Marsh McLennan

-

Marsh is also suing a second tier of former Florida leaders.

-

Success in the soft market will be had when careful preparation meets opportunity.

-

The executive will fill the role previously held by Howden’s Figliozzi.

-

Some disagreement remains in where rate declines have been swiftest and how much further they could go.

-

A US landfall is not expected, but the storm could hit the Bahamas by Friday.

-

The broker said WTW hasn’t shown it was irreparably harmed by the defection.

-

Property insurance rates declined by 9%, the same as in the prior quarter.

-

Property pricing fell by 8%, while casualty rate increases tapered to 3%.

-

Early Q3 earnings reports point to worsening market conditions.

-

Property, cyber and workers’ comp rates were all down mid-single digits, offsetting casualty hardening.

-

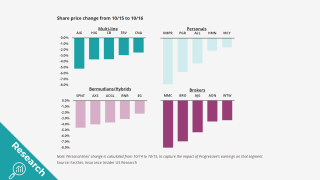

The selloff may hint at headwinds for equity investors.

-

The broker’s new business and client services division is targeting $400mn of savings.

-

Earlier this week, the broking house announced a rebrand to Marsh.

-

The motion claims the New York court has no jurisdiction in the case.

-

Guy Carpenter will rebrand as Marsh Re, as a new central tech/operations unit is created.

-

WTW claims at least two $1mn accounts were also unfairly lost to Howden.

-

Sources said Marsh Specialty UK growth leader Lizzy Howe will lead the operation.

-

According to McKinsey, the projected spending on data centers is expected to hit $6.7tn by 2030.

-

The hire comes as Guy Carpenter fills the void created by the Willis Re raid earlier this year.

-

The $20bn+ TIV data center is seen as the leading edge of significant new demand.

-

A federal judge restricted former Marsh employees from soliciting for Howden.

-

The Insurance Insider US news team runs you through this week’s key agency M&A.

-

The broker has filed a motion to dismiss the lawsuit by Marsh.

-

The company said defendant "distraction" can’t make up for flimsy arguments.

-

After spending 20 years at Aon, Goodman will start a senior executive position with Guy Carpenter.

-

The lawsuit is the third filed by MMA against Alliant in the past year.

-

Parrish, now CEO of Howden US, and his colleagues said they didn’t violate contracts.

-

Patton Kline succeeds Glod as US aviation and space practice leader.

-

A key hearing in the poaching case is set for September 4 in New York.

-

Not everyone will emerge unscathed as brokers navigate the slow-growth environment.

-

The plaintiffs seek a declaration that part of Marsh recruits’ restrictive covenants are unenforceable.

-

The Insurance Insider US news team runs you through this week’s key agency M&A.

-

An industry veteran of 34 years, the executive is known for placing US healthcare business in London.

-

The suit asserts the raid will cause “incalculable harm” to the broker.

-

Brown & Brown fell 10% and Ryan Specialty 8% as investors digest the deteriorating outlook.

-

The lawsuit claims more than 100 employees left with Parrish and his three reports.

-

Staff targeted include producers that channel business through Howden’s London wholesale arm.

-

Casualty rates increased 4% globally but shot up 9% in the US.

-

It is slim pickings for quality mega deals and the brokerage has an in-built need for speed.

-

The expansive European broker is targeting Mike Parrish’s team and former McGriff staff.

-

The executive briefly exited the firm last month for a role at Marsh.

-

The technology will help analyze growing and emerging risks, especially climate change.

-

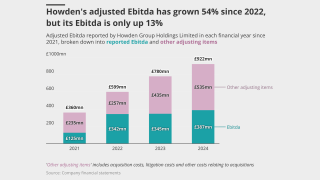

Total revenues grew 12% due to the contribution from acquisitions.

-

The broker also alleges a coordinated effort undermine client confidence.

-

Marsh’s property book saw an average decline of 9% in Q1, a trend that appears to have continued through Q2.

-

The Insurance Insider US news team runs you through this week’s key agency M&A.

-

The broader legislation narrowly passed the Senate and now heads to the House.

-

He was most recently Marsh’s US manufacturing and automotive practice head.

-

Premium rose across the top 15 P&C risks in 2024.

-

Willis’ continued reinsurance build-out has targeted London and Bermuda marine and retro specialists.

-

The executive will report to US construction practice leader Jim Dunn.

-

The move follows a recent string of initiatives for Howden in Latin America.

-

Major insurance industry groups and companies have recently pressed lawmakers to include the provision.

-

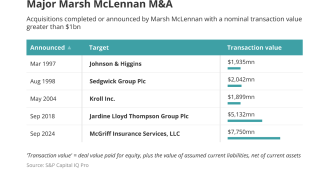

The pair joined MMA after the $7.75bn purchase of McGriff in November.

-

Marsh McLennan CEO Doyle dubbed legal system abuse a "tax” on US economy.

-

Brokers across London and Bermuda have handed in their notice to join the start-up reinsurance broker.

-

The executive will take the global role alongside his existing US responsibilities.

-

Sources said that negotiations are proceeding well with a path to do a cash deal.

-

The suit names former Marsh execs Hanrahan and Andrews as defendants.

-

In casualty, getting significant blocks of capacity remains a major challenge.

-

The executive had previously been at Aon for over 15 years.

-

It will be tough to pull off prior goals despite management assurances.

-

The pair add to the roster of aviation-focused hires at WTW.

-

The executive was most recently at Oliver Wyman after joining from AIG last year.

-

The hires form part of WTW’s build-out of its US aviation practice.

-

The only major product line to see rate increases was casualty.

-

Marsh alleges Aon also went after its clients as well as its employees.

-

Insurance Insider US explores the economics of the lift-out growth strategy.

-

California wildfires had ‘little or no impact’ on property cat pricing at April 1, Dean Klisura said.

-

Guy Carpenter president Dean Klisura added that Q1 was a record cat bond issuance quarter.

-

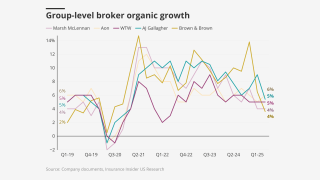

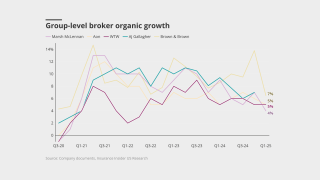

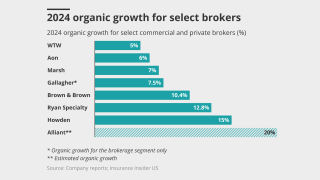

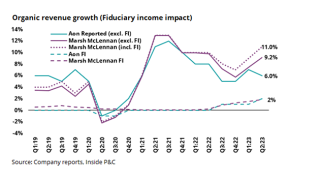

The growth figure represents a 5-point deceleration on the 9% reported in Q4 2024.

-

The UK broker is still in talks with Mubadala about a standalone investment in the business.

-

Rouse was promoted to co-global placement leader last October.

-

It is understood that Marsh brokered the tower, which is exposed to claims from a 2024 breach.

-

The Insurance Insider US news team runs you through this week’s key agency M&A.

-

Sources said Brown & Brown has an advantage as it entered the process several weeks ago.

-

Adam Russell most recently held the role of head of strategy for global placement.

-

The promotions come after Aon hired Marsh’s construction and surety heads.

-

Perlman has been at MMA for over six years, most recently as president of national business insurance.

-

Andrew George will report to president and CEO of Marsh Martin South.

-

The executives will join the company in the coming weeks.

-

Competition for specialty reinsurance talent remains high.

-

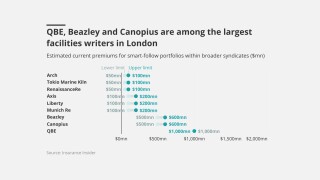

The big brokers are lining up London capacity to write follow lines on US risks.

-

The Pacific region led the quarter’s price decline at -8%.

-

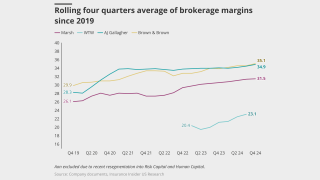

Company-specific strategies will play a vital role in sustaining growth in the current market.

-

Guy Carp CEO Dean Klisura said LA wildfires could slow rate reductions at 1 April.

-

The executive will link up again with former colleague Lucy Clarke in Q2.

-

Organic growth in broking segment Marsh accelerated during the reporting period.

-

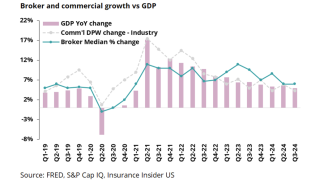

But forecasts of slowing growth in recent years have been too pessimistic – and uncertainty remains.

-

Some will play “pretend and extend”, but others will sell to strategics or take the steep climb to an IPO.

-

The firm’s trajectory could, however, make it harder to meet guidance going forward.

-

Rivera will succeed current CEO Carlos Rivera, effective January 1.

-

The deal’s closing comes just a month and a half after the companies announced the transaction.

-

The promotion is effective as of January 1.

-

Prior to the event, clients were expecting a “very competitive market environment”.

-

CEO John Doyle said global property rates were down 2% versus flat in Q2.

-

Organic growth fell by 1 point quarter on quarter and was down by 5 points from Q3 2023.

-

The mid-market unit has been a home run but will now face the fresh test of integrating a $1.3bn revenue business.

-

The transaction will be one of the largest involving two strategics in broking history.

-

The transaction would be one of the largest strategic-on-strategic deals ever in the broking space.

-

The region has 13 offices across Texas and Louisiana.

-

Ellis will re-join Marsh after leaving in 2019 for a position at AIG.

-

“They want to grow their portfolios,” Guy Carpenter's CEO added.

-

Ridge Muhly and Adam Kornick join from Gen Re and Porch Group.

-

The facility launch comes after Marsh launched its Slipstream marine facility.

-

The quarter was the first period where prices didn’t increase since the third quarter of 2017.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

A quick round-up of today’s need-to-know news, including Ryan Specialty, Marsh, Allstate.

-

The executive said challenging loss cost trends were contributing to rate rises.

-

-

Earnings per share were up 10%, while the margin expanded by 1.3 points.

-

-

Steadfast, AUB and BMS have joined the top 20.

-

Horton provides insurance services across Indiana, Illinois, Wisconsin, Minnesota and Florida.

-

Seven members of the construction team have resigned, including construction practice leader Patrick Baker.

-

She said potential hurricane activity was just one factor impacting the 2025 outlook.

-

Regulatory compliance risks were listed as the third-greatest concern.

-

He will report to Cynthia Beveridge, global chief broking officer for commercial risk.

-

Rappa will take on the role effective May 20.

-

AJ Gallagher had also shown an interest in acquiring the Australian retailer.

-

The practice aligns existing capabilities from Marsh Specialty and others.

-

Global commercial insurance rates rose 1% in Q1, down from a 2% increase in Q4 2023.

-

The transaction value represents approximately 5.9x of its 2023 revenue and 28x net income.

-

Early results suggest another strong quarter with a variety of driving forces.

-

The US casualty market was “challenging”, the executive said.

-

Property rate increases decelerated to 3% in the quarter.

-

The Q1 figure represents a 2-point acceleration on the 7% reported in Q4 2023.

-

Graham Knight will become chairman of natural resources.

-

April Files is based in Houston, Texas.

-

The new facility is backed by Lloyd’s syndicates and London-based international insurers.

-

Participating members can purchase up to $10mn in (re)insurance.

-

The talks are advanced, and the process is likely to move rapidly.

-

Marsh Specialty has released its Political Risk Report 2024.

-

Insurance Insider US examines public brokers’ 2023 M&A.

-

-

The executive will head a team of over 70 energy specialists.

-

Shannan Fort was a partner in McGill’s FI and cyber team.

-

The index’s 2023 peak was Q2, when rates increased 19%.

-

Falling rates in finpro and increased competition in property drove the trend.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

The CEO flagged a trend towards mega settlements and said there was concern around the direction of loss costs.

-

Property rate increases decelerated to 6% in Q4, compared to 7% in Q3 and 10% in Q2 2023.

-

The broker's growth was down 3 points on the 10% reported in Q3 and level with the 7% posted in Q4 2022.

-

Effective immediately, Wolfe will help drive growth strategies across the region. He will also lead Guy Carpenter’s US facultative business alongside Frank Guerriero, chairman of Guy Carpenter Facultative.

-

In October 2023, it was announced that Powell was leaving Marsh to join WTW as the broker’s global chief claims officer.

-

The Global Risks Report 2024, made in partnership with Marsh and Zurich, shows that extreme weather events, misinformation and disinformation are top risk severity concerns.

-

While not record-setting, 2023 was a “solid year” for insurance brokerage M&A, and there is “tempered” optimism for 2024.

-

European rates on line increased by 7.60%, while in the US prices were up 5.25%.

-

Andy Stirk comes to Marsh from Ascot Group but had previously been MD in Marsh’s financial and professional liability practice.

-

Reinsurers are looking to grow in top-layer cat risk, resulting in “variable” outcomes on sign-downs.

-

She joins Marsh following a 20-year career at Aon.

-

Amynta Ease-of-Business president Arthur Seifert said he expects MGAs to move away from the popular Dutch auction process and instead find one party that’s a good fit.

-

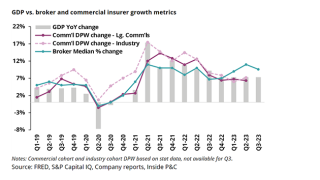

Broker and commercial carrier trends separate as inflation slows but rates stay elevated.

-

Kowell succeeds Michael Pellegrini, who was appointed head of specialty for both markets last month as Michelle Sartain took over as US and Canada president.

-

Based in Washington, DC, she will report to Pat Tomlinson, Marsh McLennan US and Canada CEO and Mercer president.

-

Commercial insurance pricing remained flat, increasing by 3% globally over the period, the same as the prior quarter.

-

Marsh cites its primary listing on the NYSE, along with the costs and administrative burdens of listing on LSE, as reasons for delisting.

-

Current cyber brokerage leader for the US and Canada, Meredith Schnur, will succeed Reagan as cyber practice leader, US and Canada.

-

Last week, this publication revealed that Howden agreed to pay Guy Carpenter in excess of £50mn ($61mn) to settle the poaching suit related to Massimo Reina and a defecting European team.

-

The Inside P&C news team runs you through the earnings results for the day.

-

Concern around prior-year loss development and social inflation is impacting the market.

-

“As we look to January 1, the market appears to be more orderly than last year, but we expect underwriting discipline to continue,” CEO John Doyle told analysts.

-

Adjusted earnings per share increased by 33% and the group also reported margin expansion.

-

The payment represents the largest ever made in a team lift case in the London market.

-

Pat Tomlinson will also step into the role of president and CEO of Mercer and vice chair of Marsh McLennan when his predecessor, Martine Ferland, retires in March 2024.

-

Pellegrini succeeds Michelle Sartain, who was promoted to US and Canada president earlier this year as Pat Donnelly took over as Marsh specialty president.

-

The question of how to finance the private brokers no longer begins and ends with a PE flip.

-

Differences in business mix and definitions yield differing trajectories for brokers, but in the absence of a recession, we may see continued margin improvement.