Top Section

Postcard from NetDiligence: Overcapacity, AI and Akira

Growth concerns were top of mind at this year’s conference.

Research

Research

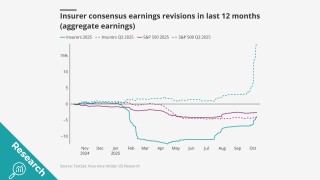

Lighter cat losses a plus, while top-line, organic growth and reserving concerns persist.

Expansion into adjacent markets, capital return and M&A among top means of capital deployment.

Industry stocks were firmly behind the S&P 500 in Q3.

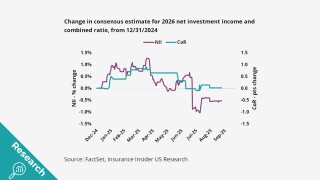

Lower rates mean lower investment incomes and higher book values for insurers.

Opinion

Opinion

-

The mood at APCIA in Orlando was cautiously optimistic around another orderly 1.1 renewal

Adam Kovac and Kyoung-son Song -

AmTrust's MGA spin-out is a canny deal with a blue chip partner

Adam McNestrie and Ben Wylie

Latest news

Latest news

A quick roundup of today’s need-to-know news, including NetDiligence 2025, California’s Fair Plan and more.

The layoffs will mostly affect workers in Michigan.

WTW claims at least two $1mn accounts were also unfairly lost to Howden.

The broker is understood to manage Brown & Brown’s account at Howden.

Featured

Featured

Featured

Growth and profitability ‘a balancing act’ for MGAs: ISC CEO

The MGA platform wants to expand into Europe and the UK and grow its wholesale business.

Most Read

Perspectives

Perspectives

When owners are not paying attention, discipline and governance are not top priorities.

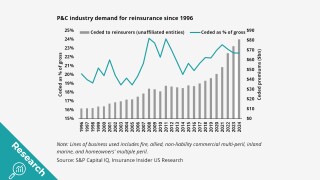

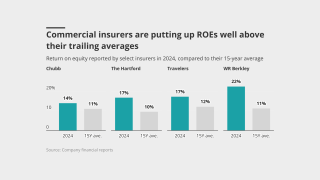

Unpacking how much excess capital there really is and dissecting the source of its returns.

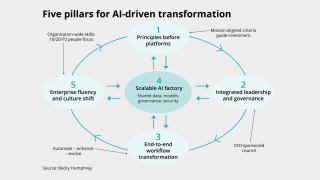

Here’s the five-pillar playbook for insurers ready to move from pilots to profit.

Despite elevated ROEs, insurers have remained disciplined.

Interviews

As both carriers and reinsurers deal with softening markets, all eyes are on hurricane-prone areas.

The deal will give the broker access to an M&A war chest to fuel inorganic growth.

The firm posted trailing 12-month organic growth of 23% YoY supported by a three-pillar strategy.

Neptune’s stock price jumped 25% on the first day of trading.

Ad slot #2

Analysis

Analysis

Verisk's recent deals and its interest in cyber-analytics firm CyberCube show M&A in the segment has ticked up.

According to McKinsey, the projected spending on data centers is expected to hit $6.7tn by 2030.

The insurance industry’s lower reliance on foreign skilled workers softens the blow.

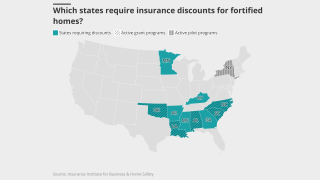

Sources said momentum around resiliency laws is growing at the state and local level.

Insider on Air

Insider on Air

In Partnership With

Everest Evolution

“I don’t see the [E&S market] momentum slowing down”, said Stephen Buonpane, President of Everest Evolution™.

In Partnership With

M&A Services

The explosive growth of the E&S market, coupled with higher seller valuations, is driving a steady stream of carrier M&A activity, said Jason Murgio, Principal & CEO and Paul Procops, Vice President, of boutique insurance investment bank Merger & Acquisition Services.

From cat losses from wildfires and hurricanes to litigation battles to the shifting commercial insurance landscape — these are the stories that defined our industry in the last 12 months.

In celebration of Insurance Insider US Honors Awards, please enjoy our Year in Review video.

In Partnership With

Aspen

AI Is transforming the insurance industry but “natural intelligence” remains important, Bruce Eisler, Aspen US CEO and Aspen Insurance CUO said. “We are risk takers not daredevils”, he said.

Conferences & awards

Executive Business Club Meeting

4 November 2025

New York

Upcoming webinars

-

In Partnership with Workday

The insurance CFO revolution: How to leverage tech to make smarter, faster decisions

Join us for a free webinar, in partnership with Workday, 10:30 EDT/15:30 BST, Oct 15 -

Insider On AirIn Partnership With Markel

[Webinar] Volatile waters: Insuring marine war risk during geopolitical instability

Join Insurance Insider for a free webinar, in partnership with Markel, 10:30 EST/ 15:30 GMT, Nov 5 -

In Partnership with Moody's

[Webinar] Unlocking precision: How granular data is transforming property underwriting

Join Insurance Insider, in partnership with Moody’s, for a free webinar, 10:30 ET/15:30 GMT, December 2 -

In Partnership with M&A Services

[Webinar] Sleeping assets awaken: Monetising dormant insurance shells

Join Insurance Insider, in partnership with M&A Services, for a free webinar at 8:30 EDT/15:30 BST on 9 December

Ad Slot #2