Aspen

-

Aspen's GWP increased 0.9% to $1.13bn, as it focuses on “robust cycle management”.

-

The insurer paid tribute to the executive’s lasting contributions to the firm.

-

The state’s AG said the case threatens continued offshore oil and gas operations.

-

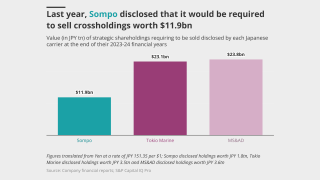

The action follows Sompo’s $3.5bn all-cash acquisition of Aspen Insurance.

-

Ratings agency said the Sompo deal could have positive financial and operational benefits for the Bermudian.

-

Analysis of market conditions, reserves show that this might not lead to an overnight consolidation boom.

-

Group CEO Mikio Okumura cited “solutions that have not been fulfilled”.

-

Sources see Aspen as the right fit for Sompo, with Apollo getting a full cash exit.

-

The lawsuit has been filed as sales talks with Sompo yielded a deal.

-

The Japanese company announced the $3.5bn deal today, three months after the Bermudian completed its IPO.

-

The Japanese carrier has agreed to buy Aspen for a realization of $3.5bn.

-

The all-cash deal values the Bermudian’s stock at a 36% premium.

-

This publication first reported deal talks last week.

-

The insurer has chosen a “take two” deal after buying Endurance, betting again on Bermuda.

-

This publication revealed yesterday that the two were in detailed takeover talks.

-

Sources said that detailed discussions have taken place, with a clear path to a deal.

-

The executive said the floor on D&O pricing is in sight.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

The newly created role consolidates leadership across UK entities.

-

-

Last year, the firm obtained a Class 4 license in Bermuda.

-

The executive replaces Mike Warwicker, who left the firm earlier this year.

-

The underwriter has held positions at The Hanover, Liberty Mutual and Zurich.

-

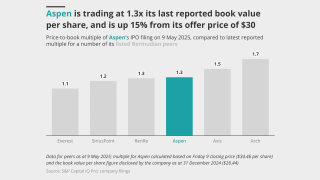

The company completed its upsized IPO last week and traded up to 1.3x book.

-

The company’s upsized public offering priced at $30 per ordinary share.

-

The IPO was announced at the end of April, targeting ~$2.6bn-$2.9bn.

-

The specialty carrier is braving volatile macroeconomic conditions in a second effort to list.

-

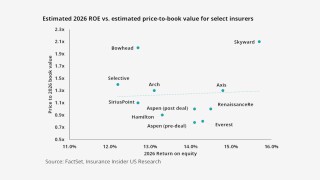

We assess the Bermudian’s standing amid waning investor sentiment and economic uncertainty.

-

The carrier is targeting an IPO valuation between $2.6bn and $2.9bn.

-

The carrier is offering shares priced at $29-$31.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

In October, this publication revealed that the carrier had resumed IPO preparations.

-

Cat losses in reinsurance rose 11.1% year over year to $45.1mn, driven by Hurricane Helene.

-

He joins from R&Q Insurance Holdings, where he has been chief accounting officer.

-

The business put up strong H1 numbers, and has named Christian Dunleavy group president.

-

Coalition Re to offer active cyber reinsurance via two products supported by Aspen-led capacity.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

The new leadership structure is designed to create more accountable executive roles responsive to Aspen’s strategy.

-

Dellwood recently appointed Aspen’s Felicia Rawlin as head of property.

-

The carrier will reassess the market in the fourth quarter, or early in 2025.

-

Aspen said reduced reinsurance appetite made it a good time to seek alternative capacity.

-

The companies originally established the capacity agreement in January 2023.

-

The group-level CoR worsened 4.7-points in the quarter, coming in at 89.4%.

-

The deal adds to Aspen’s existing support of the InsurTech in the UK and Canada.

-

Woodlands Financial Services listing is likely in Q2, but overall environment is subdued.

-

Putting together two “show me” stories risks investor skepticism.

-

It was announced earlier today that former Aspen UK CEO Richard Milner was set to join Chaucer as group CEO.

-

The company also confirmed earlier reports from this publication that Goldman Sachs would be a leading bookrunner, along with Citigroup, Jefferies and Apollo Global Securities for its ~$4bn H1 2024 IPO in New York.

-

Based in Chicago, Michael Tate will be responsible for the design, implementation and execution of insurance solutions related to the US inland marine business.

-

The announcement comes almost two months after this publication revealed that the carrier had lined up Goldman Sachs, Citibank and Jefferies to run its $4bn H1 IPO in New York.

-

CEO Mark Cloutier attributed the performance to increased investment income, driven by a higher rate environment, as well as increased fee income from Aspen Capital Markets, which “enhanced” the quality of earnings.

-

Ratings could be lowered by one notch depending on regulatory restrictions on cash flow from Bermuda operating entities to non-operating holding companies, the ratings agency said.

-

Tim Mardon will become CUO at Aspen Bermuda Limited and a member of Aspen Re’s leadership team.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

Sources said the roughly $2.7bn book value business is likely to target a valuation of 1.5x book or above — pointing to a valuation in excess of $4bn.

-

AM Best recorded 2022 US E&S direct written premium at just under $100bn in another year of strong growth.

-

Bianconi joined Aspen in 2016 and has held a number of roles including, most recently, as head of US cyber.

-

The move to gear up for a listing follows a non-deal roadshow held over the summer.

-

Insurance's GWP decline was driven by a couple of programs that were underperforming, while reinsurance's deceleration was driven by a deliberate slowdown in the mortgage book.

-

Net income increased to $219mn over the period, up from $48mn in the same period last year, while underwriting income increased by 33% to $208mn.

-

In her expanded role, she will work with trading partners to represent Aspen in the US for all business segments and build out existing distribution strategies.

-

The executive joins from Crum and Forster, with 20 years’ cyber experience.

-

Tartaglia will focus on driving process, data and systems excellence to support Aspen’s commercial and business strategy.

-

John Welch left his role as CEO of domestic markets at Axa XL Re last year in a leadership reshuffle.

-

The company did not provide prior-year period figures as it usually discloses its results on a semiannual basis.

-

Mark Cloutier set out Aspen’s plans for top-line 2023 growth in the range of 10%, and a continued strategy of pursuing rate rather than exposure growth in property cat.

-

The Bermudian carrier reported GWP of just over $4.3bn in 2022, a 10% increase on the year prior.

-

David Altmaier previously served as the commissioner of insurance for the state of Florida, leading the office of insurance regulation for more than six years.

-

The number of global, non-life run-off deals dropped to 48 over 2022, compared with 54 in 2021, according to a report from PwC.

-

The former Canopius CEO will chair the company’s nominations and governance committees.

-

Based in Bermuda, the executive will oversee the firm’s investments in technology and support its growth initiatives.

-

Nick Acker joins from Arch Insurance group, where he spent 10 years, most recently as a vice president in its wholesale and distribution management team.

-

The firm’s leadership said a pattern of strong results is needed before triggering an IPO process.

-

The carrier also reported GWP of just over $2.3bn for the first half of the year.

-

De Couto has worked at Aspen for over seven years, first as underwriting and portfolio analytics SVP, and as head of exposure management over the last year.

-

The carrier’s former accountant KPMG will now have to respond to EY’s enquiries.

-

The carrier has also announced a brace of promotions in its first-party and specialty teams.

-

The existing $770mn adverse development cover between the two parties has been absorbed as part of the deal.

-

Aspen joins Counterpart’s paper platform, which has been backed by Markel since the InsurTech launched in 2020.

-

The business performance is on track for an eventual flotation, but the date will depend on stock market conditions, the CEO said.

-

The reinsurance segment swung back to underwriting profits as its CoR declined 8.5 points to 93.6% and its LR improved 11.4 points to 63%.

-

Under the terms of the deal, Aspen will provide paper across multiple geographies with three programs in the US and four in Europe.

-

Inside P&C’s news team runs you through the key developments from the last week.

-

Project Leaf will see environmental, social and governance (ESG) information issues woven into Aspen’s decision making for its credit and political risk portfolio.