Arch Capital

-

Hardy Pickering is the second senior financial executive to depart from Hamilton in recent months, after group-level CFO Tony Urasno left in May.

-

Arch and Watford Re informed HPS on 1 July that they had terminated the investment agreement, under which the hedge fund managed 69% of the carrier’s portfolio.

-

Following strong year-to-date performance, P&C stocks were down in June after a change of tone in a Fed meeting.

-

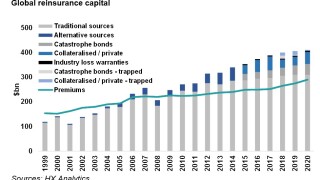

The changing reinsurance market dynamics are impacting reinsurers' ability to raise rates.

-

The investment expert has worked for Amundi, Standish Mellon, and Gannett, Welsh & Kotler.

-

Several (re)insurer reporters do not anticipate the rate momentum to slow down materially even as they build on exposure growth.

-

Arch CEO Marc Grandisson has said he is “not losing sleep” over the prospect of new (re)insurance startups snuffing out the hard market.

-

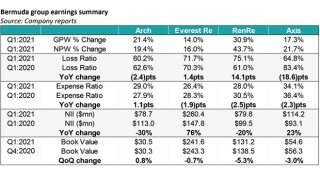

Arch’s combined ratio improved by 1.2 points to 89.2% and company weathered winter storms to produce an underwriting profit just shy of $200mn.

-

The carrier joins peers including Tokio Marine Kiln, MS Amlin and Brit.

-

The new reinsurance backing is provided by Arch’s Bermudian arm and Lloyd’s syndicate 1955.

-

Around 80% of the losses are expected from the reinsurance business.

-

Arch Insurance has named Jim Villa as a senior vice president of strategy and distribution at the carrier’s accident and health (A&H) business unit.

Related

-

Arch promotes Short to head of digital

June 04, 2025 -

Arch kicks off MGA McNeil spin-off process

May 15, 2025