Personal auto

-

Sources said Jefferies and RBC have been retained to advise on the sale process.

-

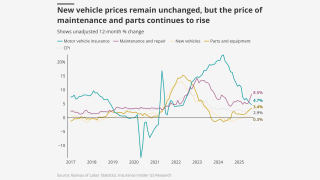

Casualty and auto loss costs continue to rise due to inflation as we head into 2026.

-

Insurance has been an increasingly salient issue among politicians in the state.

-

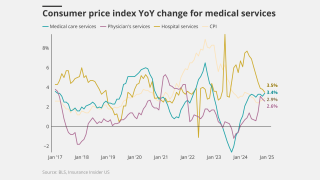

The medical care index increased 3.5% over the past 12 months.

-

The company announced several moves Monday, including the promotion of Nancy Pierce to Geico CEO.

-

The ratings agency said that it continues to assess State Farm’s balance sheet among the strongest.

-

The executive said inflation isn’t completely gone but is now “more understood”.

-

The reserve strengthening stemmed from bodily injury and defense costs for accident years 2023 and prior.

-

The LA fires were a microcosm of “everything we do well when things go bad”.

-

The executive’s exit follows CEO Joseph Lacher’s resignation last week.

-

September’s medical care index increase follows a 0.2% drop in August.

-

By line of business, $35mn of the charge relates to commercial auto and $5mn to personal auto.

-

The insurer booked a $950mn policyholder credit expense in September.

-

Joseph Lacher will step down as president and CEO and resign from the board.

-

Though wildfire losses are up, total losses are the lowest since 2015.

-

The governor has yet to sign a pending bill to create a public cat model.

-

The charges allege “egregious delays” and “unreasonable denials” in claims.

-

The proposed changes aim to establish clear guidelines for intervenors.

-

While the Fed is more concerned with jobs, other macroeconomic concerns trouble the industry.

-

A report by the ratings agency challenges current industry wisdom.

-

The bipartisan legislation would make Fema a cabinet-level agency.

-

The data modeling firm said losses previously averaged $132bn annually.

-

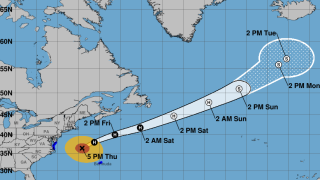

Storm surge of two to four feet could affect the North Carolina coast.

-

Life-threatening surf and rip currents are expected on the east coast of the US.

-

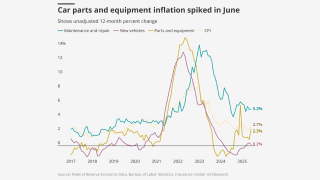

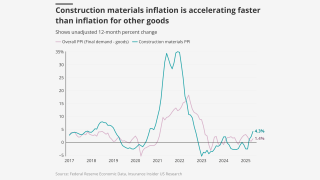

Despite mild headline CPI, some insurance-related items are heading in a worrying direction.

-

July’s medical care increase was up from June’s o.6%.

-

The gross loss ratio for the homeowners InsurTech fell by 12 points last quarter.

-

The company reduced its proportional quota share program from 55% to 20% cession.

-

The company also purchased $15mn of SCS parametric coverage.

-

On Q2 calls, carrier executives called out fierce competition in various lines of business, and a misalignment of interest.

-

CEO Roche said that “significant price increases” are still to come, however.

-

The broker posted a 6.5% drop in organic growth YoY.

-

Mercury’s recovery from the guaranteed percentage of losses is $47mn.

-

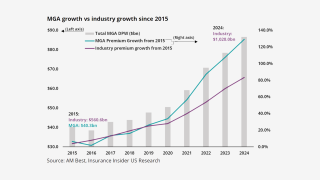

Smaller accounts remain less affected by an influx of MGAs.

-

The automaker’s insurance arm wrote over $300mn in premium last year.

-

Hagerty Re will now assume 100% of the premium and 100% of the risk.

-

The executive said the claims industry is going to “be transformed”.

-

Litigation seeks to block insurers from passing assessment costs to consumers.

-

Rising inflation could raise claims severity but also increase investment income.

-

June’s increase was up from May’s 0.2%.

-

The late March storm caused extensive damage in southern Quebec and Ontario.

-

Early adopters of AI will see efficiencies – and likely increased market share, Kantar said.

-

In The Car offers embedded auto insurance by integrating policies into dealership management systems.

-

The Pennsylvania-based insurer experienced a 10-day network outage this month.

-

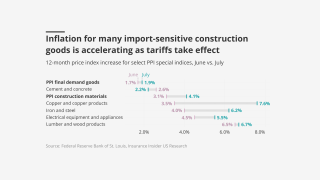

Tariffs could drive up property loss costs, but the impact on other items has been muted.

-

The medical care index numbers were below April’s 0.5% rise.

-

The regulator said further measures could still be passed in this session.

-

Insurers have termed the Democrat-backed legislation “flawed”.

-

One measure could give regulators greater leeway to deny rate requests.

-

The company seeks the full 30% homeowners’ rate request it made last June.

-

Two wind and hail events were responsible for 60% of the total.

-

The medical CPI is up 3.1% for the last 12 months.

-

Hits to personal auto, workers’ compensation led to a drop in NWP.

-

At his last annual meeting as CEO, Buffett highlighted the importance of Berkshire’s insurance operations.

-

The primary and reinsurance unit CoRs were 103.1% and 98.7%, respectively.

-

But automotive repair costs are likely to increase faster than home repair.

-

The Lone Star State has seen rapidly increasing rates in recent years.

-

CEO Marchioni said the overall hit would likely be “in the low single digits”.

-

The sale price represents Elephant’s approximate net asset value.

-

In operation since 1991, Pearl represents Ocean Harbor and Equity insurance companies.

-

Auto and homeowners’ insurance will see effects from the tariffs.

-

Customers will keep their agent relationship and policies will not be impacted.

-

The investment firm’s holdings were down to $59mn at the end of Q4.

-

The state has seen 11 new entrants into the insurance market, reflecting renewed confidence.

-

The company received over 10,100 home and auto claims as of January 27.

-

Loss-cost indicators are high for liability, low for property.

-

The all-items index posted a 2.9% rise for the last 12 months.

-

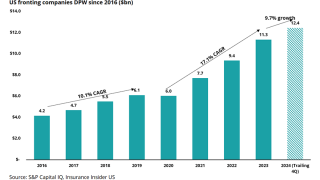

Fronting growth fell by half in 2024 due to uncertain loss climate and high cost of capital.

-

Rate inadequacy and inflationary pressures represent significant headwinds, however.

-

The estimate includes $102mn from Milton and $114mn Helene development.

-

Net property losses from Hurricane Milton in October reached $153.6mn.

-

The renewal book has auto, home, renters and condo policies, among others.

-

Initial expectations for the later storm prove overblown, while inland auto losses mount for the earlier event.

-

The catastrophe loss estimate for September totalled $889mn, pre-tax.

-

A bill in Congress would expand a similar pilot tried earlier in New York City.

-

The storm is projected to make landfall in the next 24 hours in the highly populated Tampa Bay region.

-

The lawsuit alleges the data is being used by insurers to increase premiums.

-

Lawsuit claims GM unlawfully sold data to insurers collected from 1.5m drivers.

-

Reforms would seek to tamp down legal costs that can drive insurance costs up.

-

NatGen allegedly collected $500mn associated with the fraud.

-

Reserving trends, pricing declines and hurricane forecasts are causes for concern.

-

Longstanding investor Stone Point will continue as a partner and board member.

-

US SCS insured losses YTD already stood at around $12bn prior to these events.

-

Flash floods moved into Texas overnight and into the lower Mississippi Valley Monday.