Aerospace

-

After outsized losses, the (re)insurer still sees opportunity in a softening market.

-

The Marsh-placed account renews its all-risks cover on 16 November.

-

Insurer results and 1.1 reinsurance renewals will shape the trajectory of 2026.

-

Patton Kline succeeds Glod as US aviation and space practice leader.

-

Besides Russia-Ukraine losses, the Air India crash losses totaled $26mn.

-

Net adverse development for the quarter increased 30% year on year to $89.2mn.

-

The carrier has scaled up its international insurance offering in recent years.

-

The acquisition follows a strategic partnership the two struck last August.

-

The two parties seek to delay a judge’s summary judgment order.

-

The company has settled, or is in the settlement stage, for 80% of the exposure.

-

The suit names former Marsh execs Hanrahan and Andrews as defendants.

-

IGI saw opportunities in energy, ports and terminals and marine cargo but remains cautious in long-tail lines.

-

Space pricing experienced double-digit increases after the 2023 capacity retreat.

-

AIG, HDI Global and others have settled. Chubb’s fight continues.

-

The pair add to the roster of aviation-focused hires at WTW.

-

The hires form part of WTW’s build-out of its US aviation practice.

-

A positive outcome could significantly curb insurers’ exposure to the loss.

-

Overall market capacity increased by 5.3% year-on-year, the broker reported.

-

Of the 178 passengers and crew on board, no serious injuries have been reported.

-

The offering includes GA, aviation GL and airport and product manufacturers liability.

-

Q2 renewals will likely signal changes in the reinsurance market, the broker said.

-

In tandem, it pegged its net cat loss estimate from California wildfires at $160mn-$190mn.

-

Starr-leads the WTW-placed all-risks cover for American Airlines.

-

The broker cautioned unresolved Russia-Ukraine claims remain a ‘Black Swan’

-

LAU will become the new Core Specialty Aviation & Aerospace Division.

-

The program was developed in collaboration with Allianz Commercial.

-

A California ruling could set an important precedent as other courts consider similar cases.

-

Ball will succeed Jeff Poliseno, who is set to retire.

-

The executive joins Applied from Canopius.

-

The Plane Talking report said the longevity of the ‘buyers’ market’ is in question.

-

Crashes and collisions accounted for 63% of aviation insurance claims between 2019 and 2024.

-

Ian George will be joined by Sawyer and Williamson as account executive and consultant respectively.

-

This is Chubb’s second MGA deal in the past few months.

-

Hallmark’s commercial business will be fronted by HDI subsidiaries.

-

The market remains “delicately balanced” amid global conflicts and claims deterioration.

-

Old Republic Aerospace CEO Ralph Sohl will continue in his current position.

-

-

Thursday’s announcement means that the Russian insurer is off the hook for claims proceedings.

-

The broker said reinsurance capacity has contracted over the past 18 months, and the once-diamond-hard aviation war market has started to soften.

-

The move follows another incredibly soft year for the all-risk market as aviation war continues to harden.

-

Rokstone, the Aventum Group’s (re)insurance MGA, has appointed Jordan Landford as global head of aviation, to be based in Atlanta, Georgia.

-

Looking to the key Q4 renewal period, Gallagher said there is “little to suggest a drastic shift in conditions”.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

Avenue Capital-backed Greylag claimed that insurers denied coverage of the two lost aircraft, which have a value of nearly $110mn and $120mn, respectively.

-

The news comes a few weeks after this publication revealed that UIB was in advanced discussions to take over local broker South Re.

-

The news comes two months after this publication revealed that UIB was exploring the acquisition of the Lima-based aviation-focused reinsurance intermediary.

-

Mark Sperring’s promotion comes just a few months after AIG’s former head of global aerospace, Steve Eccles, left the carrier.

-

The aviation war segment is also proving ‘treacherous’ to buyers, according to the latest Plane Talking report.

-

The increase takes the carrier’s total reserves for the conflict to $145.6mn.

-

The aviation programme manager will exclusively use SiriusPoint’s paper across the US.

-

Based in Birmingham, Alabama, the executive will report to NFP management, cyber and professional liability managing director Matthew Schott.

-

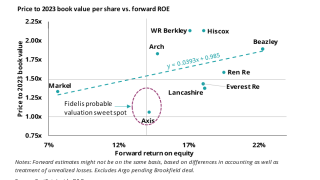

The Fidelis IPO has no clear precedent, but there is an appetite for investment in the specialty space, as seen earlier this year with the Skyward public listing.

-

The carrier cited a “huge” spread of possible outcomes from various lawsuits relating to aviation claims from the conflict.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

The lawsuit argues that one engine that was leased out in Ukraine and 16 engines that were leased out in Russia have suffered physical loss or damages.

-

Steve Eccles joined AIG in April 2020 from Argo, where he was active underwriter of Syndicate 1200.

-

Starr Insurance Companies will issue the insurance policy to protect against the non-payment risk typically held by financiers.

-

Aviation insurers are still facing uncertainty moving into 2023, with a slew of legal cases, and large losses from the previous quarters looming above them.

-

The lessor is looking to recoup $750mn from its war insurers or over $875mn from its all-risk insurers, in the event that its war claim fails.

-

The amount Aircastle is looking for in the suit is, however, lower than the $350mn insurance claim that for equipment stranded in Russia.

-

The market is waiting to see if the loss deterioration changes soft dynamics that were developing in the key Q4 all risks renewals.

-

The hull war market is also looking to target premiums in excess of $500mn, up from the $180mn it achieved in 2021.

-

In his new position, the executive will focus on the firm’s expansion of its aviation insurance offerings.

-

In his new role, Martin Audis will be based in London and will report to Nigel Griffiths, regional head of general aviation.

-

Despite the uncertainty surrounding the conflict, rates in the airline all-risk market remain flat.

-

The carrier, which has been a leader in the war liability market, has re-evaluated its appetite as a result of the Ukraine conflict.

-

The lessor is recording a write-off for 19 aircraft leased to Russian airlines after it successfully recovered three planes since the start of the outbreak.

-

Based in Atlanta, Evancho specializes in fixed and rotor wing commercial operations as well as defense industry risks.

-

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

Carl Shephard will serve as aviation senior broker in London and Chris Latta as vice president for the US Southeast region aviation practice.

-

Based in São Paulo, Brazil, the executive will oversee the carrier’s aerospace underwriting strategy reporting to Nancy Bewlay, Axa’s global CUO.

-

The move follows the departure of QBE’s former aviation head Steve Allen and 10+ of his staff in October.

-

The underwriter has spent 20 years in aviation underwriting with Catlin and Beaufort.

-

This publication revealed earlier this week that Allen and at least other 11 executives had left QBE to a single competitor.

-

The executive had headed the unit since 2016 after joining from AIG’s aerospace business.

-

Both NFP and Piiq’s soon-to-be owner Ardonagh are part-owned by Madison Dearborn, which has invested heavily in P&C broking over the past decade.

-

With around 50 members of staff across the business, the divestiture is not expected to significantly alter the competitive landscape.

-

United Airlines’ all-risks policy could face liability claims, while the Pratt & Whitney policy could see a partial grounding claim.

-

Despite the grounding of multiple Boeing 777 planes, the incident is unlikely to result in another claim from Boeing, sources said.

-

The intermediary's disclosure confirms the end of a process that began with dawn raids in the UK almost four years ago.

-

Lamont Rosemond and Joshua Ray have taken up new leadership roles within the carrier’s North America aviation business.

-

The reinsurer has around a 20% line on the broadcaster’s policy, with Willis Towers Watson acting as the broker.

-

Bruno takes leading role in the MGA’s general aviation team.

-

Alex Barker returns to the carrier after a spell working as an aviation insurance broker at Marsh.

-

The carrier has placed its book of primary business into run-off but will continue to write space reinsurance.

-

The change comes ahead of the renewal in December of the Willis Towers Watson-brokered cover.

-

The respected aviation underwriter joined the company in 2017 from AIG.

-

Chuck Couch has joined the aviation insurance MGA in Atlanta.

-

In court documents, the defence company says Aon failed to provide sufficient claims notification advice.

-

Johnny Wadhams has moved to the broker from Chubb, where he was chief underwriting officer for aviation.

-

"It costs less $ to insure a Falcon 9 mission," said Musk in a Tweet.

-

The hires are the latest personnel changes in the aviation broking market amid a prolonged war for talent.

-

In its Plane Talking report the broker said insurers are still focused on long-term rate adequacy.

-

David Boyle, Ed Louth, Paul Baker and Neil Black will join the broker’s global aerospace team.

-

Plummeting passenger volumes will directly affect premiums collected by insurers.

-

The broker has made six global aviation hires as the battle for staff in the market continues.

-

The Ukrainian airline executive said insurers are seeking permission from the US to make payments.

-

Mid-year M&A including the aviation deal increased the broker’s margin by about 50 bps.

-

Sources said Island Express Helicopters holds a $50mn hull and liability insurance policy.

-

The broker said that Boeing claims of up to $1.5bn had prompted rates to surge.

-

Sources said carriers will likely need OFAC approval to make liability payments to Iranian families.

-

The roughly $53mn cost of the aircraft’s hull will fall on the carrier’s war policy, sources said.

-

Concerns have arisen over how payment may be split if the aircraft’s black box is not recovered.

-

Richard Stockley joins several Willis alumni at the new broking operation.

-

The Civil Aviation Administration of China account has an annual premium volume of about $85mn.

-

Marcia Rosset and Mike Dumenil are set to join the business.

-

The senior broker resigned from Willis Towers Watson yesterday, according to sources.

-

Carsten Nawrath joins the carrier after leading Swiss Re’s general aviation and aerospace business in EMEA.

-

Michael Dobson will take over from outgoing general counsel Stephen Walsh in early January.

-

Wayne Hawkins, Stuart Nelson and Andrew Barker are set to join the Steve McGill-led broker.

-

Matthew Stott joins JLT aerospace alumnus Phil Gingell at the charter aviation insurance specialist.

-

Mark Shurville has 28 years’ experience and previously worked for Willis Towers Watson and Marsh.

-

The Swiss carrier joins Convex as a recent market entrant.

-

Jamie Connor has joined the MGA’s Melbourne office.

-

Steve Wilkinson, Milorad Piper and Wan Xin Lee have joined the broker’s aviation operation.

-

Tony Ambrose and Martyn Holland will work from London, while Julie Meyer and Stephen Murray join in New York.

-

The carrier last week announced it would gradually shutter nine lines of business, including aviation.

-

The carrier also confirms the appointment of Chubb upstream energy chief James Langdon as UK energy and construction head.

-

The response follows large losses in recent months and reduced risk appetite among space in insurers.