Root

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

Full-stack carriers fail to outclass incumbents with no clear platform differentiation.

-

Its partnership channel grew three times in new writings year-over-year.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

The stock was hovering around $40 per share just before closing.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

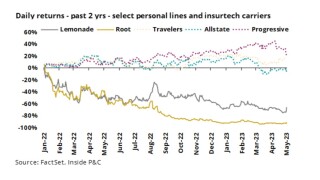

Hippo shares were up 20%, while Root’s shares dropped over 20%.

-

The InsurTech maintained a disciplined approach to deploying capital.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

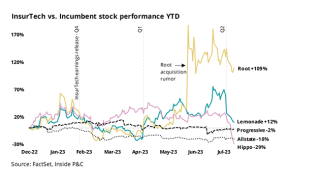

Root’s improved results make it an attractive acquisition, not a comeback story.

-

The InsurTech’s shares gained over 50% in value on Thursday.

-

The price movement came amid a tech stock rally on Wall Street.

-

The company posted favorable development in the last quarter of 2023.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

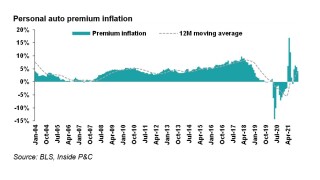

“We're certainly not banking on inflation abating at this moment in time,” Alex Timm told analysts.

-

The Inside P&C news team runs you through the earnings results for the day.

-

On the surface, InsurTech results were better than the noise from incumbents, but caution is needed to ascertain the quality of new business coming in during a time when even industry leaders stumble.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

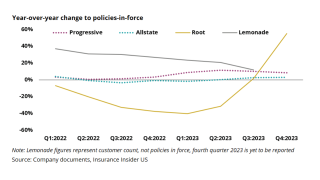

In the quarter, Root saw its auto policies in force shrink 31.5% to 203,840, though they were up slightly from 199,685 policies in Q1 2023.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

The Inside P&C news team runs you through the earnings results for the day.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

The announcement follows reports that Root has filed a lawsuit against Embedded related to the violation of a non-disclosure agreement.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

The suit is related to the violation of a non-disclosure agreement between the parties.

-

“Tomorrow will be a better day.” “Next year will be a better year.” “The coming decade will be when this industry realizes its true potential.” We hear the same for most public enterprises.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

There has been no official response from Root, but Inside P&C took a look at the company reportedly making the takeover bid, Embedded Insurance.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

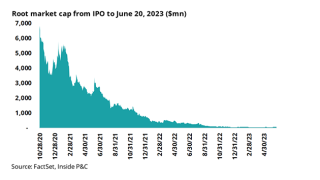

This would be a premium to Root’s closing price on Tuesday of $6.02 per share, which gives the company a market value just north of $80mn, significantly below its peak of roughly $7.5bn.

-

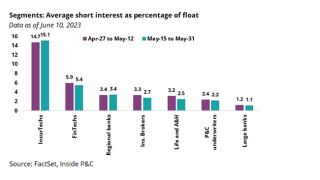

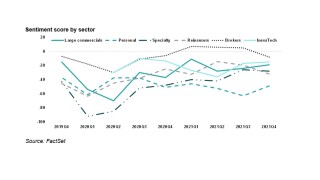

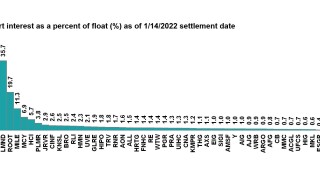

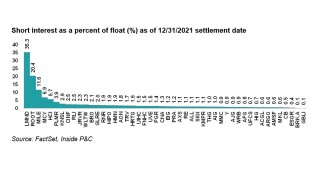

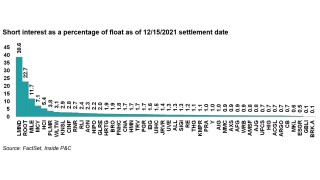

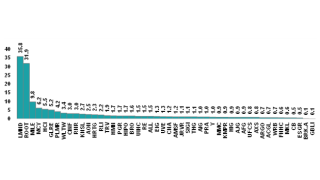

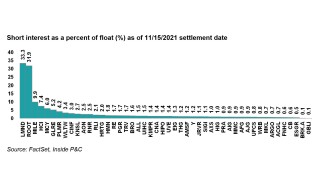

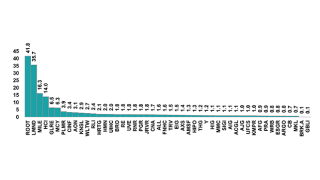

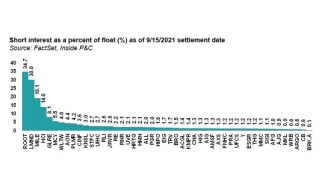

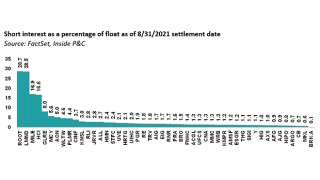

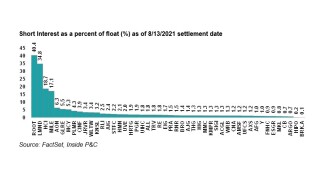

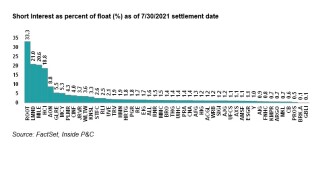

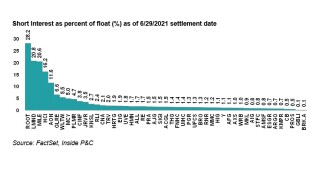

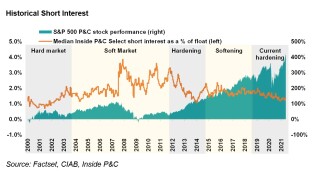

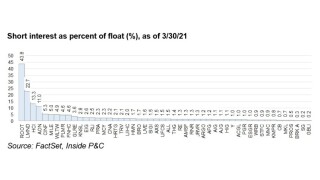

InsurTechs are still the most heavily shorted among P&C names, though they likely have been beneficiaries of a short squeeze for most of 2023.

-

InsurTech carriers pivot to profitability vs growth.

-

The company is seeing high single-digit loss cost trends, so the carrier will file for rate ‘even in states where we at target’.

-

The InsurTech slashed its operating loss by 59% year on year to $29.8mn, as gross loss ratio narrowed by 12.6 points to 71.5%.

-

Root’s challenges generate lessons for other InsurTechs, as its stock value crash leads to a management exodus, and the banking collapse dries up funding needed to balance cash burn.

-

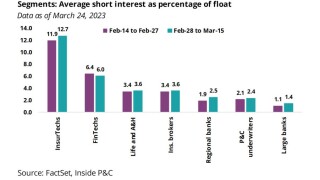

Recent data shows an increase in InsurTech short interest and a slight uptick for brokers and P&C insurers as a result of economic uncertainty following the banking crisis.

-

Binkley previously served as deputy CFO, chief accounting officer and principal accounting officer.

-

Lemonade and Root both reported strong Q4 results, but will need to execute plans to near-perfection to turn things around.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

The executive also stepped down from the InsurTech’s board of directors on Monday.

-

The move follows the carrier’s 30-point improvement in its combined ratio to 101.4% after markets yesterday.

-

Inside P&C’s news team runs you through the key highlights of the week.

-

CFO Rob Bateman said that loss ratio improvements and adjustments around cost structure will work to bring the cash burn down.

-

Embedded partner Carvana accounted for 41% of new writings in Q4 2022, plateauing from 38% in Q3 2022 and 27% in Q2 2022.

-

The InsurTech is accusing Brinson Caleb Silver and his alleged co-conspirators of executing a scheme which defrauded it of at least $9.4mn.

-

On December 30, the company announced launching an investigation into a series of transactions made by a former senior employee in 2022.

-

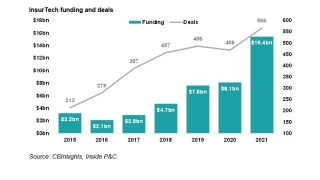

2022 marked a reversal from last year’s unprecedented levels of global investment in InsurTech as the macroeconomic scenario flipped and investors put lossmaking companies under a magnifying glass.

-

Inside P&C’s news team runs you through the key highlights of the week.

-

Though Carvana’s financial situation might cause InsurTechs to think twice about an embedded partnership, the auto dealer’s woes could lead to an easing of loss cost pressures for personal auto insurers.

-

Media reports said a group of Carvana’s 10 biggest lenders holding around $4bn of the company's unsecured debt have made a three-month pact to act together in the case of restructuring.

-

InsurTechs’ mounting losses and continuing cash burn combined with reinsurance market hardening could spell trouble for the sector.

-

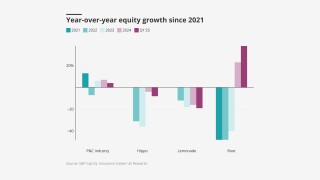

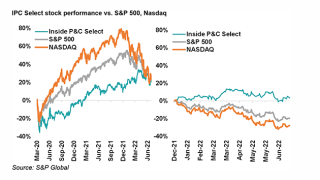

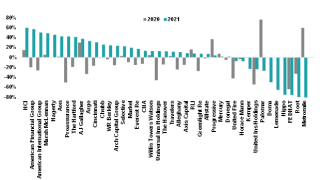

Our Trump/Biden note from yesterday discussed the rotation from growth stocks to value stocks playing out over 2022. Unfortunately, insurance technology stocks have had it the worst, with Lemonade stock down 49%, but still doing relatively better than Root (down 86%) and Hippo (down 80%).

-

The CEO added that Root was in a “very conservative stance” with its loss trend assumption, as the actual numbers seen right now were lower.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

The company reported a 56.8% improvement YoY in its operating losses along with a 33% decline in auto policies in force.

-

As ITC Vegas begins, the Inside P&C Research team explores the discussions needed among InsurTechs to address questions around capital, partnerships, and profitability prospects.

-

Odyssey Group’s cyber chief Robert O’Connell is looking to raise up to $1bn of capital for a monoline cyber reinsurer.

-

The InsurTechs’ results show the path to profitability remains unclear, even as Lemonade said it expects to be self-funding from here.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

The InsurTech will carry its current strategy to prioritize profitability over top line growth through the second half of the year, according to executives during the conference call.

-

The Insurtech narrowed its loss ratio despite multiple inflationary pressures in the personal auto sector.

-

The executive discussed InsurTech challenges, his priorities for Branch, fundraising, and his concerns about the capital markets.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

The sector was hit by a rough first half of 2022, with more to come in the second half of the year.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

The CEO of one of Europe’s largest online pharmacies will serve on the company’s audit, risk and finance committee to fill the seat of recently departed director Elliot Geidt.

-

Embedded insurance can help sidestep some of the challenges faced by InsurTech 1.0.

-

Companies that had easily lured investors with major premium growth are now scrambling to prove their fundamentals work, and are sitting out fundraising to avoid a down round.

-

The personal auto writer’s partnership with the digital dealership should serve as a warning for other InsurTechs.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

The executive, currently managing director of VC firm Redpoint Ventures, was a member of the firm’s board since 2018.

-

The company aggressively moved to reduce capital consumption, tighten its underwriting and take rate action in the first quarter of 2022.

-

Root implemented 18 rate increases year-to-date with a weighted average rate of roughly 19%.

-

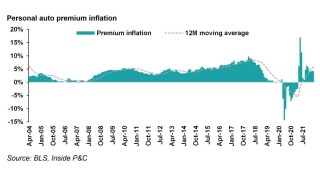

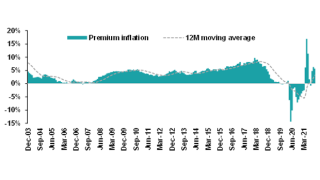

March’s CPI report shows elevated inflation levels, including vehicle CPI of 10.5% and average used car price increase of 24.7%.

-

Following the acquisitions of Trov and Insureon, what InsurTech M&A deals are next?

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

The executive joins the Ohio-based InsurTech after a year at Ategrity, where he served as president and CFO.

-

Insurance carriers tailor their comments to leave investors walking away with an optimistic view.

-

Birnbaum’s experience spans more than 20 years in product, business operations, sales, marketing and strategy at companies such as GrubHub and Expedia.

-

Inside P&C’s news team runs you through the key developments from the past week.

-

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

The InsurTech’s auto policies-in-force shrunk 7% to $354mn from Q3, driven by its workforce termination and underwriting remediation.

-

Root’s chief product officer, Hemal Shah, notified the company of his intention to resign, effective March 18 in a fresh executive departure.

-

Investors are taking a second look at private valuations, as they realize that an IPO or a SPAC exit is no longer an attractive option in the short term.

-

The next generation must stay private longer, employ a partnership approach to capital and take the complexities of insurance more seriously.

-

Stock prices fluctuated, and InsurTech short-sellers took some profits.

-

Root also issued BlackRock warrants equal to 2% of all issued and outstanding shares on a diluted basis at an exercise price of $9.00 per share.

-

The InsurTech’s stock traded at $28.25 by midday Tuesday, down from its $163.93 peak in February 2021.

-

It is hard to see how the auto insurer can simultaneously address all of its challenges.

-

The share price of the auto InsurTech plunged after the company said it was cutting its headcount by 330 staffers, or about 20% of its workforce.

-

Recently terminated Root employees took to social media platforms to announce their dismissals, after the company eliminated about 20% of its workforce.

-

The company termed the massive headcount reduction as an “organizational realignment”.

-

The latest report shows even higher inflation pushing up severity, forcing carriers to take rate.

-

InsurTechs, including Lemonade, Root, Hippo, and Metromile, shed some short interest but remain the target of choice for short-sellers.

-

The departure comes after the InsurTech announced sweeping changes to its executive ranks in June.

-

The Inside P&C research team looks forward to the big issues of the new year.

-

Lemonade, Root, and Metromile remain the focus of short sellers, as most firms see little short interest change.

-

The monthly CPI report shows that inflation continues to push severity higher as carriers take rate in response.

-

Lemonade and Root remain the focal points of short sellers, while Metromile’s stock loan fee rate increases (pending acquisition).

-

The InsurTech’s co-founder said longstanding carriers initially had an advantage in the volumes of data at their disposal but were held back by the inability to leverage modern technology.

-

Short interest fell in InsurTechs, but not enough to ease the pressure on the sector.

-

The firm posts quarterly results amid worsening loss-cost trends, and its stock jumps.

-

The Ohio-based InsurTech is also adjusting its prices models to expand modeled coverages and improve segmentation.

-

Root shares leap in Thursday trading after InsurTech posts revenue gain, per-share loss that best Wall Street expectations.

-

The auto InsurTech blamed the higher loss ratio on an industry-wide spike in frequency and severity trends, larger inflationary pressures and an increase in miles driven.

-

Root and Lemonade remain the highest-shorted stocks covered, as short interest in most firms remains flat in anticipation of earnings.

-

The private equity-backed retail brokers have lessons to teach the sector’s tech start-ups.

-

Timm was speaking at InsureTech Connect on a panel entitled “Public versus Private” that weighed the benefits and drawbacks for InsurTechs pursuing a public listing.

-

Without any major catalysts, the short interest for the industry was muted, with movement centering around InsurTechs once again.

-

Pressure on Root cools following stock price dips, but persistent short interest in InsurTechs suggests that prices haven’t bottomed out yet.

-

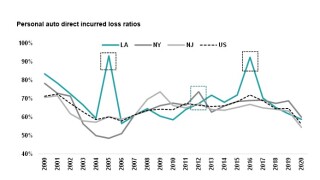

Ida soaks the tri-state – and has the potential to affect personal auto carriers more than comparable storms of the past.

-

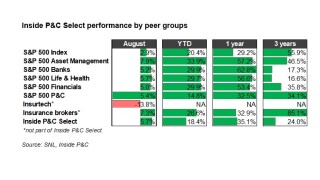

The Inside P&C Select Index outperformed the S&P 500 (5.7% to 2.9%) in August, despite Hurricane Ida making landfall.

-

Pressure on the InsurTechs – specifically Root and Lemonade – is intensifying.

-

The deal follows a similar partnership agreed last week by the program carrier and Hippo.

-

What's next for the firm after posting poor results and cutting guidance?

-

The InsurTech has revised its guidance and plans to shrink its book in Q4.

-

InsurTech short interest dwarfs legacy insurers as they come under pressure to produce profits.

-

Changes in short interest were muted despite large stock moves, including big rises at HCI and Lemonade.

-

The Inside P&C Research team looks at what subsectors the new class of InsurTechs is targeting.

-

Auto InsurTech Root said on Tuesday that the company completed its catastrophe reinsurance program renewal at June 1 using Tremor’s auction-based tech platform Panorama.

-

Personal auto carriers lowered rates in response to 2020’s loss cost trends, but chasing market share now could be a mistake.

-

Short interest data shows an incremental uptick in short interest for InsurTechs, with slight declines for the brokers.

-

Root has been mentioned seven times on Reddit message board WallStreetBets in the last two days, with many comments noting the significant short seller interest in the stock.

-

Former Evernote CTO Anirban Kundu will take over from Manges, who will remain an employee during a handover period, before becoming an adviser.

-

The personal lines giant announced a $300mn deal last night to buy non-standard auto writer SafeAuto.

-

The SPACs merging with Hippo, Doma and Qomplx are all trading below the redemption price.

-

Management should examine the relationship between company strategy, broader market cycles and short interest.

-

Continued capital depletion could result in additional pressure on management teams with regard to executing their original business plans.

-

Any faster-than-anticipated re-opening could have a negative impact on loss cost trends.

-

The carrier made an operating loss of $94.3mn over the three-month period.

-

Although this period’s short-interest shift was muted, the next update will likely show greater movement as Q1 is digested.

-

In the absence of macro and micro catalysts the short interest changes in the broader industry were muted.

-

Taking Metromile public cost the firm an estimated 22% of gross proceeds, followed by Hippo at 11%.

-

On a forward basis, frequency estimates could look high with base figures in 2020 being significantly impacted by initial lockdown measures.

-

Short interest as a percent of float is a great indicator of current market sentiment.

-

Shareholders have until May 18 to apply to the court to be a lead plaintiff in the case.

-

The stock of peer InsurTech Metromile had also risen by 5.7% at the end of trading.

-

Surprisingly, beyond the InsurTech names, changes in short interest were somewhat muted for the broader P&C sector.

-

While the direct channel has strengthened over the past year, Root has not grown auto PIF since Q1:20.

-

Net earned premiums dropped almost 70% as the company increased its use of reinsurance.

-

The InsurTech defines a ‘seasoned’ state as one where its data science-driven cost model has been accepted by the regulator, and where the company has had two price price filings approved.

-

Reduced accident development led to a prior underestimate in the December frequency benefit.

-

Capital markets are adjusting to a new reality in which online communities of retail traders can fuel dramatic swings in equity prices.

-

Inside P&C places the key news from the past week under the microscope.

-

Root’s “4.0” underwriting model will bring “giant improvements", the CEO said at a Goldman Sachs conference.

-

The governance practices at Lemonade, Root and Metromile are distinctly “management-friendly” and bear some resemblance to tech disruptors outside the industry.

-

After the high of a “successful” IPO, Root has quickly been introduced to the less fun sides of being a public company.

-

The share price of the Ohio-based carrier had dropped to $15.26 by midday.

-

The CEO said that state-wide expansion would be a “substantial growth lever” for the business.

-

The CEO said that state-wide expansion would be a “substantial growth lever” for the business.

-

Root’s loss ratio fell 23.5 points to 89.8% in Q3, while its loss adjustment expenses improved 3 points to 9.9%.

-

The bank is among Wall Street institutions sounding a note of cautious optimism as they begin to cover the InsurTech.

-

But for its stock valuation and ~$650mn to $750mn in new cash proceeds, Root seems in every way like a business in crisis based on its fundamentals.

-

Shares hit a high of $28.58 at 12:15, New York time, before returning to their opening levels.

-

The carrier raises almost $655mn through the sale of new shares, while existing investors sell another $70mn of stock.

-

The IPO plans to raise around $600mn in fresh capital.

-

Progressive’s September results were strong. The firm reported $0.57 in operating EPS, up 48.7% YoY, and saw a headline combined of 88.3% (down -4pts YoY).

-

Our research team delves deep into the latest “unicorn” IPO from InsurTech land.

-

The carrier is expected to garner the highest IPO valuation of any InsurTech to date, overtaking Lemonade’s $1.6bn debut price tag.

-

The carrier has reportedly hired Goldman Sachs to lead preparations for a listing as early as this year.

-

Preparations are understood to have included the retention of investment banks and discussions with investors over the move.

-

‘The reality is that the best drivers may sometimes have terrible credit scores, but the risk they present on the road is minimal,’ Root said.

-

Evercore is understood to be advising the InsurTech company on the upcoming series F round.

-

The stratospheric rise of Lemonade’s share price in its opening days raises the question of whether other InsurTechs will now rush to list on the public markets.