State Farm

-

The commissioner said more work needs to be done, but big companies are interested in coming back.

-

Carriers underweight in E&S could lead the charge in the next round of M&A.

-

The Republican said his office has launched an investigation into the denials.

-

The ratings agency said that it continues to assess State Farm’s balance sheet among the strongest.

-

State regulators have largely avoided enforceable AI regulations, but bad news could change that.

-

The regulations are designed to address long-term solvency concerns.

-

State Farm is under investigation as its premiums have been rising “drastically".

-

IBHS CEO Roy Wright says insurers need a comprehensive approach to resilience.

-

Roughly half a year since the LA fires, brokers said there’s hope things are turning around.

-

The class can collectively challenge State Farm’s property claims calculations.

-

The ruling comes as insurers face growing legal pressures following the January blazes.

-

Lara approved an interim rate increase for the company just weeks ago.

-

The company seeks the full 30% homeowners’ rate request it made last June.

-

State Farm will need to provide its CA subsidiary with a $400mn surplus note.

-

The carrier has received 12,300 claims as of 28 March.

-

Commissioner Lara also proposed a $500mn cash infusion from parent State Farm.

-

The carrier has also received 11,750 fire-related claims so far this year.

-

The company is seeking an emergency rate increase after the devastating Los Angeles wildfires.

-

State Farm General has asked California regulators for an emergency rate increase.

-

The carrier has paid $1.75bn on around 9,500 claims filed from the wildfires.

-

Sources said California regulators need to show they’re receptive to private insurer needs.

-

The insurer is seeking a 22% interim raise, but the request is currently on hold.

-

The insurance commissioner said the carrier has not shown the need for price increases.

-

The insurer disclosed the estimates as it seeks emergency rate hikes from regulators.

-

The company says the recent wildfires will be the costliest in its history.

-

The carrier has around $2.5bn-$4bn of reinsurance cover specifically for California risk.

-

The company received over 10,100 home and auto claims as of January 27.

-

A state-mandated, one-year moratorium on non-renewals is also in place.

-

Insurers are fighting to recoup claims they have paid out.

-

Independent litigation threatened a $4bn settlement with wildfire victims.

-

The victims claim insurers shouldn’t get settlement cash before they’re made whole.

-

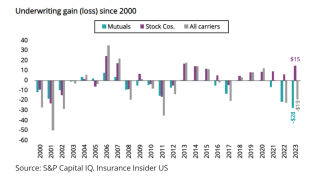

The discrepancy between rising claim counts and favorable reserves is cause for concern.

-

Mutuals struggle to react and adapt to a worsening loss environment.

-

The downgrade reflects the company’s balance sheet strength, which AM Best assessed as weak.

-

The carrier stopped accepting new HO business in the state last May.

-

-

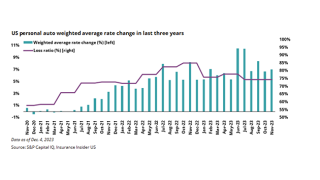

Personal lines rate filings are rising, even as some inflation drivers slow.

-

Increased cat losses in property offset auto improvements.

-

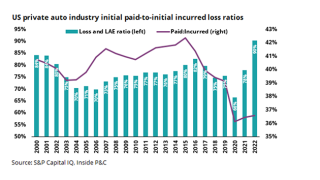

Cooling CPI metrics and improving loss ratios indicate a positive shift for the personal auto industry, but results are not yet back to where they need to be.

-

Personal auto carriers risk falling behind in the battle between loss costs and approved rate declines, while homeowners carriers’ double-digit filings might not be enough to keep up.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

Carriers have been dealing with elevated storm activity this year, whilst additional purchases to match inflating values had largely been parked in 2023.

-

This is the second downgrade faced by State Farm and its subsidiaries from AM Best in the last month.

-

The ratings agency affirmed its financial strength rating of A++ and long-term ICR of aa+ on the mutual and its affiliates.

-

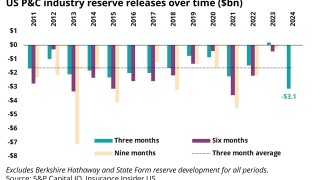

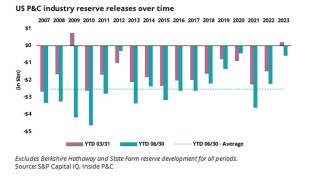

Differing trends in short- and long-tail lines offset each other to create a net positive for the industry, though the releases are slowing significantly.

-

Inside P&C’s news team runs you through the key highlights of the week.

-

An uneven loss environment in personal lines calls for a cautious reading of reserves.