-

The Insurance Insider US news team runs you through this week’s key agency M&A.

-

Sources said that the platform drafted in Ardea Partners to advise on the recap.

-

Earlier this year, this publication revealed that Atlas was considering a potential sale.

-

The $21/share pricing falls in the middle of the expected range.

-

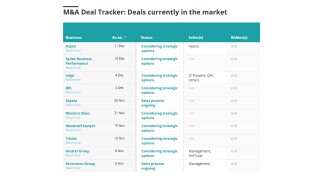

Insight into the state of the insurance M&A market, powered by Insurance Insider US’s comprehensive deal database.

-

The deal would follow AJG’s regional acquisitions of THB Chile, Brazil’s Case or the Colombian retail book of Itau.

-

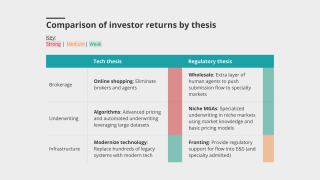

HNW family offices are now among investors considering the US MGA segment.

-

Tompkins Insurance is a subsidiary of Tompkins Financial Corporation.

-

The global insurer is buying access to distribution and underwriting at a carrier with a 27% GWP CAGR.

-

The acquisition will expand PHLY’s presence in the niche market.

-

The Insurance Insider US news team runs you through this week’s key agency M&A.

-

Gray specializes in contract bonds for mid-sized and emerging contractors.

-

Sources said that the transaction valued the Californian auto F&I business at over $1bn.

-

Onex’s own balance sheet will become a 63% owner and AIG takes a 35% stake.

-

Greenberg has strong links with IQUW management, and praised the firm’s leadership and cultural fit.

-

This publication revealed that Starr was zeroing in on the deal earlier today.

-

The parties could announce the transaction soon, according to sources.

-

Sources said that the businesses in Canada and LatAm were part of Everest’s original plans to sell its retail book.

-

AIG has agreed to pay Everest $10mn per month for nine months for transition services.

-

The global insurer will need to convince investors on the quality of the book.

-

BP Marsh has agreed the sale of its 28.2% shareholding as part of the deal.

-

AIG will fold the portfolio into its existing business, leaving the liabilities and legal entities with Everest.

-

The Insurance Insider US news team runs you through this week’s key agency M&A.

-

Old Republic said the acquisition is expected to close in 2026.

-

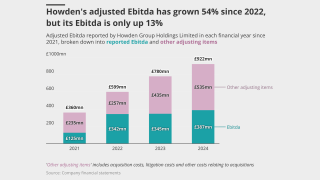

The company and its main debt provider Ares agreed to relax its debt terms in April.

-

Dealmaking took centerstage, but other discussed topics were growth, talent and capacity.

-

Sources said that Piper Sandler is advising the Dallas-based program manager on the process.

-

The Jay Rittberg-led program manager kicked off a strategic process in August.

-

Sources said the PE-backed platform retained IAP to advise on the process.

-

The company is looking to grow through its new MGA incubator program.

-

The Insurance Insider US news team runs you through this week’s key agency M&A.

-

SageSure’s recent M&A in Florida was driven by being selective with policies and smart about claims costs.

-

MGAs that are good operators will stick out compared to the rest.

-

Private capital–backed buyers accounted for 73% of the 513 transactions this year.

-

The Insurance Insider US news team runs you through this week’s key agency M&A.

-

The MGA platform wants to expand into Europe and the UK and grow its wholesale business.

-

The broker will now have access to an M&A war chest for inorganic growth.

-

The carrier has renewed and extended its capacity arrangement with the MGA.

-

The Insurance Insider US news team runs you through this week’s key agency M&A.

-

Seller White Mountains will retain a roughly 15% fully diluted equity stake.

-

Proceeds will be used to pay off debt maturing at the end of the year and to support new market growth.

-

The business has been ~70% owned by White Mountains since January 2024.

-

The firm posted trailing 12-month organic growth of 23% YoY supported by a three-pillar strategy.

-

Sources said that Howden Capital Markets is advising the fronting company.

-

Spectrum joins investors ForgePoint, Hudson and MTech.

-

Verisk's recent deals and its interest in cyber-analytics firm CyberCube show M&A in the segment has ticked up.

-

The company will continue its capacity partnership with the MGA until 2030.

-

Return horizons are shifting, and entrepreneurial underwriters should start looking at longer tail business.

-

The Insurance Insider US news team runs you through this week’s key agency M&A.

-

The transaction marks the largest US market entry by a Korean non-life insurer.

-

With the deal, sources expect backers Tiptree and Warburg Pincus to exit the Floridian insurer.

-

Sources said the start-up has two $10mn+ Ebitda platform deals lined up.

-

The Insurance Insider US news team runs you through this week’s key agency M&A.

-

The deal values the Onex-backed P&C broker at over $7bn.

-

The low degree of overlap between the combining portfolios benefits both parties.

-

Other parties that looked at the business include CPPIB, Permira and Carlyle, sources said.

-

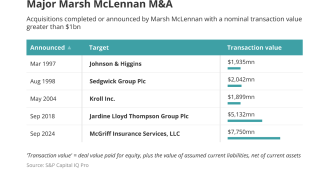

A federal judge restricted former Marsh employees from soliciting for Howden.

-

The deal’s benefits headlined AJG’s investor day presentation.

-

Onex is making the investment alongside PSP, Ardian and others.

-

This publication revealed earlier this year that the firm was working with Ardea to explore strategic options.

-

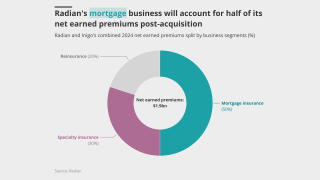

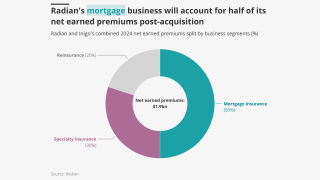

The mortgage insurer said Inigo will continue to operate as a standalone business.

-

The acquisition furthers Howden’s expansion into the US retail space.

-

The Inigo CEO said the lack of portfolio crossover was highly attractive to Inigo.

-

The US mortgage insurer announced its $1.7bn acquisition of Inigo earlier today.

-

The deal becomes part of a wave of carrier dealmaking.

-

Sources said the agency first considered a debt raise but recently pivoted to a sale process.

-

The as-yet unnamed platform will have to compete in a crowded market for M&A and lift-out opportunities.

-

A process has not been launched and a firm timeline for a liquidity event has not been agreed.

-

Tangram will become the inaugural portfolio company of Balavant Insurance.

-

The MGA business was valued at an enterprise valuation of upwards of $1.1bn, sources said.

-

This publication reported earlier today of the asset manager’s foray into the MGA space.

-

The deal represents a first entry into the US MGA market for the $1.1tn asset manager.

-

The Insurance Insider US news team runs you through this week’s key agency M&A.

-

As part of the transaction, PE firm Atlas Merchant has agreed to sell its interest in MarshBerry.

-

The deal is expected to result in $700mn in combined GWP in Florida upon completion.

-

The boutique retail broker provides P&C and benefits services in the Mexican Caribbean hospitality sector.

-

The Insurance Insider US news team runs you through this week’s key agency M&A.

-

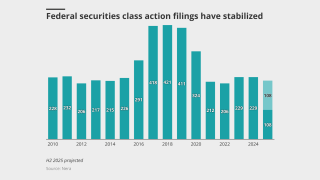

Lawyers said uncertainty raises litigation risks, and signals from the federal government aren’t expected to help.

-

The insurer has been under review with positive implications since March.

-

Andrew Robinson returns to Lloyd’s after his previous involvement via The Hanover’s Chaucer deal.

-

Apollo executives David Ibeson and James Slaughter are committed to the future as a combined entity.

-

The US specialty carrier announced Tuesday that it was buying the Lloyd's business for $555mn.

-

Aon acquired NFP from Madison Dearborn in April last year in a $13.4bn deal.

-

In June, this publication revealed that Apollo had appointed Evercore and Howden to run a process.

-

Arkansas-based RVU provides commercial P&C and some specialty programs.

-

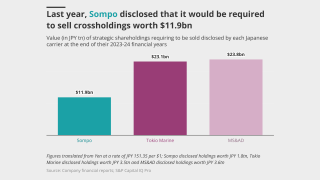

The action follows Sompo’s $3.5bn all-cash acquisition of Aspen Insurance.

-

A view into PE-fueled activity in the MGA sector, as LatAm carrier M&A accelerates.

-

Ratings agency said the Sompo deal could have positive financial and operational benefits for the Bermudian.

-

James River said the court was right to dismiss the fraud case.

-

The Insurance Insider US news team runs you through this week’s key agency M&A.

-

The company said defendant "distraction" can’t make up for flimsy arguments.

-

Analysis of market conditions, reserves show that this might not lead to an overnight consolidation boom.

-

Group CEO Mikio Okumura cited “solutions that have not been fulfilled”.

-

The likes of Genstar, Leonard Green and Bain also looked at the program manager.

-

Sources see Aspen as the right fit for Sompo, with Apollo getting a full cash exit.

-

Sources said that the NY-based TL underwriter has retained Piper Sandler to run the process.

-

The lawsuit has been filed as sales talks with Sompo yielded a deal.

-

The Japanese company announced the $3.5bn deal today, three months after the Bermudian completed its IPO.

-

The Japanese carrier has agreed to buy Aspen for a realization of $3.5bn.

-

The all-cash deal values the Bermudian’s stock at a 36% premium.

-

This publication first reported deal talks last week.

-

Hasnaa El Rhermoul will be SVP at Ethos Transactional, sources said.

-

Sources said Atlas’ owner is selling the retail agencies but will retain the Hawaii carrier Island Insurance.

-

The Insurance Insider US news team runs you through this week’s key agency M&A.

-

Equidad earlier sold its soccer team to group of US investors that includes actor Ryan Reynolds.

-

The insurer has chosen a “take two” deal after buying Endurance, betting again on Bermuda.

-

This publication revealed yesterday that the two were in detailed takeover talks.

-

This publication revealed yesterday that Sompo is currently in negotiations with Aspen.

-

The completion is also good news for Marsh, Aon, WTW and other potential buyers in US retail.

-

Sources said that detailed discussions have taken place, with a clear path to a deal.

-

The deal was announced last month.

-

The Brazilian carrier grew earned premiums to over $100mn in 2024.

-

The company said the judge overlooked key issues in dismissing its fraud case.

-

The broker approved a grant of $316mn in equity awards payable in staggered amounts over the coming five years.

-

Insurance Insider US takes a closer look at tuck-in activity as valuations continue to hold steady.

-

The Insurance Insider US news team runs you through this week’s key agency M&A.

-

The move includes One80 Intermediaries, formerly part of Risk Strategies.

-

This publication revealed two years ago that EQT could lodge a $1bn claim.

-

The Insurance Insider US news team runs you through this week’s key agency M&A.

-

This publication reported yesterday that Talanx was closing in on the sale.

-

With roughly 200 employees, the South American operations generated over EUR130mn in 2024 GWP.

-

CEO David Howden accused rivals of “restricting choice for their own clients”.

-

Verita leadership and staff will remain intact and “seamlessly functional”.

-

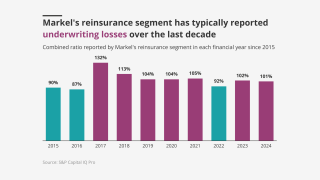

The company was right to drop its reinsurance unit and refocus on its specialty roots.

-

The Insurance Insider US news team runs you through this week’s key agency M&A.

-

The Risk Strategies parent company had also been the subject of bids from Marsh and Howden.

-

The wholesaler also paid nearly $29mn for the Irish MGU 360 Underwriting.

-

AJ Gallagher has responded to a request for additional information under the HSR filing.

-

DB reiterated that no final decisions have been made regarding a potential deal.

-

AmeriLife and OneDigital are in the market while Relation is preparing for a liquidity event.

-

Nationwide will delegate management of the policies to Ryan Specialty.

-

The company provides management workflow for residential contractors.

-

The lawsuit claims more than 100 employees left with Parrish and his three reports.

-

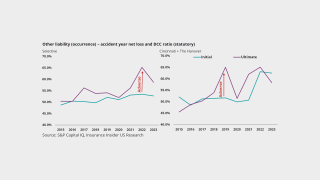

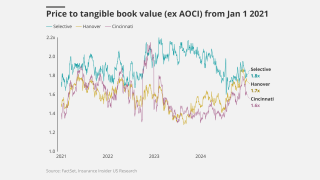

The regional insurer has increased its weighting to OLO and commercial auto, versus comp.

-

The carrier agreed to acquire Liberty Mutual’s P&C firms in Thailand and Vietnam in March.

-

This is its second significant wholesale acquisition this year following the $54mn takeover of NBS.

-

North American carriers completed the most transactions in the first half of 2025.

-

The Insurance Insider US news team runs you through this week’s key agency M&A.

-

A timeline for the process has yet to be determined, but the base case is H1 2026.

-

Sources said the Atlanta-based platform retained Evercore to run the auction.

-

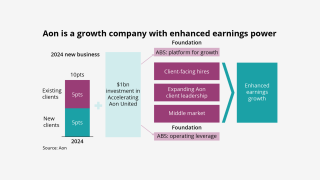

The NFP acquisition was a “tailwind for organic growth, not a key driver”, said CFO Edmund Reese.

-

Sources said that Evercore is running the process, which went through first-round bids earlier this month.

-

Weatherbys Hamilton provides private client, bloodstock and farm coverage.

-

This is the New York-based firm’s first acquisition since launching in 2024.

-

It is slim pickings for quality mega deals and the brokerage has an in-built need for speed.

-

Recent inbound offers can “oftentimes” be a leading indicator that the market is slowing, he said.

-

The expansive European broker is targeting Mike Parrish’s team and former McGriff staff.

-

The Insurance Insider US news team runs you through this week’s key agency M&A.

-

The judge ruled the deal relied too heavily on Bermuda law for US law to apply.

-

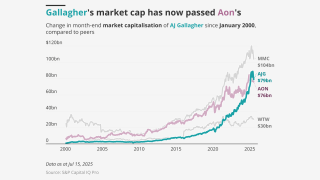

Succession, heavyweight M&A and expanding beyond its core will all test the broker.

-

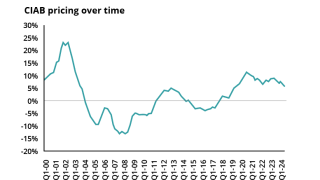

On the rate environment, Schnitzer said the amplitude of the pricing cycle is shrinking.

-

The broker has emerged as the emphatic winner of the supercycle, but new tests are coming.

-

This publication revealed the planned stake purchase earlier this week.

-

Underhill spent nine years at BHSI as global head of transactional liability.

-

In May, this publication revealed that Warburg was among the PE bidders for KAP.

-

The Insurance Insider US news team runs you through this week’s key agency M&A.

-

Apax and Carlyle will continue to back the broker consolidator.

-

The MGA opened the door for potential growth via M&A besides organic growth, team hires and carrier carve-outs.

-

A London wholesaler broker would be a compelling second move.

-

The FTC granted early termination of the waiting period, leaving the acquisition on track to finish in early 2026.

-

The CD&R and Stone Point-backed wholesaler said that further international deals may follow.

-

Sixth Street and Cornell also bid for the wholesaler.

-

The Bermudian investor already owned a 1% interest in the NY-based MGA platform.

-

The deal comes amidst an expected spell of M&A on Lime Street.

-

The Insurance Insider US news team runs you through this week’s key agency M&A.

-

The cyber business will continue to operate as a standalone entity.

-

Earlier this year, Insurance Insider US revealed that the insurers were in takeover talks.

-

The carriers remain in takeover negotiations but have not reached a decision around valuation.

-

The take-private deal was announced in July 2024.

-

A second look at the services deals boom powered by this publication’s M&A Tracker.

-

The Insurance Insider US news team runs you through this week’s key agency M&A.

-

Sources said BMO was retained earlier this year to advise on the strategic process.

-

The vote paves the way for the finalization of the deal in the first half of 2026.

-

Westfield will receive $260mn in cash and ~2.75 million shares of First Financial stock worth about $65mn.

-

Sources said NY-based Lee Equity is seeking to extend its investment in the TPA heavyweight.

-

The Insurance Insider US news team runs you through this week’s key agency M&A.

-

In March, this publication revealed that Pinnacle was considering a sale.

-

PwC reported that deal volume decreased to 209 deals from 297, but values climbed to $30bn from $20bn.

-

Howden has been expanding its South American presence through M&A.

-

The Insurance Insider US news team runs you through this week’s key agency M&A.

-

The deal triples Hippo’s new homeowner leads and extends Baldwin’s MGA capacity.

-

Hippo will also provide capacity for existing and future MSI programs.

-

Above-market organic growth, mid-market M&A and talent infusions were all heralded.

-

Howden recently expanded in South America with the takeover of Contacto and Innova Re.

-

The trend is expected to be most pronounced in the Middle East, the survey found.

-

The broker is targeting run-rate synergies of $150mn by the end of 2028.

-

The appointment follows B&B’s acquisition of Accession.

-

The deal multiple is understood to be around 15x adjusted Ebitda.

-

The $10bn acquisition of Risk Strategies is the biggest broker deal relative to size we have seen.

-

The acquirer will carry out a ~$4bn equity placement to help finance the transaction.

-

The Insurance Insider US news team runs you through this week’s key agency M&A.

-

White Mountains invested $150mn in the retail platform earlier this year.

-

The Michigan-based firm will join Ryan Specialty’s binding authority division.

-

The merger is on track to close in H2 2025, CEO Pat Gallagher said.

-

This publication revealed back in February that Itel was being prepared for a sale.

-

The deal values the company, formerly PCF, at roughly $5.7bn.

-

The PE firm’s Aaron Cohen said full integration of broking assets is crucial.

-

The acquisition follows a strategic partnership the two struck last August.

-

With fee income less understood, a primary acquisition or merger could reset the narrative.

-

The purchase aims to bolster Markel’s marine product line in the Asia-Pacific region and EU.

-

The Insurance Insider US news team runs you through this week’s key agency M&A.

-

Acrisure recently raised $2.1bn from investors in its latest step towards an IPO.

-

The deal leaves premier surety as Travelers' sole Canadian portfolio.

-

Kestrel stock will begin trading on Nasdaq tomorrow under the symbol KG.

-

Acrisure followed the recaps of Hub International and Broadstreet Partners.

-

He will also invest in the company.

-

The Insurance Insider US news team runs you through this week’s key agency M&A.

-

The sale process was first reported by this publication three months ago.

-

Sources said that negotiations are proceeding well with a path to do a cash deal.

-

The Insurance Insider US news team runs you through this week’s key agency M&A.

-

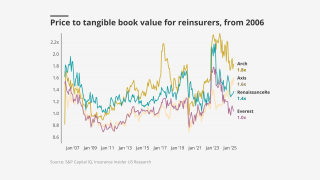

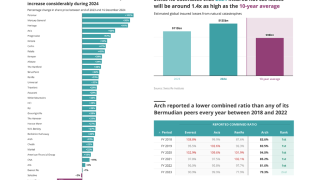

Unpacking how much excess capital there really is and dissecting the source of its returns.

-

Previously, the auction drew takeover interest from DB and Dai-ichi.

-

Sources said MarshBerry was retained earlier this year to run the sale.

-

Sources said that the program manager is being advised by Dowling Hales.

-

Sources suggested that the multiple could be as low as the 13x range as valuations reset.

-

The exec said if he were a carrier CEO, now is the time he would start looking for deals.

-

Insurance Insider US revealed last year that Intercare had retained MarshBerry to explore strategic options.

-

Insurance Insider US revealed last week that Hub had secured a ~16.5x Ebitda valuation in its “private IPO”.

-

The two deals bring the combined company’s Ebitda to about $25mn-$30mn.

-

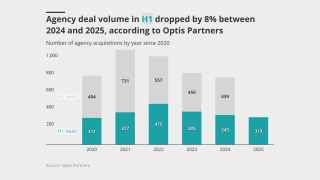

Q1 was the ninth consecutive quarter of below-average deal volume.

-

The Insurance Insider US news team runs you through this week’s key agency M&A.

-

Broadstreet announced the most deals, followed by Hub and Gallagher.

-

The firm also reported it paid $82.8mn for Brazilian brokerage Case Group.

-

The deal will place the highest ever private valuation on a broking firm.

-

The preferred shares will mandatorily convert to common equity on an IPO.

-

Alliant is celebrating its 100th anniversary this year, and is the ‘furthest thing from a serial acquirer,’ Greg Zimmer, CEO, Alliant, said at RISKWORLD 2025.

-

In casualty, getting significant blocks of capacity remains a major challenge.

-

The executive also spoke about growing organically and via M&A.

-

MGA platforms, however, are seeing higher multiples than those in retail.

-

The platform will focus on acquiring MGAS across lines of coverage.

-

The Insurance Insider US news team runs you through this week’s key agency M&A.

-

The company completed the acquisition yesterday.

-

AJG still has $2bn of M&A capacity after the AP and Woodruff Sawyer deals.

-

It acquired wholesaler ARC Excess & Surplus, confirming an earlier report from this publication.

-

Last summer Insurance Insider US flagged 3 advantages that minority deals provide.

-

The firm acquired total assets of $65mn and assumed liabilities of $11mn.

-

Sources said JP Morgan and RBC are advising the brokerage.

-

The deal is expected to close in the second quarter.

-

The Insurance Insider US news team runs you through this week’s key agency M&A.

-

The broker's share price dipped 11% in morning trading after its Q1 earnings missed expectations.

-

Sources said the firm retained Ardea to run the process.

-

The MGA will focus on insurance for agents, carrier partners and clients.

-

The sale price represents Elephant’s approximate net asset value.

-

The Kelso and Arch-backed run-off player has retained Evercore to advise.

-

The firm acted as the front for Trouvaille Re, the E&S property sidecar for MGA AmRisc.

-

The Insurance Insider US news team runs you through this week’s key agency M&A.

-

Guy Carpenter president Dean Klisura added that Q1 was a record cat bond issuance quarter.

-

Sources said Morgan Stanley has been drafted in to run the auction later this year.

-

In operation since 1991, Pearl represents Ocean Harbor and Equity insurance companies.

-

Meco's 2024 gross written premiums totaled $63mn.

-

The UK broker is still in talks with Mubadala about a standalone investment in the business.

-

Fortegra launched a sale process months ago with Barclays and BofA advising.

-

The move will enable Hadron to deliver more admitted insurance solutions to clients and policyholders.

-

Sources said the Ethos-led group will take roughly a 40% stake.

-

The business will still look at large non-life deals in particular in-the-money ADCs.

-

The Insurance Insider US news team runs you through this week’s key agency M&A.

-

Business hates uncertainty and geopolitical tensions are off the charts.

-

The deal had HSR approval and was waiting on approval from the UK.

-

This publication revealed last October that BroadStreet was seeking investors.

-

Insurance Insider US examines potential tariffs’ impact on the PE-backed brokers amid the jammed conveyor belt.

-

The book of business comprises both personal and commercial lines.

-

This publication revealed last year that Brownyard was considering a sale.

-

The Insurance Insider US news team runs you through this week’s key agency M&A.

-

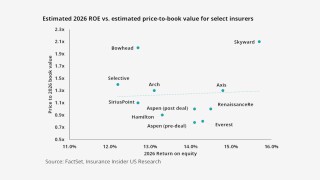

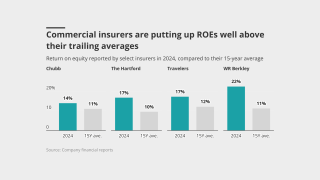

Despite elevated ROEs, insurers have remained disciplined.

-

Even if M&A activity picks up, Atlantic does not expect R&W rates to jump significantly.

-

The insurer also pointed to accelerating growth, M&A to come, and a sub-30% ER.

-

Sources said Brown & Brown has an advantage as it entered the process several weeks ago.

-

In February, the company announced it received regulatory approval for the deal.

-

A US buy would have to be easily integrated, the CEO stated.

-

There is a long waiting list of carriers looking to pull the IPO trigger, but market conditions remain tough.

-

Sources said the Evercore-run Risk Strategies process has drawn the interest of Brown & Brown.

-

The Insurance Insider US news team runs you through this week’s key agency M&A.

-

After a period of business building, MGAs will likely spend more time optimizing.

-

The shares will be purchased via the open market or private third-party transactions.

-

This publication revealed earlier that Command was seeking a new backer.

-

It makes sense for Next to secure a sale as an exit strategy in an increasingly challenging funding environment.

-

PE and international players could be drivers of P&C carrier M&A activity in the future.

-

Sources said that Insurance Advisory Partners is advising the fac MGA on the strategic process.

-

What insurers can learn from the history that led to this deal.

-

The Insurance Insider US news team runs you through this week’s key agency M&A.

-

Gallagher already has HSR approval for the $1.2bn Woodruff Sawyer acquisition.

-

Ahead of the deal, Ergo owned a 29% stake in Next, which generated top line of $548mn last year.

-

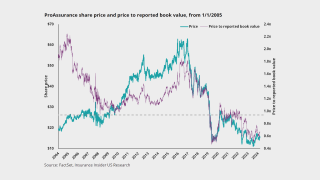

ProAssurance brands will be transitioned to The Doctors Company in "all/most markets" over time.

-

The Californian insurer is buying the medmal carrier for $25.00 per share, or a ~60% premium.

-

Evercore has reached out to a combination of strategics and private equity houses.

-

Cue a feeding frenzy from suitors and a frenzy of speculation from the market.

-

The Insurance Insider US news team runs you through this week’s key agency M&A.

-

A quick roundup of our best journalism for the week.

-

A rebound is expected this year, however, led by strong US activity.

-

Sources said that the broking giant will look to add around 10 additional backers at a $30bn EV.

-

The Insurance Insider US news team runs you through this week’s key agency M&A.

-

The company said it now expects the transaction to close in H2 2025.

-

Insurers and distributors must adapt or risk irrelevance.

-

The California broker’s pro forma revenue for full year 2024 was $268mn.

-

This is the second acquisition Amwins has announced this year.

-

The Insurance Insider US news team runs you through this week’s key agency M&A.

-

There were no signs of deceleration in claims and insurance services M&A during February.

-

Sources noted that Dowling Hales is advising the MGA.

-

WKFC’s chief executive D’Onofrio will become RSUM’s global CUO.

-

Talks are not preliminary, but a deal is not imminent for the two brokers, sources said.

-

Other digital distribution platforms, including ProWriters and SportsInsurance, are also exploring a sale.

-

Last October, this publication revealed that NSM was considering a carve-out of its B2B programs.

-

The Insurance Insider US news team runs you through this week’s key agency M&A.

-

This was Ryan’s second-largest 2024 deal, after its $1.4bn Assure purchase.

-

CEO Tim Turner said the firm still has an ambitious M&A pipeline and financial flexibility to execute deals.

-

Sources said that the MGA has been working with investment bank Waller Helms to find a potential investor.

-

The news comes around three months after GTCR agreed to sell AssuredPartners to AJ Gallagher for nearly $13.5bn.

-

He emphasized that Consilium is a private business and intends to remain one.

-

Gallagher paid out $1.7bn in 2024, additional to its costs for AssuredPartners.

-

Regionals and smaller carriers need to exercise vigilance when expanding commercial casualty lines.

-

It was the broker’s second-largest deal in Q4 after it completed the takeover of Dutch brokerage Quintes.

-

The Insurance Insider US news team runs you through this week’s key agency M&A.

-

The group should also tilt capital allocation away from M&A and deepen its disclosure.

-

Sources said the Lake Mary, Florida-based firm is working with boutique bank Lincoln International.

-

The Insurance Insider US news team runs you through this week’s key agency M&A.

-

Sources said that Waller Helms/Houlihan Lokey is working with the firm as financial adviser.

-

This is FMH’s first acquisition since acquiring Axa XL’s crop unit last April.

-

Challenges will include boosting the target’s organic growth, Building the Machine, and prepping for an IPO.

-

The MGA and 49% owner SiriusPoint could bring in a new investor.

-

The Insurance Insider US news team runs you through this week’s key agency M&A.

-

Earlier this month this publication revealed Howden’s $2bn+ fundraising talks with Mubadala to fund a US deal.

-

AJ Gallagher expects to complete the $13.5bn acquisition of AssuredPartners in Q1.

-

Average revenue per agency acquired was $3.1mn, down 21.2% from 2023.

-

Brown also said California needs a Marshall Plan-like strategy after the wildfires’ devastation.

-

Acrisure may be the first heavyweight broker to go, with Hub, BroadStreet and Howden also contenders.

-

Valuations for platforms last year remained steady, at 14.02x Ebitda.

-

The Insurance Insider US news team runs you through this week’s key agency M&A.

-

Sources said the MGA secured support from MS Transverse, Axis, AmTrust and Summit for TL business.

-

Sources said Dowling Hales is advising the professional lines quoting platform on the process.

-

BroadStreet took the lead as the most acquisitive brokerage last year with 90 takeovers.

-

The Insurance Insider US news team runs you through this week’s key agency M&A.

-

Last July, this publication revealed that the agency had retained Piper Sandler to run a process.

-

At Zurich, Hirs served as group head of M&A and CFO for North America.

-

The Insurance Insider US news team runs you through this week’s key agency M&A.

-

It is understood that the bid is part of Sisa’s expansion plans across Central America.

-

This publication revealed in July that Aperture had retained Deloitte for the sale.

-

The deal comes around three years after Markel sold a controlling interest in Velocity for $181.3mn.

-

Risk Strategies looks like the deal that makes most sense, but other targets could include Galway or Hilb.

-

LAU will become the new Core Specialty Aviation & Aerospace Division.

-

Terms of the deal, which is expected to close in Q1, were not disclosed.

-

Sources said the platform has retained Barclays and Goldman Sachs to run a process.

-

The transaction comes after Kestrel explored a deal last quarter to raise ~$150mn of capital.

-

The Insurance Insider US news team runs you through this week’s key agency M&A.

-

The $2bn+ raise would likely rest on the base case of an IPO in the medium term.

-

Sources said that with the equity refinancing, Alliant secured an enterprise value of ~$25bn.

-

The MGA will become part of binding authority unit Amwins Access.

-

Insurance Insider US dissects the largest and hottest deals of the year across segments.

-

The new, publicly listed specialty program group will be led by Luke Ledbetter.

-

The business will operate as a full-service MGU under Amynta Risk Solutions.

-

The Insurance Insider US news team runs you through this week’s key agency M&A.

-

A look back at the year in P&C (re)insurance, with the aid of some of our visual journalism.

-

IAP served as financial adviser to Atri in the transaction.

-

This is CRC’s first purchase since parent TIH sold retail broker McGriff to MMA.

-

Insight into the current state of the insurance M&A market, powered by the Insurance Insider US M&A Deal Tracker.

-

The company has been buying out Omers’ shares since 2015.

-

The Insurance Insider US news team runs you through this week’s key agency M&A.

-

The executive has prior experience at Houlihan Lokey, Nomura and Deloitte.

-

Deal value was driven by mega deals including MMA-McGriff and Enstar-Sixth Street.

-

The carrier doesn’t have big concentrations with distributors and conducts business with individual brokers.

-

Rasher also has offices in Seville, Cordoba, Valencia, Malaga, Granada and Pamplona, as well as Latin America.

-

Some will play “pretend and extend”, but others will sell to strategics or take the steep climb to an IPO.

-

The Montreal broker will use the funds to expand its Canadian operations.

-

Sources said the ~C$55mn Ebitda business retained RBC to run the strategic review.

-

The deal is financially attractive, but risks diluting the jewel that is Gallagher’s US mid-market business.

-

AIG launched an IPO of Corebridge Financial in September 2022.

-

The executive said the combined entity could execute 100-110 tuck-in M&A deals a year.

-

The deal represents a 14.3x Ebitda multiple and strengthens Gallagher’s mid-market position.

-

The deal dramatizes the jammed PE deals conveyor, with the playing field tilted towards strategics.

-

If the deal is finalized, it will represent the largest in the acquirer’s history.

-

The Insurance Insider US news team runs you through this week’s key agency M&A.

-

A quick roundup of our best journalism for the week.

-

The move follows a $4.5bn+ debt and preference share refinance in September.

-

The sale of the business was confirmed in June.

-

The Insurance Insider US news team runs you through this week’s key agency M&A.

-

The deal follows Bishop Street’s acquisition of Ethos’ TL operations from Ascot.

-

Insight into the current state of the insurance M&A market, powered by the Insurance Insider US M&A Deal Tracker.

-

The Insurance Insider US news team runs you through this week’s key agency M&A.

-

In late August, Insurance Insider US revealed that Leavitt was looking for a minority investor.

-

Sources said that the underwriter has been working with Houlihan Lokey to find a potential backer.

-

Earlier this month this publication revealed that the brokerages were in advanced talks to secure a deal.

-

Woodruff Sawyer is understood to have revenue in the $240mn ballpark and Ebitda in excess of $50mn.

-

The deal follows Davies' recent acquisitions of the TPA arms of HW Kaufman and Brown & Brown.

-

The average size of acquired agencies was $2.74mn, down from $4.23mn a year earlier.

-

The deal’s closing comes just a month and a half after the companies announced the transaction.

-

The Insurance Insider US news team runs you through this week’s key agency M&A.

-

Lee succeeds Neill Currie, who will become an independent director.

-

It is understood that the TPA is working with Waller Helms on the process.

-

Carlyle re-launched efforts to find minority investor last June.

-

The Insurance Insider US news team runs you through this week’s key agency M&A.

-

The Bain-backed fronting carrier acquired Spinnaker’s shell subsidiary earlier this year.

-

Following the closing of the deal, Aviad Pinkovezky will be named First Connect CEO.

-

The UK and Ireland have also seen “increased activity”, with four deals announced.

-

Sources said that the AmTrust-backed fronting carrier has retained Evercore to run the process.

-

Nicola Gaisford joined RiverStone from R&Q last year.

-

The MGA platform will become part of Ryan Specialty Underwriting Managers.

-

The Insurance Insider US news team runs you through this week’s key agency M&A.

-

-

Sources said the brokers are in the final stages and could seal a deal in the next couple of weeks.

-

Management is showcasing its ambition, but it’s also dialing up risk.

-

The retail broker upsized its revolving credit and delayed draw term facilities.

-

Sources said the E&S insurer is seeking to draw a line and trade forward as an independent business.

-

The wholesaler also paid $11.7mn in cash to Alera for the acquisition of Greenhill Underwriting.

-

Rate deceleration in property cat increased in September, and property pricing overall was down in Q3.

-

The sale is expected to close next month, though terms are not yet final.

-

Casualty, general liability and excess will also see rate pressure.

-

BroadStreet remained the most acquisitive, followed by Hub and Inszone.

-

The global broker has beaten off competition from AJ Gallagher, and a number of other strategics.

-

It is understood that the business-to-consumer programs are not included in the potential transaction.

-

The Insurance Insider US news team runs you through this week’s key agency M&A.

-

It is understood that the company has retained the services of Dowling Hales as adviser.

-

More broadly, the firm is looking at over 100 potential mergers in its pipeline, with ~$1.5bn acquired revenue.

-

Backers and CEOs may be wary of falling into the same trap as larger PE-backed retail brokers.

-

The Teachers’-backed broker consolidator is being marketed off ~$700mn of Ebitda.

-

In our new database, you can find all of the key data points on P&C commercial lines deals in our coverage universe in one place.

-

Fleming alleges fraud and misrepresentations on the part of James River.

-

The broker’s acquisition amid shifting tides is likely the beginning of a larger M&A uptick in the space.

-

The agency is expanding organically and via M&A with a focus on minority-owned businesses.

-

Sources said that Piper Sandler is running the sale process for the ~$50mn Ebitda business.

-

The Insurance Insider US news team runs you through this week’s key agency M&A.

-

Sources said that a deal between the two sides could be reached in the next couple of weeks.

-

Sources said that Nacional would only consider a bid north of $150mn.

-

Deal flow is still far below levels seen in 2021.

-

The Insurance Insider US news team runs you through this week’s key M&A deals.

-

The Insurance Insider US news team runs you through this week’s key M&A deals.

-

The mid-market unit has been a home run but will now face the fresh test of integrating a $1.3bn revenue business.

-

Private equity-backed buyers accounted for 73.1% of all deals in the period.

-

Interest in these vehicles has increased recently, but market softening could throw a curve ball at growth.

-

This follows a spate of program manager deals Ryan Specialty has made.

-

The broker will take a charge of $1.6bn-$2.1bn relating to the sale.

-

The transaction will be one of the largest involving two strategics in broking history.

-

The Insurance Insider US news team runs you through this week’s key M&A deals.

-

The move comes less than a year after AssuredPartners’ sale process reached a stalemate.