Operations/tech

-

The insurer plans to automate around 85% of key functions surrounding underwriting and claims processes.

-

The company has been growing rapidly since the summer, with at least 300 currently employed.

-

It is understood that Liberty will halt support for property lines in the LatAm region effective 2026.

-

The payment will cover what the filing called “foregone incentives at his former employer”.

-

The plaintiffs' bar has been playing out the same rulebook for 15 years. It’s time the defense catches up.

-

Finance and insurance hiring is 27% below 2022’s peak, compared with 37% nationwide.

-

The platform will debut in Germany before an accelerated global rollout in 2026-27.

-

The CEO thanked his friends and colleagues and said he was “going quiet”.

-

A former NOAA climatologist who left the agency is running the new operation.

-

The company is looking to grow through its new MGA incubator program.

-

Christopher Reynolds and AJ Jones have been hired as business development directors.

-

Since Simon Wilson was elevated to insurance CEO, the firm has been refocusing its underwriting.

-

The tech subsidiary applied to list its common stock on the New York Stock Exchange under the ticker symbol “XZO”.

-

Activists from the left and the right are focusing on insurance, often on the same issues.

-

Guy Carpenter will rebrand as Marsh Re, as a new central tech/operations unit is created.

-

The layoffs will mostly affect workers in Michigan.

-

The specialty insurer was recently acquired by Korean carrier DB Insurance.

-

Sources said Marsh Specialty UK growth leader Lizzy Howe will lead the operation.

-

The new unit will be led by former Emerald Bay exec George Dragonetti.

-

The firm posted trailing 12-month organic growth of 23% YoY supported by a three-pillar strategy.

-

JH Blades, Southern Marine and Energy Technical Underwriters will merge to form the new brand.

-

The $20bn+ TIV data center is seen as the leading edge of significant new demand.

-

Getting that message across is key to bettering the industry.

-

Sources said the start-up has two $10mn+ Ebitda platform deals lined up.

-

Sources said they expect the carrier’s listing to raise about $100mn.

-

The executive has been with ASG since it was formed in 2016.

-

The insurance industry’s lower reliance on foreign skilled workers softens the blow.

-

This will be Fidelis’ first office in North America and will be led by former Navigators Re head Ivan Vega.

-

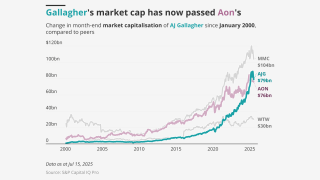

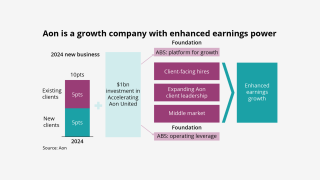

The deal’s benefits headlined AJG’s investor day presentation.

-

As data privacy litigation increases, insurers increasingly lean on exclusions.

-

The program, expected to start doing business next month, will be wholesale-only.

-

It is understood that CyberCube has been considering a sale of the business.

-

Claude Wade is to step down from his role to address ongoing health issues.

-

Sales velocity ticked up to 12.2% in Q2 but has remained steady in the past five years.

-

The move includes One80 Intermediaries, formerly part of Risk Strategies.

-

Despite being hailed as an asset, executives said the current situation is not ideal for either valuation or competitive purposes.

-

The tech could quickly open the door to disruptors, and firms with poor data management will lose out.

-

More investment in early stage firms is an indicator of bullish market, says Gallagher’s Johnston.

-

The 127-acre corporate campus has been the reinsurer’s North America headquarters since 1999.

-

CEO David Howden accused rivals of “restricting choice for their own clients”.

-

Insurers must write policies in high-risk areas in order to incorporate the model.

-

The executive said the claims industry is going to “be transformed”.

-

The awards, now in their fifth year, will be held in New York at 583 Park Avenue on September 25.

-

Cardinal E&S expands the carrier's underwriting capabilities and makes it more competitive relative to peers.

-

The technology will help analyze growing and emerging risks, especially climate change.

-

The broker has emerged as the emphatic winner of the supercycle, but new tests are coming.

-

While official return to office mandates have gathered steam, what they look like in practice can vary widely.

-

The VC firm has been incorporated in Delaware since its founding in 2009.

-

The MGA is expected to launch a product-recall portfolio in September.

-

Volante joins capacity providers Allianz and Tokio Marine Kiln.

-

The executive previously held roles at Capgemini, The Hartford and AIG.

-

Early adopters of AI will see efficiencies – and likely increased market share, Kantar said.

-

The insurer’s system has now been out of commission for over two weeks.

-

The platform will capture and standardise data from all submissions, the broker said.

-

The Pennsylvania-based insurer experienced a 10-day network outage this month.

-

Slide will also expand its footprint to New York and New Jersey towards the end of the year.

-

The insurer first noticed “unusual network activity” on June 7.

-

Markel is simplifying its structure from six US wholesale and two US retail regions to four integrated US regions.

-

Above-market organic growth, mid-market M&A and talent infusions were all heralded.

-

Case added that recently acquired broker NFP has “exceeded” expectations.

-

The Series C brings the company's valuation to $2.1bn, its highest to date.

-

This publication revealed back in February that Itel was being prepared for a sale.

-

Ed Short was previously VP, digital partners, at Arch.

-

Starr joins a panel that includes capacity from Axis and Skyward.

-

The Floridian brokerage expects to bring its leverage levels below 4x later this year.

-

The program will succeed the previous buyback launched in 2023.

-

The exec said if he were a carrier CEO, now is the time he would start looking for deals.

-

At his last annual meeting as CEO, Buffett highlighted the importance of Berkshire’s insurance operations.

-

Specialty insurer’s global chief of claims warns others about the allure of AI.

-

The Nordic operations have capacity provided by Allianz Commercial.

-

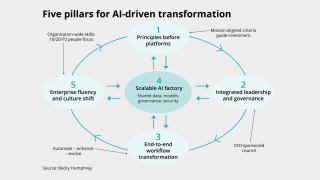

Here’s the five-pillar playbook for insurers ready to move from pilots to profit.

-

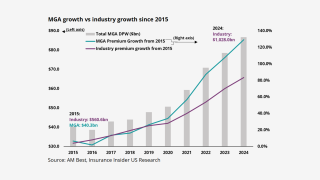

MGA growth is still strong but has passed its 2022 peak.