Skyward Specialty Insurance

-

Dairy and livestock products within the agricultural unit were main growth drivers in Q3.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

The executive joins from MSIG USA.

-

Andrew Robinson returns to Lloyd’s after his previous involvement via The Hanover’s Chaucer deal.

-

Apollo executives David Ibeson and James Slaughter are committed to the future as a combined entity.

-

The US specialty carrier announced Tuesday that it was buying the Lloyd's business for $555mn.

-

In June, this publication revealed that Apollo had appointed Evercore and Howden to run a process.

-

In liability, the carrier is steering away from where inflation has been volatile.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

The acquisition follows a strategic partnership the two struck last August.

-

The latest E&S player planning to IPO remains a “show me” story.

-

The former leader, Kirby Hill, will assume the role of chairman, captives and specialty programs.

-

The CEO spoke after Chubb chief executive Evan Greenberg’s call to action at RIMS.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

Sills’ background, a strong backing, and laser-sharp E&S focus make Bowhead stand out.

-

The unfunded commitment related to the investment was $24.4mn in 2024.

-

Approximately 12% to 13% of Skyward’s premium was in commercial auto in Q4.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

The specialty carrier expects to report a 91.6% Q4 CoR and GWP growth of 20.8% to $388.4mn.

-

In the quarter, the company reported a CoR of 92.3%, up two points YOY.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

Westaim reported roughly $79mn in net proceeds from the sale.

-

The executive noted that limits on sourcing funds alone won’t have a material effect.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

-

A quick round-up of today’s need-to-know news, including Ryan Specialty and Skyward Specialty.

-

In an interview with Insurance Insider US, Robinson spoke about life after the IPO, talent, litigation financing and cat.

-

His experience includes HPR engineering, facultative reinsurance and E&S underwriting.

-

The specialty insurer reported 27.2% Q1 top-line growth and a lower CoR of 89.6%.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

The firm’s Q4 GWP grew over 21% fueled by surety, transactional E&S and captives.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

It is understood that the cyber InsurTech has ~$100mn of excess delegated authority capacity and around 20 backers.

-

Intact Insurance’s Regina Williams and Sandi McIntosh joined the new team in December.

-

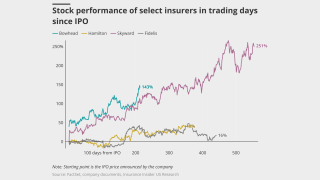

The Aspen IPO provides an opportunity to benefit from the specialty market without commensurate prior-year reserve risks due to an LPT cover.

-

Over a 40-year career, the executive has held numerous high-level positions in the insurance and investment industries.

-

In addition, Westaim COO Robert Kittel also resigned from Skyward’s board while Tony Kuczinski was named lead independent director.

-

The offering sold 3.6mn shares priced at $30.50 apiece and brought in approximately $104.9mn.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

With the fundraising, Skyward will capitalize on market opportunities within existing lines of business, but also continue to expand into new products.

-

CEO Robinson said Skyward continues to see “strong submission activity” as business flow rose over 20% year-on-year.

-

The Inside P&C news team runs you through the earnings results for the day.

-

The carrier has appointed Scott Bailey as vice president of field operations for contract surety, among seven recent hires.

-

The alternative energy warranty captive solutions will be available throughout the United States and Canada.

-

The upgrade follows a period of underwriting volatility, with management instituting several initiatives to refine underwriting focus and risk selections as a specialty lines writer.

-

Skyward saw 15%-20% risk-adjusted rate increases during its property cat renewals as its attachment point rose to $12mn from $10mn the year before.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

The Inside P&C news team runs you through the earnings results for the day.

-

Before working at ICS, Robert Nizzi spent over six years at Enterprise Risk Strategies, where he was president until 2017.

-

The Canadian investment company sold 3.85 million shares of common stock, priced at $23 per share.

-

Skyward Specialty Insurance completed its initial public offering at the beginning of the year.

-

Inside P&C’s news team runs you through the key highlights of the week.

-

Anthony Kuczinski spent 34 years at Munich Re, serving as president and CEO for 15 years of Munich Reinsurance US Holdings until December 2022.

-

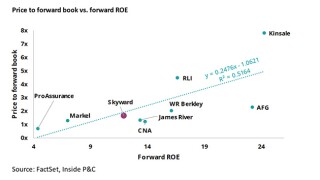

Strong results reflect tailwinds in the E&S space, but social inflation will be a trend to watch.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

Skyward’s surety book grew over 50% in Q1 after the company invested in a new surety platform with industry analytics.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

The specialist’s ex-cat LR improved 2.4 points to 61.1% benefitted by the continued run-off of exited lines and the shift in the mix of business.