Hippo

-

Full-stack carriers fail to outclass incumbents with no clear platform differentiation.

-

CEO Rick McCathron also said the company is seeking to diversify its portfolio.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

The deal triples Hippo’s new homeowner leads and extends Baldwin’s MGA capacity.

-

Hippo will also provide capacity for existing and future MSI programs.

-

Shares were down as much as 20% after Hippo posted a $48mn loss.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

Consolidation options include fronts merging, competition, larger fronts becoming carriers and fronts being acquired by carriers.

-

Hippo estimated its pre-tax cat loss from the LA wildfires at $42mn.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

The Bain-backed fronting carrier acquired Spinnaker’s shell subsidiary earlier this year.

-

Following the closing of the deal, Aviad Pinkovezky will be named First Connect CEO.

-

The carrier filed a separation agreement with the SEC on Wednesday.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

Hippo shares were up 20%, while Root’s shares dropped over 20%.

-

The InsurTech’s cat weather loss ratio improved by 83%

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

The InsurTech’s quarterly revenue increased 80.2% to $64.5mn.

-

The InsurTech will push for its services segments as main growth drivers.

-

The company also increased participating reinsurers to 19 from 14.

-

The decision to pull back from some business in the meantime will cause “additional [total gross premium] declines in 2024,” the executive said.

-

The Inside P&C news team runs you through the earnings results for the day.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

The decision is expected to incur charges of approximately $2.2mn to $2.7mn for severance, benefits and related costs in cash expenditures during Q4 2023, the company wrote in a regulatory filing.

-

In August 2022, the company announced plans to cut around 10% of its staff in a bid to improve efficiencies amid challenging market conditions for InsurTechs.

-

Sources said the fronting company has drawn the interest of private equity firms, including Summit Partners.

-

Inside P&C’s news team brings you all the top news from the week.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

Worsening results in key states and belated rate action weigh against a shifting business model, making the path to profitability unclear.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

The shareholders are among the company’s top 10 largest and hold nearly 2.5% of outstanding shares.

-

The executive said the company will likely start with builders’ policies and then gradually continue to other segments.

-

Sources added that the company will continue to monitor portfolio performance to reopen business on a state-by-state basis.

-

On the surface, InsurTech results were better than the noise from incumbents, but caution is needed to ascertain the quality of new business coming in during a time when even industry leaders stumble.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

The Inside P&C news team runs you through the earnings results for the day.

-

In Q2, 80% of Hippo’s cat losses were caused by five major wind and hail events in Colorado and Texas.

-

“Tomorrow will be a better day.” “Next year will be a better year.” “The coming decade will be when this industry realizes its true potential.” We hear the same for most public enterprises.

-

Hippo’s gross loss ratio remained unchanged at 76% and its net loss ratio rose 23 points to 273% as the InsurTech was hit by catastrophic events in Q1, mainly in California.

-

The company expects to turn adjusted Ebidta positive by the end of 2024 with cash of at least $400mn.

-

The InsurTech said it had raised its per occurrence limit by 32%.

-

2022 marked a reversal from last year’s unprecedented levels of global investment in InsurTech as the macroeconomic scenario flipped and investors put lossmaking companies under a magnifying glass.

-

InsurTechs’ mounting losses and continuing cash burn combined with reinsurance market hardening could spell trouble for the sector.

-

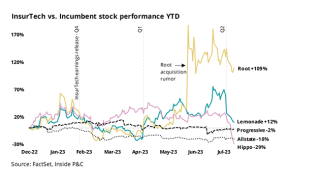

Our Trump/Biden note from yesterday discussed the rotation from growth stocks to value stocks playing out over 2022. Unfortunately, insurance technology stocks have had it the worst, with Lemonade stock down 49%, but still doing relatively better than Root (down 86%) and Hippo (down 80%).

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

CEO Rick McCathron said he is not concerned about reinsurance supply, as the company has multi-year capacity with partners and has improved loss ratios.

-

The gross and net losses represented 52 points of the gross loss ratio and 44 points of the net loss ratio.

-

As ITC Vegas begins, the Inside P&C Research team explores the discussions needed among InsurTechs to address questions around capital, partnerships, and profitability prospects.

-

The InsurTech’s stock price was down as much as 9% in after-hours trading following the announcement.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

The InsurTech’s investor day presentation highlighted several measures the company is taking to turn its results around, but will they be enough?

-

The firm told investors it is targeting $420mn-$450mn in revenue by 2025 from $119mn-$121mn in 2022.

-

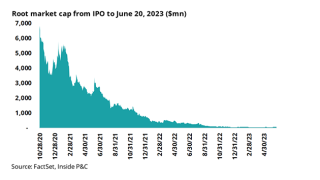

Listed InsurTech valuations have taken a battering this year as markets re-price tech stocks.

-

Odyssey Group’s cyber chief Robert O’Connell is looking to raise up to $1bn of capital for a monoline cyber reinsurer.

-

The executive believes the company will be able to achieve profitability without raising additional capital.

-

The company attributed its Q2 performance to rate adequacy improvements and a 10% favorable loss reserve development on attritional losses from prior periods.

-

Nichols served as Interim CEO and chairman of the board at Protective Insurance Company.

-

The InsurTech’s announcement follows a notice from the exchange regarding its common stock falling below the $1.00 threshold over a 30-day period.

-

The executive discussed InsurTech challenges, his priorities for Branch, fundraising, and his concerns about the capital markets.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

Embedded insurance can help sidestep some of the challenges faced by InsurTech 1.0.

-

FTSE Russell determines membership for its Russell indexes primarily by objective, market-capitalization rankings and style attributes.

-

With the geographic expansion, the personal lines InsurTech will reach 94% of the US population, in 40 states.

-

Inside P&C’s news team runs you through the key developments from the past week.

-

Through the partnership, the personal lines InsurTech will offer water damage, fire and break-in coverage.

-

Following his promotion, Hippo’s new CEO discussed InsurTech public market conditions, the funding environment for private companies, inflationary pressures and loss ratios.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

Companies that had easily lured investors with major premium growth are now scrambling to prove their fundamentals work, and are sitting out fundraising to avoid a down round.

-

The personal auto writer’s partnership with the digital dealership should serve as a warning for other InsurTechs.

-

First Connect will offer a cyber protection insurance product underwritten by BlinkSM.

-

Simard joins Hippo after 10 years at American Family Enterprise, where he most recently served as associate vice president of property field and catastrophe claims.

-

The homeowners-focused InsurTech slashed expenses, posted an improved gross loss ratio and reiterated guidance.

-

According to the company’s chief insurance officer, it benefits from having multiple data sources on each policy.

-

-

With New York, Hippo products now reach nearly 89% of the US population in 38 states.

-

Following the acquisitions of Trov and Insureon, what InsurTech M&A deals are next?

-

Inside P&C’s news team runs you through the key developments from the past week.

-

Hippo’s stock has plunged 32% to around $2 per share this year, and nearly 80% since the company began trading publicly in August.

-

The home insurance group’s GWP swelled 66% to $120.6mn from the prior year period.

-

The next generation must stay private longer, employ a partnership approach to capital and take the complexities of insurance more seriously.

-

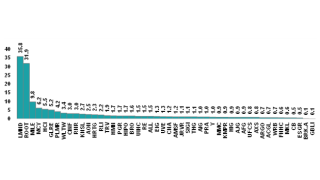

Stock prices fluctuated, and InsurTech short-sellers took some profits.

-

The InsurTech’s stock traded at $28.25 by midday Tuesday, down from its $163.93 peak in February 2021.

-

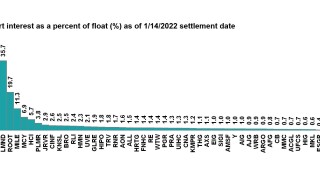

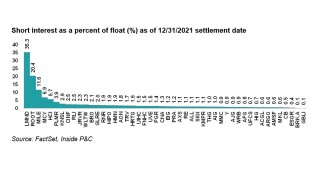

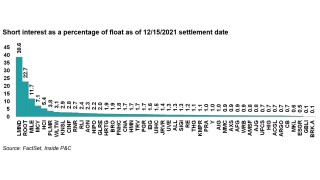

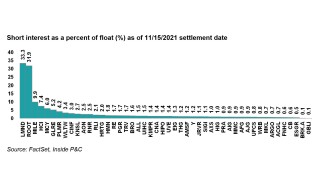

InsurTechs, including Lemonade, Root, Hippo, and Metromile, shed some short interest but remain the target of choice for short-sellers.

-

The partnership should allow Hippo to expand its commercial lines HOA product into new markets.

-

Lemonade, Root, and Metromile remain the focus of short sellers, as most firms see little short interest change.

-

Lemonade and Root remain the focal points of short sellers, while Metromile’s stock loan fee rate increases (pending acquisition).

-

The Week in Brief: FM Global’s vaccine mandate, Hippo on going public, Hagerty SPAC deal redemptionsInside P&C’s news team runs you quickly through the key developments from the last week.

-

Richard McCathron said that Metromile’s fate does not concern him because InsurTechs are not made equal.

-

Just over a quarter of shareholders voted to redeem shares as Aldel Financial took classic car underwriter public.

-

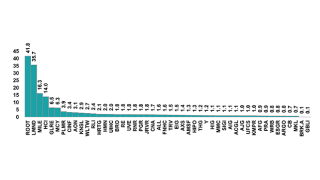

Short interest fell in InsurTechs, but not enough to ease the pressure on the sector.

-

Everyone knows the phrase “A jack of all trades is a master of none.” Relatively few people know the continuation of the phrase: “but often times better than a master of one.”

-

Hippo execs showed confidence in the company as the InsurTech diversifies geographically with 63% of new homeowners' premium growing outside California and Texas.

-

The InsurTech lowered its LR to 128%, helped by cutting the contribution of cats to the loss ratio from 75% to 50%.

-

Root and Lemonade remain the highest-shorted stocks covered, as short interest in most firms remains flat in anticipation of earnings.