WR Berkley

-

The Japanese P&C carrier agreed a deal to buy 15% of WR Berkley shares in March.

-

Some disagreement remains in where rate declines have been swiftest and how much further they could go.

-

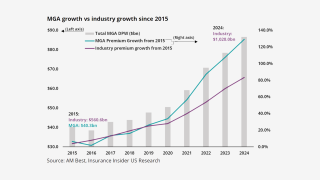

Normalized growth and peak multiples confirm we are headed towards a Darwinian race.

-

Cat losses in Q3 were light as peak hurricane season passes without incident.

-

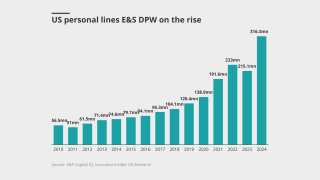

The CEO also said that the “bloom is off the rose” in the E&S property market.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

She joins the specialty insurer after working at Hamilton as CUO.

-

Insurers did not see a slowdown in rate but some are still fine-tuning their portfolios following the LA fires.

-

On Q2 calls, carrier executives called out fierce competition in various lines of business, and a misalignment of interest.

-

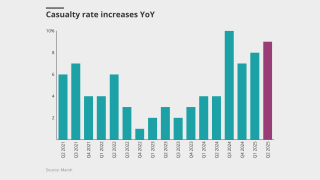

Loss trend concerns persist, but insurers are vouching on the opportunity to push for more rate increases.

-

Recent inbound offers can “oftentimes” be a leading indicator that the market is slowing, he said.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

The January wildfires did little to hamper their appetite, apart from California.

-

The latest E&S player planning to IPO remains a “show me” story.

-

The insurer's professional liability reinsurance book shrank by around 25%.

-

The company’s stock jumped 14% within 30 minutes of the market’s open.

-

The shares will be purchased via the open market or private third-party transactions.

-

Submission flows in WR Berkley’s E&S business overall are growing “considerably faster” than its admitted business.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

The carrier doesn’t have big concentrations with distributors and conducts business with individual brokers.

-

This could change if Milton losses turn “ugly”.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

For many, it could be a “wake-up call” to the systematic exposures inherent in cyber.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

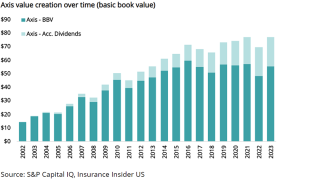

Industry trends show the Axis book value growth goal may be hard to hit.

-

Focus on reserves to continue as gap between cautious reservists and others emerges.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

Earlier today, the carrier reported that its Q1 combined ratio came in at 88.8%, down from last Q1’s 90.6%.

-

Reinsurers will try to put pressure on insurers for casualty and liability lines, as they did in property.

-

Carriers expressed confidence on the line’s ability to withstand medical inflation.

-

Commercial carrier earnings continue to show mixed prior-year development.

-

On Wednesday, the insurer reported 12% growth in net written premiums.

-

The specialty carrier’s top-line growth accelerated throughout 2023.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

The syndicate is suing its reinsurers to cover Covid-19-related claims in California, Colorado, Florida, Illinois, Nevada, New York and the UK.

-

Schuermann joined Berkley Entertainment as chief operating officer in 2021 from NN Inc. Broshcart served in the president role upon the unit’s formation in 2004.

-

The exec has nearly 30 years of property and casualty insurance experience and succeeds interim CWG president Melodee Saunders.

-

S. Akbar Khan is a 20-year insurance industry veteran, most recently serving as a senior officer at a leading national US insurer.

-

Christopher Balch is succeeding Matthew Mueller, who has been named chairman of the business. Both appointments are effective immediately.

-

The company also continues to be “very mindful” of medical cost trends, which CEO Berkley noted were shifting very quickly after a benign period.

-

The Inside P&C news team runs you through the earnings results for the day.

-

Forte joined the specialty insurer in early 2018 as public entity SVP, CUO and COO after a spell at AIG based in New Jersey.

-

Flows to the E&S market remain strong, executives have said, while dislocation in the property space continues to buoy overall pricing conditions.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

Apart from public D&O and workers' comp, the specialty lines insurer is seeing “very strong submission growth”.

-

The Inside P&C news team runs you through the earnings results for the day.

-

The deal will result in a pre-tax net realized gain of $86mn in the second quarter.

-

The new business unit will offer excess liability coverage to specialized markets, starting with environmental and energy industries.