Aon

-

Clear Blue originally filed the suit in late 2023, alleging reckless conduct and misrepresentation.

-

The executive was formerly EVP and central regional leader at Aon.

-

The executive has been at the broker for over 20 years.

-

The executive has worked for Aon for almost two decades.

-

Cyberattack/data breach remains in the top slot.

-

Home buyers looking to close on a mortgage could find the private market an attractive alternative.

-

According to McKinsey, the projected spending on data centers is expected to hit $6.7tn by 2030.

-

The executive will join Howden’s new US retail broking operation.

-

Reinsurer executives during a Aon reinsurer panel stressed that the industry worked hard on setting the right structure.

-

The platform aims to “bend the loss curve”.

-

Supply for property outstrips demand, but the casualty market is “bifurcated”.

-

Aon acquired NFP from Madison Dearborn in April last year in a $13.4bn deal.

-

The broker has filed a motion to dismiss the lawsuit by Marsh.

-

After spending 20 years at Aon, Goodman will start a senior executive position with Guy Carpenter.

-

The lawsuit is the latest development in the multi-billion dollar reinsurance scandal.

-

Price decreases became lower throughout Q2, however, averaging 3% in April, 2.3% in May and 1.6% in June.

-

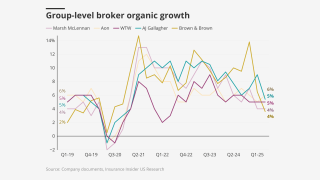

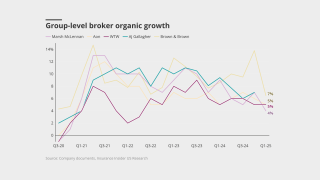

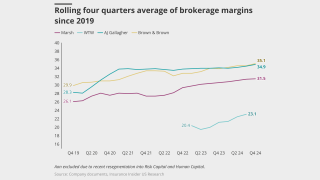

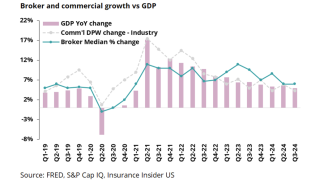

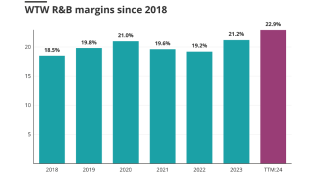

Not everyone will emerge unscathed as brokers navigate the slow-growth environment.

-

Brown & Brown fell 10% and Ryan Specialty 8% as investors digest the deteriorating outlook.

-

The broker has noted that double-digit reductions are increasingly available in property.

-

As the US recovers from a major flood event, the vast majority of Americans remain uninsured.

-

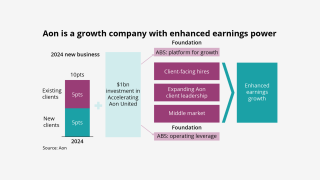

The NFP acquisition was a “tailwind for organic growth, not a key driver”, said CFO Edmund Reese.

-

The broker’s EPS beat consensus at $3.49 for the quarter.

-

The former Lloyd’s CEO is also eligible for a target $5mn annual equity award.

-

The executive briefly exited the firm last month for a role at Marsh.

-

John Neal was due to start at Aon as global reinsurance CEO in September.

-

The former Lloyd’s CEO will not make his planned move to Aon.

-

US events accounted for more than 90% of global insured losses.

-

The broker has expanded the number of global industry verticals to seven from four.

-

He was most recently Marsh’s US manufacturing and automotive practice head.

-

The executive brings more than 25 years of insurance experience.

-

The broker noted a “significant variation” in renewal outcomes.

-

The executive will report to US construction practice leader Jim Dunn.

-

In North America, the median W&I claim payment in 2024 was $5.5mn, the highest on record.

-

The platform will capture and standardise data from all submissions, the broker said.

-

Coverage has broadened while limits have increased, the broker said.

-

The executive was formerly head of cyber solutions, North America.

-

The ongoing demonstrations could have law enforcement liability implications.

-

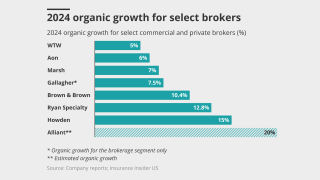

Above-market organic growth, mid-market M&A and talent infusions were all heralded.

-

The documents figure in a potential criminal case against a CCB employee.

-

Case added that recently acquired broker NFP has “exceeded” expectations.

-

The executive has 15 years of experience in meteorology and cat analytics.

-

Muñoz was also Aon Re chairman for the Latin American region.

-

The executive will remain CEO of reinsurance until September 1.

-

Most of the losses are attributable to a supercell storm in Texas.

-

The executive will also continue as MD overseeing Caribbean fac.

-

Two large storms hit the Midwest and Ohio Valley regions on May 14-17 and May 18-20.

-

The exec will lead key initiatives including Aon United, and work closely with NFP.

-

Hussey will take over the role left vacant when Luis Sonville moved to AJ Gallagher late last year.

-

Growth in construction projects is increasing the need for coverage.

-

The industry is seen as “resilient” amid a volatile risk environment.

-

He was appointed executive chairman for international in 2021.

-

New broker vehicles are setting up amid accelerated softening in D&F.

-

During first quarter earnings calls, insurers argued that they can mitigate volatility.

-

The executive was previously a top US casualty broker.

-

In an economic downturn, the kneejerk reaction is to treat insurance and risk management as a cost.

-

The executive had previously been at Aon for over 15 years.

-

He takes over from Amanda Lyons, who was promoted to global product leader last year.

-

It will be tough to pull off prior goals despite management assurances.

-

The broker's share price dipped 11% in morning trading after its Q1 earnings missed expectations.

-

The commercial risk and reinsurance units delivered mid-single-digit growth.

-

Marsh alleges Aon also went after its clients as well as its employees.

-

Insurance Insider US explores the economics of the lift-out growth strategy.

-

Insured losses were the second highest on record for the first quarter.

-

Total reinsurer capital grew by $45bn in 2024 to $715bn.

-

Keogh worked at Aon for nearly 30 years before retiring in 2022.

-

A new report warns that underwriters must consider political uncertainty and macroeconomic trends.

-

The broker has promoted Oriol Gaspa Rebull to global head of analytics strategy.

-

Cue a feeding frenzy from suitors and a frenzy of speculation from the market.

-

The executive will join the firm effective May 1.

-

Earlier today, Aon confirmed president Eric Andersen had stepped down from his role.

-

The executive will remain with the firm as a senior adviser to the CEO until mid-2026.

-

-

Perlman has been at MMA for over six years, most recently as president of national business insurance.

-

The executives will join the company in the coming weeks.

-

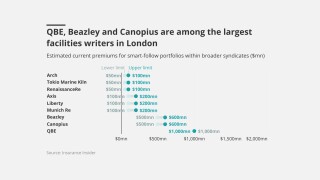

The big brokers are lining up London capacity to write follow lines on US risks.

-

The broker has over 30 years’ experience and will be based in Dallas.

-

The event now includes a casualty portion and has officially been re-branded as the Property and Casualty Symposium.

-

Company-specific strategies will play a vital role in sustaining growth in the current market.

-

The average change for primary policies with the same limit and deductible was a 3.5% decrease.

-

Aon saw lower rates in reinsurance as capacity outstripped demand.

-

President Andersen said he was optimistic about the 2025 reinsurance market.

-

The broker introduced 2025 guidance for mid-single-digit or greater organic growth.

-

The figure was 54% above the 21st century average.

-

The Palisades fire is estimated at $9bn-$12bn, while Eaton is $6bn-$8bn.

-

Total economic and insured losses are “virtually certain” to reach into the billions.

-

The Corporation’s CEO will run Aon Reinsurance Solutions.

-

The move means Lloyd’s will have a new chairman and a new CEO in the same year.

-

But forecasts of slowing growth in recent years have been too pessimistic – and uncertainty remains.

-

Many cedants secured aggregate and subsequent coverage at 1 January.

-

The multi-day weather outbreak caused widespread damage from Texas to the Carolinas.

-

In property, Canada, Central and Eastern Europe and UAE renewals were impacted by losses.

-

Some will play “pretend and extend”, but others will sell to strategics or take the steep climb to an IPO.

-

The firm’s trajectory could, however, make it harder to meet guidance going forward.

-

The former CEO will also serve as executive managing director within Aon’s reinsurance solutions business.

-

The executive is currently Asia Pacific CEO.

-

The executive spent over 15 years at Aon in various M&A-related positions.

-

-

Total insured losses are expected to range from $34bn to $54bn.

-

Underwriting remains disciplined as insurers target profitable growth.

-

The global broker has beaten off competition from AJ Gallagher, and a number of other strategics.

-

The price for policies with the same limit and deductible decreased 6.0%.

-

Insured losses for 9M 2024 have hit $102bn, according to a report.

-

Ball will succeed Jeff Poliseno, who is set to retire.

-

The broker said Europeans are pushing hard for rate or attachment point relief.

-

The broker expanded margins and grew earnings per share by 17% during the quarter.

-

He replaces Kevin Madden who will assume the role of chairman for North American real estate.

-

An estimated $6bn to $9bn will be ceded to the FHCF, and $6bn to $10bn to traditional reinsurance markets.

-

She most recently led the broker’s UK insurance vertical.

-

The “exceptionally large and powerful” Category 4 storm made landfall in Florida last month.

-

Richard Pennay will become CEO of Aon Securities.

-

Anna Digel is now chief broking officer for Aon’s US financial services group.

-

Third-party litigation funding has been linked to rising casualty insurance prices.

-

Padilla has also held senior regional roles at Cooper Gay and Swiss Re.

-

Criado will retire on October 31, after nearly five years with Aon.

-

Bruce joined the Aon primary casualty team in Atlanta in 2016.

-

The expanded team aims to increase capability across global specialty lines and property specialty retrocession.

-

The broker reported that global reinsurer capital reached a record of $695bn as of June 30.

-

The US carrier abandoned the project due to high price expectations.

-

Portfolios of clients of varying size in the same region aggregate more risk.

-

White Rock claims CCB was responsible for the “lion’s share” of fraudulent letters of credit.

-

Clients are taking advantage of market conditions to restore coverage limits.

-

Sources said LSM head of third party in Miami Humberto Pozo will serve as interim head of distribution.

-

The executive will end her career at Aon Bermuda effective October 1.

-

Manufacturing now accounts for 41.7% of all claims, from 15.2% previously.

-

Nick Nudo joins as senior managing director of reinsurance.

-

The execs joined Chad Karasaki and Michael Grossi, who are heading up the new practice.

-

However, the market is still struggling with excess capacity and low demand.

-

Walsh is currently co-president of the northeast region.

-

He will focus on the London and US markets, including the placement of consortia and binders.

-

Q2 was the ninth consecutive quarter of year-over-year price decreases.

-

The carrier recognized a goodwill of $256mn and intangible assets of $39mn from the transaction.

-

The Hartford and Aon also posted notable, though more muted, stock bumps.