-

Sources have said the layer will provide the carrier with protection for the Northeast US only and attaches at a remote level.

-

The carrier’s E&S property book is “up 29%, with 25 points of rate”, said the executive.

-

The Hanover has tapped Stephanie Seibold as president of alternative markets and Arthur Barrett as president of programs.

-

It is more dependent on property, and its longevity is uncertain.

-

Florida posted 8% growth for August, marking a stark decline from 48.8% in July, while Texas’s surplus line premium grew 16.7% year-on-year, down from 28.1% the previous month.

-

The market has passed a watershed around the apportionment of losses for attritional cat events between insurers and reinsurers.

-

Shifting economic winds make growth plays more attractive, causing insurer stock performance to lag though short interest remains flat.

-

For insurers, the Golden State is one of the last places they want to face disputes or lawsuits with consumers.

-

The carrier has taken advantage of what it says are inherent strengths in talent and tech as well as a ‘golden’ E&S age.

-

With Maui wildfire investigations beginning to point the finger at Hawaii Electric, it’s possible the insurance industry will see things play out as they did with PG&E in California, but the smaller scale of local utilities suggests lower potential recovery for insurers.

-

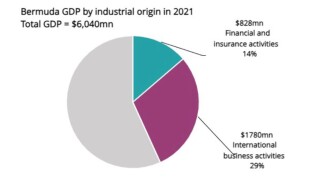

A 15% tax is in the works, but appears manageable, and with (re)insurance being Bermuda’s largest industry, the territory will take steps to keep companies where they are.

-

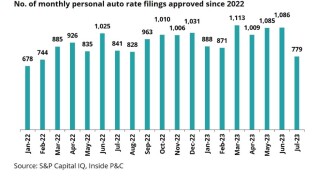

At the same time, insurers are assessing the level needed to address loss cost trends.