-

The global insurer will need to convince investors on the quality of the book.

-

The global insurer will pick up a $650mn portfolio of US casualty business.

-

AIG will fold the portfolio into its existing business, leaving the liabilities and legal entities with Everest.

-

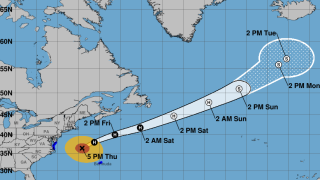

A US landfall is not expected, but the storm could hit the Bahamas by Friday.

-

The storm could bring flooding to Jamaica, Cuba and Haiti.

-

The bill includes provisions to encourage retrofitting homes in high-risk areas.

-

While limited to only some accounts, it’s a sign of the intense competition in the segment.

-

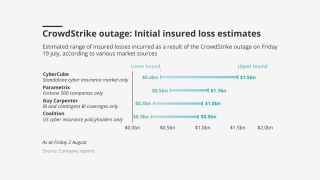

A canvassing of the cyber market suggests the impact will be negligible.

-

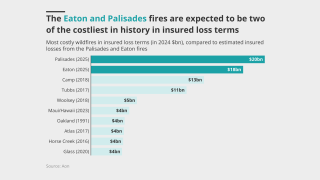

The range allows “for information that could emerge beyond what is known today”.

-

Selective’s CEO earlier attributed Q3 adverse development to the NJ market.

-

The company and its main debt provider Ares agreed to relax its debt terms in April.

-

A former NOAA climatologist who left the agency is running the new operation.

-

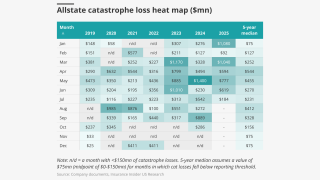

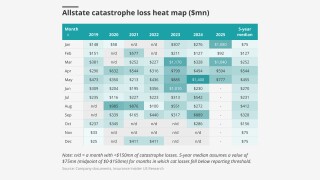

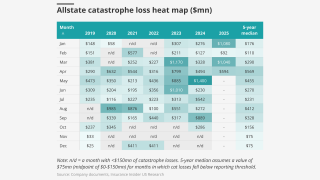

Cat losses in Q3 were light as peak hurricane season passes without incident.

-

AWS suffered a large-scale service disruption originating in northern Virginia.

-

There’s nothing medical about SAM claims.

-

Northeast Insurance said 55 claims were brought under the Child Victims Act.

-

Since Simon Wilson was elevated to insurance CEO, the firm has been refocusing its underwriting.

-

The protection covers the US insurance book for the 2024 and prior accident years.

-

Critics claim the dispute system denies consumers' key legal rights.

-

Nine-month insured losses still exceeded $100bn due to California wildfires.

-

As the Great Japanese M&A Contest develops, the executive said inorganic expansion is “a top priority”.

-

Though wildfire losses are up, total losses are the lowest since 2015.

-

A US district judge ruled a delay could put human life and property at risk.

-

The federal panel hasn’t finalized a timeline for formulating the new rules.

-

Shared and layered accounts are seen as reaping the biggest benefits.

-

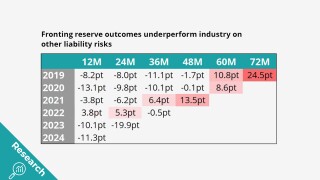

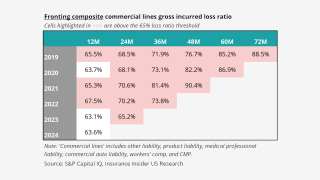

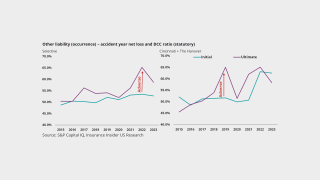

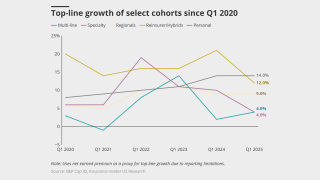

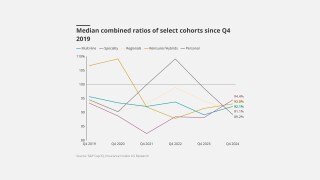

Fronting doesn’t look any better when it’s broken down by segment.

-

Trade credit insurers are expected to respond with tighter buyer limits and stricter wordings.

-

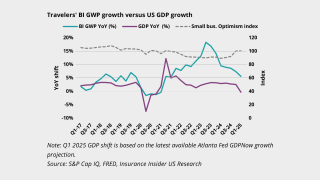

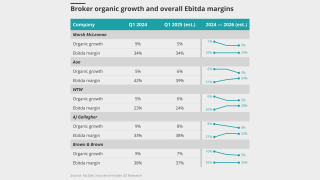

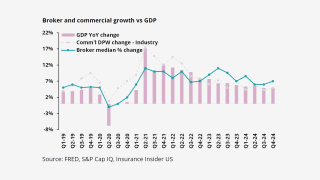

Growth concerns were top of mind at this year’s conference.

-

The governor has yet to sign a pending bill to create a public cat model.

-

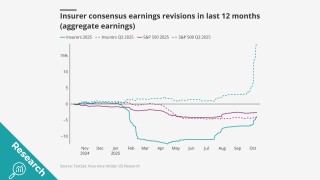

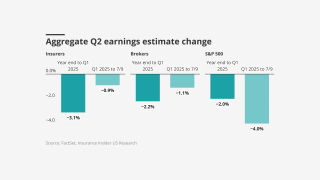

Lighter cat losses a plus, while top-line, organic growth and reserving concerns persist.

-

Moretti has relocated to California from London.

-

Jonathan Rinderknecht was arrested Tuesday on destruction of property charges.

-

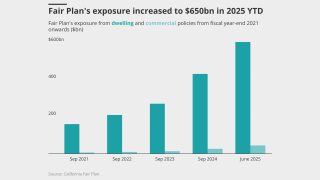

The insurer of last resort currently has $2.15bn of cat bond protection on risk.

-

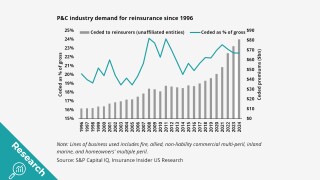

As both carriers and reinsurers deal with softening markets, all eyes are on hurricane-prone areas.

-

Expansion into adjacent markets, capital return and M&A among top means of capital deployment.

-

Insurers continue to compete on price, especially in the SME sector.

-

The ratings agency cited a reduction in exposure to nat cat risk as a reason for the change.

-

Sexual abuse and molestation exclusions are starting to hold in higher layers of hospital towers this year.

-

Home buyers looking to close on a mortgage could find the private market an attractive alternative.

-

Winds have strengthened to 80 mph, and the hurricane is expected to intensify further over the next 48 hours.

-

The jump in the latest estimate could be due to damage to seasonal properties only being recently discovered.

-

The NHC also warned that a hurricane watch could be required in Bermuda as early as Monday afternoon.

-

According to McKinsey, the projected spending on data centers is expected to hit $6.7tn by 2030.

-

The tropical cyclone is expected to be named Imelda.

-

Juries don’t significantly differentiate in cases involving severe injury.

-

California’s insurance regulator has Fair Plan depopulation, cat models on his mind.

-

Rates continue to be favorable for buyers across major lines of coverage.

-

Despite the formation of Gabrielle, there is "a very high probability" of a below-average season.

-

The risk also ranked as a top three concern for companies of all sizes.

-

Whether in property or casualty, areas of the market will be profitable even with new entrants, the executive said.

-

The proposed changes aim to establish clear guidelines for intervenors.

-

Cat losses in August were below historical trends, but we are not in the clear just yet.

-

Following the Golden Age of Specialty, franchise quality will play a bigger role in determining success.

-

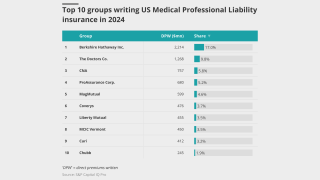

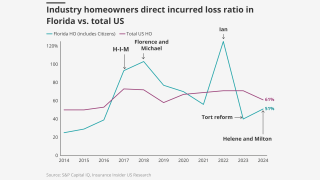

Despite tort reform, physicians’ insurers are struggling with the same loss inflation challenges as other liability peers.

-

Average incident costs for SMEs were up nearly 30%.

-

The MGU is entering the often-difficult habitational GL space with an initial E&S offering.

-

As data privacy litigation increases, insurers increasingly lean on exclusions.

-

The measures also seek to encourage greater wildfire mitigation efforts.

-

While the Fed is more concerned with jobs, other macroeconomic concerns trouble the industry.

-

This follows the news that AmTrust will spin off some of its MGA businesses.

-

The specialty MGA said it didn’t experience direct losses from the LA wildfires.

-

Reinsurers will not back business indefinitely where loss ratios continue to exceed the industry by a wide margin.

-

The Berkshire subsidiary is seeking coverage for a $22mn antitrust loss.

-

IBHS CEO Roy Wright says insurers need a comprehensive approach to resilience.

-

A report by the ratings agency challenges current industry wisdom.

-

The annual meeting took place in Pasadena, California, miles from the site of LA wildfires.

-

Models anticipate a busier second half, particularly in the next few weeks.

-

The wildfire MGA is expecting to write higher value homes soon and may expand into new states.

-

Ransomware claims have made up the majority of recent large losses.

-

The company saw a 53% decrease in cyber claims after a surge in 2024.

-

The fundraising round brought in $50mn for the insurer.

-

A survey from PwC described the sector as “stable”, “evolving” and “dynamic”.

-

Supply for property outstrips demand, but the casualty market is “bifurcated”.

-

Clients in the segments that AIG trades in may not be as receptive to the idea as the insurer would like.

-

The bi-partisan legislation would make FEMA a cabinet-level agency.

-

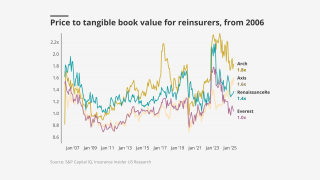

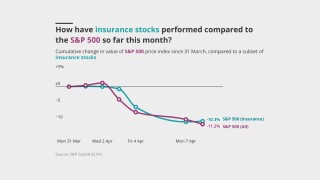

Despite rate reductions accelerating, the sector-wide combined ratio is set to remain below 90% through 2027.

-

The executive said claims can be a differentiator in a softening market.

-

The rest of 2025 appears poised to remain favorable for insureds, however.

-

The data modeling firm said losses previously averaged $132bn annually.

-

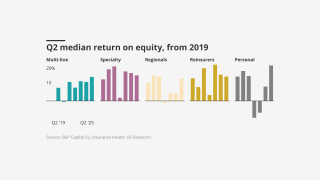

After the LA wildfires in Q1, carriers got some relief in Q2 ahead of wind season.

-

The group claims the White House is undermining disaster preparedness.

-

Cat losses in July were below historical trends, but all eyes are on peak hurricane season.

-

Storm surge of two to four feet could affect the North Carolina coast.

-

The Delaware high court’s reasoning could find application in other cases.

-

The US has been lucky over recent decades to avoid a $100bn insured hurricane event.

-

The program is aimed at affluent homes valued between $1mn and $6mn.

-

Life-threatening surf and rip currents are expected on the east coast of the US.

-

The company was hit with a data breach on July 16.

-

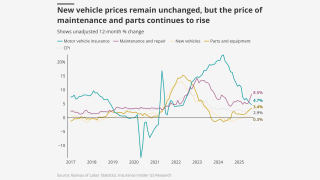

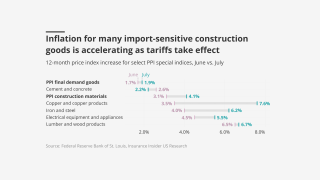

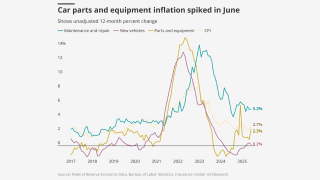

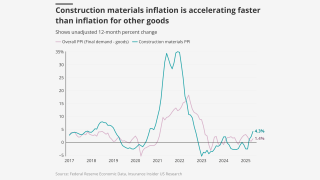

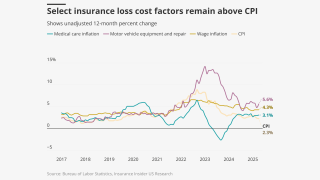

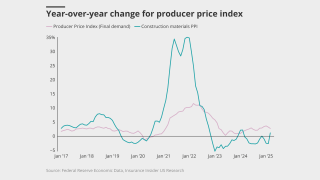

Despite mild headline CPI, some insurance-related items are heading in a worrying direction.

-

Profitability improves, even as growth stagnates.

-

The estimate covers property and vehicle claims.

-

This publication revealed two years ago that EQT could lodge a $1bn claim.

-

A shift to back to the admitted property space and MGAs choosing ignorance are other possible scenarios.

-

Both organisations still predict an above-average hurricane season.

-

As the fires spread, the priority shifted from saving structures to saving lives.

-

The forecast has increased since the early July update due to several additional factors.

-

California wildfires account for $40bn of the insured loss tally in H1.

-

The group has hit multiple industries since March, including a raft of insurance companies.

-

The risk of cyber incidents that cause physical damage is also rising.

-

Reinsurers are mostly aligned on cat reinsurance, but goals are otherwise diverse.

-

This follows last month’s takeout of 12,000 Citizens policies.

-

The CEO said business remains adequately priced in most classes.

-

Roughly half a year since the LA fires, brokers said there’s hope things are turning around.

-

The carrier is reducing its exposure to quota shares and shifting to XoL.

-

Millions are evacuating after one of the strongest earthquakes in modern history.

-

Mercury’s recovery from the guaranteed percentage of losses is $47mn.

-

Insurers can offer features the beleaguered fund can’t, the MGA said.

-

The regional insurer has increased its weighting to OLO and commercial auto, versus comp.

-

Insured losses produced the second highest first-half tally since records began in 1980.

-

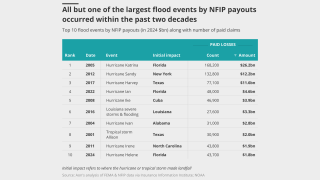

As the US recovers from a major flood event, the vast majority of Americans remain uninsured.

-

The company adjusts its rate options to expand California business under the new cat model.

-

The executive said the claims industry is going to “be transformed”.

-

Court documents show Travelers subsidiary Northfield Insurance is the insurer.

-

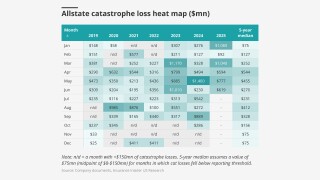

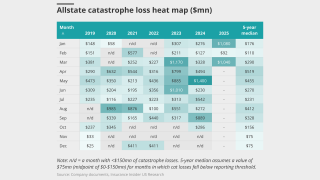

The research team presents the June cat heatmap.

-

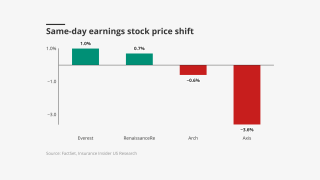

Pricing slowdown and reserving concerns are the hot-button topics as earnings kick off.

-

The company also encouraged insurers and brokers to support the initiative.

-

Rising inflation could raise claims severity but also increase investment income.

-

BI claims are notoriously difficult to manage and some insurers believe binary coverage can help.

-

The losses were below May’s $777mn, but almost 3x higher than for June 2024.

-

The suit claims billions of dollars are being illegally withheld.

-

Rate gains are easing across many commercial and personal lines.

-

The US accounted for 92% of all global insured losses for the period.

-

US events accounted for more than 90% of global insured losses.

-

The Inflation Reduction Act 2022 established new tax credits to incentivize investment in renewables.

-

State legislation has led to major strides in rate adequacy.

-

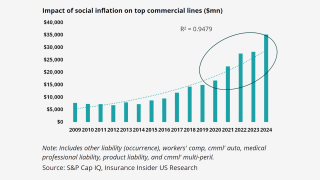

Social inflation, reserving, and organic growth are the topics to watch this earnings season.

-

Category 4 and 5 storms could become more common and hit further north.

-

Nominee Neil Jacobs was warned cuts will cause ‘rising home insurance rates’.

-

Despite predicting fewer hurricanes, the numbers are still above average.

-

When it comes to sympathetic juries, high net worth individuals are under the same pressure as corporations.

-

The weather-modelling agency is predicting a below-normal season.

-

The floods have killed at least 81 people, with dozens more missing.

-

Marsh’s property book saw an average decline of 9% in Q1, a trend that appears to have continued through Q2.

-

The investigation follows several civil racketeering cases filed by Tradesman based on similar facts.

-

The late March storm caused extensive damage in southern Quebec and Ontario.

-

The company said the reduction was due to years of steady improvements.

-

Early adopters of AI will see efficiencies – and likely increased market share, Kantar said.

-

The ruling comes as insurers face growing legal pressures following the January blazes.

-

The exec said the feds have been given data to potentially pursue criminal charges.

-

With the added capacity, the MGA can offer up to $35mn per risk.

-

Property rates are coming under further pressure, while liability is being buoyed by ongoing challenging loss trends.

-

The partnership is being formed via Liberty Mutual’s Ironshore subsidiary.

-

The insurer intends to take on up to 81,040 policies this year.

-

The outages began around 07:00 ET on Tuesday.

-

Much was learned after the fires, but it could take years before that data influences models.

-

The insurer’s system has now been out of commission for over two weeks.

-

In North America, the median W&I claim payment in 2024 was $5.5mn, the highest on record.

-

The research team presents the May cat heatmap.

-

It didn’t have a major impact on insurers’ finances – instead, it served as a wake-up call.

-

The regulatory body is also looking at AI rulemaking and catastrophe resiliency.

-

Allstate attributed the bulk of its losses to three major wind and hail events.

-

Tariffs could drive up property loss costs, but the impact on other items has been muted.

-

The impact of SAM claims is reverberating through the tower and the broader marketplace beyond hospitals.

-

Florida regulators have also approved takeouts for Mangrove and Slide.

-

Coverage has broadened while limits have increased, the broker said.

-

A deep-dive analysis shows LitFin is not the boogeyman this industry paints it out to be.

-

This is up from last year’s $1bn protection for its Florida treaty.

-

An active hurricane season threatens to weigh on hard-fought capital and underwriting margins.

-

Few claims have been filed thus far, as damages have been highly localized.

-

Van Bakel said that AI can help triage thousands of disaster claims.

-

The company first experienced system disruptions on June 7.

-

The suit, filed in Florida federal court, is Uber’s second Rico case.

-

The former Hub executive has over 30 years of experience in transportation.

-

Chubb told insurers to look inward in the fight against LitFin, but insurers are also tied to that industry.

-

The number has expanded by around 40% from an earlier update, sources said.

-

Estimates on what a cat five in downtown Miami could cost vary, but it would be painful for reinsurers.

-

The modeller said the insurance market could be exposed to unexpected aggregations.

-

The latest update brings the agency’s combined estimate for Milton and Helene to $32.4bn.

-

The executive has 15 years of experience in meteorology and cat analytics.

-

Catastrophe losses in Q1 exceeded $50bn, the second highest on record.

-

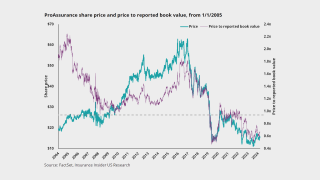

With fee income less understood, a primary acquisition or merger could reset the narrative.

-

HCI secured three towers with $3.5bn in XoL coverage.

-

The program includes all perils coverage and subsequent event protection.

-

The $2.59bn renewal is up 45% from last year.

-

Up to nine million acres of US land are considered likely to burn.

-

Last week, TSR updated its forecast and is now predicting above-average storm activity.

-

Most of the losses are attributable to a supercell storm in Texas.

-

The Floridian also secured $352mn of multi-year coverage extending to 2027.

-

The collective CoR of 45 Floridians hit 93.1% in 2024

-

Starr and Axon also are among those on the Marsh USA-placed $40mn line.

-

Florida’s top regulator says he’s eyeing eventual tweaks to the state’s cat fund, too.

-

Burford’s CEO said Chubb is inappropriately using its corporate power.

-

Politically related exposures are growing for the marine market.

-

TSR previously predicted activity slightly below the 1995-2024 average.

-

A historic cat loss year remains a possibility as storm losses accumulate.

-

SCS can no longer be considered a "secondary" peril for the US insurance market, Steve Bowen said.

-

The agency forecasts up to five major hurricanes and 19 named storms.

-

Kirsh was involved in launching an industrywide “legal system abuse coalition”, which now has 350 participants.

-

Two large storms hit the Midwest and Ohio Valley regions on May 14-17 and May 18-20.

-

The two parties seek to delay a judge’s summary judgment order.

-

Wildfires resulted in heavy losses for insurers focused on HNW, personal lines and reinsurance.

-

"Smoke damage is real damage," Commissioner Lara said.

-

Tornadoes have killed at least 32 people in three states.

-

The targeted uplift comes after Mercury ceded nearly $1.3bn of wildfire losses to reinsurers in Q1.

-

Competition and ample capacity are pushing premiums lower.

-

Inflation indices fell in April, but some items related to P&C are still elevated.

-

Previous complaints alleged their involvement, but this is the first time a complaint has identified the alleged funders.

-

The company has settled, or is in the settlement stage, for 80% of the exposure.

-

Two wind and hail events were responsible for 60% of the total.

-

Rates have fallen an average of 10%, though changes can be highly specific to each property.

-

The revision is significantly lower than the $4.5bn October estimate.

-

Modeling wildfires is particularly challenging compared to primary perils like hurricanes.

-

This in turn gives carriers on a tower a little more liberty and less risk to optimize claim outcomes.

-

They cover environment, political violence, equipment and cannabis.

-

The CEO spoke after Chubb chief executive Evan Greenberg’s call to action at RIMS.

-

Writing credit wraps for LitFin firms and steering third-party assets to them should stop.

-

The industry is seen as “resilient” amid a volatile risk environment.

-

Growth and returns on equity fall, but most of the industry is still profitable.

-

Shares were down as much as 20% after Hippo posted a $48mn loss.

-

The MGA market now makes up 10% of the overall P&C market.

-

The carrier said it is prepared to drop asset managers, lawyers, banks and brokers.

-

The market is also facing potential losses from injuries to NFL stars.

-

The insurer has not decided whether to sell its Eaton subrogation rights.

-

The program is designed to address a changing risk environment.

-

As the industry gathers in Chicago, Insurance Insider US reviews key discussion points.

-

The facility provides up to $100mn in claims-made excess casualty coverage.

-

The impact could also raise home-building costs by $10,000 per unit.

-

But automotive repair costs are likely to increase faster than home repair.

-

The LA wildfires, however, will be the firm’s largest event to date.

-

Secondary perils are no longer so secondary, but the losses are already priced in for commercial property.

-

Growing economic and population exposures are driving potentially larger insured losses.

-

Axis is retroceding $2.3bn of reinsurance segment reserves to Enstar.

-

The program will offer liability coverage up to $5mn per occurrence.

-

The company will continue to deploy additional limit in property cat through mid-year, the firm’s CUO added.

-

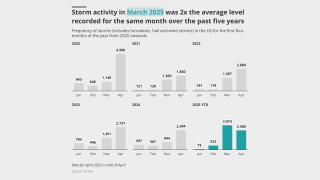

Severe weather in March drove monthly and Q1 losses to historic highs.

-

Imported goods account for 30%-50%+ of materials used for HNW homes, versus 15%-25% in standard houses.

-

SCS losses were also above average in Q1 due to “lingering” La Niña conditions.

-

The law imposes limits on third-party litigation funding, among other changes.

-

The carrier surpassed the retention on its annual aggregate reinsurance cover for the year to March 31.

-

Insured losses were the second highest on record for the first quarter.

-

Industry bellwether results and commentary don't indicate a crisis, despite uncertainty.

-

He will replace Scott Lee, who is retiring after 40 years in claims.

-

The industry loss data provider also increased its estimate for Hurricane Helene to $15.3bn.

-

The insurer achieved an 86.4% acceptance rate of the policies selected.

-

After seven years of premium rate growth, rates are down 5% to 40% across the US.

-

Despite positive inflation headlines, there are issues for insurers under the surface.

-

Economic unease will join cat losses, renewals, and organic growth as Q1’s key topics.

-

It is understood that Marsh brokered the tower, which is exposed to claims from a 2024 breach.

-

The suit alleges a “deliberate scheme” to deny smoke damage claims.

-

The investment recovery will be welcome but Chinese tariffs will contribute to loss-cost inflation.

-

A positive outcome could significantly curb insurers’ exposure to the loss.

-

Storms in the UK and Ireland drove losses in the commercial segment.

-

The coverage will only be available in Illinois and Michigan at first.

-

The program is being launched through subsidiary Southern Marine.

-

Trade credit and marine are among the lines facing direct impacts amid a broader inflationary challenge.

-

A survey from the carrier looked at the political risk and violence concerns of companies.

-

Despite wildfires, reinsurers are “well positioned to maintain strong profitability in 2025”.

-

P&C has strengths that will help it survive this crisis, but not without some pain.

-

The 12 insurers together have $418mn in policyholder surplus.

-

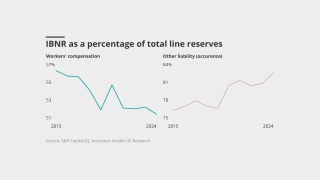

What past trends can tell us about the future of commercial reserving.

-

The prediction comes after a highly active hurricane season in 2024.

-

The tariffs could expose insurers to the risk of recession and shrinking income.

-

Colorado State University is predicting 17 named storms, nine hurricanes and four major hurricanes.

-

The insurer also pointed to accelerating growth, M&A to come, and a sub-30% ER.

-

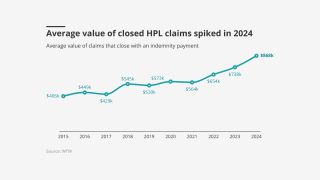

The costs of accident/casualty-related claims continue to rise.

-

The amount of change over the past year falls short versus the discourse.

-

Capital funding new litigation dropped 16% YoY, however.

-

The carrier has received 12,300 claims as of 28 March.

-

Defendants claim that Tradesman lacks standing to bring the case.

-

This publication revealed earlier that Command was seeking a new backer.

-

A new report warns that underwriters must consider political uncertainty and macroeconomic trends.

-

The Georgia verdict is one of many legal battles over Monsanto’s herbicide.

-

Cat losses last month were lighter than historical trends, but all eyes are on Q1 figures.

-

ShoreOne is offering an all-in-one policy that includes flood protection.

-

What insurers can learn from the history that led to this deal.

-

The March 13-16 storms would mark the first billion-dollar US SCS event of the year.

-

The insurance industry has experienced mounting losses from severe convective storms.

-

The agency collects gold standard data and conducts research. Without that, there’s more uncertainty.

-

A quick roundup of our best journalism for the week.

-

Of the 178 passengers and crew on board, no serious injuries have been reported.

-

The Democratic senator said increased federal oversight of insurance is not the answer.

-

Kathleen Reardon, CEO of Hiscox Re & ILS, also talked about the impact of the California wildfires and why it’s important for cedants to work with a reinsurer with strong underwriting and modelling skills when disaster strikes.

-

The MGA recently secured capacity to write HNW homes in California.

-

The carrier was seeking to expand its March 1-renewing program.

-

While significant, the fires are expected to be an earnings rather than a capital event for the industry, John Huff, CEO of the Association of Bermuda Insurers & Reinsurers, said.

-

Admitted insurer withdrawals and rising demand are pushing more entrants into E&S.

-

Aviation reserve strengthening added 10.1 points to the combined ratio.

-

Four cat modelers have also submitted their tech for regulatory review.

-

Executives see earnings benefits from workers’ comp beginning to diminish.

-

Some $4.8bn of reinsurance and cat bond limit will come up for renewal in 2025.

-

Hippo estimated its pre-tax cat loss from the LA wildfires at $42mn.

-

As of February 14, the company received 405 claims.

-

The London D&F market will shoulder most of the losses.

-

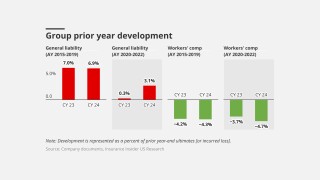

Underwriting profits for casualty-exposed insurers show signs of struggle as loss costs worsen.

-

Under the new guidelines, the carrier is requiring more distance from the brush.

-

Workers' comp continued to offset GL adverse development, but the bucket is running dry.

-

The estimate is based on industry losses in the range of $35bn-$45bn.

-

The US sports disability market has been dubbed the “problem child” due to its volatility.