Argo

-

The announcement comes a week after the institutional investor said it would accelerate its pivot to an insurance-led strategy.

-

Arturo Pelaez will continue in his managing director role at Brookfield Asset Management.

-

Argo shelved the sale of its Bermudian insurance business in mid-2024.

-

The agency cited SiriusPoint’s recent management moves including lower cat exposure as a driver of the change.

-

The move comes after Argo Pro announced it will exit professional lines.

-

The executive also served as CCO at Aspen before moving to Vantage.

-

Around $155m of the businesses in-force gross premium will be transferred to Core Specialty.

-

The company is not contemplating any other major structural changes.

-

The business – which writes professional liability, excess casualty and property - was marketed by investment bank RBC.

-

He brings 23 years of insurance industry experience.

-

-

Argo will initially front the business under a 100% quota agreement with ASU.

-

The executive expects the Bermudian to start onboarding programs later in 2024 or early in 2025.

-

“Unfortunately, it's a situation of getting rate to fund [the litigation costs] and being able to stay in the market long term,” Taylor told Insurance Insider US in an interview.

-

Insurance Insider US’s morning summary of the key stories to get you up to speed fast.

-

In tandem, the Bermudian promoted David Corry and Greg Chilson to heads of casualty and professional lines, respectively.

-

Current CEO Thomas Bradley, who announced his intention to retire on the closure of the deal, will receive a one-time cash bonus of $1.2mn.

-

The Inside P&C news team runs you through the earnings results for the day.

-

The appointment follows that of Williams and Drakontaidis as head of contract surety and head of commercial surety respectively.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

The Inside P&C news team runs you through the earnings results for the day.

-

Argo has also hired former RLI surety head Greg Chilson as an adviser.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

The charge was related to a reassessment of potential claims in professional lines, mostly from accident years 2019 and prior, and to losses from businesses Argo has exited.

-

The companies expect to complete the transaction in the second half of the year, subject to regulatory approvals and customary closing conditions.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

Argo’s first bids included an implied firm value of $49.71 per Argo common share and $40 per share in cash, among others.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

The firm’s US unit recorded $36.6mn of net unfavorable development in Q4 2022, compared with a $121.6mn charge in Q4 2021.

-

S&P said the change reflected uncertainty around Argo’s risk appetite following its $1.1bn acquisition by Brookfield Reinsurance.

-

The member joined the board in August 2022, two and a half years after ending his activist campaign against the carrier’s management.

-

The ratings agency has placed under review with developing implications Argo’s A- financial strength ratings, as well as its credit ratings.

-

Inside P&C’s news team runs you through the key highlights of the week.

-

Analysis of Argo’s valuation suggests this is a rich multiple when accounting for potential reserving noise.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

The reinsurer said in its Q4 earnings call that Argo’s takeover further diversifies its operations and adds a foundational piece to its expanding P&C activity in the US.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

The consideration represents a 48.7% premium to Argo’s share price before the sale of its Lloyd’s business.

-

Inside P&C’s news team runs you through the key highlights of the week.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

Enstar is conducting due diligence around taking on the rest of the Argo back book.

-

Activist investor Capital Returns had nominated Ron Bobman and David Michelson, but withdrew the nominations on Monday.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

The withdrawals of the activist investors have come just three days before the insurer’s annual shareholder meeting.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

The carrier has called this month’s vote ‘a critical moment in Argo’s history’.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

The activist investor’s statement comes as a reaction to Argo’s message to investors last Friday ahead of the carrier’s annual shareholder meeting.

-

The carrier is urging shareholders to appoint all seven of its nominees to the board in an annual meeting next month, amid activist investor pressure.

-

Inside P&C’s news team runs you through the key highlights of the week.

-

Completion of the transaction followed receipt of the required regulatory approvals and satisfaction of other closing conditions.

-

The Bermudian claimed Ron Bobman and David Michelson’s directorship would ‘diminish’ the board’s capabilities and expertise.

-

The CEO addressed the progress of the strategic process in his first interview since taking the role.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

The insurer received regulatory approval for the LPT yesterday and expects to take the related $100mn charge in Q4 instead of Q3.

-

The specialty insurer booked an $11.9mn overall net adverse reserve development, up from $6.2mn last year, fueled by a $16.2mn charge in the US business.

-

Axis’ pivot away from property reinsurance comes just as the sector reaches one of the biggest inflection points.

-

The activist investor has been trying to join the board of the struggling firm and has been interviewed by Argo.

-

The company said the resignation was due to “professional and personal commitments”.

-

Argo Group has been sued by investors, who claim the company has engaged in inadequate underwriting and misrepresentation of facts which resulted in a 60% drop in the specialty carrier’s common stock value this year.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

Bobman said the board of directors “demonstrated poor judgment” by approving the recruitment of Jessica Snyder as president of Argo’s US insurance division.

-

Capital Returns Master has proposed its president Ronald Bobman and David Michelson, president of DWM Consulting, as two new Argo board members.

-

A broader approach to deal structure leaves room open for a private firm to reverse into the company to go public.

-

Inside P&C’s news team runs you through the key highlights of the week.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

Westfield will take on 2021 and 2022 as part of the agreement, but it is not yet clear if 2020 will be included in a legacy deal Argo struck this year for 2018 and 2019 in the run-up to sale.

-

Goldman Sachs has reapproached potential bidders as the Bermudian moves rapidly following the recent legacy deal and divestiture.

-

Inside P&C’s news team runs you through the key highlights of the week.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

The deal price represents 1.16x tangible book value.

-

A sale of the managing agency and Syndicate 1200 would represent tangible progress in Argo’s strategic process.

-

Inside P&C’s news team runs you through the key highlights of the week.

-

The specialty insurer continues to face obstacles in finding a buyer, and a period of independence might now be the better option.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

The executive will report to CEO and executive chairman Tom Bradley, who recently took over the role on a permanent basis.

-

With the addition of roughly 512,000 shares, Enstar’s interest in Argo was valued at ~$62.7mn at the end of June.

-

Odyssey Group’s cyber chief Robert O’Connell is looking to raise up to $1bn of capital for a monoline cyber reinsurer.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

The dip follows a nearly 18% decline in the company’s stock price on Tuesday.

-

Yesterday, Argo disclosed that it entered into a loss-portfolio transfer agreement with Enstar and will accept an after-tax charge of $100mn in Q3 to secure the cover.

-

The stock was down $5.91 early trading hours from its close of $32.22 on Monday.

-

The deal also includes a $75mn loss corridor that must be eroded before adverse development passes to the legacy firm.

-

The scourge of former CEO Mark Watson will finally join the board after wielding major influence over the last three years.

-

Argo sued K2 in May claiming that the team lift-out was accomplished through breaches of fiduciary duty and contract.

-

Inside P&C’s news team runs you through the key highlights of the week.

-

The Goldman Sachs-run process drew limited interest and does not offer a path to takeout at a premium valuation.

-

The sector was hit by a rough first half of 2022, with more to come in the second half of the year.

-

Inside P&C’s news team runs you through the key highlights of the week.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

It is understood that the carrier, which is currently going through a sale process, is being advised by TigerRisk.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

The board retained Goldman Sachs to advise in April, and the investment bank has been running a sales process.

-

Current CEO Bradley will receive 78,760 shares of restricted stock over a 12-month period, as well as 135,000 stock appreciation rights with an exercise price of $43.80.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

Kevin Rehnberg, who has been out on leave for health reasons since March 2022, is stepping down from the top role and the board of directors.

-

KPMG has been appointed to succeed its Big Four rival as the up-for-sale Bermudian tries to turn the page on its delayed annual filings.

-

Selling Argo may be harder than you think given its Lloyd’s operation and questions around balance sheet strength.

-

Insurers could face pressure if interest rate and recession fears intersect with worsening loss cost trends.

-

Last month, Argo’s board announced they were looking at an “exploration of strategic alternatives” for the company.

-

The remark addressed Argo’s Q4 $132mn reserve charge that fueled activist claims that the company should be sold.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

Q1 net adverse prior year reserve development was $3.4mn, or 0.7 points on the LR, up from last year’s $1mn net reserve charge.

-

Inside P&C’s news team canters through the week’s key developments.

-

The firm initiated an exploration of strategic alternatives – including a potential sale or merger.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

Ron Bobman first called for the sale of the firm back in September 2021, and recently launched a proxy campaign to join its board.

-

The embattled carrier has faced mounting pressure from investors to sell the business.

-

Argo Re kept its A- (excellent) financial strength rating.

-

Based in Chicago, the executive will join the construction practice led by senior vice president Kristyn Smallcombe.

-

Inside P&C’s news team runs you through the key developments from the week.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

Activist investors continue to tighten the screw on the insurer’s management team.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

The company reported a pre-tax, pre-divide income of $5.3mn and combined ratio of 105.6%.

-

Major shareholder mocks Argo statements on progress, stating “attempt at transformation has failed,” based on Argo performance.

-

The carrier has interviewed nominees Ron Bobman and David Michelson.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

Capital Returns has proposed to nominate both Ron Bobman and David Michelson to the Bermudian carrier’s board.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

The insurer also failed to file its annual report on time last year.

-

Inside P&C’s news team runs you through the key developments from the past week.

-

The firm reported upbeat quarterly earnings, but the best move remains a sale.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

Argo’s underwriting loss widened to $109mn in Q4 2021 from $33.7mn the year before, driven by a $132mn reserve charge.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

Argo’s Q4 2021 loss ratio jumped to 87.1% from 69.8% a year ago, despite cat losses dropping to $6.8mn from over $50mn in Q4 2020.

-

Let’s get you up to speed on some of this week’s key M&A deals.

-

The $130mn-$140mn reserve charge undermines the management case that it can turn the business around.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

The company said on Tuesday it would take up to a $140mn reserve charge on prior-year claims in Q4 and write down the value of its Lloyds business by as much as $45mn.

-

The investor has been calling on the board to explore strategic alternatives for the business since September last year.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

The company is also writing down the value of Syndicate 1200 by $40mn-$45mn.

-

The Inside P&C research team looks forward to the big issues of the new year.

-

Supply chain disruptions are impacting material costs and timelines, but the Biden administration’s legislation promises growth.

-

The veteran executives will report to Argo commercial specialty president Gary Grose.

-

The acquisition comes as Argo works to reduce volatility in its portfolio, including selling Ariel Re and shedding limits in its property book.

-

The executive said during a Q3 earnings call that the company wouldn’t comment on market rumors related to the sale of its primary Lloyd's insurance business.

-

The company shrank overall GWP by 1.6% to $876mn, weighed down by a 10% drop of in international premiums, though it grew its core lines of business in the US by 20%.

-

Projects on hold are restarting, and materials prices are jumping 25% to 30%.

-

The exit in London comes at a time of wider market discussion around the adequacy of cat pricing.

-

The divestiture comes amid Argo’s drawback from international business.

-

Activist investor Ron Bobman is pushing for quick turnaround and a potential quasi-fire sale of Argo, missing out on the firm's greater potential.

-

Capital Returns Management has waged successful campaigns against Watford, FBL Group and FedNat.

-

The business is being marketed by investment bank Morgan Stanley following last year's sale of Ariel Re.

-

The sale is another step in the company’s remediate or exit strategy in the business lines where it hasn’t met its scale or pricing targets.

-

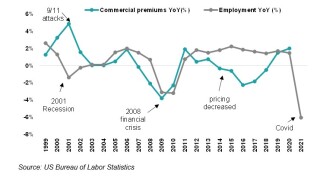

Employment data indicates that easy growth and margin expansion may slow soon.

-

Sources suggested the business was unable to secure its reserve price from bidders.

-

Matt Harris, the carrier’s head of international, has also left the business, as general counsel Susan Comparato takes up the role of chief administrative officer.

-

The insurer cut average annual loss exposure by 40% more than a year ahead of schedule after shedding property limit and restructuring reinsurance purchases.

-

The underwriting profits within the carrier’s US operations narrowed to $25mn, after higher economic activity and attritional claims caused margins to tighten.

-

The US-focused specialty carrier has appointed a trio of female executives to top roles in recent days.

-

Argo had signaled his departure last week, announcing Higley would be replaced in his old role by former Berkley exec Laura Havice.

-

The executive will oversee a roughly $300mn book of business, and replaces Jim Cornwall, who left the carrier in April.

-

Argo’s US marine business offers inland marine products such as trucking cargo cover, as well as contractors' equipment and sports equipment policies.

-

Following strong year-to-date performance, P&C stocks were down in June after a change of tone in a Fed meeting.

-

The post Covid-19 return to work creates opportunities in professional liability.

-

The move comes amid a reassessment of ESG by (re)insurers.

-

Activist investors are successfully learning how to navigate a regulated industry.

-

Kevin Rehnberg says the carrier is disappointed with the level of catastrophe losses but expects less volatility going forward.

-

The US-focused specialty insurer dropped its core loss ratio by almost two points as it delivered its best underlying underwriting result since 2016.

-

The program services company has added Argo’s head of construction.

-

Claims from Winter Storm Uri will cost the carrier about $43mn, before tax.

-

Landi has led Argo’s US management liability platform since his arrival at the business in 2016.

-

Corrections to historical numbers push the net loss down to $58.7mn.

-

The company thinks that business line optimization, underwriting enhancements, expense initiatives and tech will help it to hit new targets.

-

The ratings agency has also affirmed the bbb- credit rating of Argo’s parent company.

-

The CEO says he will put resources into the Argo's best performing lines of business, and take quick action in segments that fall short.

-

The carrier expects to file the accounts within a 15-day extension window.

-

The sale of the subsidiary is the latest step in CEO Kevin Rehnberg’s plan to dial down risk and free up capital at the carrier.

-

Argo is looking to redeploy capital from reinsurance and into high growth US E&S.

-

The company benefited from improved underlying results, premium growth at its US operations, and a much smaller reserve hit.

-

The executive replaces Jay Bullock, who announced his departure last summer.

-

The carrier has set aside $13mn to pay coronavirus claims at its international unit.

-

The executive, based in Chicago, is a former broker and joined Argo’s ceded re team from Allied World in 2020.

-

Inside P&C’s research team examines some of the areas that will be closely watched during the results season.

-

The regulator found that Watson and Argo failed to disclose $5.3mn in personal benefits.

-

Christie and Martell arrive from The Hartford and Markel, respectively.

-

As part of the deal Pelican Ventures and JC Flowers will provide capital for 2021 onwards, with Argo maintaining responsibility for years prior.

-

The investment consortium has also finalized an operational partnership with Apollo Syndicate Management.

-

Across the P&C market, share prices outstripped the 1.16% uptick in the S&P 500 index and the 2.28% rise in S&P 500 financials.

-

The company provided confirmation of its work to break up international and a $100mn expense reduction target.

-

The disposal plans are the latest of a string of restructuring measures under the leadership of CEO Kevin Rehnberg.

-

The international segment’s underlying loss ratio improved by 15 points to 50%.

-

Ariel Re will focus on key lines of business, including cat, retro, marine and professional lines.

-

The insurer will cut 20 jobs as a result of the run-off plan.

-

The Bermudian is expecting to pay $17mn in third quarter Covid-19 claims.

-

Chris Sitowski joins the carrier from Chubb North America.

-

Former RenaissanceRe CEO and founder Jim Stanard looks set to pick up the reinsurance platform.

-

The funding for the deal was set to come from Cantor Fitzgerald and its billionaire CEO Howard Lutnick.

-

Inside P&C takes a deep dive into the carrier’s prospects almost a year after Watson’s exit.

-

He has joined the carrier as a senior vice president of underwriting.

-

This publication reported in June that the Bermuda-based company had withdrawn from writing open market SME cyber business.

-

Axis Capital and Argo Group shares jumped nearly 5%, while shares in Arch, Travelers and Alleghany were all up more than 3%.

-

On average, Argo underwriters commanded a 10% rate rise, and E&S lines submissions continued to increase.

-

The specialty insurer’s underlying loss ratio dropped to 55.9% from 59.3% the year before.

-

Activist investor Voce had previously criticised the performance of the firm's international businesses.

-

The offering will be used to repay the remaining $125mn of a loan and provide working capital for growth.

-

The estimate is in line with Argo's earlier projection and will likely precede additional announcements from the sector in the coming weeks.

-

CEO Kevin Rehnberg continues to reshape Argo management following Mark Watson III’s departure.

-

Sources say the carrier’s group head of cyber Paul Miskovich has left his post.

-

The execs are set to leave the firm after a combined 26 years at Argo and its predecessor companies.

-

Argo has consented to a cease-and-desist order and will pay a $900,000 civil penalty.

-

The carrier’s chief executive officer said the “vast majority” of BI cover in the US has virus exclusions.

-

Core underwriting margins in the International segment remained flat YoY, while underlying results in the US weakened.

-

The losses mainly relate to event cancellation and BI losses.

-

RLI shares plunged by nearly 12 percent, while and Argo dropped over 6 percent.

-

Bernard Bailey and Fred Donner join Carol McFate as new Argo directors following a shareholder vote.

-

Insurance stocks outperformed as Federal Reserve agreed to take further action and lawmakers mulled a pandemic backstop.

-

The bolstered position follows a detente between the fund and the insurer’s management.

-

Transformations in Argo’s corporate governance following the proxy advisers’ support for little-to-no change raises questions about the role such firms play in a complex business like insurance.

-

Argo’s proxy filing unveils the depth of its past culture issues and raises questions on what the board knew, when it disclosed it, and how that shaped the terms of Mark Watson's departure.

-

The former CEO has instructed his lawyers to dispute what the company believes he should repay.

-

The expenses were made public in a disclosure to investors on Friday.

-

AM Best issued a cruel blow to the sense of a new dawn at Argo with a ratings downgrade and a negative outlook, largely citing corporate governance concerns.

-

The ratings agency said the action follows Argo’s response to a recent SEC subpoena.

-

Argo kicked off a new era under new leadership as it looked to rebuild bridges with external stakeholders after a bruising 2019, hinting at a bold plan to “simplify, reduce and eliminate”.

-

The Bermudian has put its corporate jet up for sale in wake of public criticism over expenses.

-

Argo reported an operating loss of $2.15/sh, including a $114mn underwriting loss that was mainly the result of a $77mn reserve charge tied to its London, Bermuda, and European operations.

-

Argo continued to drip feed details of its negotiated settlement with activist Voce, with two new board members.

-

Dr Bernard Bailey and Fred Donner will stand for election at the Argo annual shareholders meeting on 16 April.

-

Argo announced the widely expected permanent appointment of Kevin Rehnberg to the CEO position. It also announced that former Allied World CFO Tom Bradley had been made chairman of the board.

-

The leadership moves come after a year of activist investor-driven turmoil at the carrier.

-

Interim CEO Kevin Rehnberg begins his tenure in time-honored tradition when taking over a P&C company at a “challenging” time: reserve charges, impairment charges and higher loss picks.

-

Interim CEO Kevin Rehnberg said the results were “clearly unacceptable”.

-

The former AIG treasurer’s appointment as a director came as part of a truce with activist investor Voce Capital.

-

Paragon insurance will acquire the business, which will continue to write on Argo paper.

-

The executive joins Verus after about 20 years with Bermudian carrier Argo.

-

The Bermudian carrier’s retreat from Miami follows similar moves by Brit and Aspen.

-

The investor’s nominee Carol McFate will take the spot vacated by former CEO Mark Watson III.

-

The meeting was moved up from a previous date in May after five directors stepped down.

-

The activist investor called on the carrier to elect shareholder-nominated directors.

-

The departures represent a significant win for the activist investor, which was seeking to force a special meeting to oust the directors.

-

It is unclear whether Argo’s board is so shameless as to be immune from public criticism, or so addicted to it that they are actively seeking it.

-

The former executive’s business travel has been restricted as part of the exit deal.

-

A proposal for a special meeting from activist fund Voce Capital requires the backing of at least 10 percent of Argo shareholders.

-

There is an old saying that you should never ask a barber if you need a haircut. The same goes for financial advisors who get paid on activity rather than success.