Berkshire Hathaway

-

Both the primary and reinsurance segments benefitted from a light cat year.

-

The executive will initially focus on casualty fac business incoming as the result of the Markel renewal rights deal.

-

The program, expected to start doing business next month, will be wholesale-only.

-

The Berkshire subsidiary is seeking coverage for a $22mn antitrust loss.

-

The company has also appointed David Tran as head of programs, Canada.

-

The reinsurance CoR fell 2.3 points to 79.5% while the primary CoR rose 4.7 points to 98.7%.

-

The former Corvus president will report to Ajit Jain.

-

The company also encouraged insurers and brokers to support the initiative.

-

Underhill spent nine years at BHSI as global head of transactional liability.

-

Unpacking how much excess capital there really is and dissecting the source of its returns.

-

Michael Brooks, SVP, head of transactional liability, will be taking over temporarily.

-

The take-up rate will depend on the price discount and market segment.

-

The conglomerate’s insurance subsidiaries will have to make do without some of their prior strategic advantages.

-

The facility is a nudge towards a structural change, not a full-out assault.

-

Both Chubb and Zurich will underwrite the risks, with Nico as the sleeping partner.

-

At his last annual meeting as CEO, Buffett highlighted the importance of Berkshire’s insurance operations.

-

The primary and reinsurance unit CoRs were 103.1% and 98.7%, respectively.

-

The facility provides up to $100mn in claims-made excess casualty coverage.

-

He will replace Scott Lee, who is retiring after 40 years in claims.

-

The two internal hires have been with BHSI for around five years.

-

The appointments cover US casualty, the US Central region and construction.

-

The executive will continue as head of BHSI’s E&P lines business.

-

BHSI is dividing its retail general property unit into four regions.

-

The carrier was seeking to expand its March 1-renewing program.

-

Berkshire Hathaway’s "float" rose to $171bn in 2024 from $169bn in 2023 as Buffett praised Geico’s Todd Combs.

-

The conglomerate reported after-tax cat losses of $1.2bn related to Hurricanes Helene and Milton in 2024.

-

Sources said Berkshire will move from the largest single capacity provider to a single-digit percentage line size.

-

The agency affirmed its A+ financial strength rating for the companies.

-

Mr Cooper Group said it was the target of a 2023 hacking attack.

-

The conglomerate expects pre-tax losses from Hurricane Milton of between $1.3bn-$1.5bn in Q4.

-

The panelists discussed the ILS reset and the path to maintaining discipline in this sector.

-

The two senior positions will be based in London.

-

The move comes just days after the Warren Buffett-controlled conglomerate reached the $1tn market cap mark for the first time.

-

Andrew Knight will fill the newly created role of country manager.

-

-

The conglomerate now owns around 27 million Chubb shares valued at roughly $6.9bn, compared to nearly 26 million in Q1.

-

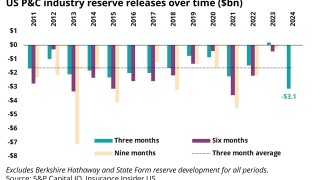

The industry could weather a recession, unless loss costs and reserving pressures worsen.

-

Geico more than tripled underwriting profits.

-

The executive has had a 40-year career at AIG, Berkshire Hathaway and Lloyd’s.

-

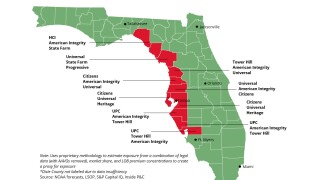

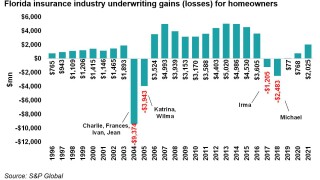

In 2023, Berkshire provided around $1bn in capacity to the Floridian insurer.

-

Berkshire Hathaway and Canada Life Re will provide as much as A$680mn of protection annually.

-

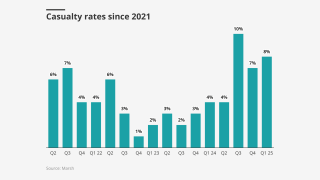

The discrepancy between rising claim counts and favorable reserves is cause for concern.

-

He succeeds Darryl DeSouza, who is retiring after 10 years with the company.

-

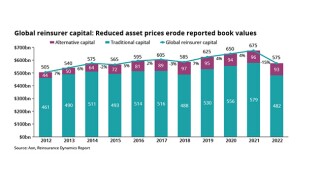

Changes in investment strategy and strong results show carriers can weather financial storms.

-

The $6.7bn Chubb investment is an outlier in the Berkshire portfolio.

-

The conglomerate exited its $620mn position in Markel, which it has held since 2022.

-

Analysis of 2023 statutory data shows that Californian insurers are leaning more heavily on reinsurers but at a nationwide level, premium cessions were more stable.

-

Across three offerings, Victor increased coverage maximums by $33mn.

-

The insurance arm’s CoR declined 4 points to 89.3% on lower cat losses.

-

Freeman has spent 11 years in property leadership roles with BHSI.

-

The new offering marks the expansion of BHSI’s US marine facilities.

-

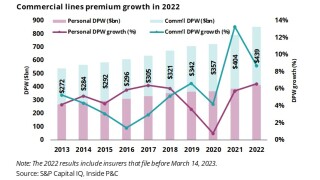

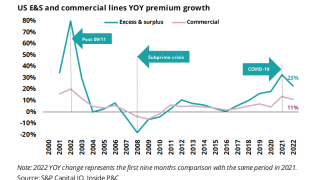

As admitted carriers pull out of riskier plays, E&S continues to expand and thrive.

-

Chres Lee was previously M&A counsel for Liberty Global Transaction Solutions.

-

He praised 2023 insurance results as other sectors were a “disappointment”.

-

Geico reported lower frequency, higher severity and increased favorable development.

-

A quick roundup of this week’s biggest stories.

-

Its confederation of insurance subsidiaries will have to operate with fewer strategic advantages than they do today.

-

The underwriter will work in the retail property team at BHSI serving the central region.

-

Berkshire Hathaway announced that Munger “died peacefully” in a California hospital this morning, citing the Berkshire vice chairman’s family.

-

The executive has over three decades of surety experience in underwriting, consulting, and claims roles, including a stint as surety claims counsel.

-

Lower losses reflected higher average premiums per auto policy, increased reserve releases and lower claims frequency, which were partially offset by higher severity.

-

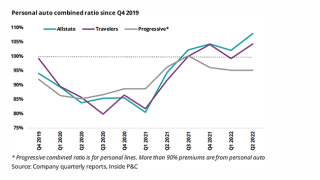

Ahead of third quarter earnings, many personal lines insurers are pulling several levers to right-size their operations, including conducting layoffs and reducing exposure.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

Sources said the Houston, Texas-headquartered program manager is now writing business on Sutton National paper.

-

Joining the company in 2014 as senior underwriter, casualty, Meyer has held increasingly senior positions in BHSI’s North America casualty organization.

-

The two subsidiaries, which together command less than 1% of the homeowners' market share in the Golden State, are the latest to flee amid persistent inflation, high cat losses and a strict regulatory environment.

-

The Omaha conglomerate held its ~2.1% stake in Aon valued at nearly $1.5bn and its interest of over 3% in Markel, worth over $652mn at the end of Q2.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

Geico’s CoR fell 10.3 points to 94.7%, fueled by higher average premiums per auto policy, a reduction in advertising costs and favorable reserve development.

-

In addition to his new role, the executive will retain his current position as head of marine for the Australasia region.

-

Early private deals have provided far more stability in this year’s renewal than last.

-

Everest Re’s $1.5bn capital raise could be part of a continued pivot, or an early indicator of a shifting marketplace.

-

Inside P&C’s news team runs you through the key highlights of the week.

-

Analysis of 2022 statutory data shows top US-exposed reinsurers grew assumed premiums 13% year-on-year in 2022.

-

Securities filings show the conglomerate’s ownership of Markel holdings was valued at over $600mn at the end of March.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

Citizens’ board is slated to meet on May 16 at 13:30 ET to discuss the reinsurance and risk transfer program.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

Given better pricing following a disappointing January 1, the company increased its exposure significantly.

-

The carrier also reported lower claims frequencies, offset by increases in claims severities.

-

Browne becomes deputy global chief underwriting officer and Holmes assumes the role of global underwriting officer of property for energy and construction.

-

Byrnes joined BHSI almost four years ago as construction vice president for the US Eastern region, overseeing construction professional liability.

-

The latest statutory data release shows commercial carriers continued to benefit from the extended pricing cycle and exposure growth propelled by inflation, although growth slowed year-on-year.

-

Buffett said Berkshire's financial strength allows its insurance subsidiaries to “follow valuable and enduring investment strategies” unavailable to competitors.

-

The deterioration was driven by increased cost inflation in property and physical damage claims, which began to accelerate in the second half of 2021 and continued through 2022.

-

Five auto insurers receive approval to raise rates after 32-month halt by the California Department of Insurance.

-

It is understood that the executive will be joining the conglomerate’s reinsurance business, run by Ajit Jain.

-

The ending of an exclusivity arrangement also allows Berkshire Hathaway to offer reinsurance to Australian rivals.

-

Murphy will fill the position left vacant after former board member David Gottesman died on September 28.

-

Inside P&C Research examines E&S sector growth over the past year and revisits historic trends.

-

Five other executives in the unit will get promoted, including Greg Freeman to US retail leader and Mark Lees to global property underwriting officer.

-

Based in Chicago, Norman will oversee the firm's regional teams underwriting commercial public and private non-profit management liability insurance.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

The personal auto giant still grappled with increased claims severities driven by cost inflation in property and physical damage claims.

-

The Massachusetts Bay Transportation Authority claims the firms failed to act over the bankruptcy of LMH-Lane Cabot Yard Joint Venture.

-

The completion of the deal comes after last week the companies received all regulatory approvals.

-

Berkshire Hathaway and Alleghany have received regulatory approvals to close the $11.6bn deal announced earlier this year.

-

Inside P&C’s news team runs you through the key highlights of the week.

-

Fidelis and MS Reinsurance are among the ceding companies that have support from Ajit Jain’s unit.

-

Auto insurers look set to generate a larger share of losses than with most US wind events.

-

Universal P&C, the FHCF, Axis, Berkshire and Nephila are among the firms that will be in focus as the loss develops.

-

If current forecasts prove accurate, this will be a pivotal moment for the already off-balance Florida cohort and could result in a new market landscape.

-

Claims analysis shows slow reactions to negative trends can affect several quarters, but carriers who emerge strong will be able to pursue growth faster than the competitors who are always playing catchup on loss cost trends.

-

The firm's ethos will remain the same, but the bigger balance sheet may help it win clients and absorb volatility.

-

With the additional shares, Berkshire now owns around 3.4% of the Richmond-based specialty insurer, a stake that as of June 30 was worth over $605mn.

-

The personal lines insurer’s results were also impacted by the states’ regulatory climates and inflationary trends.

-

The Q2 deterioration in Geico’s underwriting performance was offset by improvements in its other divisions.

-

Danny Engell will serve as chief underwriting and analytics officer, succeeding Mark Barba who retired in June.

-

More than 98% of votes cast supported the acquisition.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

The case is linked to losses associated with asbestos-related injuries and claims filed over two decades ago in Montana.

-

Forecasters have again predicted an active season for storm activity, with the Florida market particularly vulnerable to high cat activity.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

The chunky deal comes as many reinsurers are heavily cutting their Florida cat books.

-

The defendants denied the accusations of misappropriation of trade secrets and confidential information by BHSI.

-

The Warren Buffett-led conglomerate also remained firm in its position in rival broker Aon.

-

Other defendants in the complaint include Endurance, Great American Insurance, Ironshore, Ace American Insurance and TIG Insurance.

-

Inside P&C’s news team runs you through the key developments from the week.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

The insurer accused its former global casualty CUO Foley and SVP London of misappropriation of valuable confidential information.

-

The meeting highlighted economic challenges and left questions about future acquisitions after an eventual management transition.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

Shareholders supported Buffett remaining as chairman and chief executive on a nearly 6-to-1 margin.

-

Geico saw claims frequency increase across all coverages, while severity especially increased in property damage, collision and bodily injury coverages.

-

Long-time executive Kathy Reid will bring more than 25 years of insurance industry experience to the role.

-

Berkshire’s board opposed the proposal and recommended that the shareholders vote against it.

-

The firm’s reinsurance heavy business mix, investments, and slowing value creation likely kept buyers away.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

Alleghany said its representatives and financial advisers solicited alternative deals from 31 potentially interested third parties but did not receive any proposals.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

Chubb has also received demands from shareholders for more information on its climate-related policies.