Hippo

-

Full-stack carriers fail to outclass incumbents with no clear platform differentiation.

-

CEO Rick McCathron also said the company is seeking to diversify its portfolio.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

The deal triples Hippo’s new homeowner leads and extends Baldwin’s MGA capacity.

-

Hippo will also provide capacity for existing and future MSI programs.

-

Shares were down as much as 20% after Hippo posted a $48mn loss.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

Consolidation options include fronts merging, competition, larger fronts becoming carriers and fronts being acquired by carriers.

-

Hippo estimated its pre-tax cat loss from the LA wildfires at $42mn.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

The Bain-backed fronting carrier acquired Spinnaker’s shell subsidiary earlier this year.

-

Following the closing of the deal, Aviad Pinkovezky will be named First Connect CEO.

-

The carrier filed a separation agreement with the SEC on Wednesday.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

Hippo shares were up 20%, while Root’s shares dropped over 20%.

-

The InsurTech’s cat weather loss ratio improved by 83%

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

The InsurTech’s quarterly revenue increased 80.2% to $64.5mn.

-

The InsurTech will push for its services segments as main growth drivers.

-

The company also increased participating reinsurers to 19 from 14.

-

The decision to pull back from some business in the meantime will cause “additional [total gross premium] declines in 2024,” the executive said.

-

The Inside P&C news team runs you through the earnings results for the day.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

The decision is expected to incur charges of approximately $2.2mn to $2.7mn for severance, benefits and related costs in cash expenditures during Q4 2023, the company wrote in a regulatory filing.

-

In August 2022, the company announced plans to cut around 10% of its staff in a bid to improve efficiencies amid challenging market conditions for InsurTechs.

-

Sources said the fronting company has drawn the interest of private equity firms, including Summit Partners.

-

Inside P&C’s news team brings you all the top news from the week.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

Worsening results in key states and belated rate action weigh against a shifting business model, making the path to profitability unclear.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

The shareholders are among the company’s top 10 largest and hold nearly 2.5% of outstanding shares.

-

The executive said the company will likely start with builders’ policies and then gradually continue to other segments.

-

Sources added that the company will continue to monitor portfolio performance to reopen business on a state-by-state basis.

-

On the surface, InsurTech results were better than the noise from incumbents, but caution is needed to ascertain the quality of new business coming in during a time when even industry leaders stumble.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

The Inside P&C news team runs you through the earnings results for the day.

-

In Q2, 80% of Hippo’s cat losses were caused by five major wind and hail events in Colorado and Texas.

-

“Tomorrow will be a better day.” “Next year will be a better year.” “The coming decade will be when this industry realizes its true potential.” We hear the same for most public enterprises.

-

Hippo’s gross loss ratio remained unchanged at 76% and its net loss ratio rose 23 points to 273% as the InsurTech was hit by catastrophic events in Q1, mainly in California.

-

The company expects to turn adjusted Ebidta positive by the end of 2024 with cash of at least $400mn.

-

The InsurTech said it had raised its per occurrence limit by 32%.

-

2022 marked a reversal from last year’s unprecedented levels of global investment in InsurTech as the macroeconomic scenario flipped and investors put lossmaking companies under a magnifying glass.

-

InsurTechs’ mounting losses and continuing cash burn combined with reinsurance market hardening could spell trouble for the sector.

-

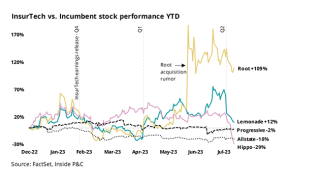

Our Trump/Biden note from yesterday discussed the rotation from growth stocks to value stocks playing out over 2022. Unfortunately, insurance technology stocks have had it the worst, with Lemonade stock down 49%, but still doing relatively better than Root (down 86%) and Hippo (down 80%).

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

CEO Rick McCathron said he is not concerned about reinsurance supply, as the company has multi-year capacity with partners and has improved loss ratios.

-

The gross and net losses represented 52 points of the gross loss ratio and 44 points of the net loss ratio.