ProAssurance Group

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

The FTC granted early termination of the waiting period, leaving the acquisition on track to finish in early 2026.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

There is a long waiting list of carriers looking to pull the IPO trigger, but market conditions remain tough.

-

ProAssurance brands will be transitioned to The Doctors Company in "all/most markets" over time.

-

The Californian insurer is buying the medmal carrier for $25.00 per share, or a ~60% premium.

-

Profitability over growth continues to be the company’s “mantra”.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

Executives said the company continues to shrink its book of business in markets with poor underwriting conditions.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

Rand said the company remains “very bullish on the long-term value that NORCAL brings.”

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

The carrier’s comments on claims severity should serve as a warning for the industry

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

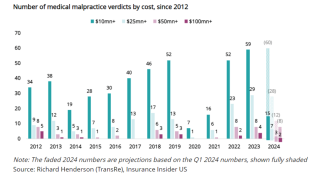

Social inflation is driving “cat-type” losses, with an increase in $50mn-plus verdicts.

-

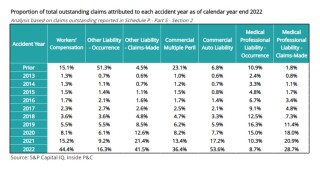

Workers' comp saw an ongoing significant increase in losses.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

Around 65% of the carrier’s claims costs were related to medical expenses, which the company attributed to increased costs for care of injured workers driven by healthcare wage inflation and medical advancements.

-

Executives noted that the company has been cautious about releasing prior year reserves because of inflationary impacts on policies written later in 2022 and into 2023.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

The Inside P&C news team runs you through the earnings results for the day.

-

Inside P&C’s news team runs you through the key highlights of the week.

-

In an interview with this publication, the executive added that jury sentiment is driving these large awards.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

Company shares opened at $12.33 on Friday, down nearly 50% from their 52-week high of $24.50.

-

With social inflation increasing since Covid, ProAssurance’s recent announcements could be the tip of the iceberg for older claims in the industry.

-

Inside P&C’s news team runs you through the key highlights of the week.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

Two of the verdicts were around $15mn and two were between $40mn and $45mn.

-

The specialty P&C segment’s underlying loss reflected claims severity trends, largely from prior accident years, which adversely impacted the calendar year loss ratio.

-

The firm booked a Q4 $5mn reserve release that represented a favorable effect on its results of 2%, down from 6.7% in Q4 2021.

-

The deterioration of combined ratios in the specialty P&C and Lloyd's syndicates segments was offset by the improved results in workers' compensation.

-

The chief executive added that his company will continue to take a conservative approach to reserving, as the process remains less consistent amid Covid’s enduring impact on closing patterns.

-

The increased combined ratios in the reinsurance segments were offset by the improved results in the company's workers' compensation segment.

-

Ned Rand said that while the ruling opens up exposure for physicians and hospital operators, he anticipates more criminal exposure than medmal exposure.