Homeowners' insurance

-

The ratings agency cites ongoing deterioration in results for personal auto and homeowners’ lines, along with rising loss costs, driven by inflationary pressures.

-

The Senate Budget Committee, chaired by Democratic Senator Sheldon Whitehouse, is seeking information on plans to address increased underwriting losses from extreme weather events.

-

Cedeño Camacho will expand his insurance carrier holdings to North America.

-

Carriers have sought to restore profitability through a mix of rate hikes, policy restrictions and localized non-renewals and moratoriums on new business.

-

Insurance Insider US’s morning summary of the key stories to get you up to speed fast.

-

Commissioner Lara’s 2019 mandate, ordering FAIR to offer a more comprehensive insurance package beyond its historical “fire-only” coverage, has now survived a second court challenge.

-

The office also said it has approved the assumption of 650,399 policies from Florida Citizens so far this year, a more than 800% increase from the previous year.

-

The Floridian was approved for 75,000 policies, made 72,958 offers and assumed 53,750 policies – a 74% acceptance rate.

-

Insurance Insider US’s morning summary of the key stories to get you up to speed fast.

-

The government funding bill signed by Biden on November 16 contains provisions extending National Flood Insurance Program to February 2, 2024.

-

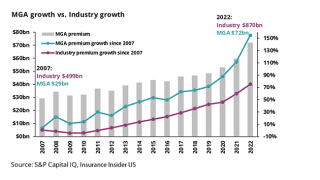

The Insurance Insider US Research team walks buyers through valuation considerations for InsurTech MGAs, as capital constraints point to further consolidation.

-

The E&S personal lines insurer also named Malcolm Tsung as commercial lines product management VP and Scott Crozier for a similar role in the personal lines division.

Related

-

Kin Series E valuation hits $2bn

September 08, 2025 -

QBE pulling out of California as part of US homeowners exit

September 05, 2025 -

Neptune files IPO prospectus, listing $119mn revenue for 2024

September 04, 2025 -

House committee votes to advance FEMA reform bill

September 03, 2025 -

Reductions in property rates expected to slow going into 2026: RPS

September 02, 2025