Everest

-

The protection covers the US insurance book for the 2024 and prior accident years.

-

The state’s AG said the case threatens continued offshore oil and gas operations.

-

The move is the latest in a series of casualty leadership shake-ups at the insurer.

-

The $20bn+ TIV data center is seen as the leading edge of significant new demand.

-

He will spearhead the division’s launch slated for 2026, which will be the first product launch for ICW Group’s specialty unit.

-

Reinsurer executives during a Aon reinsurer panel stressed that the industry worked hard on setting the right structure.

-

The affirmations reflect Everest’s strong underwriting diversification.

-

He joins the company after 22 years in casualty leadership roles at Chubb.

-

Sources said that the carrier has held preliminary talks with private debt investors.

-

The executive most recently served as head of North American treaty reinsurance.

-

Reinsurers are mostly aligned on cat reinsurance, but goals are otherwise diverse.

-

Specialty casualty now accounts for around 22.2% of its insurance business mix.

-

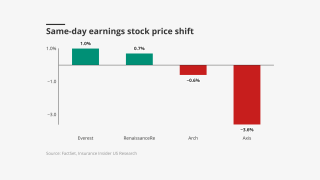

The Insurance Insider US news team runs you through the earnings results for the day.

-

Jill Beggs was most recently COO for reinsurance.

-

Jim Williamson said litigation funding had evolved into an investment class.

-

The carrier has scaled up its international insurance offering in recent years.

-

The executive will be responsible for leading E&S primary and excess casualty.

-

The remediation process is on track for completion in the fourth quarter.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

Everest’s US wholesale business is seeking to expand its market presence.

-

London-based US excess casualty writers are increasingly looking to attach lower in the tower.

-

The executive was named group CEO in January.

-

Joe Fobert will report to William Hazelton, EVP of Everest.

-

Jeanmarie Giordano joined the company last September.

-

The executive was Everest CEO from 1994 to 2013 and has served as board chair since 1994.

-

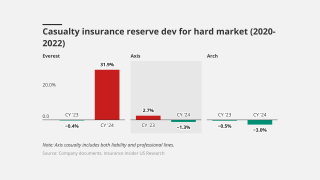

GAAP reserve triangles reveal the struggles of some hybrid franchises.

-

John Howard was appointed as an independent, non-executive member.

-

At the PLUS D&O symposium, executives raised concerns over tariffs and the role of reinsurance.

-

The agency said it does not expect a “material impact” from the charge.

-

At January 1 renewals, prices dropped 5%-15% for loss-free programs.

-

The Bermudian’s wildfire loss estimate was based on an industry loss range of $35bn-$45bn.

-

The carrier’s year-end kitchen sink action is a make-or-break moment for a troubled franchise.

-

CEO Jim Williamson said social inflation was a “growing barrier” to a vibrant economy.

-

The (re)insurer recorded a reserve charge of nearly $1.3bn within its casualty insurance book.

-

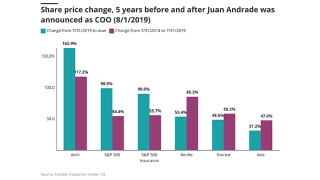

He was appointed acting CEO earlier this month, after Andrade’s departure.

-

The appointment follows a series of moves across the Miami treaty sector over the past 12-18 months.

-

Carlos Becerra will succeed Delgado as Miami-based LatAm fac head.

-

New CEO Williamson will likely continue walking the hybrid path, with an emphasis on fixing US casualty.

-

The carrier tapped the run-off market in Q4 for a US casualty insurance-focused portfolio.

-

He succeeds Wayne Peacock, who retires this year after four years of service.

-

Andrade is taking up a CEO role at another “prominent financial services firm”, Everest said.

-

The executive had joined the firm from Chubb in May.

-

Everest Group’s regulatory filing did not give a reason for the resignation.

-

A signal around Q4 adverse development has brought the carrier into the spotlight.

-

Both executives will be reporting to EVP Bill Hazelton.

-

She steps in to replace Phil Taylor, who left the company in September.

-

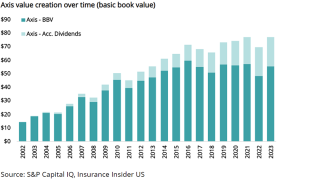

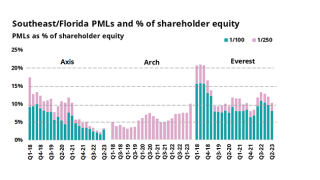

Arch stands out among hybrids, but Axis and Everest grind it out.

-

Andrade flagged expected 5% to 10% increases in the US and Europe.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

In tandem, John Posa joins the primary casualty team as vice president.

-

This follows a spate of program manager deals Ryan Specialty has made.

-

This publication revealed last year that Ocampo will lead the Colombia unit.

-

Anthony Izzo has been appointed chief broking officer to lead the team.

-

He succeeds Rob Clark, who was appointed global broker account lead.

-

Stephen Buonpane will lead the division, with Danielle Stewart as COO.

-

Mike Mulray is leaving to pursue other opportunities.

-

In November, the company said it aimed to reach the goals between 2024-2026.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

The insurer also hired ex-Chubb SVP Lope Garcia as chief claims officer.

-

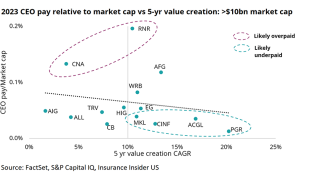

Analysis shows several CEOs with pay diverging from the trendline.

-

The executive was co-founder and chief insurance officer for MGA Shepherd.

-

Doshi takes over from Jiten Voralia, who was promoted to head of NA treaty reinsurance in February.

-

Industry trends show the Axis book value growth goal may be hard to hit.

-

Mexico is Everest’s second office in LatAm after the (re)insurer opened its regional headquarters in Chile.

-

Analysis of 2023 statutory data shows that Californian insurers are leaning more heavily on reinsurers but at a nationwide level, premium cessions were more stable.

-

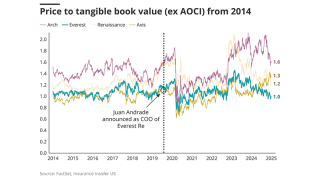

New leaders of these reinsurers have started strong, but Axis still has work to do.

-

Craig Hanrahan joins as Northeastern region leader from Chubb.

-

The company plans to grow exposure for June 1 and July 1 renewals.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

-

Jill Beggs has been named chief operating officer for reinsurance.

-

The carrier said it has acted prudently on 2016-19 GL loss trends.

-

Insurance Insider US runs you through the earnings results for the day.

-

Chuck Volker has been with Everest for more than 20 years, most recently serving as SVP, head of US property and specialty.

-

Bill Hazelton replaces David Sandler, who is leaving Everest after six years.

-

The business will bring together aviation, marine, cyber, engineering and parametric solutions.

-

Ratings could be lowered by one notch depending on regulatory restrictions on cash flow from Bermuda operating entities to non-operating holding companies, the ratings agency said.

-

The executive will be responsible for all aspects of Everest’s retail, middle market and builder’s risk businesses.

-

Everest is targeting a combined ratio of 89%-91% for 2024-2026, compared to the 91%-93% target range from its previous investor day event in 2021.

-

This year, casualty pro-rata rates overall moved about 1 point, Everest’s Jim Williamson added, noting other deals in H2 where the numbers moved more than that.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

The company’s Q3 cat losses fell 77% to $170mn, compared to $730mn in the prior year quarter.

-

Everest North America insurance president Mike Mulray will head up the business on an interim basis while the carrier appoints a permanent unit leader.

-

In her new position, McDermott will report directly to Everest insurance CEO Mike Karmilowicz, effective immediately.

-

The executive has over 20 years of specialty insurance experience and most recently served as Everest’s head of financial and professional lines.

-

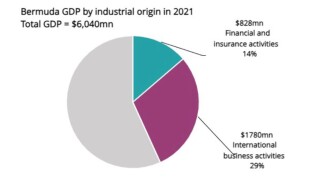

A 15% tax is in the works, but appears manageable, and with (re)insurance being Bermuda’s largest industry, the territory will take steps to keep companies where they are.

-

Differences in reinsurer strategies and risk management lead to differentiation in stock multiples and long-term value creation.

-

This will be the second senior appointment for Everest in LatAm after the (re)insurer hired Chubb’s Jaime Chaves as CEO in Mexico as part of its global build-out.

-

The chief executive also remarked on the strong rating environment in the property cat (re)insurance markets.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

The Inside P&C news team runs you through the earnings results for the day.

-

Inside P&C’s news team runs you through the key highlights of the week.

-

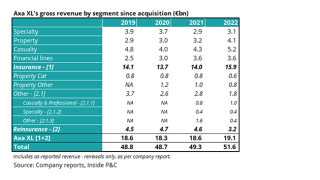

Axa’s lack of success in selling its more volatile XL Re segment has led the insurer to cut back on those lines, but the current rate environment makes this a good time to revisit a sale.

-

Inside P&C’s news team runs you through the key highlights of the week.

-

Reinsurers have mostly grown since before the Covid crisis, but the type and timing of growth affects value creation,

-

Interim CEO Luke Lichty will become head of commercial and specialty insurance for Canada.