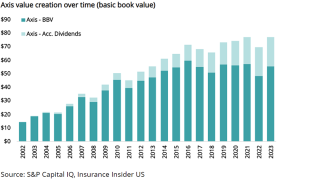

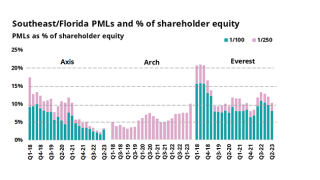

Industry trends show the Axis book value growth goal may be hard to hit.

-

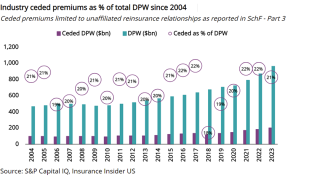

Analysis of 2023 statutory data shows that Californian insurers are leaning more heavily on reinsurers but at a nationwide level, premium cessions were more stable.

-

The Bermudian has been reducing exposure in Florida for almost a decade.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

The 100% equity award will vest in full after five years.

-

With mixed results in the reinsurance space, the specialty pivot remains a "show-me" story.

-

The initial plan was to renew $2.7bn of the acquired book.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

Additional disclosure following the RenRe acquisition reveals results for both carriers for the nine months to 30 September last year.

-

Ratings could be lowered by one notch depending on regulatory restrictions on cash flow from Bermuda operating entities to non-operating holding companies, the ratings agency said.

-

Other senior executives, including CFO Robert Qutub and general counsel Shannon Bender, received stock awards of $750,000 for their involvement in the Validus Re acquisition.

-

The number of staff retained contrasted with more dramatic cuts made after the acquisition of Tokio Millennium and Platinum.

-

After moving into the rank of fifth-largest reinsurer, following its acquisition of Validus, RenRe said it would continue to take a leading role in the regional cat space and expected to be more able to trade through market cycles.

-

The Bermudian firm said it expects the acquisition could drive more growth than the prior forecast of $2.7bn incremental premium.

-

The Inside P&C news team runs you through the earnings results for the day.

-

The deal was announced in late May, with RenRe taking over AIG’s treaty business, including AlphaCat Managers, and all renewal rights to Talbot’s reinsurance treaty unit.

-

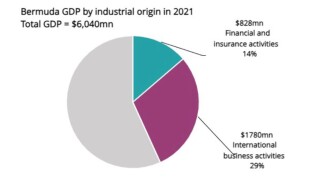

A 15% tax is in the works, but appears manageable, and with (re)insurance being Bermuda’s largest industry, the territory will take steps to keep companies where they are.

-

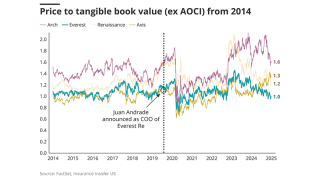

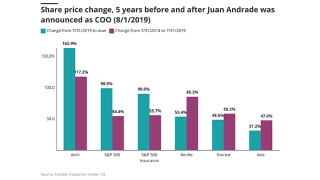

Differences in reinsurer strategies and risk management lead to differentiation in stock multiples and long-term value creation.

-

The reinsurer said it was monitoring conditions in the property E&S markets, where it has been reducing capacity to grow in property treaty, as rate gains could provide fertile ground for future growth.

-

The Inside P&C news team runs you through the earnings results for the day.

-

Inside P&C’s news team runs you through the key highlights of the week.