RLI

-

Bryant has spent over 30 years with the specialty carrier.

-

Some disagreement remains in where rate declines have been swiftest and how much further they could go.

-

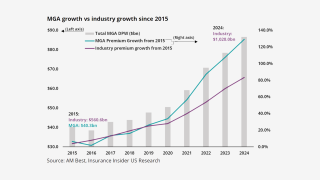

Normalized growth and peak multiples confirm we are headed towards a Darwinian race.

-

Cat losses in Q3 were light as peak hurricane season passes without incident.

-

A quiet wind season is also expected to further soften the property market.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

The executive’s skepticism is informed by the industry’s typical approach to cyclicality.

-

On Q2 calls, carrier executives called out fierce competition in various lines of business, and a misalignment of interest.

-

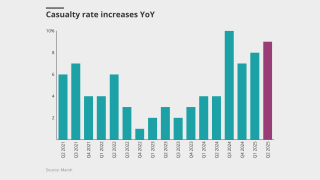

Loss trend concerns persist, but insurers are vouching on the opportunity to push for more rate increases.

-

The segment is also seeing double-digit loss cost inflation.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

The latest E&S player planning to IPO remains a “show me” story.

-

The company’s diverse portfolio could provide protection, but has heavy exposure in construction and transportation.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

Auto severity continues to be an ongoing challenge for the industry.

-

The carrier’s Q4 operating EPS declined to $0.41 from $0.77 in Q4 2023.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

The carrier saw 16% growth during the quarter.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

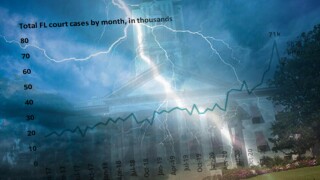

Moody’s RMS forecast total insured losses from Helene of $8bn-$14bn.

-

Executives flagged elevated packaged auto loss activity in Q2.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

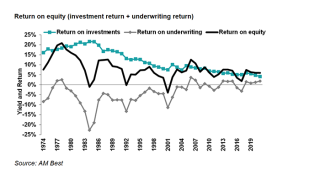

Changes in investment strategy and strong results show carriers can weather financial storms.

-

The casualty segment posted $18mn of favorable reserve development across multiple accident years.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

Competition, particularly from MGAs, is expected to accelerate in 2024.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

Michael served as RLI CEO for around 20 years until he stepped down from the specialty insurer in 2021.

-

Brodeur will have executive leadership and oversight responsibility for RLI’s pricing, reserving, risk management, reinsurance and due diligence functions.

-

The event cost the carrier $66mn, including $14mn related to reinstatement premiums on its catastrophe treaties.

-

On the company’s Q3 earnings call, COO Jennifer Klobnak said the E&S property division grew 39%, including via a 42% rate increase.

-

The Inside P&C news team runs you through the earnings results for the day.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

The estimate is based on the impact to approximately 200 structures where RLI provided primarily homeowners’ insurance.

-

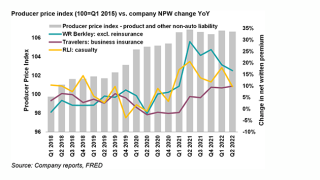

Flows to the E&S market remain strong, executives have said, while dislocation in the property space continues to buoy overall pricing conditions.

-

The January decision affected the company’s ability to offer primary-only policies and it subsequently did not believe the business model was viable long term.

-

The Inside P&C news team runs you through the earnings results for the day.

-

Management was speaking after RLI reported a Q1 combined ratio of 77.9% for Q1 2023, unchanged compared to the prior-year quarter, as top line growth accelerated sequentially to 15.6%.

-

The specialty carrier booked $4mn of net incurred losses associated with 2023 storms.

-

RLI renewed its property per-risk treaty with an estimated 40% risk-adjusted rate increase, and the first dollar retention went up to $2mn.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

The insurer’s NWP grew 14.4% to $298mn, while GWP rose almost 14% to $384mn in Q4.

-

In tandem, the company announced promotions of Chris Hughs to VP of general liability and Chris Gleason to VP of contract surety.

-

Discussion on Q3 earnings calls focused heavily on the supply-demand imbalance in cat capacity, as executives discussed how they would navigate a challenging January renewal.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

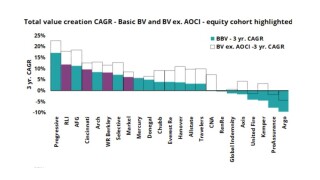

The two specialty insurers reported strong Q3 2022 earnings, continuing to outperform the commercial industry in underwriting gains and value creation.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

Of the ~$40mn Ian loss net of reinsurance, $33mn impacted RLI’s property business and $7mn its casualty unit for some package policies.

-

Overall, the company recorded an $8.8mn underwriting profit for the quarter, down almost 36% from last year.

-

The carrier is the latest in a string of primary insurers to provide loss estimates.

-

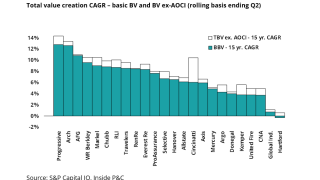

A differentiated investment strategy has led to increased value creation and price-to-book multiples for a small group of specialty carriers.

-

The insurer’s results are in line with other carriers, but they are ahead of the curve on adjusting loss costs.

-

Commercial insurers surprised with continued positive results despite economic conditions.

-

The specialty carrier said hurricane season will have to play out before any market easing takes place, especially in the Southeast.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

GWP growth slowed to about 17% on the year, versus the 22% increase in Q1 2022.

-

Insurers could face pressure if interest rate and recession fears intersect with worsening loss cost trends.

-

The specialty players are better placed than the commercial lines cohort with pricing and growth outperforming the broader market.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

The executive added that the specialty carrier purchased roughly $100mn more reinsurance in its catastrophe tower for both hurricane and earthquake exposure.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

The company’s underwriting income spiked 99% on the year to $59.5mn.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

The carrier had a minority stake in the eyewear firm.

-

The new offering is underwritten by specialty insurer RLI and covers home and offsite exposures such as general liability, equipment, furniture, fixtures and inventory.

-

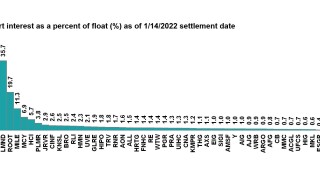

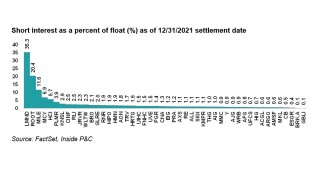

Stock prices fluctuated, and InsurTech short-sellers took some profits.

-

The carrier purchased $100mn of additional catastrophe reinsurance, effective January 1, to support its property business growth.

-

Gross written premiums were up 12% to $337mn, a slowdown from the roughly 18% growth reported in Q3.

-

InsurTechs, including Lemonade, Root, Hippo, and Metromile, shed some short interest but remain the target of choice for short-sellers.

-

The elevations of Schick and Ward follow last November’s confirmation of Kliethermes as the insurer’s new effective this January after the retirement of Jonathan Michael at end of this year.

-

The appointments are in line with the planned retirement of RLI’s current chairman and CEO, Jonathan Michael in December.

-

The firm’s margin expansion – despite rates tapering in some lines, including excess casualty – offset Ida losses during Q3.