The Hartford

-

Opportunities for growth remain in small and medium commercial accounts.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

The state’s AG said the case threatens continued offshore oil and gas operations.

-

The executive previously spent more than 16 years at The Hartford.

-

The insurance industry’s lower reliance on foreign skilled workers softens the blow.

-

The executive was previously Navigators’ head of excess casualty.

-

The executive joined Navigators in 2010 after eight years at White Mountains Capital.

-

Smaller accounts remain less affected by an influx of MGAs.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

The insurers sent denial letters to the tech company as lawsuits and damages pile up well into the multi-millions.

-

The executive joined The Hartford when it acquired Navigators in 2019.

-

Major insurance industry groups and companies have recently pressed lawmakers to include the provision.

-

The Hartford’s Q1 CoR increased 4.1 points to 96.9% driven by cat losses.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

The industry needs to find a way to rebalance power dynamics.

-

At the PLUS D&O symposium, executives raised concerns over tariffs and the role of reinsurance.

-

The company’s reinsurance business also has some exposure, the executive said.

-

The carrier strengthened its GL reserves by $130mn in Q4.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

Sources said that the new paper is replacing PartnerRe capacity that was backing the MGA.

-

'Mo’ Tooker will add personal lines to his current position overseeing SME and distribution.

-

Worrisome trends in the line may be warning signs of worse to come.

-

The insurer also promoted Rick Ciullo to head of global specialty’s US retail businesses.

-

The Hartford made the unusual move of calling out current AY development.

-

The carrier’s estimated pre-tax losses from Milton are $65mn to $110mn.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

The Hartford and Aon also posted notable, though more muted, stock bumps.

-

The contraction so far this year is in line with the executive’s expectations.

-

A roundup of today’s need-to-know news, including Commissioner Lara’s FAIR plan reforms.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

A roundup of today’s need-to-know news, including leadership changes at Chubb.

-

Michael Fish will become head of group benefits after Jonathan Bennett’s retirement.

-

The carrier is also targeting E&S growth in property brokerage and global specialty.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

Carriers expressed confidence on the line’s ability to withstand medical inflation.

-

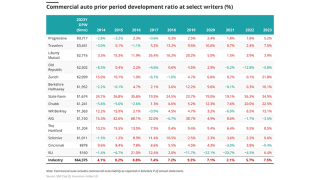

Commercial carrier earnings continue to show mixed prior-year development.

-

Commercial property pricing rose 11%, while personal auto grew 21.9%.

-

Insurance Insider US runs you through the earnings results for the day.

-

The insurer said it will continue to renew existing homeowners’ business.

-

The commercial lines market is generally rational and disciplined, the CEO told analysts at the Goldman Sachs 2023 US Financial Services Conference.

-

Insurance Insider US’s morning summary of the key stories to get you up to speed fast.

-

In tandem, the carrier announced that Stephanie Bush, who leads small commercial and personal lines, will retire after more than three decades with the company.

-

The Hartford is "starting a conversation” about complex risks and possible solutions with its Risk Monitor Report 2023, the executive said.

-

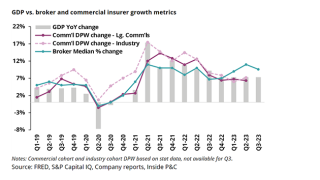

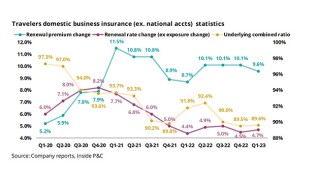

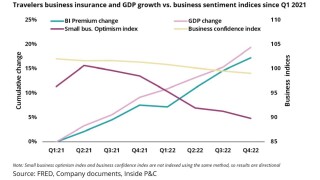

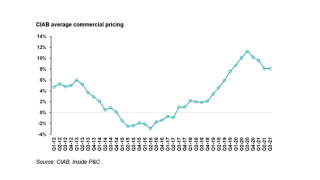

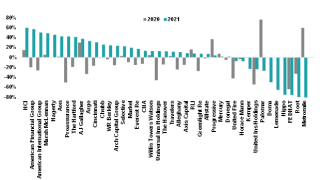

Broker and commercial carrier trends separate as inflation slows but rates stay elevated.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

The carrier’s Spectrum property business grew 13%, general property in the middle market segment was up 13% as well, and large property grew 16%.

-

AJ Gallagher posts 10.5% Q3 organic growth, lower sequentially but up year-on-year

-

Secondary perils are adding uncertainty, while modelling is still relatively unsophisticated.

-

The carrier’s E&S property book is “up 29%, with 25 points of rate”, said the executive.

-

Executives have pointed out that it is becoming increasingly difficult to talk about broader trends as micro-cycles are developing for each line.

-

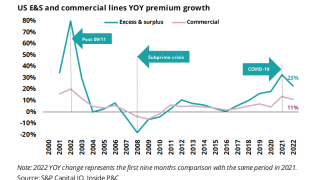

Flows to the E&S market remain strong, executives have said, while dislocation in the property space continues to buoy overall pricing conditions.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

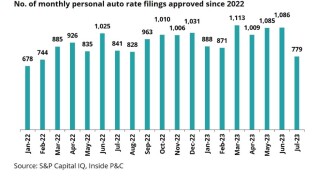

At the same time, insurers are assessing the level needed to address loss cost trends.

-

The carrier is set to achieve 20% rate increases in auto this year, with the same rate increase likely to be needed in 2024 to achieve its 2025 targets.

-

The Inside P&C news team runs you through the earnings results for the day.

-

The move is a promotion for Hamilton, who served for five years as regional vice president of Southern California.

-

The company achieved renewal written price increases of 10% in the first quarter and expects increases to accelerate into the high teens later this year.

-

The insurer made the payment on April 20, according to SEC filings reviewed by Inside P&C.

-

The carrier booked $185mn in catastrophe losses from winter storms, as well as tornado, wind and hail events across several regions of the US, in line with its preliminary disclosure.

-

Travelers posts strong results boosted by better pricing, personal lines performance, and favorable development.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

The Connecticut-based insurer said $138mn in cat losses stemmed from its commercial lines segment, while $47mn came from personal lines.

-

The payment followed a $200mn disbursement that Chubb made in Q3. The insurer expects to cover the remaining $500mn of the liability in 2023.

-

The company increased its attachment point on the $200mn aggregate cover to $750mn, up from $700mn.

-

Net losses from Winter Storm Elliott included $151mn in commercial lines and $16mn in personal lines.

-

The firm’s flattening rates and favorable reserve development provide a read-through for commercial insurers.

-

Inside P&C Research examines E&S sector growth over the past year and revisits historic trends.

-

Inside P&C’s news team runs you through the key highlights of the week.

-

The company aims to become a larger player in the E&S market and small commercial.

-

The executive has more than 15 years of specialty casualty underwriting experience, previously having worked at Aspen, QBE NA, Zurich NA and Chartis.

-

The executive will oversee all middle and large commercial business units serving multiple industries including construction and large property.

-

The chief executive said his company has clearly communicated to underwriters the need to expand or maintain margins while “prudently growing” the book of business.

-

Of the total losses related to the recent hurricane, $133mn was taken on by commercial lines, while the personal lines had the remaining $78mn.

-

A challenging legal atmosphere and drift in loss cost components add difficulty to the task of tallying ultimate losses.

-

If rapidly changing macro trends like climate change and tech development have fueled the market’s growth, inflation could do the same, the executive said.

-

Meg Carter will succeed Richard Vaughn, who left the firm a few months ago to head sales at Main Street America Insurance.

-

The executive noted that the carrier is constantly evaluating its participation in other lines besides construction, including financial lines or environmental.

-

The Hartford has reduced the share of workers’ comp in its portfolio by nearly 16 points over the last five years.

-

The executive has spent more than 11 years at the company and oversaw the integration of Navigators.

-

The Hartford has appointed Edmund Reese to its board of directors, effective October 17.

-

Chubb pushed its loss trend assumptions higher as it seeks to stay ahead of inflationary pressures.

-

The insurer’s Q2 combined ratio narrowly worsened, as improvements in commercial were outweighed by personal lines challenges.

-

The insurer’s personal lines CoR jumped 14.8 points to 101.8% while the commercial lines unit’s CoR improved 1.6 points to 87.3% in Q2.

-

The sector was hit by a rough first half of 2022, with more to come in the second half of the year.

-

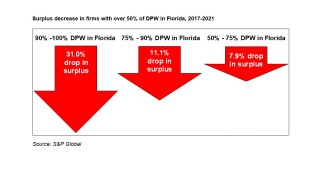

Excessive litigation costs and continued losses threaten the Sunshine state’s market.

-

Based in Washington, DC, the executive reports to Gretchen Thompson, head of inland marine, excess solutions and complex liability.

-

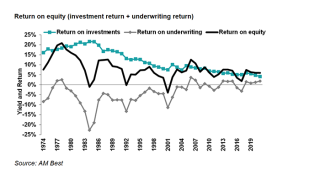

Insurers could face pressure if interest rate and recession fears intersect with worsening loss cost trends.

-

Matthew Kirk will join the carrier’s insurance executive leadership team and report to Grahame Millwater, president of global insurance.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

In response, the carrier has completed over 50 auto filings with an average rate increase of 6.2% in recent months.

-

The company's core earnings per share rose to $1.66 from $0.56 a year earlier, beating the $1.54 forecast by analysts.

-

Based in Boston, the executive will report to Michael Garrison, head of Navigators wholesale.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

Keith Mather will be responsible for building a book of international retail and wholesale financial lines business, as well as the long-term growth of global specialty.

-

The Hartford’s customers will have access to Swiss Re’s globally standardised property wordings and online platform.

-

The protracted firming phase of the cycle continues, with E&S firmer than the admitted market.

-

Insurance stocks mixed following swath of earnings results; Aon gains nearly 7% in Friday trading.

-

The deal with National Indemnity provided up to $300mn in limit for more than $100mn in adverse development above the $1.8bn of loss reserves Navigators had at the end of 2018.

-

The insurer said transforming portfolio to mostly six-month policies will help it enact price corrections in the auto LOB more quickly than in the past.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

Underwriting profits within the insurer’s personal lines unit dropped to $45mn from $154mn the year before.

-

The executive will report directly to the carrier’s head of global specialty Adrien Robinson.

-

Commercial lines loss ratios may move slightly higher, while personal auto carriers see the light at the end of the loss-cost tunnel.

-

The vote was part of ongoing bankruptcy proceedings following a string of historical sexual abuses.

-

The Inside P&C research team looks forward to the big issues of the new year.

-

Inside P&C dissects the biggest deals of the year across broking, commercial lines and InsurTech.

-

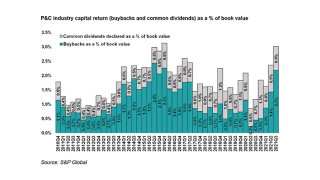

The higher level of repurchases seen in Q3 will likely last longer than expected.

-

Adrien Robinson, who took over for Vince Tizzio as the head of The Hartford’s specialty brand Navigators in June, also said his unit was planning its second biggest hiring spree in over a decade.

-

The firm showed optimism for the future, but are recent gains the new normal or a temporary positive blip?

-

The dispute will be discussed next month at a Delaware bankruptcy court hearing.

-

The Hartford’s CEO Christopher Swift said the authorization to increase the firm’s share repurchase program by $500mn during the third quarter of 2021 shows confidence in the business.

-

The segment fell to a $17mn underwriting loss, despite higher earned premiums and an improved underlying loss ratio.

-

Garrison will lead the strategic direction, growth, and underwriting for the Navigators brand.

-

The firm’s acquisition of accident & health and life business in East Asia eliminates the chance that a merger with The Hartford will go through.

-

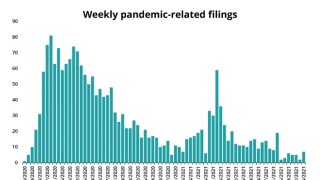

With hundreds of coronavirus-related BI suits working through state and federal courts, insurers still face a multi-billion-dollar challenge to keep judges and juries ruling in their favor.

-

The TCC has been appointed by the office of the US Trustee as the official representative for the estimated 82,5000 survivors of childhood sexual abuse related to BSA activities.

-

The figure is an increase from the original $650mn settlement agreed to in April.

-

Speaking at an investor conference on Monday, CFO Beth Costello said the company expects losses to fall well below Hartford’s cat program retention.

-

The chief executive said on Thursday the company has made progress in re-underwriting its specialty book, and that no new M&A is on the horizon.

-

The surge likely reflects talk in the buy-side community fuelled by tracking the latter's private jet.

-

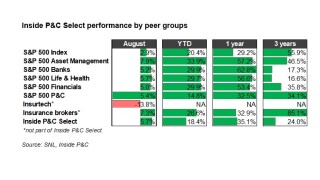

The Inside P&C Select Index outperformed the S&P 500 (5.7% to 2.9%) in August, despite Hurricane Ida making landfall.

-

The newcomers are finding it more difficult to disrupt the sector than they had expected.

-

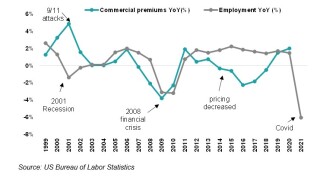

Employment data indicates that easy growth and margin expansion may slow soon.

-

In a landmark hearing, a Delaware judge struck down a provision that would have allowed the Boy Scouts of America’s withdrawal from its April agreement with The Hartford.

-

The firm’s earnings set it on the path of great expectations for 2022-2023.

-

The company is considering pricing actions, primarily in the homeowners’ line, as inflation accelerates.

-

The carrier’s cat losses fell to $128mn, from $248mn last year, when it was hit with $110mn in civil unrest claims.

-

Brodzinski will report to Adrien Robinson, who was recently named head of global specialty.

-

Following strong year-to-date performance, P&C stocks were down in June after a change of tone in a Fed meeting.

-

The legal case involving the Boy Scouts of America and The Hartford remains at an impasse, after holders of abuse claims rejected the insurer’s settlement offer.

-

The Boy Scouts of America (BSA) and lawyers for sexual assault victims are close to a settlement in the largest bankruptcy case ever filed over childhood abuse, according to a report in the Wall Street Journal.

-

Personal auto carriers lowered rates in response to 2020’s loss cost trends, but chasing market share now could be a mistake.

-

Tizzio joined The Hartford through the carrier’s $2.1bn acquisition of The Navigators Group, which closed in 2019.

-

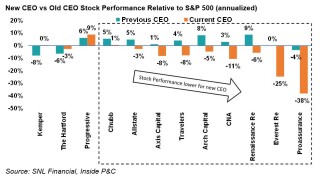

New CEOs were not able to consistently create higher book value growth than their predecessors, and any growth achieved wasn’t maintained after five years.

-

Activist investors are successfully learning how to navigate a regulated industry.

-

Chubb discipline, Hartford reluctance and investor lassitude combine to impede a transaction.

-

The Chubb CEO seeks to quash speculation the carrier may return with a sweetened takeover proposal.

-

The senior underwriter joins the carrier from Chubb.

-

The carrier provided optimistic projections on margins and growth, expanded buyback authorization and gave details about two more bids from Chubb.

-

The CEO also says M&A remains a “low priority” for the carrier and that he doesn’t see any further outsized liability exposures in the portfolio after settling with BSA.

-

Chubb reiterates its disappointment about The Hartford’s refusal to engage.

-

Rate increases remained strong in the quarter, but slowed from the end of last year.

-

Chubb offered to pay up to $70 per share for the business after its $65 offer was publicly rejected.

-

The deal will inflict a $225mn reserve charge on The Hartford for Q1.

-

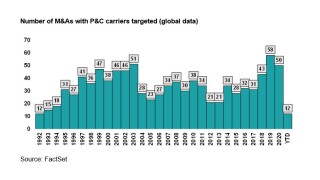

The next few years could prove to be more active in consolidation than normal for underwriters.

-

Greenberg is presumably 50 steps ahead, and The Hartford’s response last week was likely not a surprise.

-

The one-time suitor releases a statement after a report that Allianz is contemplating an offer of its own.

-

The rejection was inevitable although the emphatic nature of it hints at a real determination to remain independent.

-

The target says its board is committed to its existing business plan following the unsolicited proposal.

-

Chubb yesterday said the proposed transaction structure would be a mix of stock with the majority in cash.

-

The Evan Greenberg-led carrier confirmed last night it had made an offer to buy its smaller peer.

-

The $65 per share bid looks like an opening salvo, with potentially another $10+ per share to come.

-

The proposed consideration represents a mix of stock with the majority in cash.

-

The carrier says its board of directors is "carefully considering" the proposal.

-

The Hartford share price jumps 12% on report of deal talks with Chubb.