-

The company announced four internal promotions this week.

-

The move comes over a year after Aon completed its $13bn purchase of NFP.

-

Highly concentrated, overly leveraged fronts could repeat the Unicover-Reliance story.

-

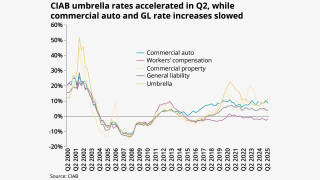

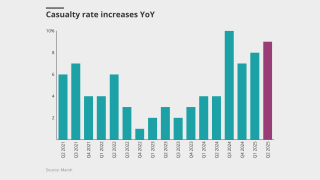

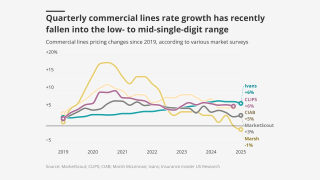

Only GL and workers’ comp had renewal rate increases compared to Q2.

-

The insurer says defendants billed “exorbitant” fees for non-existent services.

-

The company has been growing rapidly since the summer, with at least 300 currently employed.

-

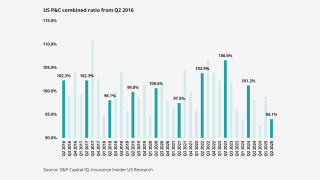

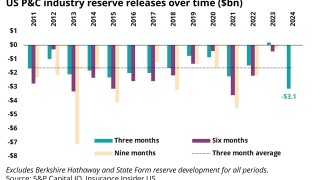

A favorable nine months for the industry does not solve its underlying problems.

-

The executive was most recently head of US casualty at Aon.

-

The executives are based in Seattle and New York.

-

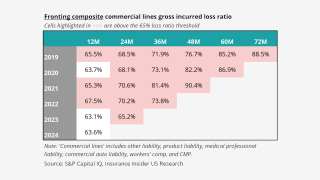

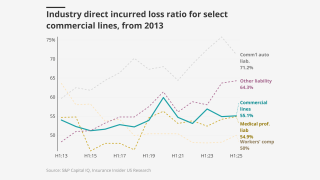

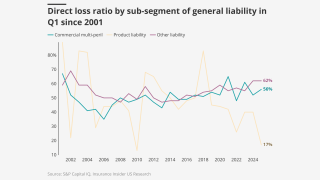

Loss ratios in troubled casualty lines ticked down year-over-year despite worsening loss costs.

-

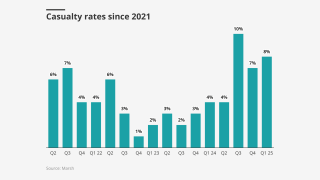

Casualty rate increases largely stabilized in Q2 and Q3 at 5%-10% for general liability.

-

The executive joins from RenaissanceRe.

-

The Caymans-based reinsurer’s Q3 CoR was 86.6%, down 9.3 points YoY.

-

The mayor-elect has promised to build 200,000 new units in New York City.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

Workers’ compensation was the only line that saw a YoY decrease.

-

The fashion brand says the insurer failed to defend it in multiple lawsuits.

-

The newly installed US vice chair explains why inefficiency drove her from legacy firms.

-

The defendant held a $1mn general liability policy with Kinsale.

-

The executive noted that an influx of new entrants in the E&S market is increasing competition.

-

The executive said inflation isn’t completely gone but is now “more understood”.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

The executive said the firm has grown its casualty business by 80% from 2022.

-

The chief executive said he doesn’t expect to see a price drop anytime soon.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

Interim CUO Nick Pritchard turned in his notice in August of this year.

-

Tompkins Insurance is a subsidiary of Tompkins Financial Corporation.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

Gray specializes in contract bonds for mid-sized and emerging contractors.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

The CEO noted that 45% of Everest’s US casualty book did not renew this quarter.

-

The company’s stock fell nearly 9% as the market digested news of an ADC, renewal rights deal and reserve charge.

-

The global insurer will need to convince investors on the quality of the book.

-

The global insurer will pick up a $650mn portfolio of US casualty business.

-

AIG will fold the portfolio into its existing business, leaving the liabilities and legal entities with Everest.

-

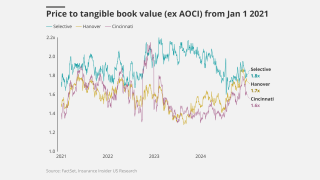

Normalized growth and peak multiples confirm we are headed towards a Darwinian race.

-

Workers’ comp rates dropped again, but the decline slowed from last quarter.

-

The appointments are aimed at offering a clearer team structure.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

Property insurance rates declined by 9%, the same as in the prior quarter.

-

Old Republic said the acquisition is expected to close in 2026.

-

Property pricing fell by 8%, while casualty rate increases tapered to 3%.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

MultiStrat, the founder of casualty ILS, is focusing on committed capital to grow, said Bob Forness, CEO, MultiStrat.

-

The CEO also said that the “bloom is off the rose” in the E&S property market.

-

The protection covers the US insurance book for the 2024 and prior accident years.

-

Property, cyber and workers’ comp rates were all down mid-single digits, offsetting casualty hardening.

-

An average of 81% of property accounts renewed flat or down.

-

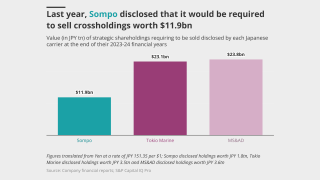

As the Great Japanese M&A Contest develops, the executive said inorganic expansion is “a top priority”.

-

The decision impacts 5% of the reinsurer’s North America P&C facultative premiums.

-

Brian Church has spent 20 years at Chubb.

-

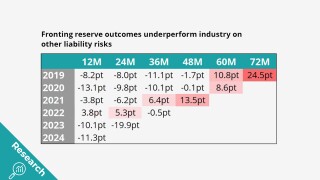

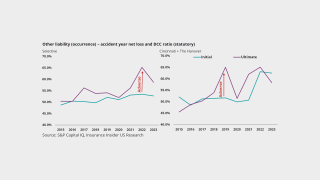

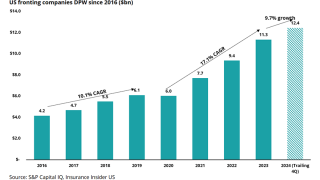

Fronting doesn’t look any better when it’s broken down by segment.

-

The mood in Orlando was sunny among cedants and reinsurers alike, but there are clouds on the horizon.

-

E&S is most exposed to growth normalization, private credit is hunting P&C and fronting is deadlocked on exits.

-

Insurers are pleased, brokers are looking for trade-offs, and everyone’s talking about Howden.

-

The unit’s co-heads, Braithwaite and Apostolides, left the firm in the summer.

-

It is understood around $1bn of premiums could be ceded to the proposed vehicle.

-

The broker will now have access to an M&A war chest for inorganic growth.

-

The Insurance Insider US news team runs you through this week’s key agency M&A.

-

Trailing three month premiums were up 7.2% versus 13.1% in August.

-

The move is the latest in a series of casualty leadership shake-ups at the insurer.

-

She previously served as Hub’s North American casualty practice leader.

-

Sexual abuse and molestation exclusions are starting to hold in higher layers of hospital towers this year.

-

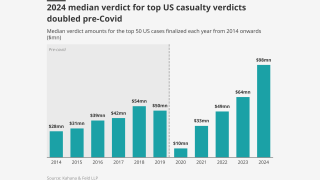

Juries don’t significantly differentiate in cases involving severe injury.

-

He will drive the growth of Chubb's claims-made excess casualty facility.

-

He will spearhead the division’s launch slated for 2026, which will be the first product launch for ICW Group’s specialty unit.

-

Whether in property or casualty, areas of the market will be profitable even with new entrants, the executive said.

-

The executive met with UK colleagues to discuss plans for the US business.

-

The WCB has denied the allegations, claiming its decisions were based on “reasonable investigations”.

-

The deal values the Onex-backed P&C broker at over $7bn.

-

Following the Golden Age of Specialty, franchise quality will play a bigger role in determining success.

-

The case is now headed to appellate court.

-

The Chicago-based executive was previously Everest’s CUO of excess casualty.

-

The MGU is entering the often-difficult habitational GL space with an initial E&S offering.

-

The executive’s skepticism is informed by the industry’s typical approach to cyclicality.

-

A process has not been launched and a firm timeline for a liquidity event has not been agreed.

-

There will also be a renewed focus on organic growth, both in P&C and across US and international operations.

-

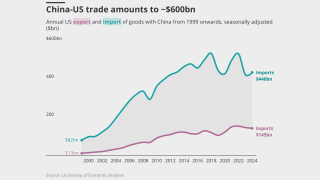

While the Fed is more concerned with jobs, other macroeconomic concerns trouble the industry.

-

Her predecessor will become head of US excess casualty and operations.

-

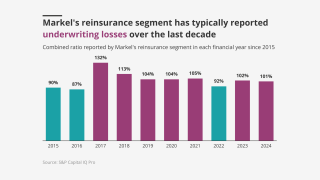

Reinsurers will not back business indefinitely where loss ratios continue to exceed the industry by a wide margin.

-

The Berkshire subsidiary is seeking coverage for a $22mn antitrust loss.

-

The affirmations reflect Everest’s strong underwriting diversification.

-

He was appointed CUO of casualty, Americas, in July last year.

-

Tricia Loney brings 20 years of industry experience to the role.

-

The platform aims to “bend the loss curve”.

-

He joins the company after 22 years in casualty leadership roles at Chubb.

-

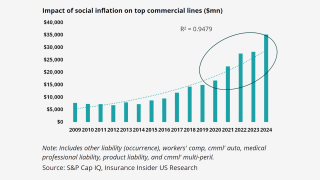

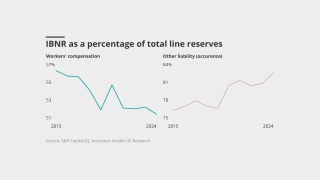

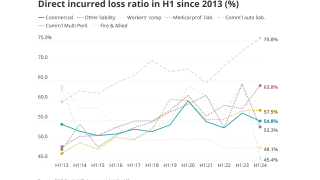

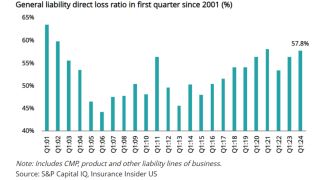

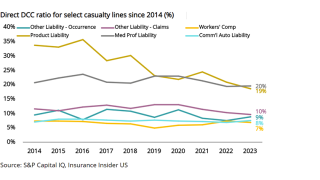

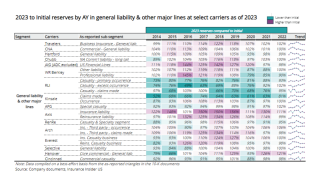

Persistent social inflation challenges evident across key long-tail lines at half-year mark.

-

All rates were up on a year-over-year basis, except for workers’ compensation.

-

Both executives will be based in New York City.

-

The ratings outlook has also been revised to stable from negative.

-

Clients in the segments that AIG trades in may not be as receptive to the idea as the insurer would like.

-

The executive will oversee the direction and management of the firm’s liability portfolio across the US and Canada.

-

The executive most recently served as head of North American treaty reinsurance.

-

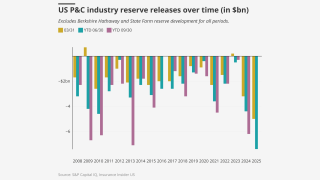

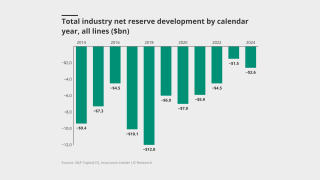

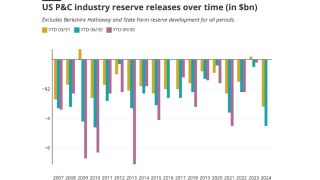

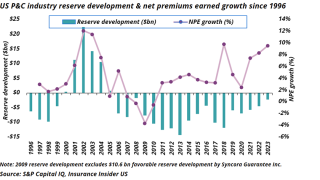

High H1 reserve releases of $7.4bn were driven by the largest of carriers.

-

California, Florida and Texas all saw decreases in monthly premium growth.

-

The ratings agency cited enhanced scale and diversification through organic growth.

-

After spending 20 years at Aon, Goodman will start a senior executive position with Guy Carpenter.

-

Cavello Bay Re will provide paper for the MGA’s business written out of Bermuda.

-

The other liability loss ratio continued to rise as workers’ comp and commercial auto reversed course.

-

Capacity has gone up slightly, with new entrants and incumbents feeling better about their books.

-

The insurer has chosen a “take two” deal after buying Endurance, betting again on Bermuda.

-

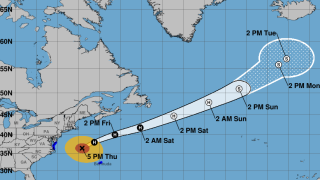

Storm surge of two to four feet could affect the North Carolina coast.

-

The Delaware high court’s reasoning could find application in other cases.

-

GL and workers’ comp, however, may benefit from a more competitive environment.

-

The promotions will enhance underwriting capability across key segments.

-

The state’s Supreme Court upheld two lower court decisions finding no liability.

-

The executive was previously Navigators’ head of excess casualty.

-

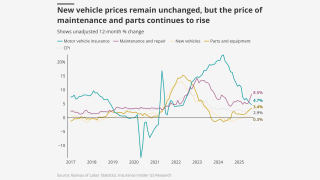

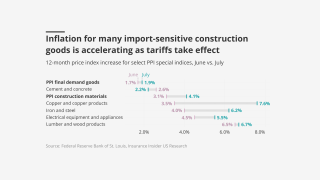

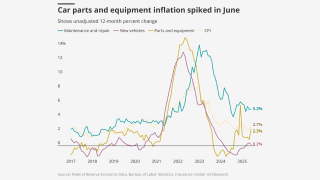

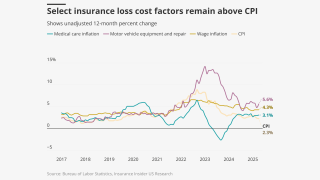

Despite mild headline CPI, some insurance-related items are heading in a worrying direction.

-

Commercial auto saw the largest rate change, which was down about a half point by the end of July to 7.96%.

-

July’s medical care increase was up from June’s o.6%.

-

Casualty premiums grew 56.7% year on year in Q2 2025.

-

Appointments include leadership in transportation, energy, marine and others.

-

It is targeting low-risk specialty lines where it has a competitive edge.

-

The tech could quickly open the door to disruptors, and firms with poor data management will lose out.

-

Q2 cat losses at AIG declined to $170mn from $330mn in the prior year quarter.

-

Social inflation is driving non-renewals, while CoRs are up for P&C and casualty.

-

Commercial liability and commercial property coverage continued to dominate the E&S market.

-

The professional lines market remains ‘challenging’ overall, however.

-

The risk of cyber incidents that cause physical damage is also rising.

-

The newly created role consolidates leadership across UK entities.

-

California posted a 47% jump YoY, from a 28.4% rise in June.

-

The Canadian insurer saw property rates dip across its global divisions, but it had strong rate on liability.

-

The executive was previously head of excess casualty, North America.

-

Specialty casualty now accounts for around 22.2% of its insurance business mix.

-

The pace of increases ticked down in the second quarter compared to Q1.

-

The broker has noted that double-digit reductions are increasingly available in property.

-

The broker posted a 6.5% drop in organic growth YoY.

-

The legacy player is working to secure its first deal, and could look to expand to US E&S.

-

The regional insurer has increased its weighting to OLO and commercial auto, versus comp.

-

The executive has been with the company for roughly one year.

-

Loss trend concerns persist, but insurers are vouching on the opportunity to push for more rate increases.

-

The executive will continue to lead CRC Insurisk in the expanded role.

-

Wind season remains an important variable, but also might not change current dynamics significantly.

-

The carrier has been steadily increasing loss trend estimates.

-

Casualty rates increased 4% globally but shot up 9% in the US.

-

Court documents show Travelers subsidiary Northfield Insurance is the insurer.

-

The move consolidates the company’s leadership of primary and excess construction casualty lines.

-

The company also encouraged insurers and brokers to support the initiative.

-

Rising inflation could raise claims severity but also increase investment income.

-

Laure Forgeron has worked at the Swiss carrier since 2009 in numerous senior positions.

-

All lines except workers’ comp are up year over year, however.

-

Rate gains are easing across many commercial and personal lines.

-

Peter Cordell will join Syndicate 1729 in January.

-

June’s increase was up from May’s 0.2%.

-

Last year, the firm obtained a Class 4 license in Bermuda.

-

Finsness joined the carrier in 2014 and was head of casualty claims in Bermuda from 2017 to 2023.

-

When it comes to sympathetic juries, high net worth individuals are under the same pressure as corporations.

-

The executive previously held roles at Capgemini, The Hartford and AIG.

-

The executive joined The Hartford when it acquired Navigators in 2019.

-

The investigation follows several civil racketeering cases filed by Tradesman based on similar facts.

-

The LA wildfires accounted for 59% of loss activity over Q1.

-

Premium rose across the top 15 P&C risks in 2024.

-

The exec said the feds have been given data to potentially pursue criminal charges.

-

The MGA and parent company Roosevelt Road Re have until July 21 to file a second amended complaint.

-

The rules would require paid rest breaks, among other measures.

-

The unit will operate via VerTerra Insurance, the company’s E&S insurer.

-

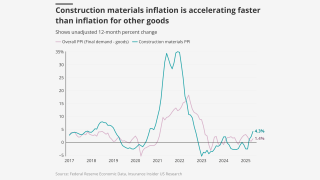

Tariffs could drive up property loss costs, but the impact on other items has been muted.

-

A deep-dive analysis shows LitFin is not the boogeyman this industry paints it out to be.

-

Major insurance industry groups and companies have recently pressed lawmakers to include the provision.

-

The pair joined MMA after the $7.75bn purchase of McGriff in November.

-

The ongoing demonstrations could have law enforcement liability implications.

-

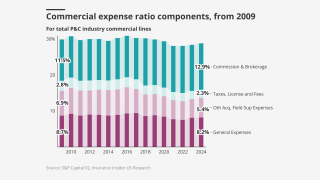

Expense ratios started to move higher in 2024 as the cycle reverses, with this trend likely to persist.

-

Marsh McLennan CEO Doyle dubbed legal system abuse a "tax” on US economy.

-

The executive brings nearly 30 years of liability experience to the role.

-

The suit, filed in Florida federal court, is Uber’s second Rico case.

-

The former Hub executive has over 30 years of experience in transportation.

-

The medical care index numbers were below April’s 0.5% rise.

-

High general liability losses are cause for concern despite modest improvements in other lines.

-

Catastrophe losses in Q1 exceeded $50bn, the second highest on record.

-

The executive will be responsible for leading E&S primary and excess casualty.

-

The legislature did pass Twia reforms, however.

-

The executive said he left the company in September.

-

The executive replaces Mike Warwicker, who left the firm earlier this year.

-

Sam Wylie has been appointed portfolio manager.

-

This will allow Ark to write business on surplus line paper and Lloyd’s business.

-

Rates and limits have done the heavy lifting to date – but there are other options.

-

The team is led by ex-Liberty Mutual executive David Perez who was hired for the launch in October.

-

The executive has been with the firm since 2011.

-

The industry veteran has also held roles at Marsh, Willis and CNA.

-

Inflation indices fell in April, but some items related to P&C are still elevated.

-

Previous complaints alleged their involvement, but this is the first time a complaint has identified the alleged funders.

-

Large account and E&S property have gotten competitive faster than expected.

-

This in turn gives carriers on a tower a little more liberty and less risk to optimize claim outcomes.

-

Strong underwriting performance and aggressive repricing of risks in most lines has aided stability.

-

He was most recently middle market casualty leader and EVP at Chubb.

-

The CEO spoke after Chubb chief executive Evan Greenberg’s call to action at RIMS.

-

The medical CPI is up 3.1% for the last 12 months.

-

Writing credit wraps for LitFin firms and steering third-party assets to them should stop.

-

“Models aren't going to tell you what the emergent risks today are,” Dolan said.

-

The take-up rate will depend on the price discount and market segment.

-

The conference came at a particularly tumultuous time for the US insurance industry and the economy at large.

-

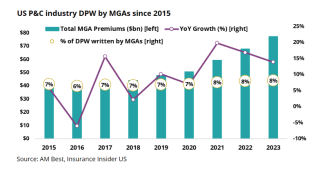

The MGA market now makes up 10% of the overall P&C market.

-

The carrier said it is prepared to drop asset managers, lawyers, banks and brokers.

-

Jack Kuhn, President of Westfield Specialty, discusses the shifting market cycles and changing landscape at RISKWORLD 2025.

-

In casualty, getting significant blocks of capacity remains a major challenge.

-

Richard Schmitzer will retire as E&S president and CEO, and Todd Sutherland will succeed him.

-

The facility is a nudge towards a structural change, not a full-out assault.

-

Both Chubb and Zurich will underwrite the risks, with Nico as the sleeping partner.

-

He takes over from Amanda Lyons, who was promoted to global product leader last year.

-

As the industry gathers in Chicago, Insurance Insider US reviews key discussion points.

-

The facility provides up to $100mn in claims-made excess casualty coverage.

-

The remediation process is on track for completion in the fourth quarter.

-

New roles include CUO for primary and excess casualty and practice leader for complex specialty.

-

The executive will begin serving as Hiscox USA’s CUO as of May 5.

-

The program will offer liability coverage up to $5mn per occurrence.

-

Everest’s US wholesale business is seeking to expand its market presence.

-

However, the firm will take a “conservative approach” until the improvements are shown in data.

-

In a post on LinkedIn, Steve Arora said investor appetite “just wasn’t there”.

-

Rates for umbrella accelerated to 9.26%, from 8.76% in Q4 2024.

-

The specialty insurance platform has now exceeded $3.1bn in premiums.

-

The Kelso and Arch-backed run-off player has retained Evercore to advise.

-

The program will provide excess casualty coverage across a broad range of industries.

-

ISA is part of Ryan Specialty National Programs, which launched last month.

-

Live since May 2023, the reinsurer has over 40 trading relationships currently.

-

Business hates uncertainty and geopolitical tensions are off the charts.

-

The appointments cover US casualty, the US Central region and construction.

-

London-based US excess casualty writers are increasingly looking to attach lower in the tower.

-

The larger awards over the past two years could serve as an anchor for future verdicts.

-

He will oversee Ascot’s US and Bermuda insurance and reinsurance companies.

-

Despite wildfires, reinsurers are “well positioned to maintain strong profitability in 2025”.

-

The 12 insurers together have $418mn in policyholder surplus.

-

What past trends can tell us about the future of commercial reserving.

-

The amount of change over the past year falls short versus the discourse.

-

The vehicle will take a quota share of all of the risks underwritten by Ryan Specialty’s MGA arm.

-

The MGA will likely expand its D&O book as well, but excess casualty will grow faster.

-

Construction defects, GL and risk-managed professional liability lines saw the greatest headwinds.

-

The executive will continue as head of BHSI’s E&P lines business.

-

The Georgia verdict is one of many legal battles over Monsanto’s herbicide.

-

Inflation, tariffs and climate change are all making for an uncertain 2025.

-

Instead, the reinsurer plans to write more casualty business through its innovations book.

-

Surplus lines are still strong, but not the standout they used to be.

-

The partnership will launch a new umbrella excess insurance product.

-

Its full-year combined ratio for 2024 ballooned to 334.6%, from 124.7% in 2023.

-

Newly released annual stat filings on reserve data show some troubling trends.

-

A quick roundup of our best journalism for the week.

-

The company is seeking to promote growth in its US excess casualty book.

-

Excess/umbrella liability and commercial auto broke the trend with high price increases, however.

-

Executives see earnings benefits from workers’ comp beginning to diminish.

-

The executive joined the Bancolombia-owned insurer as CEO in early 2020.

-

The industry needs to find a way to rebalance power dynamics.

-

The executive is returning to Tysers after nearly four years at Price Forbes.

-

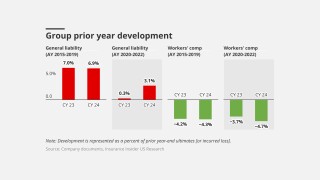

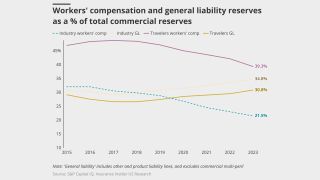

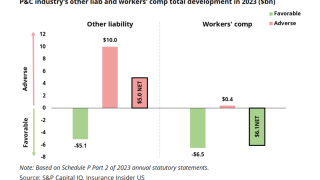

Workers' comp continued to offset GL adverse development, but the bucket is running dry.

-

Approximately 12% to 13% of Skyward’s premium was in commercial auto in Q4.

-

In the absence of interim action, the segment could face an “availability crisis”.

-

Big tort reform packages are on the table, but California steals the show, for now.

-

Frequency has rebounded, while severity has spiked beyond the pre-Covid-19 years.

-

The executive joined the firm in early 2023 after 10+ years at Aon.

-

Regionals and smaller carriers need to exercise vigilance when expanding commercial casualty lines.

-

The group should also tilt capital allocation away from M&A and deepen its disclosure.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

Insurers could absorb as much as 90% of this year’s already elevated losses given shifts in attachment points.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

Admitted carriers are dropping middle-market business due to large verdicts.

-

The underwriter has worked at Axis for a decade.

-

The Pacific region led the quarter’s price decline at -8%.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

The event now includes a casualty portion and has officially been re-branded as the Property and Casualty Symposium.

-

The executive succeeds Lou Capparelli, who becomes global casualty chairman.

-

The MGA and 49% owner SiriusPoint could bring in a new investor.

-

The carrier strengthened its GL reserves by $130mn in Q4.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

Claims related to California wildfires are "fairly insubstantial" to date, executives said.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

The impact of the devastating California wildfires is too early to ascertain, executives said during earnings calls.

-

The AIG subsidiary says it has no obligation to “defend or indemnify” McKinsey.

-

CEO Jim Williamson said social inflation was a “growing barrier” to a vibrant economy.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

The (re)insurer recorded a reserve charge of nearly $1.3bn within its casualty insurance book.

-

The insurer’s strong Q4 results might not read across to the rest of its peer group.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

Insurers are increasingly trying to push attachment points for excess layers up to $10mn.

-

Robin Hamilton has been appointed head of energy and marine liability.

-

The carrier tapped the run-off market in Q4 for a US casualty insurance-focused portfolio.

-

Rate increases are less severe and renewals are flat in some segments.

-

Supply generally exceeded demand and trading relationships were strong, CEO Tom Wakefield said.

-

A look back at the stories that defined the year in P&C for 2024.

-

The P&C industry had a rude awakening as fresh claims data came rolling in post-pandemic.

-

Concern over rate adequacy remains, but reinsurers are delving deeper into data rather than walking away.

-

Fronting growth fell by half in 2024 due to uncertain loss climate and high cost of capital.

-

By contrast, capacity remains tight at the lead level.

-

There’s a question mark around the tails of AY 2021-2023, the president said.

-

The MGA secured backing from buyout heavyweight KKR in March 2021.

-

Ceding commissions remain elevated but primary rates are improving reinsurer margins.

-

The broker said the casualty segment is approaching an “inflexion point”.

-

Andrade flagged expected 5% to 10% increases in the US and Europe.

-

Overall, insurance rates fell by 1%, led by competition in property.

-

Previously, Thomas Long was an AVP for construction at Arch.

-

Plaintiff Ionian has alleged a “fraudulent scheme” under the Rico laws.

-

He will oversee the launch of Tokio Marine’s new excess casualty line.

-

The magnitude of the hurricane may impact reinsurers’ capacity deployment.

-

Reinsurance capacity is largely stable but that doesn’t mean discussions will be a smooth ride.

-

Praedicat CEO Bob Reville outlined the firm’s approach to "casualty cat" as liability risk modeling continues to mature.

-

Third-party litigation funding has been linked to rising casualty insurance prices.

-

Attendees concurred that they don’t expect the “Golden Age of E&S” to end anytime soon.

-

Idaho and Minnesota far outpaced other reporting states in premium growth, stamping office data shows.

-

Reinsurers will likely push for double-digit US premium rate increases.

-

US liability was a hot topic at the European conference.

-

Increasing loss picks in difficult lines suggest top writers are accepting shifting loss trends.

-

The lawsuit names additional attorneys, doctors and medical practices.

-

The company is currently “underweight” in that line of business, he added.

-

The reinsurer constructed a “social inflation index” for a new study.

-

The broker reported that global reinsurer capital reached a record of $695bn as of June 30.

-

The transaction complements its previous acquisition of RMS in 2021.

-

Rate increases on primary liability placements range from 10% to 20%.

-

Umbrella was the exception, ticking up slightly on the month.

-

The highest releases in nearly 15 years challenge conventional wisdom on reserving.

-

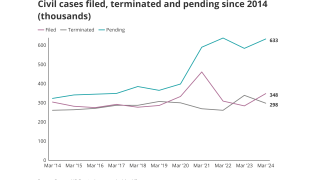

Civil case, nuclear verdict and claims count data show worrying trends.

-

The lawsuit demands coverage from insurers following opioid and product liability-related settlements.

-

While the alleged fraud is shocking, could it suggest the industry is under-investing in claims?

-

This is in large part due to the current legal environment and inflation continuing to push medical pricing up.

-

The top four lines posted low-single digit to high-single digit policy count growth.

-

-

The executive joined Chubb in 2013 as assistant VP and regional manager.

-

The executive brings more than 30 years of industry experience to the role.

-

The complaints are the first effort to crack down on existing suspicions.

-

Britt Sellers joins as head of brokerage casualty and Tyler Turk as director, primary casualty.

-

Reserve analysis shows that OL reserving may be insufficient for recent AYs.

-

The property market remains “one of the most favorable ... I've seen in my career,” the executive said.

-

Loss cost inflation remains an unknown and is sustaining price discipline.

-

Executives flagged elevated packaged auto loss activity in Q2.

-

Travelers and Selective’s releases point to ongoing reserving challenges this earnings season.

-

Markel executive Alan Rodrigues will lead the unit.

-

-

Conditions are coalescing for an uptick in carrier M&A after many subdued years.

-

The all-items CPI increased 3% year-over-year, down from 3.3% in May.

-

“Hammer letters” are going around, and insurers are struggling to coordinate on claims handling.

-

“I think it just starts with people just being desensitized to these numbers,” he said.

-

Claims department investment is needed to compete with the plaintiffs’ bar.

-

The all-items CPI has increased 3.3% over the last 12 months.

-

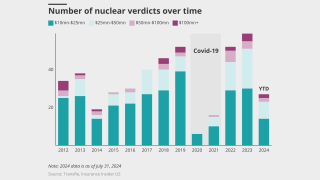

The number of nuclear verdicts rebounded to pre-pandemic levels by 2022, USCC data shows.

-

Loss picks for other liability are at a 23-year high, but that still may not be enough.

-

The H2 rate predictions mark a slight moderation from those in H1.

-

The discrepancy between rising claim counts and favorable reserves is cause for concern.

-

He will oversee management of the P&C loss adjusting business.

-

The mean nuclear verdict for 2013-2022 was $89mn, versus $76mn in 2010-2019.

-

Despite reserving actions, there are no signs of reinsurance capacity shortages in the market.

-

MGAs outpaced the P&C industry for years, but growth has begun to stagnate.

-

The executive’s experience centers on program design for complex risk.

-

Recent contingency losses reflect a willingness of the market to go looking for premiums.

-

Ascot is supporting Trident, Paragon’s public entity casualty insurance program.

-

The CEO said he is “optimistic” about the future of the commercial space.

-

Casualty is less of a concern, despite reserving issues.

-

Reserving actions have added pressure to upward pricing.

-

The CEO said companies are still taking charges on years 2013 to 2019.

-

As the industry gathers in San Diego, these are the key discussion points.

-

Other executive hires include AIG’s Joseph Fitzpatrick as head of distribution.

-

The executive joined the firm in January from Nationwide.

-

The new suite of coverages is designed to meet the unique needs of healthcare organizations.

-

Verdicts awarding more than $100mn hit a new high of 27 last year, study finds.

-

The casualty segment posted $18mn of favorable reserve development across multiple accident years.

-

Downward trends of DCC ratios are beginning to reverse, which could cause issues for long-tailed lines.

-

Social and medical inflation and litigation financing were among the factors cited.

-

The MGA’s underwriting capacity for casualty programs now totals $17mn.

-

Workers’ comp releases continue to mask deteriorating reserves in 2023.

-

Joy had previously set up the casualty practice at Global Indemnity.

-

Concerns around casualty rate adequacy are growing, the executive said.

-

A more business-friendly approach will be offset by increased uncertainty.

-

But auto insurance is still a ‘hot-button’ item for carriers.

-

AM Best then withdrew its ratings at the company’s request.

-

Based in New York, the executive will report to global head of casualty Josh Everdell.

-

It is backed by paper from MS Transverse, this publication understands.

-

Other liability adverse development is being offset by workers' compensation releases.

-

Some carriers may be pressing too hard on reserve releases from recent years.

-

The firm took a major reserve charge and has gone into remediation mode.

-

A minority view gaining currency is that 2016-19 will not be the only problem.

-

Given a number of complexities, the landing zone on a take-out price is small.

-

Is this a temporary spike or the start of a multi-quarter trend?

-

The Bermudian’s reserves will be on watch when its Japanese parent reports earnings.

-

The carrier said it has acted prudently on 2016-19 GL loss trends.

-

The drivers are not surprising, but the extent of development is, execs said.

-

The average 2023 premium renewal rate change for commercial property was significantly higher than 2022 across all months.

-

The broker’s Q4 programs reinsurance change led to a one-time $19mn charge that will allow it to reduce its PML exposure.

-

The broker’s report also hailed the best risk-adjusted margins for ILS investors in a decade.

-

January 1, 2024 was a “spotty” renewal, with the most over-subscribed deals being those bought by the major global cedants with good track records, whereas others did not attract as much attention.

-

The carrier believes its existing reserves account for any liability relating to claims.

-

The lack of momentum reflects on a general belief that underlying casualty business is well-priced for current years.

-

The need to recognize adverse development in the back book is the most plausible culprit for market behavior, and an escalation of rhetoric.

-

For some time now, property has been doing the heavy lifting around growth and rate rises in E&S.

-

Cat-exposed accounts will still face higher rates and more restrictive terms, however, as carriers continue to manage their aggregate, according to Amwins’s “State of the Market 2024” report.

-

A quick roundup of this week’s biggest stories.

-

Insurance Insider US’s morning summary of the key stories to get you up to speed fast.

-

“Unfortunately, it's a situation of getting rate to fund [the litigation costs] and being able to stay in the market long term,” Taylor told Insurance Insider US in an interview.

-

Amynta Ease-of-Business president Arthur Seifert said he expects MGAs to move away from the popular Dutch auction process and instead find one party that’s a good fit.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

Cedants and brokers are navigating the complexities of varying risk appetites signaled by reinsurers, who are willing to provide more capacity for cat treaty but only at certain layers as they maintain discipline.

-

The new financing builds on the $148mn raised to date and follows recent belt-tightening measures that included layoffs.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

On a conference call with analysts, CEO Michael Kehoe described high growth rates from over the last five years as an “anomaly” and warned investors of possible "mean reversion” ahead.

-

According to a survey, 35% of small businesses do not have general liability insurance, and 39% of those operating for 10 years or more have never updated their GL coverage.

-

Inside P&C’s news team brings you all the top news from the week.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

Broker consolidation, angst about loss trends in long-tail lines and the confidence of the E&S market were key themes in Colorado Springs.

-

The unit will focus on commercial risks with a specialized approach in niche verticals, such as construction, commercial real estate, hospitality, manufacturing and technology.

-

It is more dependent on property, and its longevity is uncertain.

-

The company’s Monday statement is the latest development in a debacle that could potentially lead to a major loss event for the utility company’s casualty insurers.