WR Berkley

-

The Japanese P&C carrier agreed a deal to buy 15% of WR Berkley shares in March.

-

Some disagreement remains in where rate declines have been swiftest and how much further they could go.

-

Normalized growth and peak multiples confirm we are headed towards a Darwinian race.

-

Cat losses in Q3 were light as peak hurricane season passes without incident.

-

The CEO also said that the “bloom is off the rose” in the E&S property market.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

She joins the specialty insurer after working at Hamilton as CUO.

-

Insurers did not see a slowdown in rate but some are still fine-tuning their portfolios following the LA fires.

-

On Q2 calls, carrier executives called out fierce competition in various lines of business, and a misalignment of interest.

-

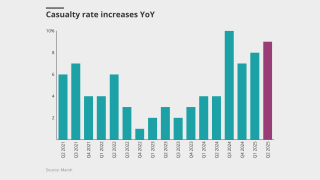

Loss trend concerns persist, but insurers are vouching on the opportunity to push for more rate increases.

-

Recent inbound offers can “oftentimes” be a leading indicator that the market is slowing, he said.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

The January wildfires did little to hamper their appetite, apart from California.

-

The latest E&S player planning to IPO remains a “show me” story.

-

The insurer's professional liability reinsurance book shrank by around 25%.

-

The company’s stock jumped 14% within 30 minutes of the market’s open.

-

The shares will be purchased via the open market or private third-party transactions.

-

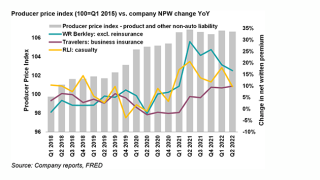

Submission flows in WR Berkley’s E&S business overall are growing “considerably faster” than its admitted business.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

The carrier doesn’t have big concentrations with distributors and conducts business with individual brokers.

-

This could change if Milton losses turn “ugly”.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

For many, it could be a “wake-up call” to the systematic exposures inherent in cyber.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

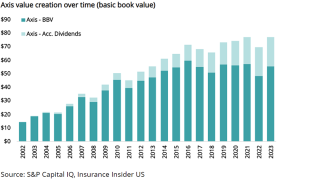

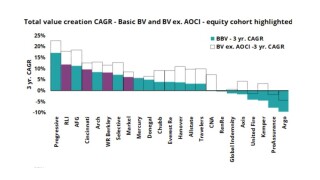

Industry trends show the Axis book value growth goal may be hard to hit.

-

Focus on reserves to continue as gap between cautious reservists and others emerges.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

Earlier today, the carrier reported that its Q1 combined ratio came in at 88.8%, down from last Q1’s 90.6%.

-

Reinsurers will try to put pressure on insurers for casualty and liability lines, as they did in property.

-

Carriers expressed confidence on the line’s ability to withstand medical inflation.

-

Commercial carrier earnings continue to show mixed prior-year development.

-

On Wednesday, the insurer reported 12% growth in net written premiums.

-

The specialty carrier’s top-line growth accelerated throughout 2023.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

The syndicate is suing its reinsurers to cover Covid-19-related claims in California, Colorado, Florida, Illinois, Nevada, New York and the UK.

-

Schuermann joined Berkley Entertainment as chief operating officer in 2021 from NN Inc. Broshcart served in the president role upon the unit’s formation in 2004.

-

The exec has nearly 30 years of property and casualty insurance experience and succeeds interim CWG president Melodee Saunders.

-

S. Akbar Khan is a 20-year insurance industry veteran, most recently serving as a senior officer at a leading national US insurer.

-

Christopher Balch is succeeding Matthew Mueller, who has been named chairman of the business. Both appointments are effective immediately.

-

The company also continues to be “very mindful” of medical cost trends, which CEO Berkley noted were shifting very quickly after a benign period.

-

The Inside P&C news team runs you through the earnings results for the day.

-

Forte joined the specialty insurer in early 2018 as public entity SVP, CUO and COO after a spell at AIG based in New Jersey.

-

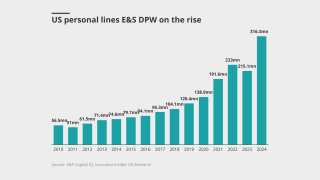

Flows to the E&S market remain strong, executives have said, while dislocation in the property space continues to buoy overall pricing conditions.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

Apart from public D&O and workers' comp, the specialty lines insurer is seeing “very strong submission growth”.

-

The Inside P&C news team runs you through the earnings results for the day.

-

The deal will result in a pre-tax net realized gain of $86mn in the second quarter.

-

The new business unit will offer excess liability coverage to specialized markets, starting with environmental and energy industries.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

Sources said it is still unclear if the specialty insurer will exit the class permanently or if it will return to the market in the foreseeable future.

-

Jay Weber succeeds Dennis Barger, who was appointed as chairman of the business, effective immediately.

-

Yesterday, the specialty insurer recorded Q1 $1 operating earnings per share, missing analyst estimates of $1.23 per share.

-

The specialty insurer booked $47.9mn of cat losses – or 1.9 points on its CoR – in Q1 and one point of unfavorable reserve development mostly related to property cat losses.

-

An industry veteran with nearly 20 years of experience, Albert served as executive vice president of strategy and business development at Selective.

-

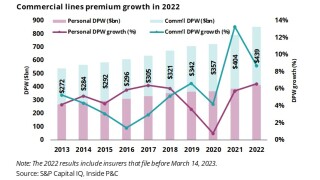

The latest statutory data release shows commercial carriers continued to benefit from the extended pricing cycle and exposure growth propelled by inflation, although growth slowed year-on-year.

-

Speaking on the company's Q4 conference call, the executive said the market should not assume that WRB will become a heavy cat-exposed writer.

-

Operating EPS for the quarter jumped 13.7% from Q4 2021 to $1.16, beating analyst consensus of $1.10 per share.

-

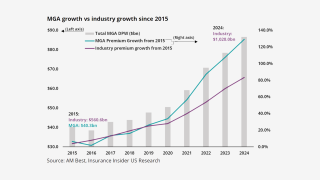

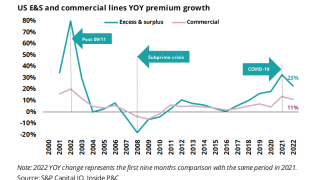

Inside P&C Research examines E&S sector growth over the past year and revisits historic trends.

-

With the election, WR Berkley increased the number of board members to ten and independent directors to eight.

-

Inside P&C’s news team runs you through the key highlights of the week.

-

At Sompo International, Neville served as executive vice president and global head of insurance claims.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

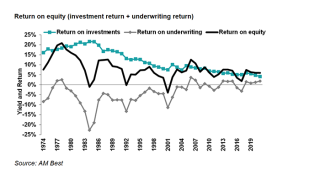

Executive chairman Bill Berkley expects the company’s returns to reach or exceed its targeted 15% rate, driven by its investment income results.

-

Sources said Ardila succeeds Sylvia Rincon, who will continue serving at the firm on its board of directors in Colombia.

-

Axis’ pivot away from property reinsurance comes just as the sector reaches one of the biggest inflection points.

-

Curtis Fletcher has been named president and CEO of the new business, effective immediately.

-

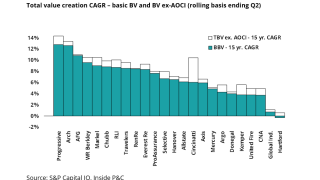

The two specialty insurers reported strong Q3 2022 earnings, continuing to outperform the commercial industry in underwriting gains and value creation.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

CEO Rob Berkley said the company would likely participate in the space for one to three years if rates remain favorable.

-

The weakened combined ratio was driven by an increase in the company's loss ratio.

-

The CEO noted that the company can participate in the property cat reinsurance market three out of every 10 to 12 years, given its approach to that class.

-

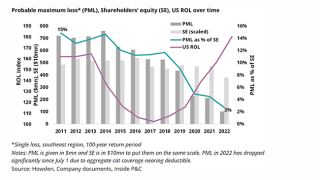

A differentiated investment strategy has led to increased value creation and price-to-book multiples for a small group of specialty carriers.

-

Berkley also increased its position in Global Indemnity and now owns around 8.5% of the firm.

-

The insurer’s results are in line with other carriers, but they are ahead of the curve on adjusting loss costs.

-

Commercial insurers surprised with continued positive results despite economic conditions.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

WR Berkley founder and chairman Bill Berkley said that his company can add at least “several hundred million dollars” to its investment income, as the Federal Reserve hikes interest rates to tame inflation.

-

The specialty insurer reported growth across almost all lines of business as it shifted focus from rate to expansion.

-

The sector was hit by a rough first half of 2022, with more to come in the second half of the year.

-

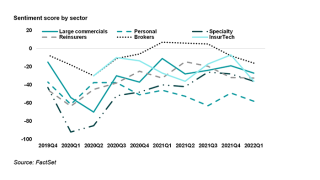

Sentiment scores are down across the industry, indicating pessimism regarding inflation and the economy.

-

Most recently, Rivera was the head of general liability underwriting at The Hanover Group.

-

Marcus joined Berkley in 2008 as a regional director at Key Risk and most recently served as Key Risk's senior vice president of sales, distribution and business analytics.

-

Insurers could face pressure if interest rate and recession fears intersect with worsening loss cost trends.