RenaissanceRe

-

Carriers underweight in E&S could lead the charge in the next round of M&A.

-

Fontana 2.0 will encompass a more flexible investment strategy than the 2022 vehicle.

-

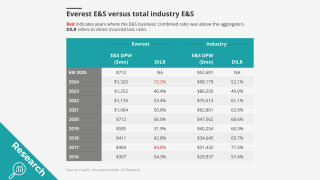

A re-focus on reinsurance nearly brings Everest back where it started.

-

Rates pulling back will rein in some of the excess margin obtained over the past three years, he said.

-

The property segment reported a combined ratio of 15.5% for the quarter, versus 60.3% a year ago.

-

The Insurance Insider US news team runs you through this week’s key agency M&A.

-

Reinsurers are mostly aligned on cat reinsurance, but goals are otherwise diverse.

-

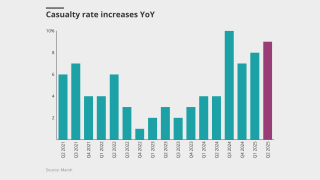

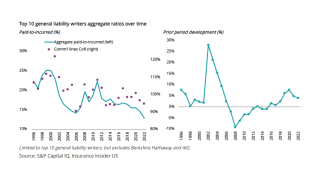

Loss trend concerns persist, but insurers are vouching on the opportunity to push for more rate increases.

-

Wind season remains an important variable, but also might not change current dynamics significantly.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

The reinsurer has also appointed Mehdi Benleulmi as global head of credit.

-

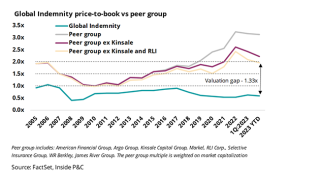

With fee income less understood, a primary acquisition or merger could reset the narrative.

-

The company will continue to deploy additional limit in property cat through mid-year, the firm’s CUO added.

-

However, the firm will take a “conservative approach” until the improvements are shown in data.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

He will oversee Ascot’s US and Bermuda insurance and reinsurance companies.

-

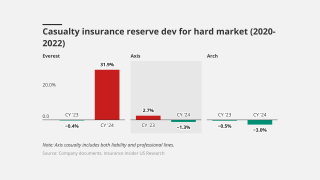

GAAP reserve triangles reveal the struggles of some hybrid franchises.

-

The reinsurer is ready to deploy additional capacity following the event, but only if prices are commensurate with risk.

-

Hurricane Milton brought the firm net losses of $270mn in Q4, while it forecast up to a $750mn wildfire hit for Q1.

-

New CEO Williamson will likely continue walking the hybrid path, with an emphasis on fixing US casualty.

-

There’s a question mark around the tails of AY 2021-2023, the president said.

-

A signal around Q4 adverse development has brought the carrier into the spotlight.

-

In other property, Helene and Milton will assure rates remain attractive, he added.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

The property market remains “one of the most favorable ... I've seen in my career,” the executive said.

-

A quick roundup of today’s need-to-know news, including the DoJ/NatGen lawsuit and RenRe's earnings call.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

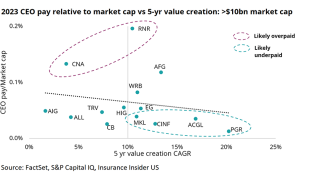

Analysis shows several CEOs with pay diverging from the trendline.

-

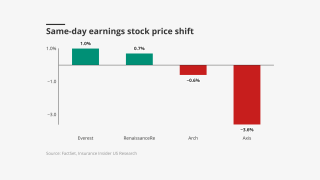

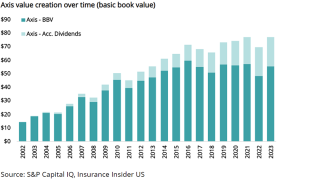

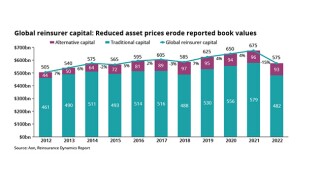

Industry trends show the Axis book value growth goal may be hard to hit.

-

Analysis of 2023 statutory data shows that Californian insurers are leaning more heavily on reinsurers but at a nationwide level, premium cessions were more stable.

-

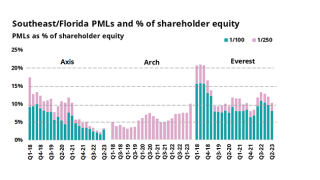

The Bermudian has been reducing exposure in Florida for almost a decade.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

The 100% equity award will vest in full after five years.

-

With mixed results in the reinsurance space, the specialty pivot remains a "show-me" story.

-

The initial plan was to renew $2.7bn of the acquired book.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

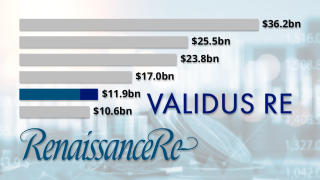

Additional disclosure following the RenRe acquisition reveals results for both carriers for the nine months to 30 September last year.

-

Ratings could be lowered by one notch depending on regulatory restrictions on cash flow from Bermuda operating entities to non-operating holding companies, the ratings agency said.

-

Other senior executives, including CFO Robert Qutub and general counsel Shannon Bender, received stock awards of $750,000 for their involvement in the Validus Re acquisition.

-

The number of staff retained contrasted with more dramatic cuts made after the acquisition of Tokio Millennium and Platinum.

-

After moving into the rank of fifth-largest reinsurer, following its acquisition of Validus, RenRe said it would continue to take a leading role in the regional cat space and expected to be more able to trade through market cycles.

-

The Bermudian firm said it expects the acquisition could drive more growth than the prior forecast of $2.7bn incremental premium.

-

The Inside P&C news team runs you through the earnings results for the day.

-

The deal was announced in late May, with RenRe taking over AIG’s treaty business, including AlphaCat Managers, and all renewal rights to Talbot’s reinsurance treaty unit.

-

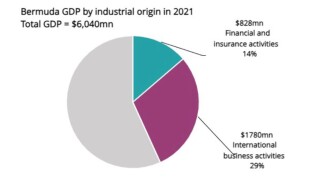

A 15% tax is in the works, but appears manageable, and with (re)insurance being Bermuda’s largest industry, the territory will take steps to keep companies where they are.

-

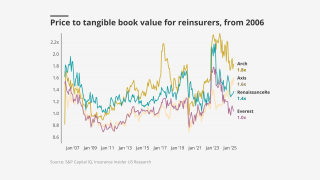

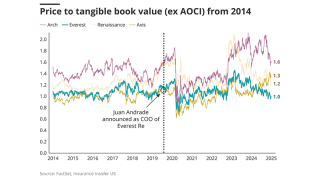

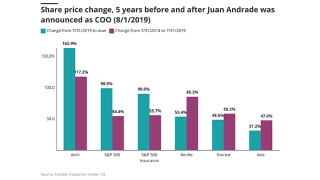

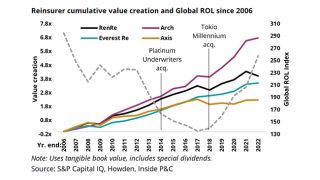

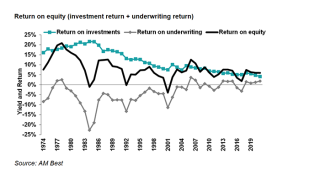

Differences in reinsurer strategies and risk management lead to differentiation in stock multiples and long-term value creation.

-

The reinsurer said it was monitoring conditions in the property E&S markets, where it has been reducing capacity to grow in property treaty, as rate gains could provide fertile ground for future growth.

-

The Inside P&C news team runs you through the earnings results for the day.

-

Inside P&C’s news team runs you through the key highlights of the week.

-

Reinsurers have mostly grown since before the Covid crisis, but the type and timing of growth affects value creation,

-

Recent top line growth and improved performance will need to be weighed against historical underperformance at group level, but the opportunity could attract a non-traditional buyer.

-

Morgan Stanley and Golman Sachs exercised in full their right to buy 945,000 shares in the company.

-

Inside P&C’s news team runs you through the key highlights of the week.

-

The review will continue until the deal closes and the agency evaluates “organizational changes and strategic positioning within the new structure”.

-

The recent deal is accretive at 18% and will allow RenRe to take further advantage of the hard market.

-

The group exited an off-strategy business at an attractive valuation – now it must give a clearer indication of where it is going.

-

The carrier intends to use the cash raised as part of its consideration for Validus.

-

The deal is not predicted to have a long-term impact on RenRe’s financial leverage, AM Best said.

-

The takeover will push it up two places to rank as the fifth-largest writer of P&C reinsurance by gross premium.

-

The Bermudian reinsurer launched a public offering of 6,300,000 common shares and anticipates raising around $1.15bn to finance the transaction.

-

Everest Re’s $1.5bn capital raise could be part of a continued pivot, or an early indicator of a shifting marketplace.

-

The CEO said the reinsurer has already written some private deals ahead of the June 1 deadline and expects to continue a pivot away from E&S in favor of property cat reinsurance.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

The segment reported a 13.5-point improvement in its CoR to 56.5%, while maintaining a 14.6% growth in net written premiums.

-

Shea has worked at RenRe for seven years, most recently having served as head of underwriting for credit before the promotion.

-

The moves follow RenRe’s positive feedback on January 1 renewals, and UPC selling most of its outstanding policies in Florida to InsurTech Slide.

-

The January 1 renewal for 2023 was “one of the most profound” the company has ever had, the CEO said.

-

The Bermudian also raised third-party capital of $402.9mn effective January 1, 2023, including $377.2mn in DaVinci and the remaining in Medici.

-

The world’s largest investment company has assets under management of more than $10tn.

-

The firm elevated Justin O'Keefe, Cathal Carr, Fiona Walden and Bryan Dalton to US and Bermuda, Europe, casualty & specialty, and property CUOs, respectively.

-

Across the P&C industry, sentiment expressed on Q3 conference calls has improved since pandemic lows.

-

The reinsurer is ready to “walk away from business” where it feels pricing and terms and conditions are not good enough.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

The Bermudian reinsurer said both appointments are effective January 1, 2023.

-

The Bermudian will purchase less retro protection in 2023, and expects a “step change” in property cat rates, O’Donnell said.

-

A 3.9-point decline in the casualty and specialty segment offset a 2.5-point deterioration in the company’s property business.

-

Axis’ pivot away from property reinsurance comes just as the sector reaches one of the biggest inflection points.

-

The estimate is driven by $540mn of losses attributable to Hurricane Ian.

-

If the hurricane season continues to be mild, it could impact pricing momentum.

-

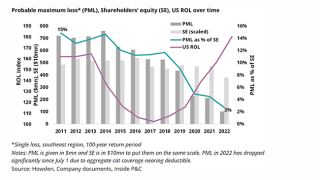

Ratings agencies suggest that carriers must do better on controlling volatility – but diverging risk appetites give the lie to the idea that the industry is walking away from risk.

-

The carrier said increased demand should maintain upward rate pressure at January 1.

-

The company’s property segment booked a combined ratio of 57.6%, 13.8 points higher compared to Q2 2021 due to a higher attritional loss ratio.

-

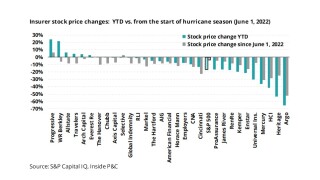

The sector was hit by a rough first half of 2022, with more to come in the second half of the year.

-

RenaissanceRe has always been a business with strong convictions and an assured management team, willing to carve out a path distinct from competitors.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

Insurers could face pressure if interest rate and recession fears intersect with worsening loss cost trends.

-

RenaissanceRe CEO Kevin O’Donnell explained on an earnings call his take on the mid-year renewals and a relatively low impact of the Ukraine war.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

The firm reported that net claims and claims expenses incurred related to the invasion had a $27.1mn negative impact in the casualty and specialty segment.

-

The committee is the most senior management team at the Bermuda company, responsible for governance and strategy of the firm.

-

Fontana investors will face a short lock-up period in the sidecar’s ramp-up phase, but thereafter there will be some “embedded liquidity.”

-

The new platform extends RenRe’s suite of ILS and reinsurance strategies.

-

The carrier has introduced a number of ESG-focused roles, which sees Cathal Carr, SVP, underwriting, appointed as global head of climate and sustainability strategy.

-

Carr was previously SVP, global head of property catastrophe at the reinsurer.

-

RenaissanceRe has nominated Shyam Gidumal to its board, while Jean Hamilton is set to retire from the board in May 2022.

-

The move has emerged after Axa XL and Hamilton took decisions to move reinsurance books out of Lloyd’s.