-

A memo to staff said the executive will be “pursuing new opportunities outside of our company”.

-

The change was made on December 2 and was effective immediately.

-

Canopius will continue to be one of several capacity providers to the MGA.

-

MGAs going public is now a viable option, but dominating a market comes first.

-

Highly concentrated, overly leveraged fronts could repeat the Unicover-Reliance story.

-

The executive said maintaining capacity is the main challenge in a soft market.

-

Admitted carriers on the other hand are still exercising caution as regulatory reforms take hold.

-

The MGA said payments to affected customers began shortly after the event.

-

Insurance Insider US reviews Euclid’s process and recent events in US MGA and retail broking.

-

The executive will report to Katalyx president and CEO Praveen Reddy.

-

The executives are based in Seattle and New York.

-

The London-based MGA will begin underwriting its international book next month.

-

It is understood that Liberty will halt support for property lines in the LatAm region effective 2026.

-

The valuation for the Jay Rittberg-led program manager is understood to be $1bn+.

-

The MGA is exploring new product lines including condos and renters, CEO John Chu said.

-

The HNW MGA previously had an exclusive distribution agreement under a partnership signed in July 2024.

-

The company announced four key leadership appointments on Wednesday.

-

The capacity deal comes over a year after Dual recruited Marilena Rodriguez Forero as CEO for the region.

-

Existing facilities and carrier partners will be transferring from K2.

-

The MGA began offering US commercial E&S property products in December.

-

Longbrook Insurance will write multiple lines of business.

-

Sources said that the New York-based InsurTech retained Evercore to advise on the process.

-

It is understood that the MGA wants to start with renewable energy and transactional liability.

-

The UK-based insurer’s Florida Re secured state regulatory approval in June.

-

The executive noted that an influx of new entrants in the E&S market is increasing competition.

-

From the carrier perspective, alignment of interests was a recurring theme.

-

Adeptive co-founder and CUO Jeff Bright will lead the MGU’s US strategy.

-

HNW family offices are now among investors considering the US MGA segment.

-

It is understood that Sutton National is the fronting carrier sitting behind the facility.

-

The Insurance Insider US news team runs you through this week’s key agency M&A.

-

It is understood the permanent reinsurance capital vehicle is called Highline Re and will sit behind fronting carriers.

-

The NFIP expiration and a successful Neptune IPO got attention, but some reinsurers moved earlier.

-

The reductions reflect a mix of programs being handed off and MGAs proactively switching.

-

BP Marsh has agreed the sale of its 28.2% shareholding as part of the deal.

-

Dealmaking took centerstage, but other discussed topics were growth, talent and capacity.

-

Sources said that Piper Sandler is advising the Dallas-based program manager on the process.

-

The Jay Rittberg-led program manager kicked off a strategic process in August.

-

Sources said the PE-backed platform retained IAP to advise on the process.

-

The company is looking to grow through its new MGA incubator program.

-

Christopher Reynolds and AJ Jones have been hired as business development directors.

-

The portfolio encompasses $5bn+ of subject premium across ~75 programs.

-

SageSure’s recent M&A in Florida was driven by being selective with policies and smart about claims costs.

-

The executive is charged with defrauding investors out of nearly $500mn.

-

MGAs that are good operators will stick out compared to the rest.

-

A Lloyd’s consortium led by Beat Syndicate 4242 backs the MGA.

-

Neil Ross was also appointed CUO for the broker’s MGA.

-

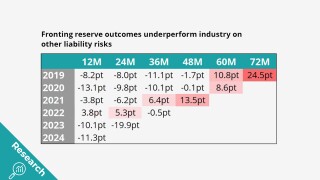

Fronting doesn’t look any better when it’s broken down by segment.

-

The MGA is also looking to build out its US mid-market professional liability expertise.

-

The MGA platform wants to expand into Europe and the UK and grow its wholesale business.

-

E&S is most exposed to growth normalization, private credit is hunting P&C and fronting is deadlocked on exits.

-

The executive said record operating income and returns don’t indicate Chubb is “beleaguered”.

-

The carrier has renewed and extended its capacity arrangement with the MGA.

-

The Insurance Insider US news team runs you through this week’s key agency M&A.

-

The new unit will be led by former Emerald Bay exec George Dragonetti.

-

Seller White Mountains will retain a roughly 15% fully diluted equity stake.

-

The business has been ~70% owned by White Mountains since January 2024.

-

Neptune’s stock price jumped 25% on the first day of trading.

-

The oversubscribed IPO priced at the top end of expected $18-$20 per-share range.

-

The MGA secured a “significant strategic investment” from Zurich earlier this year.

-

Home buyers looking to close on a mortgage could find the private market an attractive alternative.