The Hanover

-

The CEO said the carrier is seeing sequential PIF growth in several states.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

CEO Roche said that “significant price increases” are still to come, however.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

The company is also pursuing “deconcentration” to lower SCS exposure.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

The coverage will only be available in Illinois and Michigan at first.

-

The executive will continue to lead personal lines and core commercial.

-

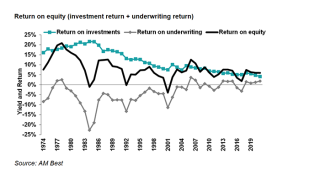

Regionals and smaller carriers need to exercise vigilance when expanding commercial casualty lines.

-

The carrier anticipates the impact of the wildfires to drive January cat losses up to $40mn.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

Middle market premiums were lower in Q3, but the company is confident growth will resume in Q4.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

Regionals may be particularly vulnerable to problematic loss cost trends and volatile cat losses.

-

The executive said the company remains optimistic about small commercial, where NWP grew 8.5% in Q2.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

The losses primarily resulted from severe convective storm activity.

-

Roche said the company's deliberate efforts to limit exposure in the Midwest offset loss trends.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

Markel, Axis and Selective booked sizeable reserve charges in their liability segments.

-

Insurance Insider US runs you through the earnings results for the day.

-

She joined The Hanover in 2015 and since 2018 has served as CUO of technology and life sciences underwriting.

-

Marohn will lead the company's E&S business, specialty industrial business, Hanover Programs, specialty general liability and Hanover Specialty Insurance Brokers.

-

Its Q3 cat losses of $196mn primarily resulted from severe convective storms in the region, and drove the overall combined ratio to come at 104.4%.

-

The Inside P&C news team runs you through the earnings results for the day.

-

A clear commonality is already emerging much as it did in the previous quarter, when severe convective storms – particularly hail – also dominated.

-

The carrier’s cat loss estimate for Q3 2023 is more than twice Q3 2022’s $90.1mn, which included $28mn attributable to Hurricane Ian.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

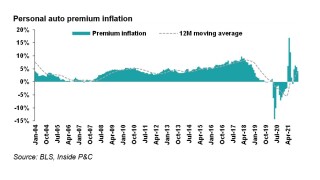

The migration is due to admitted carriers not being able to get the rate filings approved in a lot of the states – an issue that is extending beyond California and Florida, to the east coast.

-

Hamann previously served as the company's deputy president and CUO of small commercial.

-

Executives have pointed out that it is becoming increasingly difficult to talk about broader trends as micro-cycles are developing for each line.

-

These changes include increasing all payroll deductibles to specific minimum levels by coverage A limit, adding wind and hail deductibles in multiple states and transitioning to an ACV schedule for roofs as the standard offering.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

The Inside P&C news team runs you through the earnings results for the day.

-

Q2 cat losses reported by most carriers were significantly higher than a year ago owing to the number of US convective storms and likely higher carrier retentions at reinsurance renewals.

-

Losses stemmed from 19 convective storms across multiple states, with hail damage representing the majority of reported losses, primarily impacting the personal lines segment.

-

Inside P&C’s news team runs you through the key highlights of the week.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

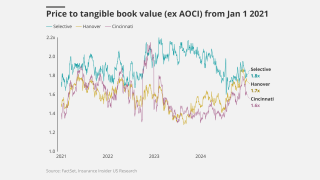

The regional cohort keeps pace with nationals on pricing, and stays ahead on reserving trends.

-

Homeowners' renewal pricing is expected to increase around 20% throughout the rest of the year.

-

The Hanover’s ex-cat CoR rose to 91.7% in the first quarter, up from 89.8% a year earlier as the company posted lower reserve releases.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

Losses stemmed from over 20 weather events, including severe freezes in February and widespread wind and tornadic activity in mid- to late March.

-

The Hanover expects its 2023 ex-cat CoR to be in the 91%-92% range, driven by rate adjustments and changes in personal auto frequency.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

The firm’s personal lines segment booked an ex-cat CoR of 98.9% (up from 92.1%), driven primarily by inflation and supply chain delays.

-

Inside P&C’s news team runs you through the key highlights of the week.

-

The insurer said its cat estimate is driven by $165mn of losses related to Winter Storm Elliott.

-

Jon Martin will succeed Schuler as management liability VP and Greggory Ketay will become distribution VP.

-

The regionals continue to find success in small and middle market business, as their pivot to a commercial focus has benefitted them.

-

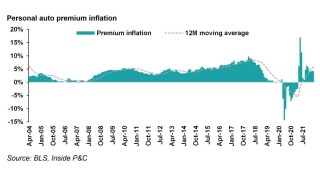

For its personal auto book the firm anticipates rate renewals of 7% in Q4, up from 4.1% in Q3, and double-digit hikes in 2023.

-

The personal lines unit reported a combined ratio of 107.3%, marking a 3.5-point deterioration from the 103.8% CoR reported in the prior-year quarter.

-

The insurer took $28mn in net Hurricane Ian losses and warned inflationary pressures surpassed expectations in general in Q3.

-

With pricing decelerating and loss-cost trends potentially reversing, regionals should continue to execute on their present strategy.

-

The firm’s specialty pivot seems to be paying off in premium growth and value creation.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

Despite strong performance in commercial and specialty, THG raised its full-year combined ratio guidance by one point, citing inflationary pressure on personal lines.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

The loss ratio in the personal lines unit increased by 7.1 points year on year, as property and auto lines faced higher severity.

-

The industry veteran of 36 years will also serve on the board’s audit committee.

-

The sector was hit by a rough first half of 2022, with more to come in the second half of the year.

-

Before joining State Street in 2019, the executive served for over 25 years at Citigroup, where he held various leadership positions.

-

Insurers could face pressure if interest rate and recession fears intersect with worsening loss cost trends.

-

The CFO attributed THG’s worsening first quarter combined ratio to increased severity in auto and homeowners claims.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

The results fall in line with other personal lines carriers, which have faced a tumultuous time offsetting loss cost trends but sought reprieve in their commercial lines segments.

-

March’s CPI report shows elevated inflation levels, including vehicle CPI of 10.5% and average used car price increase of 24.7%.

-

The carrier said agents who form strategic partnerships with select specialty carriers gain a “unique advantage” in the market.

-

The Hanover swung back to underwriting profit of $88mn after a cat-heavy Q3.

-

The company’s fourth quarter combined ratio increased by 0.5 points to 92.9% year-on-year.

-

The program offers E&O insurance coverage for real estate agents, appraisers, title agents, abstractors, home inspectors and mortgage brokers.

-

The latest report shows even higher inflation pushing up severity, forcing carriers to take rate.