Start-ups

-

Longbrook Insurance will write multiple lines of business.

-

Sources said that the New York-based InsurTech retained Evercore to advise on the process.

-

It is understood that the MGA wants to start with renewable energy and transactional liability.

-

The UK-based insurer’s Florida Re secured state regulatory approval in June.

-

From the carrier perspective, alignment of interests was a recurring theme.

-

The company is looking to grow through its new MGA incubator program.

-

MGAs that are good operators will stick out compared to the rest.

-

A Lloyd’s consortium led by Beat Syndicate 4242 backs the MGA.

-

Return horizons are shifting, and entrepreneurial underwriters should start looking at longer tail business.

-

Whether in property or casualty, areas of the market will be profitable even with new entrants, the executive said.

-

Following the Golden Age of Specialty, franchise quality will play a bigger role in determining success.

-

The MGU is entering the often-difficult habitational GL space with an initial E&S offering.

-

Tangram will become the inaugural portfolio company of Balavant Insurance.

-

It represents the platform’s formal entry into the commercial E&S market and will be led by EVP Neil Lipuma.

-

Altamont Capital MD Sam Gaynor said the goal is to have fewer programs that can each grow to a significant size.

-

The new MGU is expected to formally launch before the annual WSIA marketplace in San Diego.

-

Sources said that the start-up will be fronted by Bain-backed Emerald Bay.

-

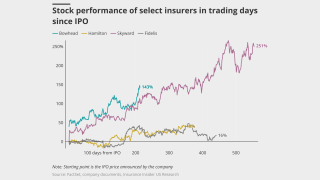

Full-stack carriers fail to outclass incumbents with no clear platform differentiation.

-

The firm will target mid-market risks with TIVs of $25mn-$1bn.

-

The expansive European broker is targeting Mike Parrish’s team and former McGriff staff.

-

In The Car offers embedded auto insurance by integrating policies into dealership management systems.

-

The Bermuda-based team is led by John Fletcher.

-

BP Marsh has subscribed for a 49% shareholding in the start-up MGA.

-

The Miami-based underwriter will write lines of up to $5mn per risk for cyber and tech E&O.

-

The latest E&S player planning to IPO remains a “show me” story.

-

Former Aviva and AIA CEO Mark Wilson will lead the new initiative.

-

Planning for the carrier was halted in January due to the CEO’s health issues.

-

The Floridian is expecting to have around 40,000 policies in force by year-end.

-

The ex-Ategrity CEO launched Pivix Specialty in September 2024.

-

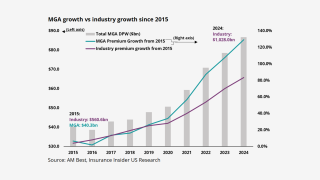

MGA growth is still strong but has passed its 2022 peak.

-

In a post on LinkedIn, Steve Arora said investor appetite “just wasn’t there”.

-

The fund apparently plans to purchase life insurance policies as investments.

-

The program is being launched through subsidiary Southern Marine.

-

K2 Cyber is entering an increasingly crowded cyber market.

-

The MGA will grow in specialty lines via talent recruitment and M&A coupled with technology enablement.

-

Sills’ background, a strong backing, and laser-sharp E&S focus make Bowhead stand out.

-

The start-up is closing a Series A fundraise.

-

The InsurTech was also removed from under review, negative.

-

The start-up has achieved an A- credit rating from AM Best.

-

The homeowners’ carrier has secured Floir approval.

-

WTW sold Willis Re to Gallagher in 2021 for $3.5bn.

-

The start-up has secured BMA approval as it looks to a 1 January kick-off.

-

The business will trade via London, the US and Canada.

-

Nationwide vet Mike Miller is launching the MGA, which focuses on the E&S market.

-

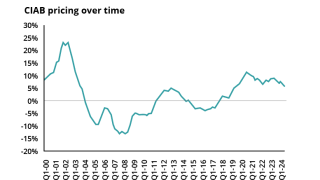

Interest in these vehicles has increased recently, but market softening could throw a curve ball at growth.

-

Elixir has an initial focus on cyber but will look to expand into other lines, including E&O and D&O.

-

Floir approved nearly 650,000 policies for takeout from Citizens for October and November.

-

The underwriting venture, Florida Re, will target both US and LatAm markets.

-

Neil Strong, Richard Holden and Jonathan Reiss have also joined as the leadership team is built out.

-

Conditions are coalescing for an uptick in carrier M&A after many subdued years.

-

This follows AIG’s voluntary dismissal of claims against Dellwood’s top execs.

-

AM Best assessed Dellwood’s balance sheet strength as “very strong”.

-

A standalone syndicate could offer capital, trading, and licensing advantages.

-

The start-up's founder set out the new broker’s strategy, M&A goals and structure.

-

Cyrus Walker will also serve on the new retail broking venture’s board of directors.

-

PE house Vistria will back the buy-and-build strategy in the independent agency space.

-

The front has lined up its first 10 programs and is confident it will get at least seven or eight of them.

-

Earlier this week, this publication revealed that Axis and Accelerant will support the recently launched MGA.

-

The M&A insurance MGA also secured support from Accelerant.

-

The firm launched late last year in the US with a $250mn capital injection, and has also acquired a UK platform.

-

The syndicate will be Asta managed and have capacity from Hampden Names.

-

It is backed by paper from MS Transverse, this publication understands.

-

The business has raised $250mn from backers including PartnerRe, RenRe, Starr and Amwins.

-

The company is aiming for a 2024 Florida rollout, offering HO-3 and DP-3 policies.

-

The carrier expects to re-emerge after operating as going-concern Anchor.

-

It is understood that the InsurTech began fundraising late last year.

-

The executive had been scoping out a new venture since late 2022, working alongside Bob Cooney on the first iteration.

-

The former Aegis London CEO joins former AIG, Marsh McLennan and Ace CEO Brian Duperreault at the start-up.

-

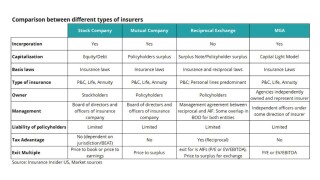

Reciprocals have been cropping up more recently, with a shift toward cat-exposed lines, giving investors a quick way to tap into the hard market with an expectation of a rich multiple at exit.

-

Farmers’ agents in Florida will be offered an appointment with Slide. Renewals issued by Slide will begin for February 2024 effective dates.

-

The platform enables users to create, manage and archive live transaction conversations across deals and across companies in one place.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

The group structure would constitute a Bermuda-based rated carrier, and an associated fund structure.

-

The reciprocal exchange received a consent order on Friday and is expected to begin underwriting in December

-

The start-up was previously targeting a $75mn raise. Investor meetings started last week and will continue into next week.

-

-

Village Protection is expected to be operational on or before January 2024.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

City of London grandee Martin Gilbert is attached to the project in a non-executive capacity, sources said.

-

Andrew Lewis has outlined growth plans for Xitus, a niche global legacy firm he has co-founded that will focus on non-life and reinsurance deals of $5mn-$50mn.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

The former reinsurance CEO had previously parted ways with Bob Cooney after working together on a reinsurer start-up last year.

-

2022 marked a reversal from last year’s unprecedented levels of global investment in InsurTech as the macroeconomic scenario flipped and investors put lossmaking companies under a magnifying glass.

-

Inside P&C’s news team runs you through the key highlights of the week.

-

Even if venture debt has always been around, sources said InsurTechs are approaching the market in different ways, as they struggle to raise equity rounds at attractive valuations.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

Private equity is cautious around even the hard market opportunity in cat.

-

The fundraise comes after the company raised $180mn of Series A funding last year.

-

Some sources argue that now is the time for new management teams to tap into the market with fresh platforms.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

The fund will primarily focus on early-stage investments in North America with an emphasis on insurance innovation.

-

The former executive is looking for $40mn to $80mn of new capital, sources suggested.

-

Names such as Next Insurance, Policygenius and Root have all announced layoffs to rein in expenses in worsening economic conditions.

-

It is understood that the outgoing exec left the company amid operational challenges and that the company has shrunk its workforce.

-

Industry veteran Beau Freyermuth worked at Hub International for 20 years before jumping to Newfront.

-

Clay Rhoades, formerly US E&S president, is named the new insurer’s CEO and will continue to report to Hamilton Insurance CEO Pina Albo.

-

Greenlight Re Innovations invests in platform that can provide on-demand, per-shipment cover.

-

The move is the latest in a flurry of steps Trean has taken to expand its presence in the white-hot programs market, and among a wave of fronting carriers that have entered the sector in recent years.

-

Carl Bauer-Schlichtegroll said InsurTechs in the IPO market attracted a lot of investors who did not understand the complexities of the insurance market.

-

The Floridian InsurTech will use around $50mn for policyholder surplus, sources said.

-

The new workplace will house the firm’s US cyber and transactional liability teams.

-

Jon Hutchens has been a tax lawyer for the last 14 years, most recently serving as a partner at Dentons.

-

The broker is developing solutions to accurately quantify intangibles including IP

-

Ambac’s fronting company Everspan has acquired Enstar’s subsidiary Providence Washington Insurance (PWIC) as part of its strategy to launch new admitted programs and expand its products portfolio.

-

Foundation Capital, Revolution’s Rise of the Rest Seed Fund, Clocktower Technology Ventures, Sure Ventures, and several angel investors, also joined the seed funding round.

-

Durable Capital, T Rowe Price Associates and Whale Rock Capital led the InsurTech’s latest round.

-

The executive joined Vantage on Monday, after spending the last 10 years at Axa XL.

-

The Silicon Valley-based Vouch, launched in 2019, raised $90mn at a $550mn valuation in its Series C round.

-

The Greg Hendrick-led firm added Richard Wall from Axa XL, Bhuma Patel from CNA, and Leona Lik from Aon for the buildout.

-

Eigen Technologies, which helps insurers and brokers extract and digitise data from various sources, hopes to accelerate growth with new investment in the London market.

-

The latest funding round was co-led by Icon Ventures and Lightspeed Venture Partners.

-

The new company will be named Newfront and is expected to place $2bn in premiums annually.

-

The executive will exit the Greg Hendrick-led start-up on July 2.

-

AIG, Axis, Chubb, Travelers, and The Hartford are among the underwriters to support the launch.

-

Ahead of its expected July 1 start, the underwriter promised “efficient and transparent processes” and “consistent decision-making".

-

The latest funding round brings the company’s total funding to date to $82.5mn.

-

The pair will work in New York under the leadership of former Willis executive William Monat.

-

Root’s reinsurance buyer Espinoza said that reinsurers had been receptive and appreciative.

-

Draper Esprit, Astanor Ventures, Lowercarbon Capital, Future Positive Capital and Time Ventures participate in financing round.

-

The start-up said it would use the additional funding to double headcount by 2021.

-

The long-rumoured appointment will see the former Ironshore executives jointly lead the Bermuda start-up.

-

The insurance price comparison business expanded net revenue by more than 100% in 2020 to $79mn and currently has a run rate of $150mn.

-

It is only six months since Next announced its Series D round at a $2bn valuation.

-

Core Specialty will retain some premium and risk on the underlying business before transferring defined natural catastrophe risks to the ILS manager.

-

Heffernan Insurance Brokers contributed to the raise, which was led by Mercato Partners.

-

The raise is understood to value the business at about $100mn.

-

The move adds actuarial muscle to Qomplx in the wake of the start-up’s agreement to merge with Tailwind, a SPAC.

-

The company launched in 18 states last year and plans to enter 11 new markets in 2021.

-

The start-up uses artificial intelligence to streamline insurance distribution and underwriting.

-

The entity plans to retain up to 30% of risk per program.

-

The fund will invest in global "growth-stage” InsurTech and FinTech companies.

-

Kornick was formerly the chief analytics officer at UK insurer Aviva.

-

The InsurTech could be merged into Reinvent Technology Partners, as Metromile prepares to go public in a similar transaction, Bloomberg reports.

-

The latest of a cohort of start-ups will focus on specialty lines syndicated on a global basis through Lloyd’s.

-

The move into commercial insurance follows Relay’s development of reinsurance placing tools last year.

-

French startup Akur8 automates risk modelling processes for insurers.

-

The move follows the company hiring new InsurTech partner Adrian Jones last month.

-

The start-up MGA is working with TigerRisk to structure (re)insurance capacity for the business.

-

Dana Bjornson joins the business from investment bank George K Baum & Company.

-

Companies with strong brands still fall down on “traditional success criteria”, the InsurTech head says.

-

Engineering Capital, Correlation Ventures, Innovation Endeavors and Sure Ventures contributed to the round.

-

Celerity will write public and private D&O business for the wholesale insurance market.

-

Abu Dhabi sovereign wealth-backed Mubadala becomes an Arbol investor.

-

The former Validus exec will become CEO, with current chief executive Larry Hannon set to remain in a senior role.

-

Sharon Fernandez’s hire follows the appointment of Munich’s Andy Rear as Buckle chairman last year.

-

At-Bay has grown gross written premiums by 600% in the last year.

-

The US carrier has offloaded a tranche of liability business written out of London.

-

The CEO dismissed comparisons between his start-up and the Class of 2005 (re)insurers.

-

CEO Greg Hendrick said the composition of the new carrier would eventually be more heavily weighted to insurance business.

-

The latest appointments include former Markel property head Peta White and former EY partner Gail McGiffin.

-

Reardon, Dudek and Roberts are all set to be reunited with former colleagues including Jeff Clements.

-

The start-up provides technology to assist carriers with underwriting and claims.

-

The start-up envisages expansion into insurance “in the coming years”, AM Best said.

-

The ratings agency has given the entity a financial strength assessment of A-.