-

Alera and Propel also raised additional capital from private equity partners Genstar and Flexpoint.

-

The rebooting of efforts to find a buyer was considered, but CEO David Disiere has decided to retain the business.

-

“If we hit ’21, as I expect, based on most recent forecasts, and in ‘22 we get close to our plan, I think a possibility for this business would be a potential IPO in early ’23,” Cloutier told this publication on Tuesday.

-

The acquisition follows a buyout in May of Northwest Insurance Services, a subsidiary of Northwest Bank.

-

The combined business will have Ebitda of around $275mn, sources said.

-

The business is being marketed by investment bank Morgan Stanley following last year's sale of Ariel Re.

-

Vaaler offers business insurance, employee health and benefits and personal lines, specialising in the construction, education and healthcare industries.

-

The reinsurer was launched as a joint venture with Enstar, Allianz and Hillhouse in 2018.

-

Late-stage interest had come from New Mountain, Atlas Merchant and Centerbridge.

-

S&P noted that the deal volume was the highest on record for a decade, and came despite uncertainty over pandemic claims.

-

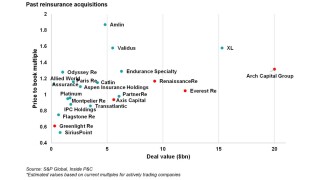

The drivers that led to the consolidation in the reinsurance industry might not replicate for a while.

-

The sale is another step in the company’s remediate or exit strategy in the business lines where it hasn’t met its scale or pricing targets.