Top Section

QBE ramps up Bermuda excess casualty launch with Aspen’s Savory

Last year, the firm obtained a Class 4 license in Bermuda which allows it to underwrite direct excess liability insurance.

Research

Research

Although overall compensation has gone up, analysis shows divergence versus value creation.

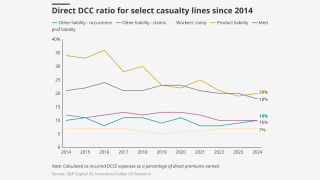

Litigation costs continue to weigh on long-tail lines, but effects of tort reform are visible.

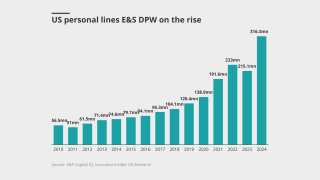

P&C’s outperformance lead dwindles, while specialty rises above other segments.

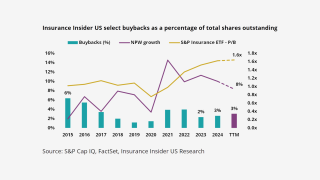

Additional buybacks are more feasible if P&C stocks slip and pricing moderates.

Opinion

Opinion

-

There was a lot of classic Aon at its investor day, but new Aon was also on display

Adam McNestrie and Ben Wylie

Latest news

Latest news

A quick roundup of today’s need-to-know news, including Allianz premiums, Upland Specialty's new MGA and more.

Apax and Carlyle will continue to back the broker consolidator.

Despite predicting fewer hurricanes, the numbers are still above average.

His 30 years of experience includes stints at Tokio Marine and Swiss Re.

Featured

Featured

Featured

M&A Deal Update: The heated claims services market and broking mega deals

A second look at the services deals boom powered by this publication’s M&A Tracker.

Most Read

-

Alleged NYC accident fraud in DoJ crosshairs: sources

July 02, 2025

Perspectives

Perspectives

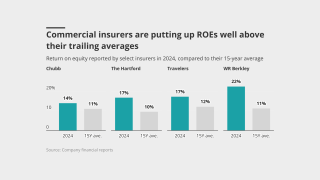

Unpacking how much excess capital there really is and dissecting the source of its returns.

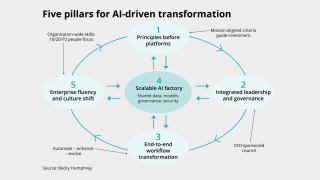

Here’s the five-pillar playbook for insurers ready to move from pilots to profit.

Despite elevated ROEs, insurers have remained disciplined.

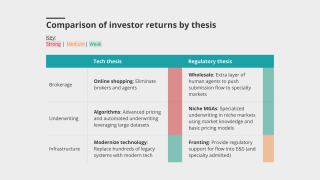

Insurers and distributors must adapt or risk irrelevance.

Interviews

The global carrier plans to hire around 300 people in the next several years in the Americas and has already filled 60 roles thus far.

The MGA opened the door for potential growth via M&A besides organic growth, team hires and carrier carve-outs.

Marsh’s property book saw an average decline of 9% in Q1, a trend that appears to have continued through Q2.

The broker has expanded the number of global industry verticals to seven from four.

Analysis

Analysis

When it comes to sympathetic juries, high net worth individuals are under the same pressure as corporations.

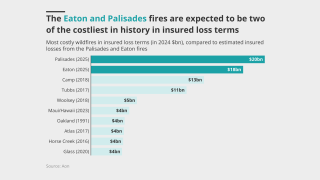

The January wildfires did little to hamper their appetite, apart from California.

Much was learned after the fires, but it could take years before that data influences models.

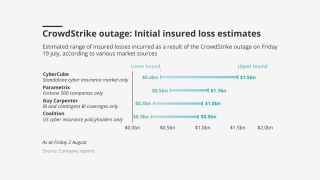

It didn’t have a major impact on insurers’ finances – instead, it served as a wake-up call.

Insider on Air

Insider on Air

In Partnership With

Swiss Re

Insurers are pairing accumulation and exposure management with modeling to navigate natural catastrophes, said Monica Ningen, CEO P&C Reinsurance US, Swiss Re.

In Partnership With

Markel

Insurers could face a “heightened claims exposure” due to increased regulation scrutiny on the fintech industry, including buy now pay later schemes, AI and crypto, said Nick Rugg, Head of Fintech and Investment Management Insurance for Markel International.

In Partnership With

AXIS

The increase in business and leisure travel – plus niche travel, such as for cosmetic procedures – is driving increased demand for travel insurance, said Guy Bonwick, Head of Global Specialty Accident and Health at AXIS.

In Partnership With

Delos

“Wildfire is a specialist peril," said Kevin Stein, Co-Founder and CEO of Delos, explaining how harnessing data is redefining wildfire risk underwriting.

Conferences & awards

Insider Progress Breakfast Briefing

October 2025

London

Executive Business Club Meeting

4 November 2025

New York

Insider Progress Breakfast Briefing

December 2025

London

Upcoming webinars

-

In Partnership with Workday

From siloed data to strategic insights: the new CFO playbook

Join us for a free webinar, in partnership with Workday, 10:30 EDT/15:30 BST, Aug. 6