Hippo

-

Full-stack carriers fail to outclass incumbents with no clear platform differentiation.

-

CEO Rick McCathron also said the company is seeking to diversify its portfolio.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

The deal triples Hippo’s new homeowner leads and extends Baldwin’s MGA capacity.

-

Hippo will also provide capacity for existing and future MSI programs.

-

Shares were down as much as 20% after Hippo posted a $48mn loss.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

Consolidation options include fronts merging, competition, larger fronts becoming carriers and fronts being acquired by carriers.

-

Hippo estimated its pre-tax cat loss from the LA wildfires at $42mn.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

The Bain-backed fronting carrier acquired Spinnaker’s shell subsidiary earlier this year.

-

Following the closing of the deal, Aviad Pinkovezky will be named First Connect CEO.

-

The carrier filed a separation agreement with the SEC on Wednesday.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

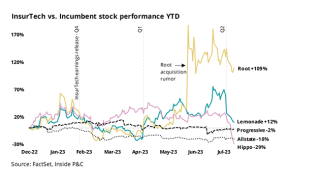

Hippo shares were up 20%, while Root’s shares dropped over 20%.

-

The InsurTech’s cat weather loss ratio improved by 83%

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

The InsurTech’s quarterly revenue increased 80.2% to $64.5mn.

-

The InsurTech will push for its services segments as main growth drivers.

-

The company also increased participating reinsurers to 19 from 14.

-

The decision to pull back from some business in the meantime will cause “additional [total gross premium] declines in 2024,” the executive said.

-

The Inside P&C news team runs you through the earnings results for the day.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

The decision is expected to incur charges of approximately $2.2mn to $2.7mn for severance, benefits and related costs in cash expenditures during Q4 2023, the company wrote in a regulatory filing.

-

In August 2022, the company announced plans to cut around 10% of its staff in a bid to improve efficiencies amid challenging market conditions for InsurTechs.

-

Sources said the fronting company has drawn the interest of private equity firms, including Summit Partners.

-

Inside P&C’s news team brings you all the top news from the week.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

Worsening results in key states and belated rate action weigh against a shifting business model, making the path to profitability unclear.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

The shareholders are among the company’s top 10 largest and hold nearly 2.5% of outstanding shares.

-

The executive said the company will likely start with builders’ policies and then gradually continue to other segments.

-

Sources added that the company will continue to monitor portfolio performance to reopen business on a state-by-state basis.

-

On the surface, InsurTech results were better than the noise from incumbents, but caution is needed to ascertain the quality of new business coming in during a time when even industry leaders stumble.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.