CARRIER FOCUS

Fuel a smarter strategy with our actionable market intelligence

CARRIER FOCUS

Fuel a smarter strategy with our actionable market intelligence

Why Insurance Insider US?

Why Insurance Insider US for carriers?

Insurance Insider US helps leading insurance carriers uncover growth opportunities and understand market dynamics that impact your business.

Stay one step ahead with exclusive insights delivered with unmatched speed

Connect the dots on emerging market trends

Elevate your strategy with our agenda-setting insights and informed projections

Trusted by leading carriers

Our Solutions: Title

Our solutions

Ready to Get Started? (IIUS)

Ready to get started?

Fuel a smarter strategy and accelerate decision-making with our actionable insights, highly informed projections, and in-depth market analysis.

- Trusted by over 60,000 individual subscribers across 70 countries

- Utilized by more than 700 companies worldwide

- 75% of the top 20 global insurance brokers subscribe

- 70% of the top 20 global P&C insurance carriers subscribe

Table

Intelligence on the London and global (re)insurance markets. |

Intelligence on the entire US domestic insurance market. |

Intelligence on the insurance-linked securities (ILS) market. |

|

| Markets covered |

Markets covered

|

Markets covered

|

Markets covered

|

| Content |

Content

|

Content

|

Content

|

| Newsletters |

Newsletters

|

Newsletters

|

Newsletters

|

| Data Tools |

Data Tools

|

Data Tools

|

Data Tools

|

Ready to Get Started? (IIUS)

Ready to get started?

Fuel a smarter strategy and accelerate decision-making with our actionable insights, highly informed projections, and in-depth market analysis.

- Trusted by over 60,000 individual subscribers across 70 countries

- Utilized by more than 700 companies worldwide

- 75% of the top 20 global insurance brokers subscribe

- 70% of the top 20 global P&C insurance carriers subscribe

News articles

News articles

Latest news

Content pieces

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

The insurer continues to exit or reduce unprofitable lines and slowed growth as a result.

-

CFO Vogt added that the vehicle’s impact from earned premiums should ramp up from 2026 through 2029.

-

A re-focus on reinsurance nearly brings Everest back where it started.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

Despite the pricing pressure, margins for the line of business remain attractive, he added.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

Since Simon Wilson was elevated to insurance CEO, the firm has been refocusing its underwriting.

-

Neil Ross was also appointed CUO for the broker’s MGA.

-

The international division is seeking a new London market manager.

-

The state’s AG said the case threatens continued offshore oil and gas operations.

-

The executive was formerly EVP and central regional leader at Aon.

-

The subsidiary will offer primary and excess liability.

-

Markel’s Bryan Sanders is receiving the Lifetime Achievement Award for his service to the industry.

-

There will also be a renewed focus on organic growth, both in P&C and across US and international operations.

-

Ryan Alternative Capital Re was launched in partnership with Axis Capital.

-

The executive will oversee the direction and management of the firm’s liability portfolio across the US and Canada.

-

The promotions will enhance underwriting capability across key segments.

-

The deal was announced last month.

-

Peter Vogt will act as a strategic advisor at Axis until the end of 2026.

-

Company alum David Murie will lead the new business unit.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

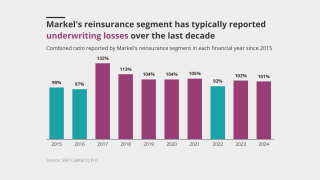

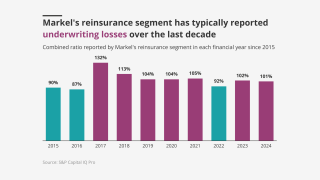

The company was right to drop its reinsurance unit and refocus on its specialty roots.

-

Reinsurers are mostly aligned on cat reinsurance, but goals are otherwise diverse.

-

The president expects to see benefits from the deal in H2 2026.

-

Lion's share of Markel Re staff have been offered roles at Ryan, with others to work on run-off.

-

The company has struggled in reinsurance, while large claims dragged down D&O results in Q2.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

Nationwide will delegate management of the policies to Ryan Specialty.

-

The Bermudian said its pursuit of SMEs through M&A will provide sustainable improvements to its bottom line.

-

Pricing was “virtually flat” in the second quarter.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

Hagerty Re will now assume 100% of the premium and 100% of the risk.

-

Cardinal E&S expands the carrier's underwriting capabilities and makes it more competitive relative to peers.

-

Finsness joined the carrier in 2014 and was head of casualty claims in Bermuda from 2017 to 2023.

-

The appointments will be effective as of August 1.

-

The unit will include both ocean and inland marine coverage.

-

Goldman will join Ascot next month to take on the newly created role.

-

Major insurance industry groups and companies have recently pressed lawmakers to include the provision.

-

Markel is simplifying its structure from six US wholesale and two US retail regions to four integrated US regions.

-

Ed Short was previously VP, digital partners, at Arch.

-

Eric Seyfried and Glen Manjos are also departing Axis’ cyber and tech unit.

-

The purchase aims to bolster Markel’s marine product line in the Asia-Pacific region and EU.

-

The changes are aimed at improving underwriting and operational performance.

-

The latest E&S player planning to IPO remains a “show me” story.

-

-

Sources said MarshBerry was retained earlier this year to run the sale.

-

The moves come as the company said it will "double down" on US E&S.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

Customers are demanding more in a larger move towards the E&S market.

-

Primary and excess casualty in the US saw double-digit rate growth and remained above loss trends in Q1.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

The days of 30%+ growth are probably behind the firm, he said.

-

New roles include CUO for primary and excess casualty and practice leader for complex specialty.

-

Overall, the company’s underwriting income fell 43% to $417mn in the first quarter.

-

Axis is retroceding $2.3bn of reinsurance segment reserves to Enstar.

-

The business will divide into US wholesale and specialty, and programmes and solutions.

-

The insurer has not yet announced a successor for the 32-year company veteran.

-

Meco's 2024 gross written premiums totaled $63mn.

-

Construction defects, GL and risk-managed professional liability lines saw the greatest headwinds.

-

Markel also announced the appointment of Jon Michael to its board.

-

Markel Insurance is made up of the firm’s three primary underwriting businesses.

-

Markel had announced the exit from the line of business in the US last year.

-

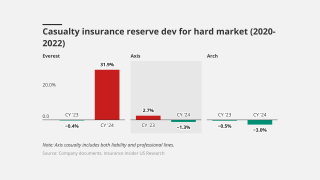

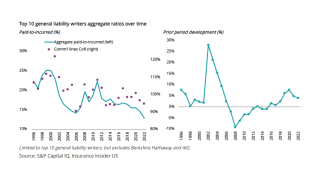

GAAP reserve triangles reveal the struggles of some hybrid franchises.

-

Technology is key to streamlining the value chain and mitigating loss ratios.

-

Jana holds around 109,000 shares and 69,000 call options, at a $307mn total value.

-

The group should also tilt capital allocation away from M&A and deepen its disclosure.

-

The company, meanwhile, is bullish on E&S US casualty.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

Rate meanwhile continues to be an area of focus in the lines most impacted by social inflation, the CEO noted.

-

The company did not take questions on its recently announced business review.

-

The insurer acknowledged additional claims in 2025 would be “reasonably possible”.

-

The specialty insurer reported favorable developments in both its insurance and reinsurance segments.

-

The board will lead the review following feedback from shareholders including activist investor Jana.

-

The carrier’s US platform will continue to be led by long-time executive Sal Pollaro.

-

The PE firm held over 6.7 million Axis shares, around 8.2% of shares outstanding.

-

The carrier also grew TL written premiums by 11% in Q4 and 24% for the full year.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

Robin Hamilton has been appointed head of energy and marine liability.

-

New CEO Williamson will likely continue walking the hybrid path, with an emphasis on fixing US casualty.

-

Tim Watson most recently served as a senior credit and political risk underwriter.

-

Old Republic Cyber will focus on providing specialized cyber and technology-related coverage.

-

The three lines add up to 80% of the deal.

-

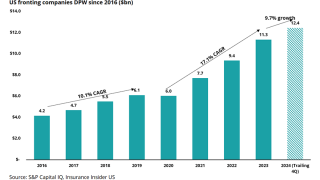

Fronting growth fell by half in 2024 due to uncertain loss climate and high cost of capital.

-

The transaction mostly covers casualty portfolios of 2021 and prior underwriting years.

-

Sources said that Archer Transactional and BlueChip Underwriting will continue operating with existing paper providers.

-

The decision reflects CNA’s “consistently positive” operating performance.

-

Jelle Ouwehand joined Arch from Marsh, where he was a senior terrorism, PV and war broker.

-

The executive joins RPS after almost 12 years at Markel.

-

A signal around Q4 adverse development has brought the carrier into the spotlight.

-

The lawsuit involves an alleged $100mn+ Ponzi scheme.

-

Both appointments are effective immediately.

-

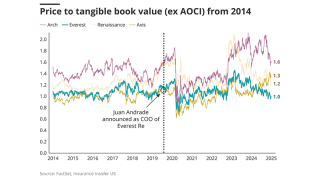

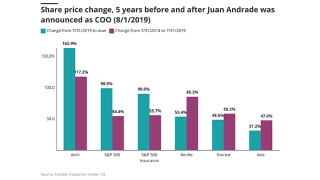

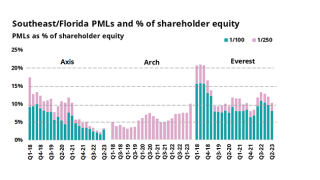

Arch stands out among hybrids, but Axis and Everest grind it out.

-

Excess casualty rates were up 10% and have been double-digit all year, the executive said.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

Arch is assuming an industry loss related to Helene in the $12bn-$14bn range.

-

Executives noted that US casualty and professional lines development has been close to flat this year.

-

The company’s reshaping of the book will be substantially completed by year end.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

Sinclair had $50mn in coverage through five separate cyber policies.

-

Hurricane Milton losses are currently estimated at $25mn-$55mn.

-

Grandisson's sudden retirement could mean a complicated future for Arch.

-

The chief executive will also receive a yearly bonus of 200% of base salary.

-

Arch announced the retirement of CEO Marc Grandisson on Monday, with immediate effect.

-

The executive has been group CUO since 2021.

-

In tandem, John Posa joins the primary casualty team as vice president.

-

The executive moves from his current role as chief risk officer for Axis Managing Agency.

-

He replaces Richard Goldfarb, who will remain as head of strategy.

-

This will not impact Markel International, which will continue to operate out of the UK.

-

Mark Gregory will retire next March, while Sara Mitchell will initially join as a strategic adviser.

-

The executive struck a cautious note on the industry’s reserve adequacy for the 2021-23 accident years.

-

Mullarkey joins from Allianz Global Corporate & Specialty.

-

-

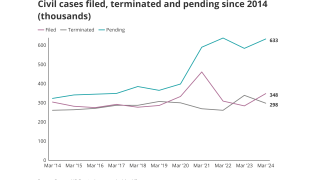

Civil case, nuclear verdict and claims count data show worrying trends.

-

Severe convective storms, wildfires and hurricanes increasingly moving inland are top concerns for the industry.

-

The carrier writes all of its E&S business in the state through Arch Specialty Insurance Company.

-

Regionals may be particularly vulnerable to problematic loss cost trends and volatile cat losses.

-

State National will provide $160mn of coverage to James River as part of the deal.

-

A quick round-up of today’s need-to-know news, including Ryan Specialty and Skyward Specialty.

-

Mark Lange, chief middle-market executive, will oversee the new businesses.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

Markel acquired 98% of Valor last month and has the option to buy the remaining equity stakes.

-

The slowdown was based on a conviction of “higher likelihood of frequency events” this year.

-

The outage is not expected to impact Axis’s financials at this time.

-

A quick roundup of today’s need-to-know news, including AIG's earnings.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

Overall long-run loss cost trends are unchanged at around 6.5%.

-

Jennifer Devereaux will provide overall leadership of casualty products.

-

The executive will replace Habib Kattan, who joined the company last summer.

-

Both parties expect to close the transaction on August 1, 2024.

-

State National is providing $160mn of adverse development reinsurance coverage.

-

Investor skepticism visible in stock prices and short interest data over first half of 2024.

-

Launched in 2021, Axis is both an investor and capacity provider.

-

-

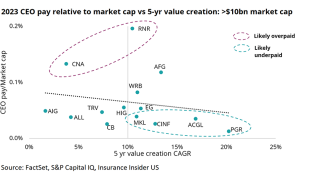

Analysis shows several CEOs with pay diverging from the trendline.

-

A standalone syndicate could offer capital, trading, and licensing advantages.

-

State National has been lined up to front for the vehicle, which would be a rare example of third-party capital in this space.

-

She will develop regional underwriting strategy and product offerings.

-

Robusto will take an executive chairmanship position on the insurer’s board of directors.

-

The two join the company from Navigators, a subsidiary of The Hartford.

-

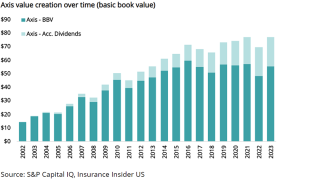

Industry trends show the Axis book value growth goal may be hard to hit.

-

-

She will oversee US and Bermuda claims operations.

-

He brings 23 years of insurance industry experience.

-

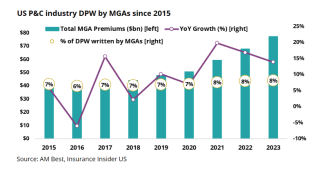

MGAs outpaced the P&C industry for years, but growth has begun to stagnate.

-

Analysis of 2023 statutory data shows that Californian insurers are leaning more heavily on reinsurers but at a nationwide level, premium cessions were more stable.

-

New leaders of these reinsurers have started strong, but Axis still has work to do.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

Long-run loss cost trends in the US are at 6.5% as a result.

-

Strack has worked at Arch for close to four years.

-

The exits represent less than 2% of the company’s insurance segment operations annually.

-

The primary casualty book was down by “some 26-odd percent from the prior year”.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

There was no material development on long-tail casualty lines across all years, he said.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

Kirsten Valder has been with Arch for 10 years and before then was a partner at Kennedys Law.

-

Pauline Morley will report to John Van Decker, head of global financial lines.

-

Will Arch’s new acquisition be another success story, or more trouble than it’s worth?

-

The executive is also CUO of Axis Managing Agency.

-

The deal includes an LPT of ~$2bn loss reserves for 2016-2023 years with Arch Re.

-

Old Republic Aerospace CEO Ralph Sohl will continue in his current position.

-

Doppstadt and Paglia have served on the board for 14 and 10 years, respectively.

-

Joe Morrello joined the firm in 2022 after serving as E&S property head at Beazley.

-

-

The executive’s exit is part of a reassessment of Axis’s primary casualty book.

-

The carrier stopped accepting new business starting February 7.

-

Rodrigues’s retirement caps nine years with Markel.

-

Vanessa Hardy Pickering and Lester Pun have also been promoted.

-

Dejung spent 13 years at Scor, most recently as cyber CUO.

-

It will begin underwriting from April 2024.

-

Marty Becker was previously chair of QBE Insurance and Alterra Capital.

-

The executive will continue in his role as global head of distribution.

-

-

The executive discussed Markel’s performance in an annual shareholder letter.

-

CEO Grandisson described Arch as "bullish" in its prospects for 2024.

-

Given a number of complexities, the landing zone on a take-out price is small.

-

Earlier in the process, sources linked Sentry Insurance with a bid for the E&S insurer.

-

With mixed results in the reinsurance space, the specialty pivot remains a "show-me" story.

-

Commercial carrier earnings continue to show mixed prior-year development.

-

Commercial auto and medmal had slight unfavorable developments in 2023.

-

Underwriting and investment income rose for P&C business.

-

Markel, Axis and Selective booked sizeable reserve charges in their liability segments.

-

The carrier did not consider pursuing an LPT deal to address the GL and PL issues.

-

The firm will still be prepared for ‘modest changes’.

-

The figure was disclosed in the group's recent 8-K disclosure.

-

Insurance Insider US runs you through the earnings results for the day.

-

The committee claims Chaucer waited until it had ‘maximum leverage’ over other debtors.

-

Axis’s reserve cleanup removes longstanding overhang and narrows the credibility gap.

-

Axis shares were trading at almost $59 after closing at around $55 Tuesday.

-

More than 100% of the reserve charge came from pre-pandemic years, as the slight release of $40mn that offset the full-year increase of $452mn was from 2020 to 2022 accident years.

-

The reserve strengthening was related to liability and professional lines related to 2019 and prior accident years, the firm wrote in a preliminary earnings disclosure.

-

The transaction would have been one of the largest the market has seen for years.

-

Participating in the funding round were Caffeinated Capital, Altai Ventures, Zigg Capital, 8VC, Buckley Ventures, Habitat Partners and Arch Capital.

-

Anna Tan will play a pivotal role in elevating the position of AXIS in the US wholesale casualty market in alignment with the company’s position as a leading specialty insurer.

-

Mike Cueman will be based in New York and report to global head of construction Steve Cross and, via a matrixed structure, to Michael McKenna, head of North America.

-

He will be based in New York and report to Mike McKenna, head of North America.

-

The deal follows this publication’s report that the Bank of America-run sale process of Castel was drawing robust interest.

-

Brian Costanzo, who joined the company in 2009, was previously CFO of Markel’s insurance business.

-

Stan Galanski most recently served as president and CEO of The Navigators Group until its 2019 acquisition by The Hartford.

-

Insurance Insider US’s morning summary of the key stories to get you up to speed fast.

-

After joining the firm in 2018 from Chubb, Cox oversaw the carrier’s Markel Specialty and Markel International divisions.

-

This replaces a $750mn program authorized in February 2022, under which $633mn of the company's common stock was repurchased as of November 29.

-

Coburn will report to Jason Busti, Axis Re president of North America.

-

The programme services carrier will serve UK MGAs from 1 January.

-

Ratings could be lowered by one notch depending on regulatory restrictions on cash flow from Bermuda operating entities to non-operating holding companies, the ratings agency said.

-

The consideration is expected to be around $140mn plus a $25mn dividend.

-

John Owen has been with Axis – and Novae prior to its merger with Axis in 2017 – for 19 years in underwriting and leadership roles.

-

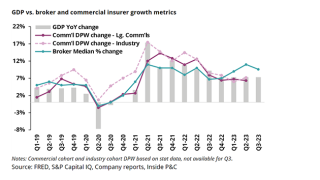

Broker and commercial carrier trends separate as inflation slows but rates stay elevated.

-

The five-person underwriting team will be led by Ian Lewis, who has been named head of intangible assets.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

A credit loss owing to a fraudulent letter of credit from Vestto added 1 point to the combined ratio in Q3, insurance president Jeremy Noble told analysts during a conference call.

-

The Bermudian also revealed a $29mn restructuring charge for Q3.

-

The Inside P&C news team runs you through the earnings results for the day.

-

The executive noted “increasing evidence [that] casualty rates widely underpriced and oversold during the last soft market need to increase.”

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

The Inside P&C news team runs you through the earnings results for the day.

-

CNA continued to push for rate in lines of business affected by social inflation in Q3, as CEO Dino Robusto said the carrier was “pleased that there is an increasing awareness for this need in the marketplace”.

-

The carrier reported better investment returns, improvements in underlying P&C performance and lower cat losses.

-

Markel named Alex Martin, Markel’s current CFO, as Sanders’ successor.

-

Carlton Maner is stepping down after having served at AXIS for almost 22 years.

-

The start-up MGU will initially focus on real estate, hospitality and leisure, financial institutions and professional services industries.

-

The sidecar has been launched alongside partner Stone Point Credit Adviser.

-

Cyber is another market Axis is watching closely, given new MGA entrants as well as the recent rise of ransomware activity, with the carrier expecting more “undulation” as a result.

-

The executive will oversee all aspects of managing direct insurance operations at the business.

-

Patin will oversee Somers’ overall investment strategy and direct its investment managers.

-

Wu will focus on supporting and growing the broker’s existing US, Canada and Bermuda strategic partnerships.

-

Some 15 months on from the property reinsurance exit, he said the firm continued to reserve the right to reshape the portfolio.

-

In addition, Arch Re global CUO Pierre Jal moved to Zurich to take over as Europe CUO, while president Matthew Dragonetti expanded his scope to lead client-centric initiatives.

-

Based in New York, the executive will report to Markel’s terrorism director Ed Winter, who is based in London.

-

Inside P&C’s news team runs you through the key highlights of the week.

-

Rate declines have not been as pronounced in private D&O, though competition is increasing.

-

Effective August 24, Kristen Hunter will start as head of inland marine – North America at Axis, bringing a team of three with her from Berkshire Hathaway.

-

A 15% tax is in the works, but appears manageable, and with (re)insurance being Bermuda’s largest industry, the territory will take steps to keep companies where they are.

-

Differences in reinsurer strategies and risk management lead to differentiation in stock multiples and long-term value creation.

M&A Deal Tracker

In the M&A Deal Tracker, you can find all of the key data points on every P&C commercial lines business in our coverage universe which is currently on the market — as well as transactions in the sector which have recently completed.

IIUS Testimonials

Take it from the industry leaders we serve

Being in claims I like to hear about mergers and acquisitions, who’s coming and going in the industry. Having that information early on is very helpful for me and my career

Robert Riccobono

SVP, Allied World

I need to be informed on the latest, breaking news, what the industry is thinking about, what developments might be going on. And so I really rely on the Insurance Insider to give me that information

Beth Diamond

Group Chief Claims and Litigation Officer, Beazley

Contact Sales/Calendly form

Contact Sales/Calendly form

Ready to learn more? Get in touch

Book a meeting with Ryan to learn how Insurance Insider US can help your business grow.

Ryan Flood

Business Development Manager

Copied!