Top Section

Q4 earnings preview: We have arrived at the inflection point

Reserves will join rate softening, margin pressure, as key topics in Q4 discussions.

-

Guy Carp has been rebuilding its marine and energy team after a major Willis Re team lift.

-

Sources said Jefferies and RBC have been retained to advise on the sale process.

Research

Research

Casualty and auto loss costs continue to rise due to inflation as we head into 2026.

Worsening market conditions drove the majority of P&C stocks to underperform the S&P 500 in 2025.

An impending soft market further complicates the outlook for carriers with long-tail casualty exposure.

Carriers underweight in E&S could lead the charge in the next round of M&A.

Opinion

Opinion

-

Insurers and brokers have lost at 1.1 – as well as reinsurers

Adam McNestrie and Ben Wylie

Latest news

Latest news

A quick roundup of today's need to know news, including loss costs, Apco Holdings and more.

This program is designed to provide insurance for small contractors.

On average, Pure members will see a 7.6% rate decrease.

The MGA’s property team buildout was led by Clif Hope, former Lexington head of property.

Featured

Featured

Featured

MGA whole account quota shares draw interest, but execution difficult

Risk and commission conflicts in quota share agreements push deals further from either party’s interests.

Most Read

Perspectives

Perspectives

When owners are not paying attention, discipline and governance are not top priorities.

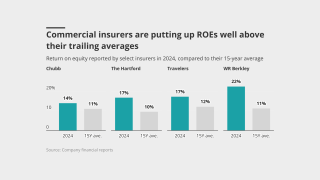

Unpacking how much excess capital there really is and dissecting the source of its returns.

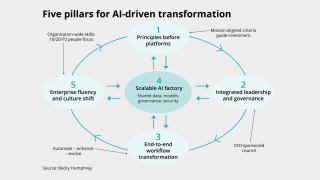

Here’s the five-pillar playbook for insurers ready to move from pilots to profit.

Despite elevated ROEs, insurers have remained disciplined.

Interviews

Wildfires and SCS led to $108bn of total insured losses globally, despite no major hurricane making US landfall.

The industry needs to step up in educating clients and understanding their vulnerabilities.

The state is drought-ridden, hail threatened and potentially making major changes this year as a result.

One avenue for capital freed up by a softer-than-expected renewal could be more M&A.

Ad slot #2

Analysis

Analysis

Modernized tactics springing from stolen online identities have surged post pandemic and are ramping up losses.

The first round of 2026 renewals was largely favorable for buyers.

Market participants on programs/MGU business in particular feel there's more capacity than 12 months ago.

Specialty was the busiest segment but still recorded a YoY drop of seven points.

Insider on Air

Insider on Air

In Partnership with

AXIS

Looking ahead to 2026, Michael Silas, Head of Global Credit, AXIS, sees mildly positive global growth driven by tech and infrastructure, but says credit sentiment remains cautious and reinsurers must still price to long‑term tail risk.

In Partnership with

Apollo

With real-time data and analytical tools giving underwriters a clear view of pricing adequacy, mix and attachment points, and allowing faster corrective action when rates fall below acceptable thresholds, insurers are shifting into a new paradigm for soft markets, said James Slaughter, Group CUO, Apollo, during an interview at the Insurance Insider’s London Market Conference.

In Partnership with

Fidelis Partnership

Insurers can turn the global energy transition into both a commercial opportunity and a force for societal good, said Charlie Heathcote, Head of Sustainability, the Fidelis Partnership, during an interview at the Insurance Insider’s London Market Conference

In Partnership with

Recorder

Allowing insurers to receive real-time data from MGAs could eliminate the need for monthly bordereaux reporting, said Matt Hicks, Co-founder, Recorder, during an interview at the Insurance Insider’s London Market Conference.

Conferences & awards

New York Conference 2026 | Add to calendar

April 23 2026

Convene, 101 Park Avenue, New York

Insurance Insider Honours 2026

2 September 2026

London

Insurance Insider US Honors 2026 | Add to calendar

September 30 2026

Ziegfeld Ballroom, New York

Upcoming webinars

-

In Partnership with Moody's

Ad Slot #2