RLI

-

Bryant has spent over 30 years with the specialty carrier.

-

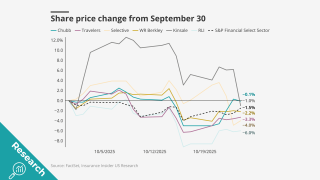

Some disagreement remains in where rate declines have been swiftest and how much further they could go.

-

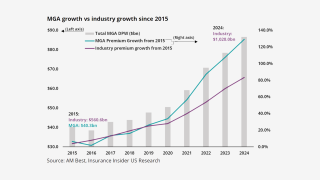

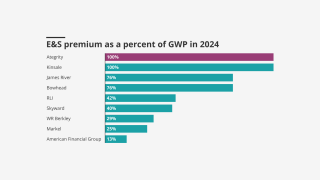

Normalized growth and peak multiples confirm we are headed towards a Darwinian race.

-

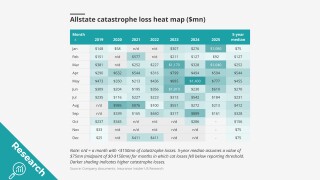

Cat losses in Q3 were light as peak hurricane season passes without incident.

-

A quiet wind season is also expected to further soften the property market.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

The executive’s skepticism is informed by the industry’s typical approach to cyclicality.

-

On Q2 calls, carrier executives called out fierce competition in various lines of business, and a misalignment of interest.

-

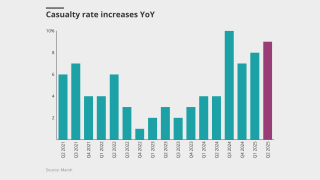

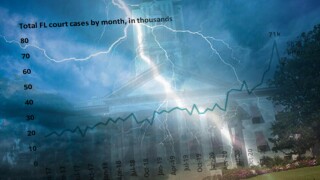

Loss trend concerns persist, but insurers are vouching on the opportunity to push for more rate increases.

-

The segment is also seeing double-digit loss cost inflation.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

The latest E&S player planning to IPO remains a “show me” story.

-

The company’s diverse portfolio could provide protection, but has heavy exposure in construction and transportation.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

Auto severity continues to be an ongoing challenge for the industry.

-

The carrier’s Q4 operating EPS declined to $0.41 from $0.77 in Q4 2023.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

The carrier saw 16% growth during the quarter.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

Moody’s RMS forecast total insured losses from Helene of $8bn-$14bn.

-

Executives flagged elevated packaged auto loss activity in Q2.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

Changes in investment strategy and strong results show carriers can weather financial storms.

-

The casualty segment posted $18mn of favorable reserve development across multiple accident years.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

Competition, particularly from MGAs, is expected to accelerate in 2024.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

Michael served as RLI CEO for around 20 years until he stepped down from the specialty insurer in 2021.

-

Brodeur will have executive leadership and oversight responsibility for RLI’s pricing, reserving, risk management, reinsurance and due diligence functions.

-

The event cost the carrier $66mn, including $14mn related to reinstatement premiums on its catastrophe treaties.

-

On the company’s Q3 earnings call, COO Jennifer Klobnak said the E&S property division grew 39%, including via a 42% rate increase.

-

The Inside P&C news team runs you through the earnings results for the day.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

The estimate is based on the impact to approximately 200 structures where RLI provided primarily homeowners’ insurance.

-

Flows to the E&S market remain strong, executives have said, while dislocation in the property space continues to buoy overall pricing conditions.

-

The January decision affected the company’s ability to offer primary-only policies and it subsequently did not believe the business model was viable long term.

-

The Inside P&C news team runs you through the earnings results for the day.

-

Management was speaking after RLI reported a Q1 combined ratio of 77.9% for Q1 2023, unchanged compared to the prior-year quarter, as top line growth accelerated sequentially to 15.6%.

-

The specialty carrier booked $4mn of net incurred losses associated with 2023 storms.

-

RLI renewed its property per-risk treaty with an estimated 40% risk-adjusted rate increase, and the first dollar retention went up to $2mn.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

The insurer’s NWP grew 14.4% to $298mn, while GWP rose almost 14% to $384mn in Q4.

-

In tandem, the company announced promotions of Chris Hughs to VP of general liability and Chris Gleason to VP of contract surety.

-

Discussion on Q3 earnings calls focused heavily on the supply-demand imbalance in cat capacity, as executives discussed how they would navigate a challenging January renewal.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

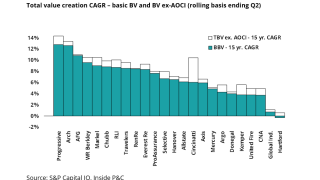

The two specialty insurers reported strong Q3 2022 earnings, continuing to outperform the commercial industry in underwriting gains and value creation.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

Of the ~$40mn Ian loss net of reinsurance, $33mn impacted RLI’s property business and $7mn its casualty unit for some package policies.