Top Section

Upper-middle market commercial an opportunity for growth amid challenges: Arch

The Bermudian said its pursuit of SMEs through M&A will provide sustainable improvements to its bottom line.

Research

Research

The regional insurer has increased its weighting to OLO and commercial auto, versus comp.

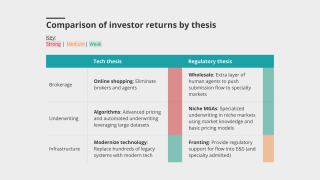

Softer market conditions are likely to create a wave of consolidation favoring large brokers.

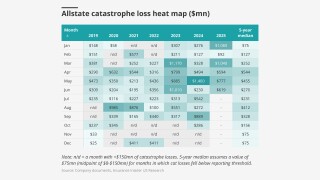

The research team presents the June cat heatmap.

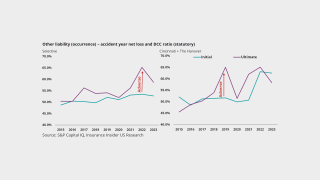

Pricing slowdown and reserving concerns are the hot-button topics as earnings kick off.

Opinion

Opinion

-

Gallagher will face new tests including succession, mega M&A and expansion beyond its core

Adam McNestrie, Rachel Dalton, Jairo Ibarra and Ben Wylie -

The Gallagher dynasty has risen due to culture, management quality and some luck

Adam McNestrie, Rachel Dalton, Jairo Ibarra and Ben Wylie

Latest news

Latest news

A quick roundup of today’s need-to-know news, including M&A, Cover Whale, Mercury and more.

Mercury’s recovery from the guaranteed percentage of losses is $47mn.

Smaller accounts remain less affected by an influx of MGAs.

The lawsuit claims more than 100 employees left with Parrish and his three reports.

Featured

Featured

Featured

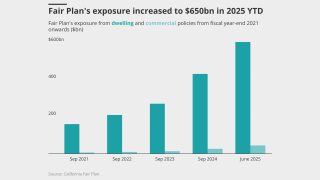

With NFIP’s future hazy, private flood providers insist they can fill the gaps

As the US recovers from a major flood event, the vast majority of Americans remain uninsured.

Most Read

-

Enstar eyes entry to Bermuda fronting market

July 29, 2025

Perspectives

Perspectives

Unpacking how much excess capital there really is and dissecting the source of its returns.

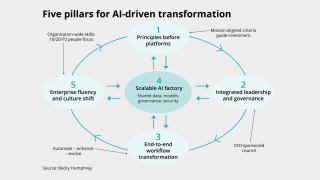

Here’s the five-pillar playbook for insurers ready to move from pilots to profit.

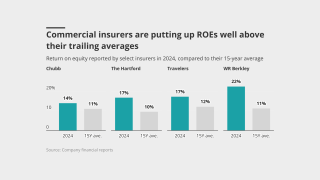

Despite elevated ROEs, insurers have remained disciplined.

Insurers and distributors must adapt or risk irrelevance.

Interviews

The executive said the claims industry is going to “be transformed”.

Cardinal E&S expands the carrier's underwriting capabilities and makes it more competitive relative to peers.

The global carrier plans to hire around 300 people in the next several years in the Americas and has already filled 60 roles thus far.

The MGA opened the door for potential growth via M&A besides organic growth, team hires and carrier carve-outs.

Ad slot #2

Analysis

Analysis

Roughly half a year since the LA fires, brokers said there’s hope things are turning around.

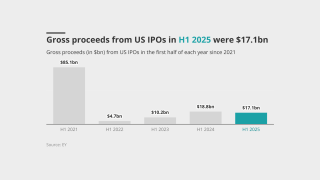

As the IPO window opened, American Integrity, Slide, Ategrity and others followed Aspen.

PL coverage is being stripped out of admitted, packaged policies and increasingly purchased in the E&S market.

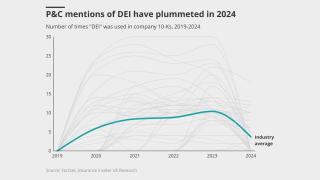

Top companies eliminated or heavily modified language related to DEI this year, analysis shows.

Insider on Air

Insider on Air

In Partnership With

Swiss Re

Insurers are pairing accumulation and exposure management with modeling to navigate natural catastrophes, said Monica Ningen, CEO P&C Reinsurance US, Swiss Re.

In Partnership With

Markel

Insurers could face a “heightened claims exposure” due to increased regulation scrutiny on the fintech industry, including buy now pay later schemes, AI and crypto, said Nick Rugg, Head of Fintech and Investment Management Insurance for Markel International.

In Partnership With

AXIS

The increase in business and leisure travel – plus niche travel, such as for cosmetic procedures – is driving increased demand for travel insurance, said Guy Bonwick, Head of Global Specialty Accident and Health at AXIS.

In Partnership With

Delos

“Wildfire is a specialist peril," said Kevin Stein, Co-Founder and CEO of Delos, explaining how harnessing data is redefining wildfire risk underwriting.

Conferences & awards

Insider Progress Breakfast Briefing

October 2025

London

Executive Business Club Meeting

4 November 2025

New York

Insider Progress Breakfast Briefing

December 2025

London

Upcoming webinars

-

In Partnership with Workday

The insurance CFO revolution: How to leverage tech to make smarter, faster decisions

Join us for a free webinar, in partnership with Workday, 10:30 EDT/15:30 BST, Aug. 6 -

Insider On AirIn Partnership with Moody's

[Webinar] Beyond property: The coming casualty catastrophe market

Join Insurance Insider, in partnership with Moody’s, for a free webinar at 10:30 EDT/15:30 BST on 30 September

Ad Slot #2