Nationwide

-

Activists from the left and the right are focusing on insurance, often on the same issues.

-

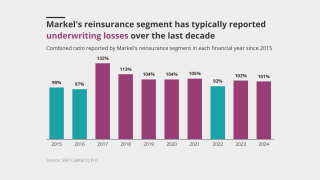

The company was right to drop its reinsurance unit and refocus on its specialty roots.

-

The president expects to see benefits from the deal in H2 2026.

-

Lion's share of Markel Re staff have been offered roles at Ryan, with others to work on run-off.

-

Nationwide will delegate management of the policies to Ryan Specialty.

-

Industry veteran Tonya Courtney will lead the company’s newest E&S business.

-

The Nationwide subsidiary is a $750mn-premium wholesale brokerage that serves about 10,000 local agents.

-

The move will expand Nationwide’s stop loss insurance sales to SMEs.

-

-

The executive previously worked at Guy Carpenter and AIG.

-

Non-renewals for certain policies will start on September 1, 2024.

-

The non-renewals will continue through June 15, 2025.

-

The executive joins from Chubb where she was EVP, digital business officer.

-

The ratings agency also downgraded carrier’s Long-Term Issuer Credit Ratings (Long-Term ICR).

-

The move reflects years of weak profitability caused by high cost inflation and cat losses.

-

The executive will lead a new specialty business line focused on global credit and political risk.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

The changes will take place “over the next few years” and will also include migrating all personal lines business into a single operating model and platform.

-

The business reductions will affect policies up for renewal from December 2023 to July 2024.

-

Inside P&C’s news team runs you through the key highlights of the week.

-

CPI figures show loss costs are cooling, and if rate levels cannot reach adequacy we are likely to see more pausing from the industry beyond State Farm, Allstate and Nationwide.

-

The carrier said the purpose of the changes is to mitigate risk and manage its personal and commercial lines portfolios.