Truist

-

It acquired wholesaler ARC Excess & Surplus, confirming an earlier report from this publication.

-

Insurance Insider US spoke with the incoming CEO to discuss the future of TIH.

-

The mid-market unit has been a home run but will now face the fresh test of integrating a $1.3bn revenue business.

-

With the disposal, TIH would amass a robust war chest for a looming MGA consolidation arms race.

-

Sources said that the business will be marketed off adjusted Ebitda of ~$500mn, including a title broking asset.

-

The broker has seen an “outpouring of interest” from talent looking to join since the Truist exit.

-

State National has been lined up to front for the vehicle, which would be a rare example of third-party capital in this space.

-

The firm will no longer have to compete with one hand tied behind its back.

-

-

The $15.5bn price tag equates to around 18x the company’s 2023 core Ebitda.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

The oversubscription may signal additional capacity waiting on the sidelines.

-

The announcement confirms earlier reports from this publication.

-

Sources said the deal was roughly three times over-subscribed as cat becomes hot.

-

He will assume the role of office president in mid-2025.

-

Sources said Stone Point and CD&R will each have stakes of around 35%.

-

The firm will have more flexibility around talent compensation and M&A activity.

-

TIH CEO John Howard said the deal positions TIH for continued growth.

-

Work is underway to line up a supporting debt raise that could be ~$7bn.

-

The executives were speaking after Truist reported Q4 organic growth of 7.3%, accelerating from 6.3% in Q3 and 5.6% in Q4 a year earlier.

-

The bank’s representatives have started reaching out to other potential interested parties.

-

He most recently served as the Truist-owned broker’s national director of P&C.

-

The broking firm promoted Rachael Yelverton to director of strategic projects while Jeremy McCaslin was named chief innovation officer.

-

Truist appointed Neil Kessler to lead the wholesale division as CEO, while Bill Goldstein will become CEO of the underwriting unit.

-

The Inside P&C news team runs you through the earnings results for the day.

-

The executive declined to comment on Truist Insurance sale reports but said the firm is constantly assessing all its options.

-

Inside P&C has independently confirmed that the bank is working on a full sale of its insurance operation amid a challenging banking environment.

-

The private equity house already owns 20% of Truist’s insurance business following a deal earlier this year.

-

Inside P&C’s news team runs you through the key highlights of the week.

-

In a recent report titled “TFC: Primed for activist”, Wells Fargo notes investor discontent and lists pressing issues to be addressed at Truist.

-

The firm’s interim CEO Ami Barlev has argued that, with Vesttoo’s weekly expenses being $360,000, freezing assets above $1m would be “catastrophic for the company”.

-

The Inside P&C news team runs you through the earnings results for the day.

-

John Howard, CEO and chairman of Truist Insurance Holdings, noted that the response to its minority sale to Stone Point had been “very positive”.

-

Organic growth fell 90 basis points from 5.6% in Q4 2022 due to carrier capacity constraints and slower growth in wholesale.

-

The sale represents an aggregate value of $14.75bn and increases Truist's common equity Tier 1 ratio by approximately 30 basis points.

-

Inside P&C’s news team runs you through the key highlights of the week.

-

Management of the insurance broking business should seek to seize the opportunities of independence with both hands.

-

The Truist Insurance Holdings CEO also said that the velocity of acquisitions would now increase.

-

Management was speaking after the announcement that Stone Point finalized a deal with Truist to acquire a 20% stake in its insurance broking business at a valuation of $14.75bn.

-

The ~$1bn Ebitda business is seeking a minority private equity buy-in to unlock value for its banking parent, and to create equity incentives for staff.

-

Inside P&C’s news team runs you through the key highlights of the week.

-

Stone Point and Clayton Dubilier & Rice are believed to be the two remaining contenders vying for a 20% stake in Truist Insurance.

-

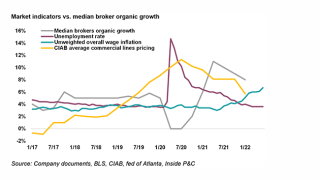

Organic growth fell 90 basis points from 6.5% in Q3 2022, but both underlying exposure and inflation continued to provide gains.

-

Inside P&C’s news team runs you through the key highlights of the week.

-

All claims in the case were dismissed with prejudice, barring the parties from bringing the dispute to another US court.

-

The bank is running a process to seek a minority stake sale of its broking arm, and is in talks with Stone Point and CD&R.

-

Inside P&C’s news team runs you through the key highlights of the week.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

Sources have suggested bids at the top end were around 16x marketing Ebitda of just over $1bn.

-

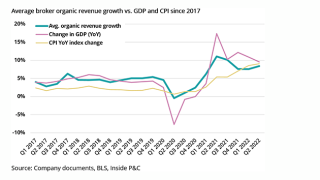

Although 2022 was on balance, a good year, macro-economic issues such as a slowing economy, falling employment, and loss cost reversion could create an overhang for 2023.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

Inside P&C’s news team runs you through the key highlights of the week.

-

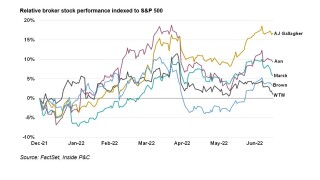

As the super-cycle slows and the economic landscape becomes more uncertain, brokers will face pressure, though a cooling labor market may aid margins.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

Margins contracted as performance-based incentives and T&E costs increased.

-

Prior to joining CRC, Gulati spent 10 years at AmTrust in various underwriting management and business development roles.

-

With the deal, CRC expects to increase its annual premium to $31.5bn from $23.5bn and grow its staff to over 5,100 employees across North America.

-

While brokers continue to report positive earnings, the possibility of a downturn shouldn’t be discounted.

-

The bank-owned broker reported positive earnings despite economic conditions, but results may vary for other brokers.