Axis Capital

-

Neil Ross was also appointed CUO for the broker’s MGA.

-

Markel’s Bryan Sanders is receiving the Lifetime Achievement Award for his service to the industry.

-

Ryan Alternative Capital Re was launched in partnership with Axis Capital.

-

Peter Vogt will act as a strategic advisor at Axis until the end of 2026.

-

Company alum David Murie will lead the new business unit.

-

Reinsurers are mostly aligned on cat reinsurance, but goals are otherwise diverse.

-

Pricing was “virtually flat” in the second quarter.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

Eric Seyfried and Glen Manjos are also departing Axis’ cyber and tech unit.

-

The changes are aimed at improving underwriting and operational performance.

-

-

Primary and excess casualty in the US saw double-digit rate growth and remained above loss trends in Q1.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

New roles include CUO for primary and excess casualty and practice leader for complex specialty.

-

Axis is retroceding $2.3bn of reinsurance segment reserves to Enstar.

-

Markel had announced the exit from the line of business in the US last year.

-

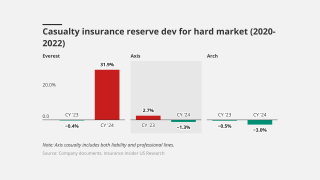

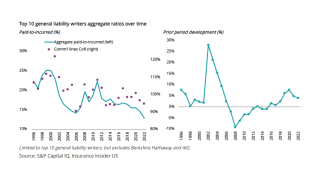

GAAP reserve triangles reveal the struggles of some hybrid franchises.

-

The PE firm held over 6.7 million Axis shares, around 8.2% of shares outstanding.

-

The carrier also grew TL written premiums by 11% in Q4 and 24% for the full year.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

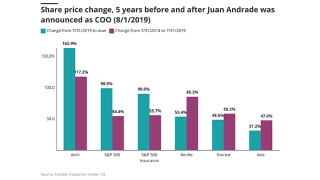

New CEO Williamson will likely continue walking the hybrid path, with an emphasis on fixing US casualty.

-

The three lines add up to 80% of the deal.

-

The transaction mostly covers casualty portfolios of 2021 and prior underwriting years.

-

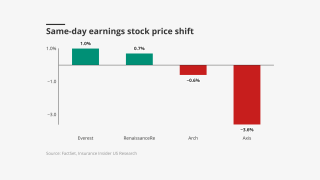

A signal around Q4 adverse development has brought the carrier into the spotlight.

-

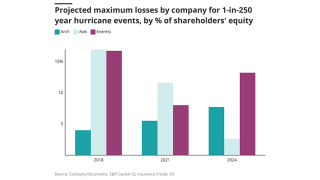

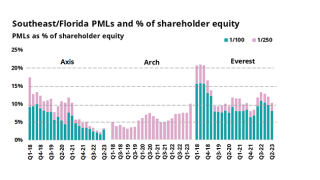

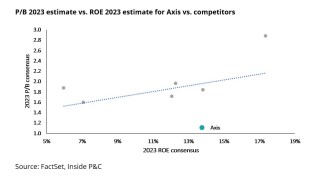

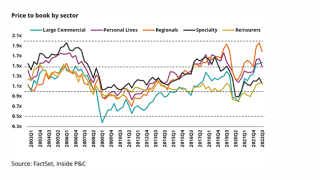

Arch stands out among hybrids, but Axis and Everest grind it out.

-

The company’s reshaping of the book will be substantially completed by year end.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

In tandem, John Posa joins the primary casualty team as vice president.

-

The executive moves from his current role as chief risk officer for Axis Managing Agency.

-

Mark Gregory will retire next March, while Sara Mitchell will initially join as a strategic adviser.

-

The executive struck a cautious note on the industry’s reserve adequacy for the 2021-23 accident years.

-

-

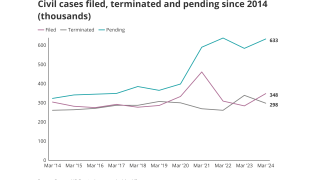

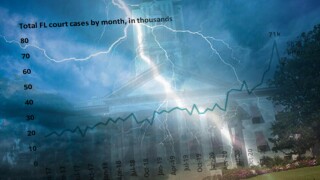

Civil case, nuclear verdict and claims count data show worrying trends.

-

Severe convective storms, wildfires and hurricanes increasingly moving inland are top concerns for the industry.

-

The outage is not expected to impact Axis’s financials at this time.

-

A quick roundup of today’s need-to-know news, including AIG's earnings.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

The executive will replace Habib Kattan, who joined the company last summer.

-

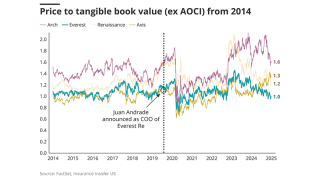

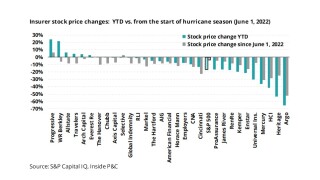

Investor skepticism visible in stock prices and short interest data over first half of 2024.

-

Launched in 2021, Axis is both an investor and capacity provider.

-

The two join the company from Navigators, a subsidiary of The Hartford.

-

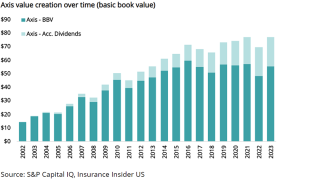

Industry trends show the Axis book value growth goal may be hard to hit.

-

New leaders of these reinsurers have started strong, but Axis still has work to do.

-

The primary casualty book was down by “some 26-odd percent from the prior year”.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

Pauline Morley will report to John Van Decker, head of global financial lines.

-

The executive is also CUO of Axis Managing Agency.

-

The executive’s exit is part of a reassessment of Axis’s primary casualty book.

-

Dejung spent 13 years at Scor, most recently as cyber CUO.

-

It will begin underwriting from April 2024.

-

Marty Becker was previously chair of QBE Insurance and Alterra Capital.

-

The executive will continue in his role as global head of distribution.

-

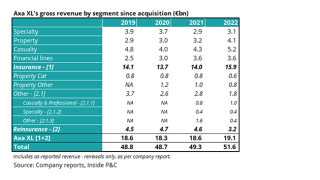

With mixed results in the reinsurance space, the specialty pivot remains a "show-me" story.

-

Markel, Axis and Selective booked sizeable reserve charges in their liability segments.

-

The firm will still be prepared for ‘modest changes’.

-

Insurance Insider US runs you through the earnings results for the day.

-

Axis’s reserve cleanup removes longstanding overhang and narrows the credibility gap.

-

Axis shares were trading at almost $59 after closing at around $55 Tuesday.

-

More than 100% of the reserve charge came from pre-pandemic years, as the slight release of $40mn that offset the full-year increase of $452mn was from 2020 to 2022 accident years.

-

The reserve strengthening was related to liability and professional lines related to 2019 and prior accident years, the firm wrote in a preliminary earnings disclosure.

-

The transaction would have been one of the largest the market has seen for years.

-

Anna Tan will play a pivotal role in elevating the position of AXIS in the US wholesale casualty market in alignment with the company’s position as a leading specialty insurer.

-

Mike Cueman will be based in New York and report to global head of construction Steve Cross and, via a matrixed structure, to Michael McKenna, head of North America.

-

He will be based in New York and report to Mike McKenna, head of North America.

-

Stan Galanski most recently served as president and CEO of The Navigators Group until its 2019 acquisition by The Hartford.

-

Coburn will report to Jason Busti, Axis Re president of North America.

-

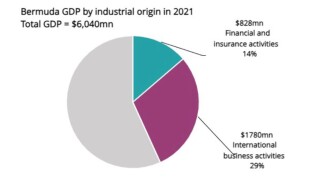

Ratings could be lowered by one notch depending on regulatory restrictions on cash flow from Bermuda operating entities to non-operating holding companies, the ratings agency said.

-

John Owen has been with Axis – and Novae prior to its merger with Axis in 2017 – for 19 years in underwriting and leadership roles.

-

The Bermudian also revealed a $29mn restructuring charge for Q3.

-

The Inside P&C news team runs you through the earnings results for the day.

-

Carlton Maner is stepping down after having served at AXIS for almost 22 years.

-

The sidecar has been launched alongside partner Stone Point Credit Adviser.

-

Cyber is another market Axis is watching closely, given new MGA entrants as well as the recent rise of ransomware activity, with the carrier expecting more “undulation” as a result.

-

Wu will focus on supporting and growing the broker’s existing US, Canada and Bermuda strategic partnerships.

-

Some 15 months on from the property reinsurance exit, he said the firm continued to reserve the right to reshape the portfolio.

-

Inside P&C’s news team runs you through the key highlights of the week.

-

Rate declines have not been as pronounced in private D&O, though competition is increasing.

-

Effective August 24, Kristen Hunter will start as head of inland marine – North America at Axis, bringing a team of three with her from Berkshire Hathaway.

-

A 15% tax is in the works, but appears manageable, and with (re)insurance being Bermuda’s largest industry, the territory will take steps to keep companies where they are.

-

Differences in reinsurer strategies and risk management lead to differentiation in stock multiples and long-term value creation.

-

Market conditions remain “vibrant” with substantial rate increases in property business.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

The Inside P&C news team runs you through the earnings results for the day.

-

In this new role, he will help shape the overall direction of the company’s specialty programs portfolio business.

-

The executive has worked at the Bermudian carrier for more than two decades.

-

Inside P&C’s news team runs you through the key highlights of the week.

-

The executive will be responsible for shaping the business unit’s strategy in alignment with the wider reinsurance business.

-

Axa’s lack of success in selling its more volatile XL Re segment has led the insurer to cut back on those lines, but the current rate environment makes this a good time to revisit a sale.

-

Romeo will be responsible for building out the US cargo program and charting a course for growth ahead of its launch later this year.

-

Inside P&C’s news team runs you through the key highlights of the week.

-

Reinsurers have mostly grown since before the Covid crisis, but the type and timing of growth affects value creation,

-

She will report to global head of cyber and technology Dan Trueman and play a key role in shaping the team’s strategic direction.

-

Everest Re’s $1.5bn capital raise could be part of a continued pivot, or an early indicator of a shifting marketplace.

-

Mark Gregory was previously CEO of Axis’s international division, while McKenna was CUO of Falvey Insurance Group for two years.

-

The withdrawal from the aviation reinsurance class announced yesterday represented ~$10mn of non-renewed premium.

-

The decrease was also driven by non-renewals of some marine business in Q1 as well as declines in some specialty lines including liability, and accident and health.

-

Tizzio’s new employment agreement starts May 4, 2023 and ends December 31, 2026, with automatic one-year renewal periods unless either party gives prior notice of non-renewal.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

Based in New York, Watt will report directly to Axis specialty insurance head and incoming group CEO Vince Tizzio.

-

Inmaculada Gonzalez was previously US head of ceded reinsurance placements.

-

He will report to John Van Decker, president of global financial lines, and will also work closely with Axis Wholesale, led by CEO Carlton Maner.

-

The decision is the carrier’s latest step in its ambition to transition to a low-carbon economy.

-

Axis CEO Albert Benchimol has led posthumous tributes to industry veteran Michael Butt.

-

Inside P&C’s news team runs you through the key highlights of the week.

-

Axis has reported good results as it heightens its focus on specialty business, but it remains to be seen if it can close the value creation gap.

-

In an interview with this publication, the CEO admitted the transition “took longer than any one of us would have wanted”.

-

The carrier estimated losing less than $10mn of desired renewals due to exits from property and property cat reinsurance.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

Pre-tax catastrophe losses during the quarter totaled $64mn, including weather-related losses of $32mn, primarily attributable to Winter Storm Elliott.

-

Although 2022 was on balance, a good year, macro-economic issues such as a slowing economy, falling employment, and loss cost reversion could create an overhang for 2023.

-

The outgoing CEO will step down in May and spend six months as a strategic adviser to the company.

-

The transaction covers net reserves for losses and loss expenses of approximately $400mn and provides ground-up cover to a policy limit of $605mn.

-

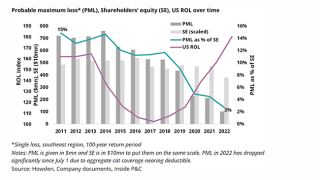

Axis’ pivot away from property reinsurance comes just as the sector reaches one of the biggest inflection points.

-

Discussion on Q3 earnings calls focused heavily on the supply-demand imbalance in cat capacity, as executives discussed how they would navigate a challenging January renewal.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

The declining number of IPOs has reduced demand for public D&O cover and created competition, but current rates may not adequately price the risk, the executive said.

-

Benchimol said there was a risk of losing business, but more important was the transition to a specialty carrier with low volatility.

-

The company said $212mn in cat losses were primarily attributable to Hurricane Ian and European convective storms.

-

The firm’s insurance business recorded $100mn of Ian-related losses while the reinsurance unit booked $60mn.

-

Based in New York, Greer is responsible for leading the surety reinsurance efforts in the United States, Canada and Puerto Rico.

-

Universal P&C, the FHCF, Axis, Berkshire and Nephila are among the firms that will be in focus as the loss develops.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

The executive noted that there are still unmet needs in the wholesale sector, and expects the flow of business to continue into the E&S channel.

-

If the hurricane season continues to be mild, it could impact pricing momentum.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

The Axis chief outlined optimism on his new structure for reinsurance, and said it can grow in its chosen classes of casualty and specialty reinsurance.

-

The company has appointed Carlton Maner as CEO, who will report directly to Axis Specialty and Reinsurance CEO Vincent Tizzio.

-

The executive will step into a newly created role, which was announced in the company’s strategic plan in June.

-

The executive will also serve as senior underwriter of professional liability.

-

Berkley also increased its position in Global Indemnity and now owns around 8.5% of the firm.

-

The ratings agency also affirmed the long-term issuer credit rating of ‘a+’ for the insurer.

-

Inside P&C’s news team runs you through the key highlights of the week.

-

After the bumpy rebalancing away from reinsurance, the firm must now step up to deliver on the plan based around its better-performing insurance unit.

-

The executive laid out the carrier’s plans following a property cat exit on a call with analysts.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

The Bermudian’s gross premiums written rose 9% year-on-year as increases from the insurance segment offset a 4% decrease in reinsurance.

-

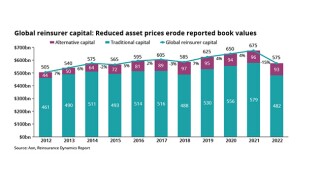

The sector was hit by a rough first half of 2022, with more to come in the second half of the year.

-

The firm announced that it is exiting the property reinsurance business.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

Sources said the company is to part ways with around 60 staff as it completes the pivot to specialty (re)insurance.

-

The ratings agency cited beneficial insurance and reinsurance pricing and a reduction in the carrier’s catastrophe risk exposure.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.